Texas is once again the place to file patent infringement lawsuits in the U.S.

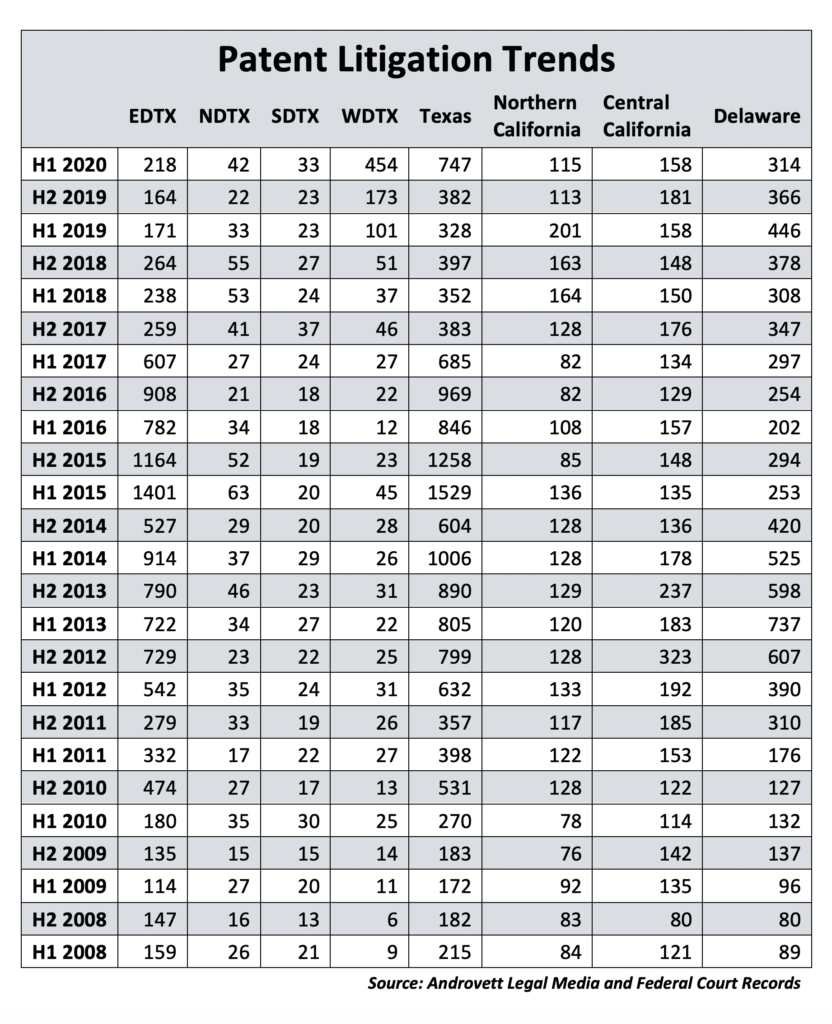

Businesses and individuals filed 747 patent complaints in the four federal court districts in Texas during the first six months of 2020 – double the number from a year earlier and twice as many as any other state so far this year.

All four federal districts – Eastern, Western, Northern and Southern – experienced significant increases in new patent enforcement litigation during the first half of this year.

Across the country, patent infringement lawsuits jumped 16% between Jan. 1 and June 30 of this year. In Texas, the number of newly filed patent disputes soared 96%, according to new data provided exclusively to The Texas Lawbook by Androvett Legal Media Research.

“We are definitely seeing an increase in new patent filings, and the increase is highlighted most in Texas,” said Baker Botts intellectual property law partner Doug Kubehl. “A lot of this is attributable to the economy and what is happening with the pandemic. When lawyers are not in trial, we have more time to look at new cases and to file news cases.

“Texas filings are up because the state has very experienced patent judges who have fast and reliable procedures,” Kubehl said.

Legal experts say there are a handful of factors contributing to the rise in new patent litigation, including a new wave of lawsuits by nonpracticing entities and increased funding from litigation finance companies.

The Western District of Texas, specifically the Waco Division, witnessed an historic wave of new patent infringement cases – a jump of 350% – and is now the most popular court in the U.S. to litigate patent disputes.

The Eastern District, a perennial favorite jurisdiction for patent plaintiff’s lawyers that includes Marshall and Tyler, saw a 33% increase in new complaints between Jan. 1 and June 30.

The number of new patent infringement cases filed in the Northern District nearly doubled during H1 2020 compared to H2 2019. Even the Southern District of Texas, which has never been a hotbed of IP litigation, experienced a 43% jump in new patent violation cases, according to the Androvett data.

Hilda Galvan, a partner at Jones Day in Dallas, said that she is “definitely seeing an increase” in patent infringement activity across the U.S.

“We are seeing more filings and more people thinking about filing new IP causes than we have in recent years,” Galvan said. “Plus, we have more companies moving their headquarters to Texas, which gives you venue in the courts of Texas.”

All eyes, however, are focused on the Western District of Texas and U.S. District Judge Alan Albright, who took the bench in the district’s Waco Division in September 2018 with the intent of making his court attractive to lawyers involved in patent litigation.

The numbers show Judge Albright has been incredibly successful.

There were only 37 new patent lawsuits in WDTX in H1 2018. This year, the Androvett data shows that the number ballooned to 454 new cases in H1 – an 1127% escalation over two years.

As a result, Judge Albright is now the most popular – and busiest – judge in the world of intellectual property disputes.

Michael Hatcher, a partner at Sidley Austin, said the Texas courts are witnessing a “perfect storm” for patent litigation.

“Judge Albright joined the federal bench with such deep experience as a patent lawyer and a former federal magistrate, and he set up rules and procedures that plaintiffs and defendants appreciated,” Hatcher said. “He did this [just months after] TC Heartland came down, and Judge Albright found himself in the perfect spot because so many tech companies have operations in Austin.”

TC Heartland v. Kraft Foods is a 2017 U.S. Supreme Court decision that significantly limited jurisdiction or venue in patent infringement disputes.

Until TC Heartland, the federal courts in the Eastern District of Texas – specifically Marshall and Tyler – were the hot spots for plaintiffs to file patent cases because of its rocket docket procedures.

At its peak in 2015 and 2016, the EDTX witnessed between 1,700 and 2,500 new infringement lawsuits each year, which was double or triple nearly every other jurisdiction. There were periods in 2015 and 2016 when more cases were filed in East Texas courts than in the other 93 districts combined.

After TC Heartland, the numbers dropped significantly. In the second half of 2019, lawyers filed just 164 new patent disputes in EDTX.

As patent litigation declined in the Eastern District, the federal judges in Delaware saw their patent docket more than double – from 202 infringement lawsuits filed in the first six months of 2016 to 446 cases in H1 2019.

“A lot of cases went to Delaware because so many corporate defendants are incorporated there,” said Cadwell Clonts & Reeder partner David Clonts. “In addition, the Delaware judges were knowledgeable and experienced in patent law.”

The number of new patent cases filed in Delaware, however, declined 30% during the past year.

At the same time, lawyers seemed to rediscover the EDTX during the first six months of 2020. There were 218 new patent cases filed in the Eastern District in H1, which is an increase of one-third over the previous six months.

“With the emergence of Waco, we thought we would have seen fewer cases brought in the Eastern District, but that has not necessarily been the situation,” said Winston & Strawn partner Kathi Vidal, who is an expert on IP litigation. “It could be that there are just more cases being filed right now.”

Doug Cawley, a partner at McKool Smith, said that “plaintiffs are challenged to find jurisdictions” that give them a “fair shake” but that the EDTX did.

“The Eastern District struggled to manage and handle the load of patent litigation that it had a few years ago,” Cawley said. “Everyone knew that there would be something that would happen to curb the popularity of the Eastern District.

“If we think the Eastern District cannot stick as a jurisdiction, we spend a lot of time thinking about other appropriate places to file,” he said. “For sure, if the Eastern District is not available, then Judge Albright is a godsend.”

Vidal, who has litigated patent cases in courts throughout the U.S., said that Judge Albright has made practicing IP law considerably more predictable, which the parties appreciate, and it lowers the cost of litigation.

“People don’t file motions if they know he is going to deny them,” she said. “He’s very transparent. He has never invalidated a patent [under 35 USC 101]. And you know if you file your case in Waco, you will get Judge Albright.”

Clonts agrees that Judge Albright deserves a significant amount of the credit for the revival of patent litigation in Texas.

“There was so much uncertainty in the patent enforcement world,” Clonts said. “Judge Albright provided the structure of accessibility and predictability and efficiency.”

“Patent infringement cases are increasing because fewer patent claims are being thrown out administratively by PTAB [Patent Trial and Appeal Board],” Clonts said. “Lots of patent claims have been sitting on the sidelines waiting to be enforced.”

IP law experts say there are other key reasons for the increase in patent infringement cases.

“A lot of this surge is related to the economy,” said Kubehl. “Many companies have cut expenses and they are now looking for new sources of revenue, and they see monetizing their patent portfolio as one possibility.

“This is combined with a significant rise in patent litigation investment companies, which provide more opportunities for lawsuits to be filed,” Kubehl said.

Galvan and others say that a significant portion of new patent filings involve nonpracticing entities or NPEs, which could be businesses, universities or even private equity firms that own patents for products they do not manufacture.

“We are seeing quite a few lawsuits by NPEs,” Galvan said. “But these are much more sophisticated and more aggressive NPEs. They are not willing to settle quickly for the mere cost of the litigation.”

Only a few years ago, most NPEs were considered “patent trolls,” which were essentially hedge funds that sue dozens of defendants with hopes of scoring early settlement agreements.

“Every NPE is not the same, and these newer NPEs are definitely different,” said Hatcher. “These are not the NPEs that are patent trolls who file just to harass or for nuisance purposes.

“We are definitely seeing an uptick in NPE suits that are much higher value cases,” said Hatcher.