Scores of oil and gas companies entered the spring of 2015 in a bind. Oil prices remained in the mid-$40s. Balance sheets had gone from black to red. Loans were coming due, even as deadlines for project commitments approached.

The exploration and production companies, believing oil prices would soon rebound and needing a quick, temporary fix, hired armies of high-paid lawyers and bankers to go to the capital markets to get them cash.

For 25 weeks this year, tens of billions of dollars flowed easily and cheaply into the oil patch and other businesses in Texas and Oklahoma through securities capital and debt offerings. Every three business days, another billion-dollar offering was announced.

Even oil and gas companies teetering on bankruptcy got their share of the cash.

Then suddenly, it all stopped.

In mid-July, the capital markets dried up for most oil and gas exploration firms. Corporate lawyers and investment bankers say there are no indications that the money spigot to the oil patch will be turned on again anytime soon.

The result, they say, is that an oil and natural gas boom built largely on investments and loans from securities offerings is headed for a lot more suffering and agony than was previously predicted.

“I’m afraid we are going to witness a lot of pain,” says William Snyder, who heads the restructuring practice at Deloitte in Texas. “The oil companies that didn’t get money in the first half of the year are just out of luck.

“There are going to be many more bankruptcies – and I mean liquidations, not restructurings – than any of us thought,” he says.

As dry as the securities market is now, it was gushing at a record pace during the first half of 2015, according to corporate lawyers and investment bankers.

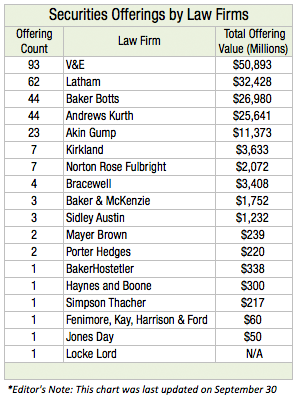

Texas and Oklahoma businesses – 90 percent of them energy companies – raised more than $150 billion through 206 capital and debt offerings in the first nine months of 2015, according to The Texas Lawbook’s Corporate Deal Tracker and Bloomberg News.

Of the 206 offerings, 179 occurred during the first six months of the year and raised $127 billion.

New data compiled by The Texas Lawbook’s Corporate Deal Tracker and Bloomberg News shows the Texas and Oklahoma companies conducted 38 capital and debt offerings during the first half of 2015 that each raised $1 billion or more, including two of the largest debt offerings in U.S. history.

By contrast, there have been only four offerings valued at $1 billion or more since July 1.

“There were so many offerings in such a short period of time,” says Michael O’Leary, a partner at Andrews Kurth who specializes in capital markets. “It was a rush by oil companies to raise as much money as possible.

“We worked days and nights and weekends,” says O’Leary, who represented Dallas-based Energy Transfer Partners and other Texas companies in 22 separate capital and debt offerings valued at $16.2 billion in 2015. “We had several clients who finished a capital deal one day and immediately jumped into a debt offering the next day.”

While most companies raise money through securities offerings to expand operations or acquire assets, the rush of securities offerings witnessed earlier this year was motivated by a different factor: survival.

“At the end of 2014, it was clear there would be a strain on many oil and gas companies because of the volatility,” says Latham & Watkins partner Michael Dillard. “Those strained companies went to the capital markets to shore up their balance sheets.”

Corporate lawyers and investment bankers say energy companies dashed for securities and debt offerings before financial institutions clamped down on them due to declining revenue and a lowering borrowing base due to shrinking asset valuations caused by $45 a barrel oil.

Throughout the spring, the Federal Reserve allowed banks to extend loans or make new loans with the projection that the price of oil would bounce back.

Corporate lawyers say there is no better evidence that money through securities and debt offerings was easily accessible than Oklahoma-based SandRidge Energy.

SandRidge has seen its market cap shrink from $2.9 billion in December 2013 to $240 million last week. A handful of analysts have the E&P company on their bankruptcy watch list. Even so, SandRidge was still able to raise $1 billion on May 28 and another $1.25 billion on June 10 through debt offerings.

The biggest wave of securities offerings started the first week of March, according to The Texas Lawbook’s Corporate Deal Tracker.

Houston-based Buckeye Partners kicked off the party by raising $191 million on March 2. The very next day, Newfield Exploration got $816 million and MarkWest Energy secured $650 million. On March 4, Concho Resources raised $755 million, which was completely overshadowed by Exxon Mobil’s $8 billion.

Laredo Petroleum was next with $763 million and Goodrich Petroleum secured $50 million on March 5. On March 10, Newfield was back seeking another $700 million. Laredo secured another $350 million on March 18.

During the four weeks of March, 55 securities offerings were issued, raising $50 billion. The issuers that month included Energy XXI Gulf Coast, Range Resources, Oasis Petroleum, Southwestern Energy, Ensco, EOG Resources, ONEOK, Antero Resources, Comstock Resources, Cheniere Energy, Western Gas Partners and two dozen other oil and gas operations.

“Had that money (and public financing) not been available in the first two quarters, we would be seeing a full meltdown now,” says John Goodgame, a corporate partner in Akin Gump’s Houston office. “Capital markets have floated companies a lot.”

Even non-energy companies jumped into the mix. In April, Dallas-based AT&T announced a debt offering of $17.5 billion, which is the third largest debt offering in U.S. history.

Suddenly, in the middle of July, it was gone.

“It was like someone turned all the spigots off,” Snyder says. “The money just dried up.”

O’Leary says that investors and lenders suddenly realized in the middle of July that oil prices were not recovering as had been forecast. In fact, oil prices dipped lower, into the $30s.

“The bloom was off the rose,” O’Leary says.

Even those four debt offerings of $1 billion since July 1 were by companies – Halliburton, Energy Transfer Partners, Kinder Morgan and Plains All American Pipeline – that are well capitalized and able to raise large sums of many in nearly any market.

“Even in the oil and gas sector, which has been hit hard by the decline in commodity prices, companies with strong balance sheets and quality assets continue to access the capital markets,” says Seth Molay, an Akin Gump partner in Dallas who specializes in capital markets.

Halliburton’s $7.5 billion offering on Nov. 5 is one of the 20 largest ever, according to Bloomberg.

Corporate lawyers say there is money out there for distressed companies that have valuable assets.

“Private equity funds have raised a lot of money – billions and billions of dollars – that they need to put to work soon,” says Rodney Moore, a partner at Weil Gotshal & Manges in Dallas.

“These private equity funds are watching the distressed companies very closely and are just waiting for the right time to step forward to make an offer,” Moore says.