In the annual ledgers of corporate law firms in Texas, 2016 was an excellent year.

For more than a dozen law firms operating in the state, it was the best year ever.

Most law firm leaders say they expect more of the same for 2017, although industry insiders say that the foundations of the Texas legal market are shifting significantly and that some prominent Texas law firms could face financially rocky times ahead.

The Texas Lawbook 40, which annually examines the finances of 40 large and prominent corporate law firms operating in Texas, found that business lawyers in the state generated historic revenues and record profits in 2016 – even though those firms as a group employed fewer lawyers who did less work and billed fewer hours.

Instead, corporate law firms relied on increasing hourly rates – some now charge as much as $1,300 an hour – and hiring lateral partners with books of business to score this year’s financial achievements.

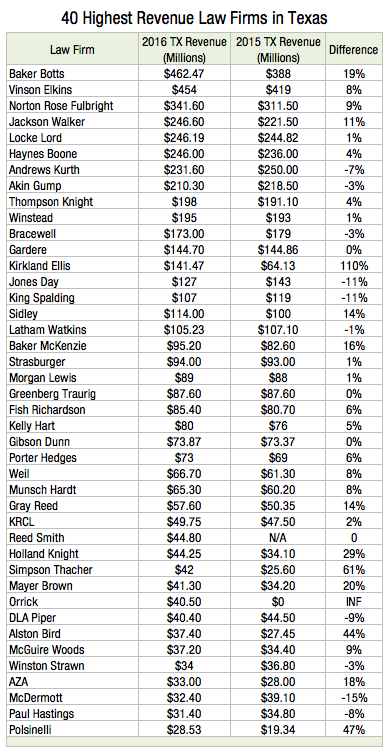

The Texas Lawbook 40, which includes law firms based inside and outside of Texas, generated a record $5.1 billion from their lawyers practicing in the state in 2016 – up nine percent or nearly $500 million from a year earlier.

The six largest law firms operating in Texas – Baker Botts, Vinson & Elkins, Norton Rose Fulbright, Jackson Walker, Locke Lord and Haynes and Boone – posted a combined $2 billion in revenues from their Texas offices in 2016, which is 6.5 percent higher than one year earlier and 30 percent more than 2010.

Those six Texas law firms employed 37 percent of the lawyers in the list of 40 law firms and generated nearly 40 percent of the revenues from the entire Texas Lawbook 40 in 2016.

“Texas law firms benefited from a healthy macro economy in Texas – some firms more than others,” says Kent Zimmerman, a law firm consultant at Zeughauser Group. “Texas law firms benefit from having three distinct and unique geographic markets – Dallas-Fort Worth, Houston and Austin/San Antonio – and an improved energy sector.”

“2016 was a record-breaking year,” says Munsch Hardt Managing Partner Phil Appenzeller.

Even mid-sized Texas-based corporate law firms, such as Kelly Hart & Hallman, Munsch Hardt, Gray Reed and Porter Hedges, scored revenue increases of five to eight percent.

“2016 was a record-breaking year,” says Munsch Hardt Managing Partner Phil Appenzeller. “We are a four-cylinder law firm – bankruptcy, corporate, real estate and litigation – and all four cylinders were firing last year.”

The Texas Lawbook 40 firm finance numbers are educated estimates based on data supplied by the law firms, as well as thorough interviews with law firm leaders and industry analysts.

Two law firms experienced extraordinary success in 2016.

Houston-based Baker Botts grew its revenue 19 percent to $462.5 million last year. Revenue per lawyer at the firm jumped $185,000 in 2016 to $1.95 million. Baker Botts received a huge financial boost from the resolution of a highly profitable contingency fee litigation.

Kirkland & Ellis, a firm founded in Chicago that opened a Houston office in 2014, saw its revenue from its Texas office jump from $64 million in 2015 to $141 million last year – a 110 percent spike.

“Last year was the best year in firm history,” says Dee Kelly Jr. “West Texas and energy are driving a lot of this.”

“2016 was a fantastic year,” says Sean Wheeler, managing partner of the Houston office of Latham & Watkins. “The year did not start out well because of the low commodity prices – and then we were off to the races.”

Data collected by The Texas Lawbook found that:

-

- Twenty-nine of the 40 corporate law firms in the survey increased their revenues from their Texas operations. Half of those 29 law firms are headquartered outside the state.

-

- Fourteen law firms saw revenues in Texas jump by 10 percent or more. Nine of the 14 are firms based elsewhere.

-

- Texas-based firms generated $3.55 billion from their Texas offices, which is up from $2.65 billion in 2010 – a 35 percent increase.

-

- National law firms generated $1.53 billion in 2016 from their Texas operations, which is an increase of 264 percent from an estimated $420 million in 2010.

“No doubt, 2016 was the best year ever for revenues in Texas,” says Jonathan Newton, who is managing partner of Baker McKenzie’s Houston office.

Baker McKenzie saw its Texas revenue jump 16 percent in 2016 to $95.2 million.

The increase in revenues by The Texas Lawbook 40 law firms came despite a 3 percent decline in the number of lawyers employed at those firms in the state in 2016. Texas-based law firms saw an 8 percent decline in headcount, while national law firms increased the number of lawyers they have in Texas by 14 percent.

As a result of the decline in headcount, revenue generated per lawyer at the 40 law firms hit a record high of $837,300 – an enormous 14 percent jump from $733,184 for those same firms in 2015.

“All performance metrics were up in 2016,” says Gardere Managing Partner Holly O’Neil.

In fact, 85 percent of the law firms in the Texas Lawbook 40 increased revenue per lawyer. Only three of the 40 – Andrews Kurth Kenyon, Mayer Brown and Polsinelli – experienced a decline, although Mayer Brown and Polsinelli actually grew overall revenue in Texas by increasing their lawyer headcount through lateral hires.

Sixteen of the 20 law firms with the highest revenue-per-lawyer ratio are based outside of Texas.

“Elite, high-powered law firms across the board are doing significantly better than the rest of the legal industry,” says Matt Anderson, senior vice president of Wells Fargo Private Banking Legal Specialty Group. “It is all a matter of who is getting the work, and I see a lot of the [elite] national firms getting the best work.”

The advantage that Texas legacy law firms have had over national practices in attracting legal work from local companies “has gone away,” says Tom Melsheimer, managing partner of the Dallas office of Winston & Strawn.

“The final barrier protecting Texas-based law firms has broken down,” Melsheimer says. “National brands are now beating local brands for local legal business.”

Einat Sadka, a director in Citi’s Private Bank Law Firm Group in Dallas, says the escrow accounts of the larger national firms are “growing considerably faster” than those of the more regional, mid-sized firms.

While national law firms are stealing away lawyers and clients, several Texas-headquartered firms still had extraordinary years.

Dallas-based Jackson Walker, for example, has chosen to buck the trend by focusing all its efforts on Texas. It has no offices outside of the state. Yet Jackson Walker grew its revenue by 11 percent to $246.6 million in 2016. The firm’s revenue per partner jumped eight percent to $711,688.

“We are not the most exciting law firm for headlines in The Texas Lawbook,” says Jackson Walker Managing Partner Wade Cooper. “We are as good as any law firm at turning billable hours into net profits. Because we kept our operations in Texas, our overhead is considerably lower. We are not paying New York, London or Dubai office rates.

“We are a great bargain,” he says. “We can provide great legal assistance without charging $900 an hour.

“2016 was a very good year – profits up eight percent and revenue per lawyer at an all-time high,” says Strasburger Managing Partner Dan Butcher.

In all, eight Texas legacy firms in The Texas Lawbook 40 – AZA, Baker Botts, Haynes and Boone, Kelly Hart, Jackson Walker, Munsch Hardt, V&E and Winstead – reported record revenues from their Texas operations.

“2016 was the law firm’s best year ever by revenue,” says Winstead Chairman David Dawson. “The better news is that the growth is over several practice areas. We are expecting more of the same for 2017. We are blessed to be in a growing and dynamic business state. We named eight new shareholders in January, which shows our success in 2016 and our outlook for 2017.”

Bracewell Managing Partner Greg Bopp says that the firm’s energy practice was “up significantly across the board.”

“All financial metrics increased year over year, and we expect it will continue in the year ahead,” Bopp says. “We have a full quarter behind us and we are off to our best start in several years.

“The key to success in this marketplace is focusing on your strength and differentiating ourselves from the competition,” he says. “The market for routine legal work is declining.”

“We had an extraordinarily successful year – a record for total revenues and profits,” says V&E Chairman Mark Kelly.

Legal industry analysts say the 2016 revenue numbers are impressive, but they also point out warning signs that Texas firms should be heeding.

“Texas-headquartered law firms saw billable hours decline six percent. Industry-wide, billable hours were flat,” says Gretta Rusanow, who is head of Citi Private Bank Law Firm Group’s Advisory Services. “The Texas market did not contract, but Texas-based law firms saw work shift to national law firms.”

Law firm data collected by Citi, Wells Fargo, Peer Monitor and Bloomberg show that legal demand from Texas businesses was, at best, flat in 2016. Some experts estimate that it actually declined by as much as three percent.

“2016 was a record year, as revenue was up 3.6%,” says Haynes and Boone Managing Partner Tim Powers.

“Revenue increases at Texas law firms is the mere result of rate increases rather than increased demand or more work by the lawyers,” Zimmerman says. “At some point, the market will no longer accept three to five percent rate increases from corporate lawyers.

“Law firms in Texas should not get too comfortable,” he says. “There are law firms that face challenges, and some of them need to change course or they could go down in the next few years.”

While legal spend at Texas-based law firms is flat, some elite law firms are achieving new legal work from companies outside of the state. For example, private equity firms used to hire only New York law firms to represent them in deals they were doing in Texas. Now, more and more of those private equity firms are hiring firms in Austin, Dallas and Houston to handle their joint ventures and investment deals.s

Coming Next Week: A profile of Haynes and Boone Managing Partner Tim Powers, who is unusually open and blunt about the future of the legal profession in Texas and predicts that some major law firms will not survive.