Rob Reedy has heard the question over and over. Why doesn’t Porter Hedges merge with Kelly Hart & Hallman?

“Yeah, it has been brought up a few times,” Reedy said.

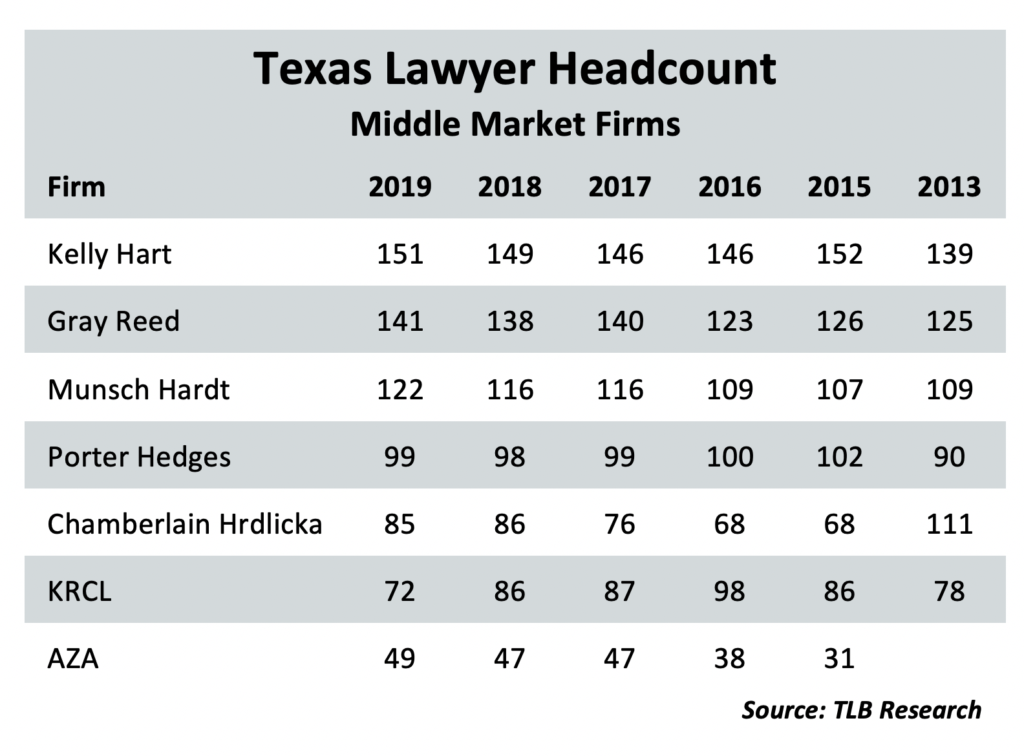

Both are full-service firms founded four decades ago with a focus on middle market companies. They each have deep and strong ties in the oil patch. They have no duplication of offices. Porter Hedges, based in Houston, has about 100 lawyers. Kelly Hart, headquartered in Fort Worth, has 150 attorneys.

“On the surface, the two firms seem like a perfect match for merging,” said Chicago law firm consultant Kent Zimmermann. “But if you dive into their numbers and their environments, you discover that they are quite different. They are managed differently and I’ve been told that they have different compensation systems. Both are excellent firms in their space, but I am not sure that they are a good match.”

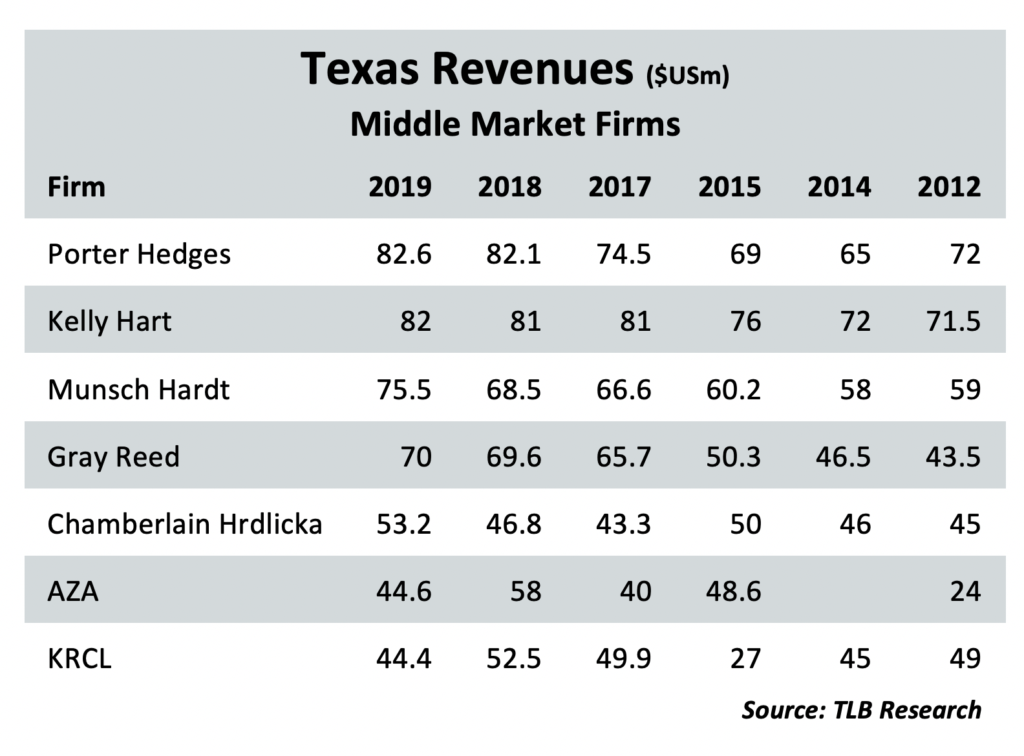

Kelly Hart and Porter Hedges are two of seven Texas middle market law firms in The Texas Lawbook 50. They are the two largest middle market firms by revenue in Texas.

Combined, these seven law firms – Ahmad, Zavitsanos, Anaipakos, Alavi & Mensing; Chamberlain Hrdlicka; Gray Reed; Kane Russell Coleman Logan; Munsch Hardt Koff & Harr; Kelly Hart & Hallman; and Porter Hedges – employed 721 corporate lawyers and generated $452 million in revenues in 2019.

None of the seven firms ranked in the top 25. The seven comprise 10% of the lawyer count of The Texas Lawbook 50 but only 7% of the top 50’s total revenues. Six of the seven are full-service firms, while one firm, AZA, is a litigation boutique.

In 2018, there were nine middle market law firms in The Texas Lawbook 50 employing 832 lawyers and collecting $493.5 million in revenues. Dallas-based Bell Nunnally dropped out of the top 50 despite increasing revenues 4% in 2019 and hitting record high revenues and profits. Coats Rose is also no longer in the 50 because the firm declined to provide financial information this year.

Just five years ago, 12 middle market law firms – Carrington Coleman, Cox Smith, Godwin Lewis, Burleson and Beirne Maynard – would have made The Texas Lawbook 50, according to firm finance data published by American Lawyer. Four of those law firm either merged with larger firms, went out of business or suffered declining revenues or stopped providing data.

Editor’s correction: Carrington Coleman has never reported its financial data to the American Lawyer and has not reported it to The Texas Lawbook. The firm’s 2015 financial data were estimates made by AmLaw. The Lawbook intended to distinguish Carrington Coleman’s data from the other four firms, but we failed to do so.

Those 12 law firms had 1,156 lawyers in 2015 that reported $632 million in income in 2015.

Legal industry analysts say these middle market firms are a throwback to old-fashioned legal practices when lawyers were actually counselors for their business clients.

“Our firm’s history is that we are a trusted advisor to our clients,” Phil Appenzeller, CEO of Munsch Hardt, told The Texas Lawbook . “This is a time when clients need lawyers to be their partners, not just a billing number.”

Kelly Hart managing partner Marianne Auld agrees.

“Our clients know they can call us with questions and we are not going to start billing them the minute we pick up our phone,” Auld said. “Our clients are our partners.”

Raymond Kane, a founding director of KRCL, said middle market firms, which have lower hourly rates and more flexibility in the rates they charge, should benefit from the current COVID-19 and commodity price crises.

“This is an environment that makes our economics a good opportunity for us with clients,” Kane said.

The lawyers at the seven firms have hourly rates that are 30% to 60% less than their big firm competitors. First-year associate compensation is closer to $140,000 than the $200,000 at top corporate firms. Partners’ annual compensation ranges from $650,000 to $2 million.

“There are some truly excellent lawyers at midsized corporate firms,” Zimmermann said. “It shows that some corporate lawyers can be satisfied making $1 million a year.”

To be sure, the seven law firms in the Lawbook 50 have some big-time corporate clients, including American Airlines, AT&T, Exxon Mobil and Neiman Marcus.

Range Resources Chief Legal Officer David Poole said he enjoys working with smaller firms.

“Not every legal matter requires a $1,000-an-hour lawyer,” Poole said. “In fact, most legal work doesn’t.”

Porter Hedges and Kelly Hart

Porter Hedges, for the second consecutive year, had the highest revenues of the middle market law firms, but the firm’s lead is ever so narrow.

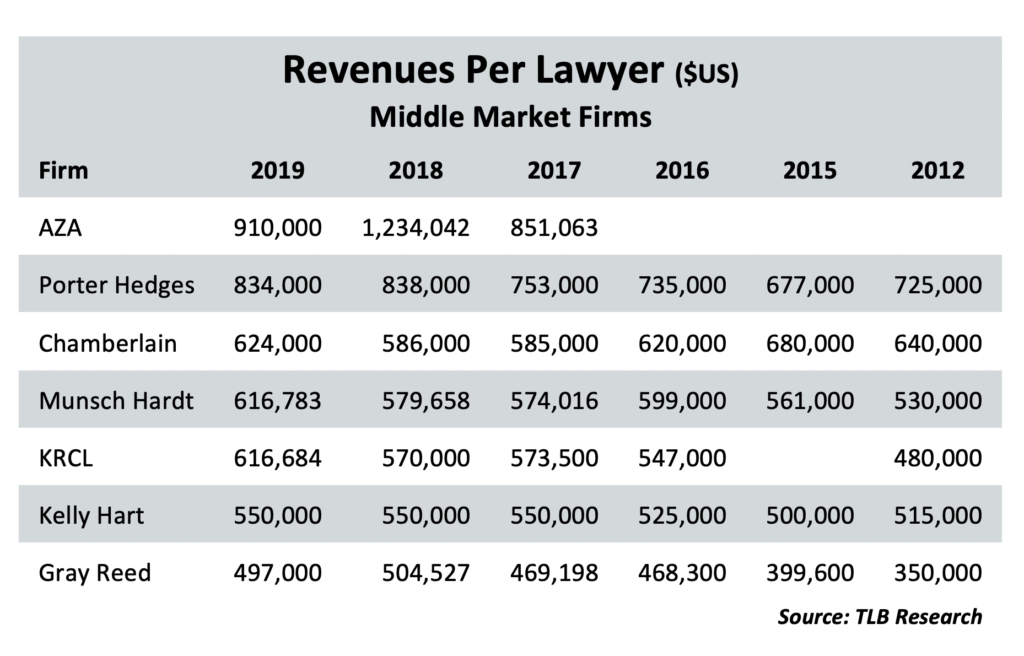

The Houston firm’s 99 lawyers in Texas collected $82.6 million, and its Oklahoma-based attorneys added $1.2 million. The firm’s revenues per lawyer declined ever so slightly to $834,000, which is 23% higher than its RPL of $677,000 in 2015.

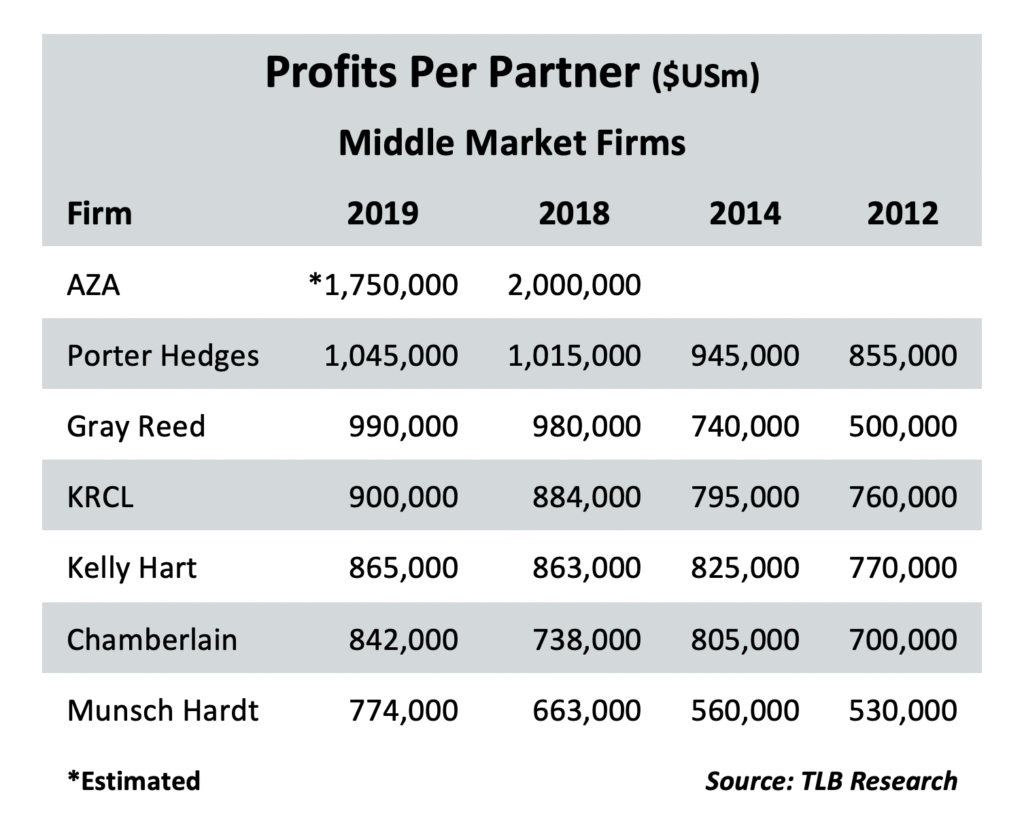

For the second year in a row, Porter Hedges also reached seven figures in its profits per equity partner in 2019 – $1.045 million, which is $30,000 more than in 2018.

“2018 and 2019 were record years – the best two years in our firm’s history,” Reedy said. “We saw strength in bankruptcy, litigation and real estate. Energy wasn’t what we hoped for, but our lawyers held their own. And we had a fantastic start to 2020.”

Porter Hedges is involved in several current major corporate bankruptcies, including Alta Mesa, Neiman Marcus, Tri-Point Oil & Gas, American Commercial Lines and Diamond Offshore Drilling.

In M&A, the Corporate Deal Tracker shows that Porter Hedges was involved in eight transactions valued at $670 million in 2019. The firm represented Toronto-based Franco-Nevada in a $300 million purchase of 2% royalty interests on assets owned by Range Resources in southwest Appalachia. In December, Porter Hedges advised LiMarCo Logistics of Houston in its sale to Grammer Industries.

“Our firm is financially healthy and in great shape,” Reedy said. “Clearly, there is going to be an impact on us and on every law firm because of COVID-19. The key is to look for opportunities.”

Reedy said the calls from out-of-state law firms seeking to merge have slowed in recent months.

“We still get inquiries and I listen to them, but so far we don’t have an interest,” he said. “There’s no appetite among our partners for a merger.”

Porter Hedges ranked 27th on The Texas Lawbook 50’s listing of law firms by revenue in Texas in 2019. Kelly Hart is only one spot behind at 28th.

Kelly Hart has about 50% more lawyers than Porter Hedges and revenues of $82 million in 2019, which is $1 million more than the year before. The Fort Worth firm reports revenues per lawyer of $540,000 and profits per partner of $865,000.

“2019 was an exceptionally strong year for us, and 2020 started strong. Everyone is working really hard,” Auld said. “Our energy section continues to be busy on transactions and litigation.”

Kelly Hart appellate partner David Keltner, a former Texas appellate judge, represented Houston-based Enterprise Products Partners in overturning a $500 million judgment against the pipeline company in a high profile, multi-year litigation against Energy Transfer Partners. Kelly Hart also represented Fort Worth-headquartered aerospace products supplier Novaria Group’s purchase of Long-Lok in December.

Regarding a possible merger, Auld echoes Reedy’s comments.

“We are happy doing what we are doing. We never say never, but no one here has a hankering for a merger,” she said.

Munsch Hardt and Gray Reed

Ranking 31st on The Texas Lawbook 50 is Munsch Hardt, which increased its revenues by 10% – from $68.5 million in 2018 to $76.5 million in 2019.

“2019 was a phenomenal year for us,” Appenzeller said. “For all metrics, we were 10% higher. By far our best year ever.”

Munsch Hardt added six lawyers last year and ended 2019 with 122 attorneys. The firm reported revenues per lawyer of $616,783 and profits per partner of $774,000, which is a 16.7% jump over the previous year.

“Our real estate lawyers were on fire last year,” Appenzeller said. “I couldn’t hire real estate lawyers fast enough. Litigation was hot. Corporate and bankruptcy sections were solid. Despite the virus, the first three months of 2020 were strong, beating budget.”

Munsch Hardt lawyers advised Dallas-based Ambit Energy in its $475 million sale to Vistra Energy last August.

Appenzeller said the firm added several excellent lawyers during the past year and plans to keep being aggressive.

Munsch Hardt lured Bradley Arant energy partner David Roth in February and grabbed bankruptcy partner Chris Johnson from McKool Smith in August.

“We had several exciting opportunities in the pipeline, but it was frustrating to have to put those on hold until the COVID-19 crisis is over,” he said.

Gray Reed, which has 141 lawyers in Texas, generated $70 million in revenue in 2019 – up $400,000 from a year earlier – and is 32nd in The Texas Lawbook 50.

For the second year in a row, Gray Reed flirted with – but once again fell just shy of – $1 million profits per partner. The firm’s revenues per lawyer declined slightly to $497,000.

Gray Reed represented Dallas-based Wing Resources last August in a $100 million equity funding commitment with Natural Gas Partners.

Chamberlain and KRCL

Chamberlain Hrdlicka is the sole middle market firm with a significant non-Texas presence. The Houston-based firm has 85 lawyers practicing in Texas – a dozen of them in San Antonio – and about 50 attorneys operating in Atlanta and Philadelphia.

In 2019, Chamberlain lawyers in Texas generated $52.3 million – a 13.7% increase over the prior year – while its non-Texas operations had $34 million in income.

The firm’s 2019 net income was $40.6 million. As a result, Chamberlain’s profits per partner jumped 14% to $842,000. The firm’s revenues per lawyer last year were $624,000 – up from $586,000 in 2018. The firm ranks 42nd in The Texas Lawbook 50.

“We had record revenues, record net income, record profits per partner – records across the board,” said Chamberlain managing shareholder Larry Campagna. “There’s a lot of tax controversy and litigation going on. M&A was very good, but we know it is slowing down. January, February and March, work was way up. I’ve been inspired by the reaction of our people.”

“A lot of clients are needing help navigating the new legislation involving small and midsized business loans and assessments,” he said.

Chamberlain added a half-dozen new shareholders last year, including former Texas Supreme Court Justice David Medina who joined in April.

Shareholder Amy Moss was the legal advisor to Houston-based Sourcewater in a $7.2 million securities offering.

Campagna said the firm is looking to grow.

“We’ve had a number of larger firms talk with us about a merger, but we are not interested,” he said. “We would look at adding small teams of people to our firm. We would like to grow. We are adding space to grow.”

Revenues at KRCL dropped 15.4% in 2019 – from $52.5 million in 2018 to $44.4 million last year. The clear reason for the decline was the amicable departure of 20 lawyers in the firm’s litigation defense practice at the end of 2018.

KRCL leaders said the firm was “too heavy” in the litigation practice and that it needed to strategically resize.

“Our goal was to increase rates and to get our revenues per lawyer numbers up,” said Kane. “We feel we had a great year.”

KRCL increased its RPL by 8%, from $570,000 in 2018 to $616,684 last year.

The firm’s profits per partner went up more than 1% to $893,000.

“Our real estate leasing practice had its best year in a long time,” Campagna said. “We have kept our overhead low, as we are not trying to compete with the big national law firms. We are actively looking for bankruptcy lawyers. We want to grow and we know we may need to take on more office space.”

AZA and Bell Nunnally

There is only one litigation boutique in the Lawbook 50: AZA in Houston.

AZA has 49 lawyers and revenues of $44.6 million in 2019, which is down 23% from their record-setting 2018 collections. AZA ranked 46th in revenues in Texas.

The firm’s revenues per lawyer were $910,000 last year, which is down from $1.23 million in 2018. Profits per partner stayed near the $2 million mark.

“We had 14 cases go to trial in 2018, but only eight trials in 2019 because several were postponed to 2020,” said founding partner John Zavitsanos. “Now it is like we are in a long version of the Twilight Zone. When we come out of this, there is going to be a litigation explosion.”

If it was The Texas Lawbook 51, then Bell Nunnally would have made the list for the second straight year. And legal industry analysts say the firm’s steady growth indicate it could easily be back in the top 50 this year or next.

With 59 lawyers, the Dallas law firm experienced a 10th consecutive year of record revenues and profits. The $36.4 million Bell Nunnally collected in 2019 was 4% more than the previous year but 20% higher than 2017.

Bell Nunnally dropped out of the top 50 only because three national law firms grew even faster.

“The firm had a remarkable 2019,” said Bell Nunnally managing partner Christopher Trowbridge. “We have increased revenues every year since 2009. We had a great year for dealmaking.

“Our labor and employment lawyers have been working around the clock,” he said. “Our bankruptcy and creditor’s rights lawyers are having their phones ringing off the wall.”

Trowbridge said that work and demand actually increased in March as the firm’s billing hours were up 8%. He said the firm ended 2019 with a significant cash balance and no debt.

“Midsized law firms like ours are able to be price flexible in providing legal services, which I think benefits us tremendously in hard economic times like these,” Trowbridge said. “It is important to remain nimble and entrepreneurial.

“Times like these are why we became lawyers,” he said. “It’s our job to find solutions for clients.”