When John Simpson and Thomas Thacher opened their law firm in 1884 at 9 Pine Street in downtown New York – one block from the New York Stock Exchange – the Texas legal market was not part of their growth strategy.

The firm now known as Simpson Thacher & Bartlett paid their lawyers $10 a month. Their first retainer was $50.

Now 136 years later, the firm is one of the richest and most influential law firms in corporate America, and Texas is a big part of its plan going forward.

Simpson Thacher, which represented the private equity firm KKR in the $45 billion leveraged buyout of TXU Energy in 2007 and now counts Tesla, Microsoft and Alibaba as clients, opened a Houston office 2011 with 10 lawyers. Today, it has 55 corporate lawyers who occupy the 53rd and 54th floors of the JPMorgan Chase Tower. The firm, which has more than doubled its Texas revenues during the past five years, reported $57 million in income in Texas. It plans to add 10 more lawyers this fall.

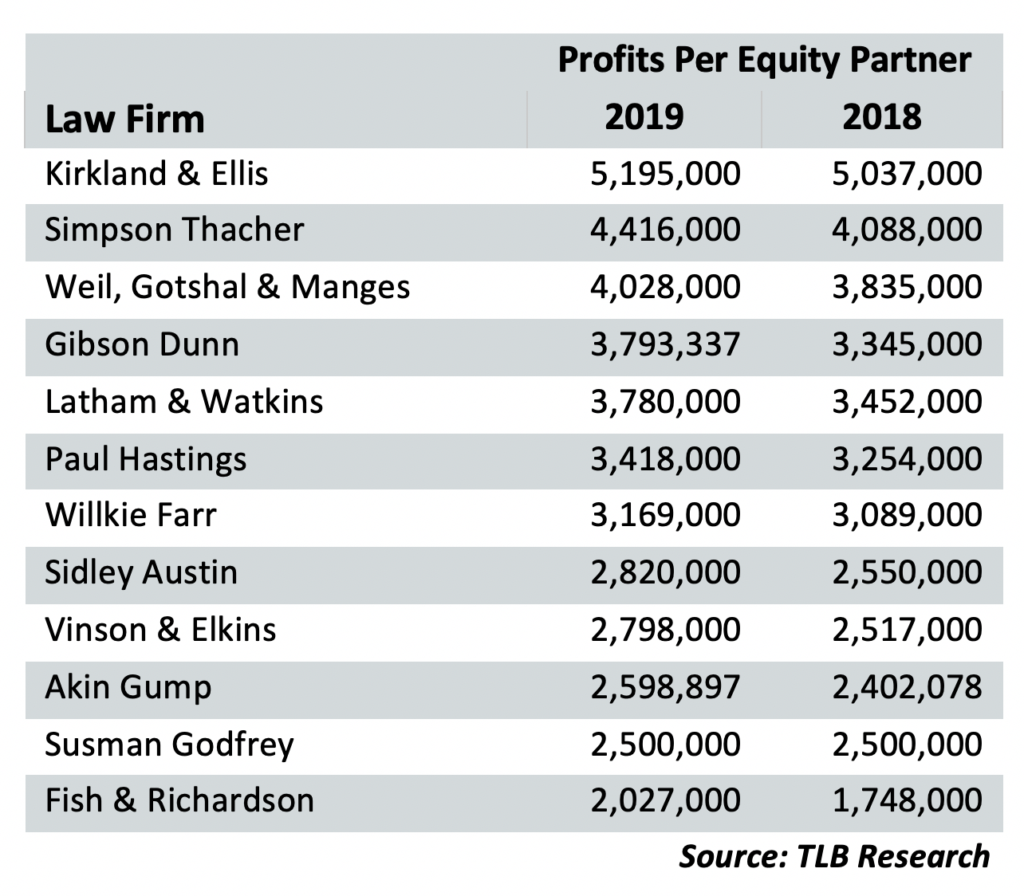

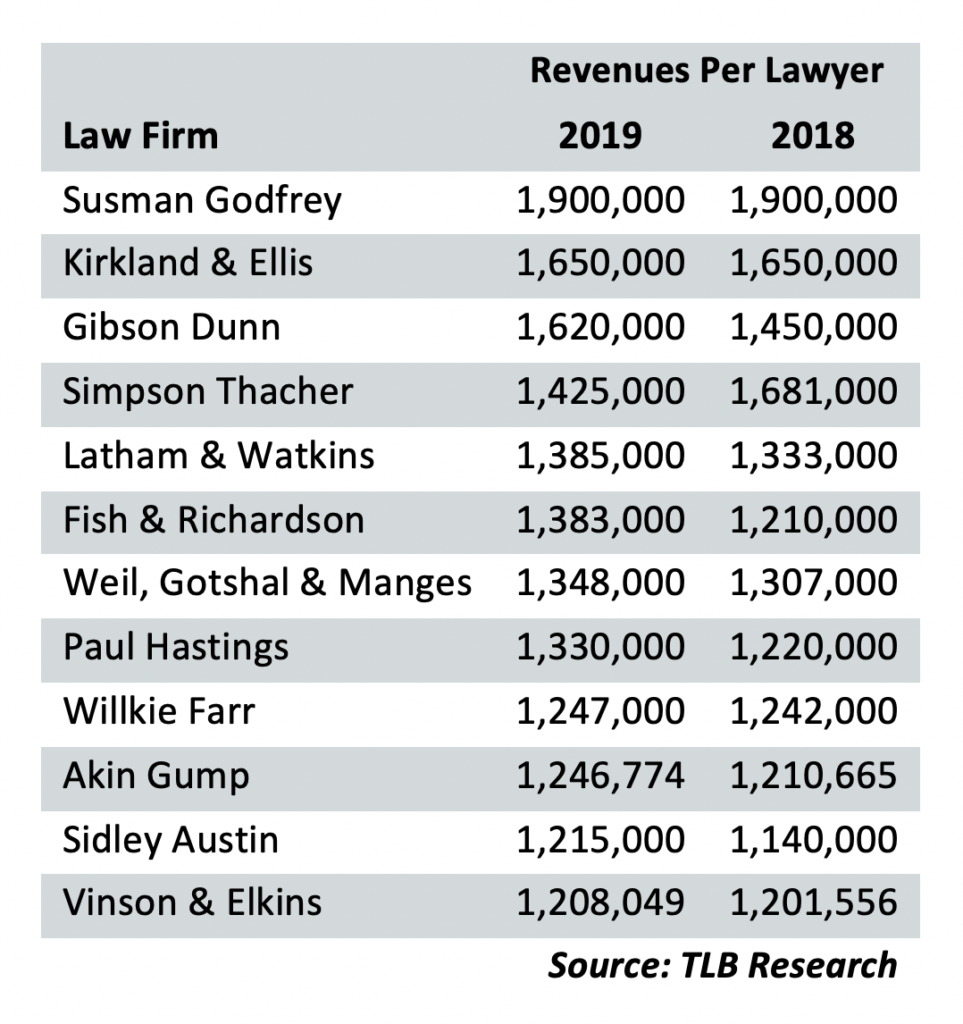

Profits per equity partner for Simpson Thacher’s lawyers in Houston exceeded a whopping $4.4 million in 2019. The firm’s revenues per lawyer were $1.425 million, which was actually a down slightly last year but is still the envy of nearly every legal shop in the Lone Star State.

“We’ve been ramping up the number of lawyers we have in Texas for the past three years, and we’ve been very busy,” says Robert Rabalais, managing partner of Simpson Thacher’s Houston operation. “Texas has been an excellent legal market for our firm and several other firms.”

There are those firms where just the name denotes prestige, strength, distinction and even superiority. Simpson Thacher is the definition of an elite corporate law firm. So are Kirkland, Latham, Weil, Gibson Dunn, V&E, Sidley and Akin Gump.

Wealthy clients with massive problems or bet-the-company matters seek out those law firms, which have the smartest, most successful and most expensive lawyers.

“No question, there are law firms in Texas that their mere name means excellence,” says Rabalais. “These law firms are home to lawyers who have the best legal expertise and the most experience doing the most complex transactions or litigation.”

There is indeed a plethora of ways to subjectively determine the best or most successful business law firms in Texas. Which firms have the best-known lawyers or have the most Fortune 500 clients? Which firms have the best rankings in Chambers or the most Super Lawyers?

When it comes to pure economics, however, there are a handful of corporate law firms in Texas – a dozen, to be exact – that standout from the rest, according to legal industry analysts and insiders.

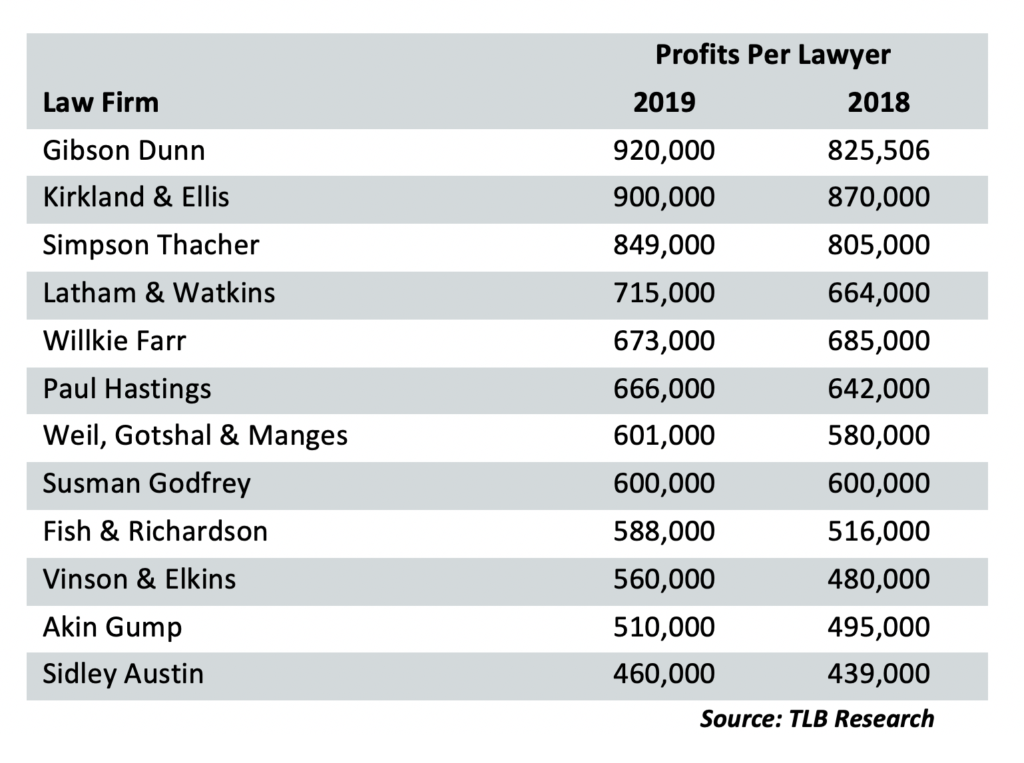

These 12 law firms achieved an elite status this year by meeting or beating three financial data points:

- Profits per equity partner (PEP) of $2.5 million or more;

- Revenues per lawyer (RPL) of $1.2 million or higher; and

- Profits per lawyer (PPL) of $450,000 or more.

“There are so many ways to judge or measure law firms – best brands, most lawyers, highest revenues, most offices – but PEP, RPL and PPL are statistics that can accurately – or at least more accurately – determine the true success of a law firm,” Kent Zimmermann, a law firm consultant for Zeughauser, told The Texas Lawbook.

“The law firms that meet those three criteria are going to attract the best lawyers, and the best lawyers attract the best clients, and the best clients pay the most money,” Zimmermann said, repeating a mantra he cites often when describing the road to success for law firms. “The firms that get the most money pay their lawyers more, and that attracts more great lawyers and the cycle starts again.”

Identifying the Dozen

Only three of the Texas Lawbook Elite firms – Akin Gump, Susman Godfrey and Vinson & Elkins – have roots in Texas.

Five of the law firms – Kirkland & Ellis, Latham & Watkins, Paul Hastings, Simpson Thacher and Willkie Farr – only opened offices in Texas during the past decade.

Three law firms on the elite list – Gibson, Dunn & Crutcher, Latham and Paul Hastings – were founded in Los Angeles.

Two other firms – Kirkland and Sidley Austin – trace their beginnings to Chicago.

Willkie Farr, Weil, Gotshal & Manges and Simpson Thacher are New York-based corporate law firms.

The final firm with elite status in Texas is Boston-based Fish & Richardson, which has a reputation as one of the best intellectual property law firms in the U.S.

The 12 elite firms employ 1,586 lawyers in Texas or 22% of the attorneys working at firms in The Texas Lawbook 50, which annually ranks the 50 largest revenue producing law firms operating in Texas.

But those dozen elite firms generated $1.98 billion in revenues in 2019, which is 30% of the $6.6 billion of total income for The Texas Lawbook 50.

“A major key to success for the top law firms in Texas is that they have one or two or three ‘top of the market’ legal practices where the lawyers in those practices are truly the best and have great reputations,” Citi Private Bank Law Firm Group Managing Director Jeff Grossman told The Texas Lawbook in an interview in April.

“The most successful law firms have great reputations because they have great lawyers in specific practice areas and those lawyers do great legal work,” Grossman said. “And they have deep benches.”

Kirkland and Gibson

There is no better example than Kirkland, which has the one-two punch of private equity M&A and corporate bankruptcy and restructuring expertise. The combo has proven extraordinarily profitable in Texas.

No law firm in Texas has ever grown faster than Kirkland, which also holds the title for richest law firm in the world during the past two years. Texas has been a huge component of Kirkland’s expansion strategy.

Kirkland opened its first Texas office in Houston in April 2014. In 2015, the firm had 45 lawyers in Texas who made $64 million. In 2019, Kirkland had 236 attorneys in Houston and Dallas bringing in $389.4 million from clients – a 508.4% increase.

According to The Texas Lawbook 50 report of the largest revenue-generating firms in Texas, Kirkland now ranks fourth behind Baker Botts, Norton Rose Fulbright and V&E. Legal industry analysts predict Kirkland will jump to No. 2 this year.

“The key to successfully opening and growing in Texas is developing and articulating a specific strategy and plan,” said Kirkland partner Andy Calder, who opened the firm’s office in Houston.

“We decided to focus first on private equity, which was a natural strength for the firm, and then go after work from the strategics,” Calder said. “It takes a considerable investment for a new firm moving into a new market to move the needle. And the legal business is much like most other industries in that it helps to have some good luck.”

Kirkland’s profits per partner last year? Hold on to your bell bottoms: $5.2 million. And its revenues per lawyer is $1.65 million.

Calder said, however, that there is plenty of high-level legal work remaining for the regional law firms.

“There is a huge role for local and regional and mid-market law firms in Texas,” he said. “There is a lot of legal work for very talented niche practices that we nor probably any of the national law firms are going to go after. Not all the legal work – even sophisticated, complex transactions and litigation – requires lawyers from a Kirkland or Gibson or Simpson to be done successfully.”

Not far behind Kirkland is Gibson Dunn, which reported $1.62 million in RPL in 2019 and PEP of $3.8 million. And the firm ranks No. 1 in Texas in PPL: $920,000. The law firm average in Texas in 2019 was $380,000.

“Some of the success of the elite firms in Texas has been by happenstance and some of it by design,” said Rob Walters, managing partner of the Dallas office of Gibson Dunn. “The elite firms have more in common than differences. They’ve attracted leadership that understands Texas, and they’re committed to practicing at the highest level.”

“They all recognized early the promise of the third coast,” said Walters, who successfully represented AT&T in the landmark antitrust trial against the federal government regarding the $85 billion acquisition of Time Warner.

Sidley and Weil

Yvette Ostolaza, managing partner of the Dallas office of Sidley Austin, agrees. Sidley, which has doubled its lawyer headcount in Texas during the past six years, has developed a powerhouse internal corporate investigations practice in Dallas and a deep bench of corporate M&A lawyers in Houston.

“The big firms that moved here that have not been as successful simply don’t understand Texas and the two legal markets of Dallas and Houston,” Ostolaza said. “You can’t be a carpetbagger here and be successful. You have to invest. You have to be part of the community. You can’t be an export law firm.

“There is a bias among corporate general counsel and corporate leaders in Texas to use local attorneys, even on their biggest and most important matters,” she said. “They want to have relationships with their outside counsel. They want to see them at receptions and have lunch with them.”

The approach has worked for Sidley, which reported $2.82 million in PEP and $1.215 RPL in Texas in 2019.

The first national elite law firm to burst into Texas was Weil in the 1980s. The New York law firm truly provided the roadmap for other non-Texas firms. They hired local lawyers and grew the office slowly and organically. Weil’s lawyers embedded themselves in the Dallas and Houston communities.

“Opening a new office requires a significant investment of time, investment in talent and some patience,” said Courtney Marcus, co-managing partner of Weil’s Dallas office. “Opening an office in a new region can be daunting economically, culturally and otherwise. The firms which have had success have generally done so by bringing on board a critical mass of local attorneys with noteworthy profiles in the Texas market.”

Lawyers at Weil generated nearly $1.35 million each in 2019. Its profits per partner exceeded $4 million. The critical component to the success of “powerhouse” law firms is providing critical expertise, according to Marcus.

“Clients come to Weil with questions of first impression, bet-the-company cases, and transformative transactional matters because of our ability to work side-by-side with our clients to resolve complex legal and business issues and our willingness to share our judgment,” she said.

Latham and Willkie

Then next splash came in 2010 when Latham opened shop in Houston – a story that has been recounted dozens of times. The firm targeted specific corporate M&A and capital markets lawyers and grew fast.

Ryan Maierson joined Latham in 2011 and is now the global chair of Latham’s public company representation practice.

“Lawyers need to remember that we are in the service business and we are here to help our clients navigate through their problems and issues,” Maierson said. “If history is any guideline, the best lawyers do their best work in troubled times.”

Latham’s profits per partner were $3.78 million in 2019, and its revenues per lawyer were $1.385 million.

Paul Hastings and Willkie Farr are two law firms that fly under the radar but neither can be ignored.

Willkie, which opened its Houston office in November 2014, grew its lawyer count more than 30% in 2019 and has added more energy lawyers since. The firm’s revenues per lawyer hit $1.247 million in 2019 and profits per partner were $3.17 million.

Willkie increased the revenues it generates in Texas from $37 million in 2018 to $50 million last year – a 32% jump.

“We are growing in Texas because we believe in the energy industry,” said Bruce Herzog, Willkie’s co-managing partner in Houston. “We have acquired a second floor in Chase Tower, which allows us to add another 20 lawyers.”

“The key is finding young, dynamic professionals who want to be involved in the community, but they are few and far between,” Herzog said.

Paul Hastings has remained steady with about 20 to 30 lawyers in Texas since it opened in 2012. The firm’s Houston office serves as the base for its U.S. energy practice.

The RPL for Paul Hastings is $1.33 million and its PEP exceeds $3.4 million.

Akin, Susman and V&E

Finally, there are the three Texas firms, which could not be more different from each other: Akin Gump, Susman and V&E.

Susman Godfrey is a three-decades-old litigation boutique founded in Houston by the great trial lawyer Steve Susman. The firm, which does a lot of contingency fee work, expanded to Dallas and then New York. With 62 lawyers in Texas, the firm reported revenues per lawyer of $1.9 million in 2019 and PEP of $2.5 million.

Akin Gump, which was founded in Dallas, has 171 lawyers in Texas and generated $213 million in revenues from its Dallas and Houston lawyers last year. With PEP at nearly $2.6 million and RPL of $1.25 million, Akin Gump has built solid energy transactional and complex commercial litigation practices.

“Dallas, Houston and Austin have dynamic economies,” said Scott Barnard, managing partner of Akin Gump’s Dallas office. “The oil and gas industry is suffering, but we know it will return. And COVID-19 has impacted several other business sectors and many companies are facing challenging times. It is our job to be there for our clients when business is good and when it is not.”

V&E is the largest law firm in Texas. It is also the most profitable Texas-based firm. V&E’s profits per partner was $2.8 million in 2019 and revenues per lawyer of $1.2 million.

Widely viewed as one of the world’s leading energy law firms, V&E represents dozens of oil and gas companies in a wide array of transactional and litigation matters. To reduce expenses, the firm shuttered its Beijing office earlier this year.

“We have increased our PEP by 107% over the past 10 years thanks to strategic planning,” said V&E Chairman Mark Kelly. “The firm made some difficult decisions to part ways with a couple practice groups that included a lot of great lawyers and friends but those practices had pricing challenges.”

“Good lawyers are needed in hard times,” Kelly said. “During these difficult times is when clients turn to their long-time and trusted law firms and counselors for strategic advice.”