© 2014 The Texas Lawbook.

By Natalie Posgate – (November 19) – Cross-border corporate lawyers Carlos Valencia and Tatiana Escribano are two of the most sought after legal advisors in Mexico.

Two years ago, they were partners in Dallas-based Thompson & Knight’s Mexico City office when they decided to move their practice to DLA Piper, a 4,000-lawyer firm headquartered in Chicago and London. Two weeks ago, Valencia and Escribano switched firms again, joining global giant Baker & McKenzie. Headhunters predict other law firms will attempt to poach the pair yet again within a few months.

The legal market in Mexico is heating up as law firms jockey for position to attract corporate clients seeking to invest tens-of-billions of dollars or more when Mexico fully implements its energy reforms in the months ahead.

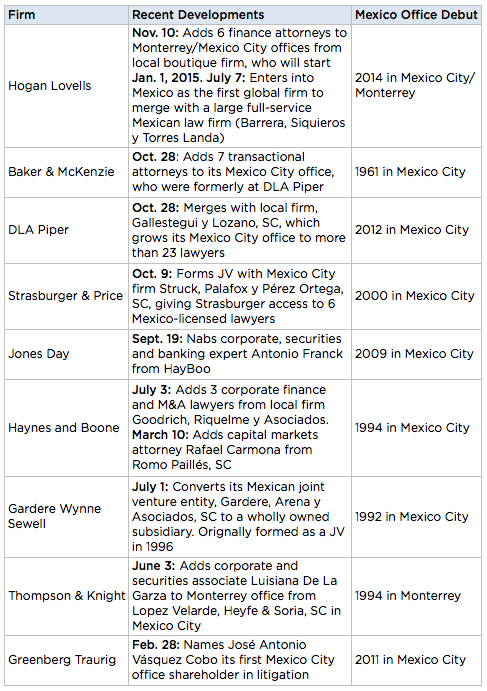

During the past few months, law firms from Texas and across the globe have raided each other’s offices in an attempt to hire experienced and well-connected corporate lawyers in Mexico. (See chart at the bottom that summarizes recent lateral hire activity).

“Everybody’s got their eyes on Mexico,” said Jeff Liebster, a New York-based partner of the global legal recruiting firm, Major, Lindsey & Africa.

Dozens of law firms – most of them based in Texas or with prominent Texas operations – are seeking to expand into Mexico. Some have opened new offices or want to do so.

Other firms are expanding existing operations, creating joint ventures with Mexican-based firms or raiding law firms that have lawyers experienced in Mexican law and who have strong political and regulatory contacts in Mexico.

“I think the law changes will absolutely transform the legal market in Mexico, but more importantly, those changes will transform the country period,” said Luis Gomar, the partner-in-charge of Dallas-based Strasburger & Price’s Mexico City office.

The historic reforms would, for the first time in 75 years, open Mexico’s rich oil and gas reserves to private outside investors for exploration and production.

During the past three months, corporate counsel from Chevron, ExxonMobil, Anadarko Petroleum, Pioneer Natural Resources, Chesapeake Energy Corp. and American Energy Partners have attended educational programs about Mexico’s energy reforms hosted by Texas law firms.

A handful of private equity firms with significant investments in oil and gas have received regular updates on the reforms, according to lawyers who represent those funds.

Even non-energy related companies realize the energy reforms south of the border will mean more business opportunities for them and, as a result, a need for more lawyers.

“What is happening in Mexico is extraordinary and our business interests and legal needs in Mexico are going to significantly increase with these energy reforms,” said Clay Scheitzach, senior vice president and senior corporate counsel at Xerox Business Services in Dallas.

“Energy companies and non-energy companies are going to need more lawyers to help us with contracts, dealing with business-to-business and labor disputes and other legal issues that will surface under Mexican law,” he said.

The competition is definitely heating up.

“We’re seeing not only Texas-based firms coming into Mexico, but also other international firms looking to establish a presence in Mexico,” said Gabriel Ruiz, the partner in charge of Thompson & Knight’s Monterrey office, which opened in 1994. “And we’re seeing that they’re going about it in different ways.”

The primary debate for law firms is whether they need to open an outpost in Mexico or can they attract and effectively represent clients from their existing Texas offices.

Four Texas-based law firms – Haynes and Boone, Thompson & Knight, Gardere Wynne Sewell and Strasburger & Price – have lawyers permanently based in Mexico. Norton Rose Fulbright is seeking to open an office. Five national law firms – Baker & McKenzie, DLA Piper, Greenberg Traurig, Hogan Lovells and Jones Day – have moved into Mexico, too.

“We will likely pursue opportunities in Mexico in the near future, as our energy, infrastructure, finance and corporate lawyers continue to be active in the region,” said Linda Addison, managing partner of Norton Rose Fulbright-U.S. “Mexico City as it stands is one of the few emerging markets in which we do not yet have an office.”

Legal industry analysts say Texas firms focused on oil and gas have an advantage because most of the initial transactions will involve exploration and production efforts in the deepwater of the Gulf off the Mexican coast and the Mexican side of the Eagle Ford Shale.

“Being a Texas-based law firm that understands how the U.S. energy industry has operated will give us a very interesting perspective on how things may potentially operate in Mexico,” Gomar said.

The large Texas law firms with strong oil and gas practices – Akin Gump, Andrews Kurth, Baker Botts, Bracewell & Giuliani, Locke Lord and Vinson & Elkins – either have no plans to expand into Mexico or declined to discuss such plans.

“Global firms understand the need for local knowledge and relationships in order to be competitive,” said Liebster, who works with top tier U.S. and Mexican law firms on their global strategies. “Some firms in Texas have historically said, ‘We can take care of this in Texas.’ But in the current market, many are re-evaluating that strategy.”

U.S. law firms seeking to handle transactional or litigation work in Mexico face significant cultural challenges, including a difference in the basic approach to legal services between Mexico and other countries.

“Practicing Mexican law in a Mexican law firm is different than practicing Mexican law in a U.S. law firm,” said Alberto de la Peña, a Mexico-licensed partner who heads Haynes and Boone’s U.S.-Mexico Cross Border practice in the firm’s Dallas office.

“The way a business U.S. law firm approaches clients and provides service sometimes may be different than the way a Mexican attorney and Mexican law firm will do it,” he said.

U.S. attorneys, according to de la Peña, often take an approach that is partially legal and partially business when advising clients. In Mexico, he said, attorneys stick strictly to the legal advice and “don’t really get involved in understanding the business issues.”

In addition, Mexico has a history of having smaller, specialized firms rather than full-service, institutionalized ones. Lawyers said that often presents a challenge for U.S. firms with strong trial practices.

“Litigation in Mexico is an entirely different animal so to speak; it is very particular to local custom,” Ruiz said. “Any firm that wants to incorporate a trial practice in Mexico will face a big challenge.”

Strasburger, which is considered one of the more conservative Texas law firms, is betting that boots on the ground will pay off. The Dallas firm opened its Mexico City office in 2000 and announced last month that it has created a joint venture with the Mexico City law firm Struck, Palafox y Pérez Ortega, S.C.

“You absolutely need Mexican-licensed lawyers to assist, and sometimes lead the transactions,” Gomar said.

Jones Day opened its Mexico City office in 2009 with 31 lawyers and has since expanded it to 74 attorneys. Two months ago, Jones Day snagged seasoned Mexican corporate, banking and securities lawyer Antonio Franck from Haynes and Boone. And Jones Day partners say the firm plans to add 10 more lawyers specializing in telecom law, international arbitration and real estate to its Mexico operations in the next several months.

Not to be outdone, Haynes and Boone, which is the largest Texas firm with a presence in Mexico, has nabbed three corporate finance partners from local firm Goodrich, Riquelme y Asociados, a Mexico City-based firm.

Luis Moreno, Haynes and Boone’s administrative partner in Mexico, said the firm has “initiated a very aggressive campaign on lateral hiring” to bring in lawyers experienced in environmental, mediation, labor and employment and tax law.

“There will be more and more competition, not only for clients, but frankly for talent and lawyers in Mexico,” said Scott Schwind, a partner in Jones Day’s Houston office who spends a significant amount of his practice on cross-border energy transactions in Latin America.

Law firms with strong financial practices in London, New York and Chicago are also part of the competition for legal talent in Mexico.

“There will most likely be more than enough work for anybody to handle,” said Ruiz of Thompson & Knight, who splits his time between the firm’s offices in Mexico City and Monterrey.

“Because of the amount of foreign investment that is expected, we will be seeing more firms come into Mexico, not only Texas-based, but maybe London-based, Chicago-based and New York-based,” he said.

Thompson & Knight experienced this firsthand in 2012 when London-based DLA Piper poached all 14 attorneys in T&K’s Mexico City office.

Just last month, half of the 14 DLA Piper lawyers, including Escribano and Valencia, moved their practices again to Baker & McKenzie, which has more than 300 attorneys in five Mexico offices.

Andrés Ochoa Bünsow, managing partner of Baker & McKenzie’s Mexico offices, said the firm currently is aggressively recruiting lawyers for its infrastructure and energy practice areas. He said the firm wants to expand its office in Monterrey, which is the home of some of the largest corporate headquarters in Mexico.

“Monterrey will be one of the hubs for the energy investments, so we’re already gearing up for that,” Ochoa-Bünsow said. “We’d like to stay one step ahead of competition and make sure we’re always prepared to meet the needs of clients in those areas, which is why we’re always actively searching for opportunities for lateral hires.”

To offset its losses to Baker & McKenzie, DLA Piper last month announced plans to merge with the Mexico City-based firm, Gallastegui y Lozano, which increases the combined firms’ manpower to more than 23 lawyers.

The biggest splash occurred in July when London and Washington, D.C.-based Hogan Lovells merged with the Mexican firm Barerra, Siqueiros y Torres Landa. Hogan Lovells, which now has 70 attorneys in Mexico City and Monterrey, is the first global law firm to merge with a large full-service firm in Mexico. The firm announced last week that it is adding six corporate finance lawyers to the Mexico City and Monterrey offices early next year.

“The Hogan merger was definitely noticed by other firms and they’re interested to know how it’s going,” said Bob Croyle, a director in Major, Lindsey & Africa’s Houston office.

Not all law firms are convinced they need to have an office in Mexico in order to serve their Latin American clients.

Rick Burleson, the founder and managing partner of Houston-based Burleson LLP, said his firm hired Armando Sañudo-Trueba, a prominent Mexican corporate and international business lawyer to join the firm’s Latin America Practice group in San Antonio.

“It’s kind of the best of both worlds,” Burleson said. “You get a Mexican lawyer who is well-known and respected. There’s a lot to opening an office in another country… we think it’s better that he’s in the San Antonio office.”

Burleson said Sañudo-Trueba and Alex Perez, a partner who specializes in cross-border M&A and is a director of the U.S.-Mexico Bar Association, travel to Mexico City “all the time.”

Oil and gas companies, Burleson said, are still trying to learn more about the opportunities being made available by the Mexico reforms.

“People are playing it pretty close to the vest because they don’t want to let people know what they’re planning,” he said. “They don’t want to start a bidding war.”

© 2014 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.