© 2018 The Texas Lawbook.

By Natalie Posgate

(Feb. 9) – A Dallas hedge fund manager, accused of illegally profiting from a systematic false information campaign about a Grapevine residential lender, has doubled-down on his response.

In his most detailed filing yet, hedge fund manager J. Kyle Bass claims not only that the information he posted about United Development Funding was true, but that he and his firm, Hayman Capital Management, were ethically obliged to publish it.

“Once Hayman learned the financial irregularities of the plaintiffs and their potentially fraudulent conduct, Hayman believed that it had an obligation to share the conclusions it derived from the UDF related research,” Bass said in an affidavit provided in support of a motion to dismiss the suit under the Texas anti-SLAPP statute.

In Bass’s affidavit, he disclosed new information related to his hedge fund’s role in alerting both the SEC and the FBI about UDF’s alleged shady financial activity:

· In March 2015, former Hayman General Counsel Christopher Kirkpatrick sent an executive summary of the firm’s research on UDF to the U.S. Securities & Exchange Commission;

· In April 2015, Hayman gave a presentation of its research findings to the FBI. A couple months later, Hayman attended a follow-up meeting with the FBI, where forensic accountants were present; and

· In late May or early June 2015, Kirkpatrick attended a meeting at the SEC’s Fort Worth Regional Office (his former employer) to present Hayman’s UDF research.

For its part, the SEC’s investigation into UDF is said to be moving toward conclusion, according to lawyers familiar with the matter.

In mid-December, senior SEC enforcement officials met with UDF executives and their lawyers to discuss the case. UDF leaders hoped to convince federal authorities to not bring charges and to explain the reasoning for some of its moves.

Lawyers familiar with the meeting say that it was cordial and that UDF executives and their lawyers presented their arguments, but SEC officials remain undeterred in their view that UDF committed wrongdoings and that charges should be levied.

UDF officials have been told that a settlement agreement needs to be reached with the SEC before the end of March or charges will likely be filed, sources said.

A source familiar with the elements of both investigations says the FBI has maintained an interest, but apparently has elected to remain sidelined while the SEC considers its case.

Last November, UDF, a Grapevine-based residential lender, filed a lawsuit alleging that Bass and Hayman had mounted what they believed to be a malicious and illegal public campaign to spread false information about UDF for their own financial benefit.

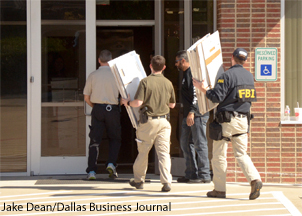

The suit, filed by Joseph Cox and Andrea Broyles of Bracewell, alleged that Bass and Hayman were instrumental in decisions by the SEC and the FBI to open investigations of UDF and its umbrella of real estate investment trust affiliates.

Bass and Hayman are known for short-selling stocks, a common investment play that, in essence, bets on a company’s stock declining. Between December 2015 and October 2016, Hayman published online posts that questioned UDF’s financials and suggested that the REIT operates much like a Ponzi scheme. The posts attracted national media attention, and, as UDF alleges, caused the REIT’s stock to plummet from $17 a share to $1 a share, which allowed Bass to profit by approximately $60 million.

Though Bass has acknowledged his firm’s short positions in UDF (and, likewise, revealed it in a disclaimer on Hayman’s website, udfexposed.com), he contends in his most recent filing the UDF information was the product of extensive research and was published because it was a matter of public interest to investors.

“Especially after Enron, it is of vital public interest that the public financial statements of public companies be openly criticized; this is exactly what Hayman did and this lawsuit is an attempt to chill future scrutiny of UDF’s troubling financial status,” Hayman says in its 52-page filing. Hayman claims that the UDF lawsuit, if allowed to proceed, will chill public discussion on the merits of other publicly traded companies – discussion that the Texas anti-SLAPP statute is specifically designed to protect.

In another affidavit attached to the motion, Hayman analyst Parker Lewis said he spent two years researching the financials of UDF after discovering that two of its funds (UDF IV and UDF V) were capitalized through a broker-dealer in common with American Realty Capital Partners (ARCP), a now-defunct REIT that faced criminal investigation. The broker, RCS Capital (RCAP), was later forced into bankruptcy after its broker-dealer license was revoked.

After beginning to research “UDF in earnest in approximately November 2014, Lewis said in his affidavit that he discovered numerous “financial irregularities” in UDF, such as abnormal high loan concentration; the use of financial proceeds to repay obligations to prior, and affiliated UDF investment vehicles; the apparent use of UDF’s largest borrower as an intermediary to facilitate the transfer of funds between UDF entities; and “certain facts or patterns that raised reasonable questions regarding general solvency concerns… regarding certain significant groups of related borrowers of certain UDF entities.”

Lewis said his research of UDF was based on “SEC filings, county court records, county and land deed recordings, central appraisal district websites, the Secretary of State taxable entity search records and visits to various physical sites.

“The research that I conducted was made in good faith and the conclusions that I reached were carefully considered and generally consistent with those reached by Hayman’s investment committee, including Bass,” the affidavit says.

Bass said Hayman sought advice from New York First Amendment lawyer Landis Best of Cahill Gordon as well as public relations firm Edelman before publishing any of its findings about UDF.

“Hayman did not recklessly disregard the truth in disseminating statements related to plaintiffs,” Bass’s affidavit says. “The website (udfexposed.com) features fact-based analysis, and provides detailed documentation of the information evaluated which establishes the bases on which Hayman’s truthful statements and opinions were made.”

Bass and Hayman’s legal team includes Michael K. Hurst, David Coale and Chisara Ezie-Boncoeur of Lynn Pinker Cox & Hurst and Cole Ramey and Karly Rodine of Kilpatrick Townsend.

Mark Curriden and Allen Pusey contributed to this report.

© 2018 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.