HOUSTON – As 2015 winded down, Alan Beck and Jeff Floyd led a team of Vinson & Elkins lawyers representing El Paso-based Western Refining in a $2.43 billion merger with Arizona-based Northern Tier Energy.

The Western Refining transaction was the fourth largest deal handled by Texas lawyers in the fourth quarter, as well as the final 10-digit transaction of the year. The fact that V&E was the legal adviser was almost expected.

Multibillion-dollar mergers and acquisitions in the oil patch – as Geico commercials might say – it’s what V&E does.

“We believe we have the reputation as the world’s leading energy law firm – and rightly so,” V&E chairman Mark Kelly said in an interview with The Texas Lawbook.

The Houston-based law firm has dominated M&A charts for law firms representing Texas-based businesses for as long as such accounting as taken place, thanks to its strength in advising clients in the energy sector. As a result, V&E reported record revenues and profits in 2014, as the lawyers in its Texas offices generated more than $1 million in revenues each.

But many legal industry observers and competitors privately predicted V&E’s legacy of supremacy in Texas M&A would end in 2015.

V&E certainly seemed vulnerable.

More than three-dozen V&E lawyers, including some of the firm’s most prominent and successful oil and gas attorneys, left the law firm during the past six years to join out-of-state law firms entering the Texas market, including three Houston partners just this week.

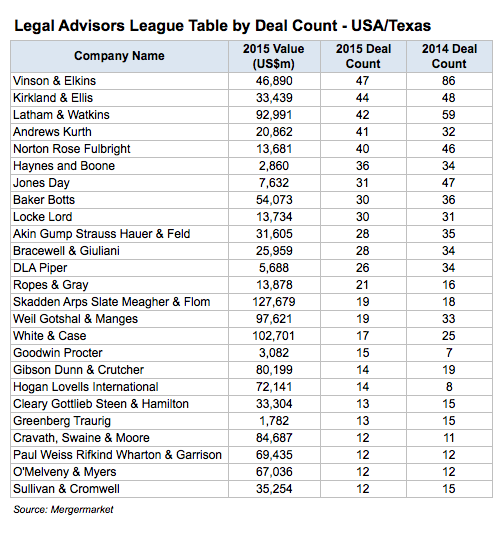

New data from Mergermarket, an independent global research firm, shows that 16 of the top 25 law firms representing Texas companies in M&A activity last year are based outside of Texas. In other words, business legal work in Texas is divided among many more firms and is no longer controlled by the Big Three (Baker Botts, V&E and Norton Rose Fulbright).

V&E’s No. 1 ranking in corporate transactions in Texas seemed especially vulnerable when oil and gas prices plummeted, which caused energy M&A to go quiet and securities offerings dry up.

After all, Mergermarket data, which was provided exclusively to The Texas Lawbook, shows that overall M&A involving companies headquartered in Texas plunged 23 percent in 2015.

To be sure, the crisis in the oil patch hit V&E doubly hard, as the number of mergers and acquisitions it handled for companies headquartered in Texas plunged 45 percent.

About 60 percent of V&E’s revenues are from energy-related clients.

“Law firms that emphasized or focused almost exclusively on oil and gas work were going to be hurt much more severely than firms with a broader client base,” said Chad Watt, an analyst and writer for Mergermarket.

“No law firm fits into this category more than V&E,” Watt said.

Despite all the economic and competitive pressures and all the predictions of demise, new data shows that V&E still ranked first in M&A and first in securities offerings for deal count in Texas in 2015.

“Against all odds, V&E remains king of M&A in the oil patch,” Watt said. “It’s pretty amazing actually.”

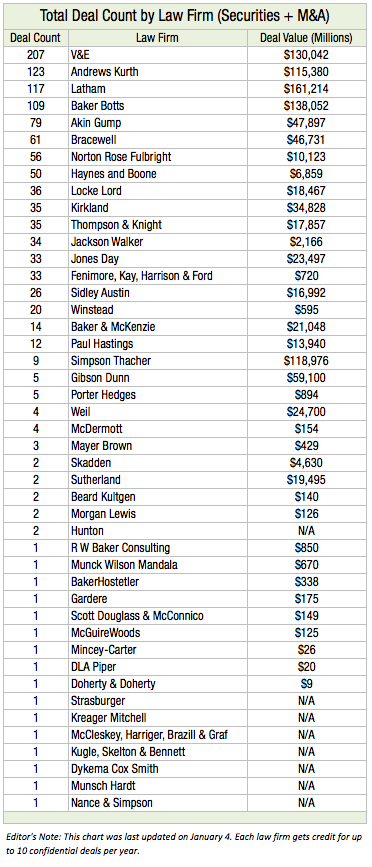

The Texas Lawbook’s Corporate Deal Tracker shows that Texas-based V&E lawyers represented clients all over the world in 207 mergers, acquisitions, joint ventures, divestitures and securities offerings with a combined value of $130 billion in 2015.

Andrews Kurth was second with 123 combined transactions. Latham & Watkins was third with 117, followed by Baker Botts and Akin Gump.

“Last year was the second best year for our firm ever – second only to 2014, which was a record year,” Kelly said. “No doubt we are in a challenging environment.”

Mergermarket reports that V&E advised 47 Texas-based companies in M&A transactions announced in 2015, down from 86 such deals in 2014. Such a steep decline – 45 percent in one year – would be catastrophic for most law firms.

But the Corporate Deal Tracker shows that, in 2015, V&E significantly expanded its representation of businesses – especially energy companies – based beyond Texas’s borders.

In fact, V&E lawyers in Texas represented nearly as many out-of-state businesses (42) in large dollar deals last year as they did in-state corporations (48), according to the Corporate Deal Tracker.

“Energy is more than just Texas and it’s more than just Houston,” Kelly said.

For example, Denver-based MarkWest Energy Partners turned to V&E to advise it on tax matters related to its $20 billion merger with Ohio-based MPLX and its sponsor, Marathon Petroleum Corporation. The firm also represented some of the non-Texas private equity firms that were part of the consortium that purchased Energy Future Holdings’ power transmission business, Oncor, for $19 billion.

Jeff Floyd, an M&A partner in V&E’s Houston office, said energy lawyers at the firm have witnessed previous downturns in oil and gas, which is comforting to the energy clients facing tough times.

“No law firm has the depth of experience as we do,” Floyd said. “General counsel and corporate boards don’t want their lawyers learning on the run during a downturn or crisis.

While officially announced deal count is down, there is still a lot of activity occurring just out of public view, he said.

“We are seeing a lot of term sheets, as people are just digesting potential transactions much more slowly,” Floyd said. “But no one is walking away.

“When prices stabilize, we are going to see a frenzy of deals in the $1 billion to $10 billion range,” he said. “When the private equity firms finally jump in, the turn in M&A is going to be dramatic.”

If V&E is strong in oil and gas M&A, it has ruled the world of capital markets in Texas.

Corporate Deal Tracker shows that V&E handled 117 securities offerings in 2015 with a combined value of $62.2 billion, which was 38 percent more than Latham, which placed second, handling 72 offerings valued at $36 billion.

During the second half of 2015, V&E was involved in a startling 45 percent of all of the securities offerings reported to the Corporate Deal Tracker – a time period that was very dry in the capital markets. Eleven of the 25 Texas lawyers who handled the most securities offerings in 2015 are partners at V&E, according to the Corporate Deal Tracker.

One of those partners is Gillian Hobson in Houston. Throughout her career, Hobson has noticed a “hiatus” starting early August for securities offerings as bankers go on vacation, albeit “less of a hiatus” since she first started practicing.

Instability in the energy market made that hiatus longer last year, she said.

“We saw a pause for a bit longer,” Hobson said. “Deals that might have gotten pushed through in a hot market were held, waiting to see what would happen.”

To understand the firm’s depth in capital markets, you have to look no further than partner Doug McWilliams, who ranked No. 1 in the Corporate Deal Tracker data for leading securities offerings for issuers and was second in leading offerings for issuers and underwriters combined.

Multiple sources have told The Texas Lawbook that McWilliams announced this week that he his leaving V&E and joining Simpson Thacher.

No law firm, including V&E, would ever argue that losing a great capital markets lawyer such as McWilliams is anything but a significant loss.

The Corporate Deal Tracker shows that if all of McWilliams’ securities offerings were subtracted from V&E’s total count, the firm’s lead over Latham, the firm in second place, drops from 38 percent to 28 percent.

Latham’s Houston office managing partner, Michael Dillard, who built an M&A and capital markets powerhouse in Houston from scratch during the past six years, said he tips his hat to V&E’s depth and staying power.

“V&E lawyers are still the lawyers we see most often on the other side of the table,” Dillard said in an interview late last year.

Four V&E partners were among the initial group of lawyers that started Los Angeles-based Latham’s Houston office in 2010. Prominent V&E oil and gas M&A partners Robin Fredrickson and Jeff Muñoz joined Latham a couple years later.

“V&E has lost some very good lawyers, including several to our firm, yet there they always are, at the top of the league tables,” he said. “A big part of it is that V&E is entrenched into the community. V&E lawyers sit on all the non-profit boards and they have placed so many of their lawyers in the corporate legal departments of their clients and those lawyers remain loyal to V&E and send them business.”

While Alan Beck co-led the final multibillion-dollar deal of 2015, he also co-led the first major securities offering of 2016 – a $1.6 billion private placement for Plains All American Pipeline in January.

At V&E, energy M&A and securities offerings… it’s what they do.

Texas Lawbook writer Mark Curriden contributed to this article.

(Editor’s Note: The Mergermarket data and the Corporate Deal Tracker data are calculated separately. Mergermarket tracks data involving Texas-based companies, regardless of where lawyers working on those deals are based. The Corporate Deal Tracker tracks only deals handled by Texas-based lawyers, even if the companies involved are based outside of Texas.)