The year 2023 is in the rearview mirror, so we’re probably telling you something you’ve instinctively surmised. But Texas-related capital markets deals in 2023 (transactions reported to the Corporate Deal Tracker that involved Texas companies or the work of Texas lawyers) looked an awful lot like 2022.

Sarah Morgan, a corporate partner at Vinson & Elkins, hadn’t seen our numbers when we asked for her impression. Still, it was the same.

“It (2023) felt a lot like 2022 with the same headwinds, mostly rising interest rates and other macroeconomic factors or concerns. There was still a decent amount of activity, but not crazy; certainly nothing like 2021,” she said.

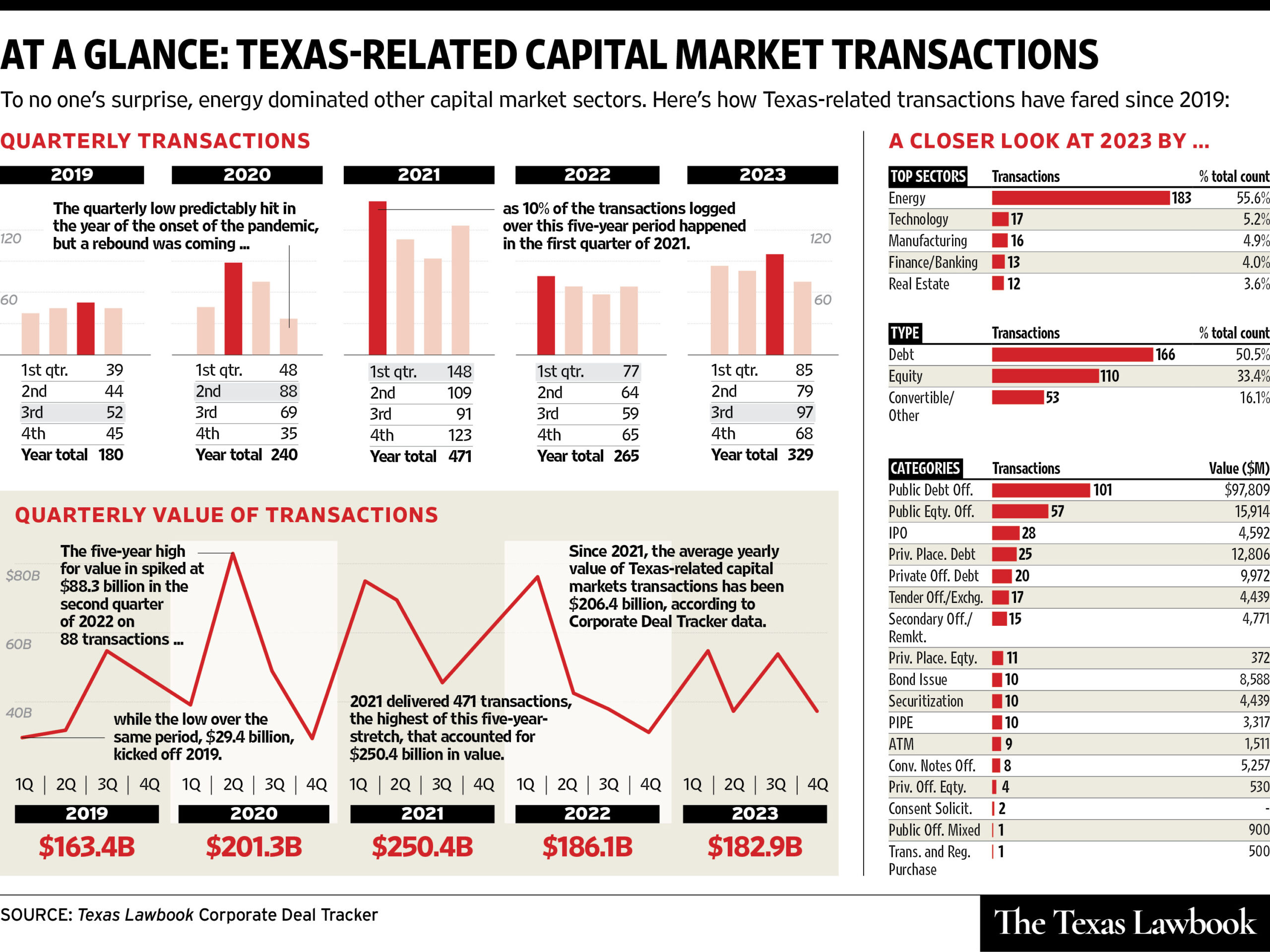

Perhaps predictably, more than half the volume (50.5 percent) and nearly three-quarters of the value (73.1 percent) represented debt issues, in one form or another. Pure equity issues represented only a third by volume (33.4 percent) and a scant 13.5 percent of value. The rest involved securitizations, exchanges or other less classifiable trades. Only 28 of the deals reported were IPOs.

Examining by quarter, the year had its highlights when compared to the past five years. Q3, for instance, cracked the top five in volume over the past 20 quarters, ranking fourth with 97 transactions. But 2021 still accounts for four of the top five quarters between 2019 and 2023. Q4 (with 68 CapM deals reported), however, ranked 11th. Q1 and Q2 ranked seven and eight.

As in M&A deals, energy predominated all Texas business sectors — only more so — representing 55.6 percent of the volume and nearly 60 percent (59.4 to be exact) of the aggregate value.

But through the first month of 2024, Morgan says she’s optimistic.

“The market now has more conviction that the fed will cut rates and that the macroeconomic environment has stabilized, which is constructive for the equity markets reopening,” she says.

“This has been particularly true of private capital raises in early 2024. The jury is still out on whether the IPO market will reopen, but there is a chance the public markets will be quiet, particularly in the latter half of the year, given that it is an election year.”

RELATED: Click here to see the Corporate Deal Tracker’s 2024 Capital Markets master list.