© 2015 The Texas Lawbook.

By Mark Curriden

(March 18) – M&A in the oil patch took a nosedive during the first two of months of 2015.

New data shows that there were one-third the number of mergers, acquisitions and joint ventures involving Texas-based oil and gas companies during January and February than there were during the same period one-year ago.

With West Texas Intermediate crude continuing to decline this week, legal experts say that deal activity is likely to remain slow because expectations between buyers and sellers remain far apart over the value of reserves in the ground.

Texas-based energy companies were involved in eight transactions during the first two months of 2015 – down from 24 such deals during the same period in 2014, according to Mergermarket, an independent global M&A research firm that produced the data exclusively for The Texas Lawbook.

The energy M&A decline is not exclusive to Texas.

Mergermarket reports that there were 36 energy transactions across the U.S. in January and February, which is down from 52 deals in the first two months of last year – a 31 percent decline.

Separately, The Texas Lawbook now tracks M&A activity by lawyers based in Texas involved in transactions anywhere in the world – compared to Mergermarket which tracks M&A according to the home or headquarters of the companies being purchased and sold.

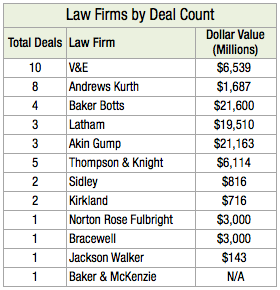

This new data shows that Texas-based corporate lawyers have been involved in 31 mergers, acquisitions and joint ventures involving companies across the globe through March 17. Of those 31 transactions, 17 were in the energy sector.

The total deal value for the 31 transactions is $35.7 billion, which includes Energy Transfer Partners’ $18 billion acquisition of Regency Energy Partners in January.

Vinson & Elkins was lead counsel in eight of the energy deals. Baker Botts and Latham advised in three of the oil and gas transactions, while Andrews Kurth, Kirkland & Ellis and Thompson & Knight were primary counsel in two deals.

You can follow The Texas Lawbook’s M&A data trackers by clicking here and here. A separate data tracker for securities offerings and IPOs is being completed next week.

Last year was a record year in Texas for M&A. Mergermarket reported that there were 536 corporate transactions in 2014 with a combined value of $275.3 billion.

© 2015 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.