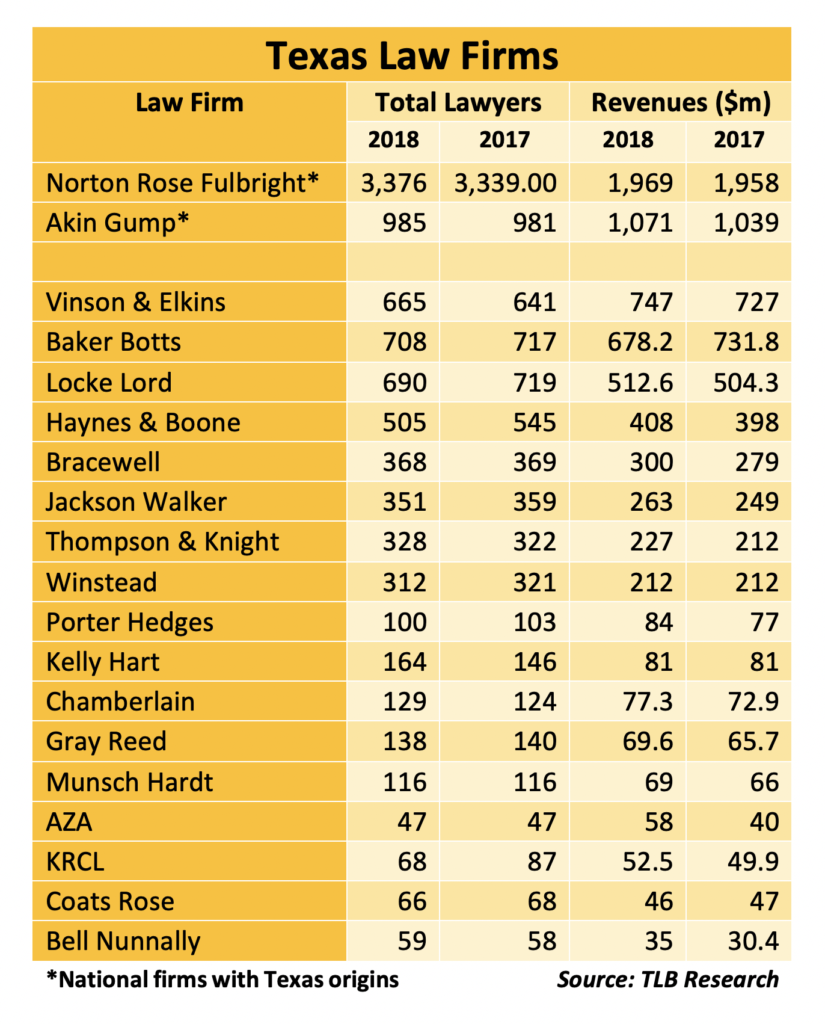

Corporate law firms headquartered in Texas saw revenues increase in 2018 despite the fact that there are fewer such law firms and that they employ a shrinking number of lawyers.

New financial data compiled by The Texas Lawbook shows that now there are only 17 Texas-based corporate law firms – all based in Dallas and Houston – ranked in the 50 largest revenue-generating firms in Texas, which is down from 23 in 2017 and dramatically down from 43 in 2010.

Even so, a dozen of those 17 firms made more money in 2018 than they did the year before, and a handful achieved record highs in revenues.

Data from The Texas Lawbook Top 50 also shows that efforts by Texas-based firms to grow their operations on the East and West coasts and internationally – a move designed to offset the explosion of national law firms that have seized a significant portion of the Texas legal market – has had mixed results at best.

Law firm leaders and legal industry analysts say that increased revenues at the 17 law firms is the result of a modest increase in demand for legal services plus a jump in the hourly rates of most business lawyers practicing in Texas.

In reality, Texas-based law firms generated $3.92 billion from their Texas and non-Texas operations in 2018 – an 11% decline from $4.4 billion in 2017.

The total number of business lawyers employed globally by law firms headquartered in Dallas and Houston fell 13% – from 5,586 in 2017 to 4,882 last year.

There is one critical factor responsible for the significant decline: Three major Texas-based law firms – Andrews Kurth, Gardere and Strasburger – collectively generated $545 million in revenues and boasted more than 700 attorneys nationwide in 2017 merged with out of state law firms in April 2018.

(Editor’s Note: An in-depth report on the 31 out-of-state based law firms ranked in the Texas Lawbook Top 50 can be read here. A handful of prominent Texas-based law firms – Beck Redden, McKool Smith, Munck Wilson and Susman Godfrey – declined to provide any of their financial data for 2018, but legal industry insiders believe that the four would be ranked in the Texas Lawbook Top 50.)

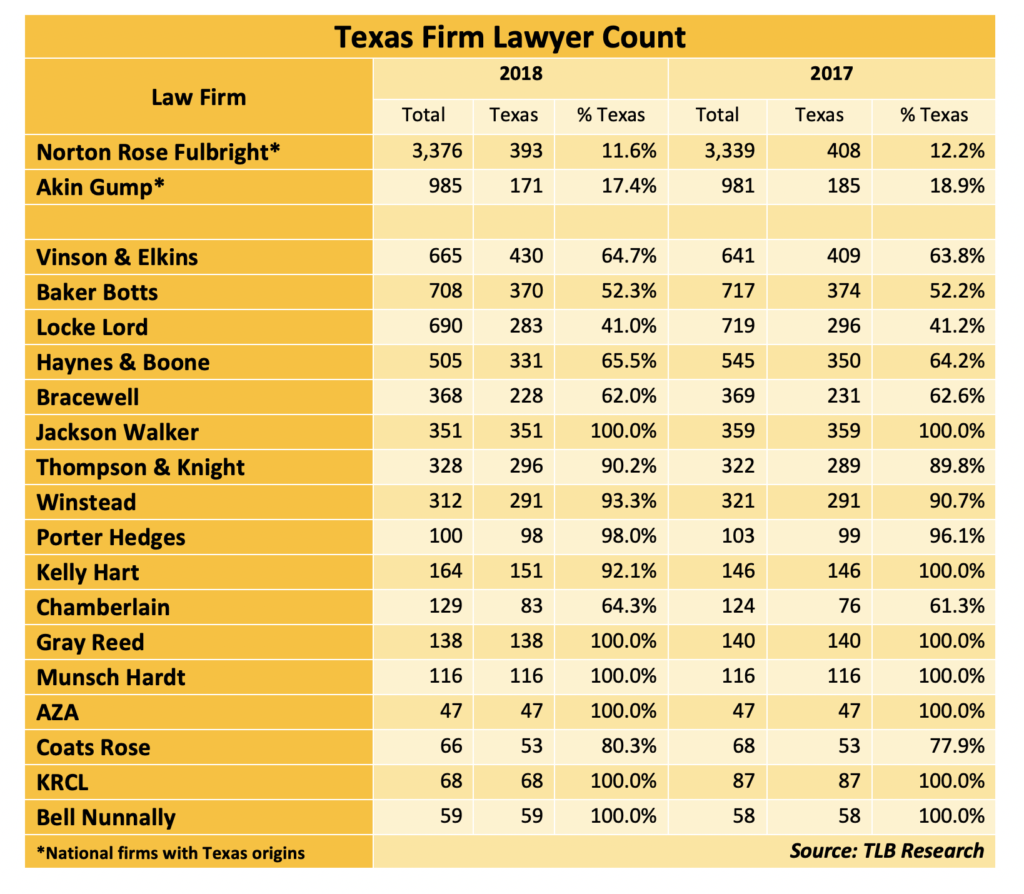

The 17 Texas law firms do not include global giants Akin Gump and Norton Rose Fulbright, which have deep Texas roots and a significant amount of management operations in Texas, but have even larger office administration functions elsewhere.

Combined, the two firms employed 4,361 attorneys – including 564 in Texas – in 60 cities around the world and reported $3 billion in revenues in 2018.

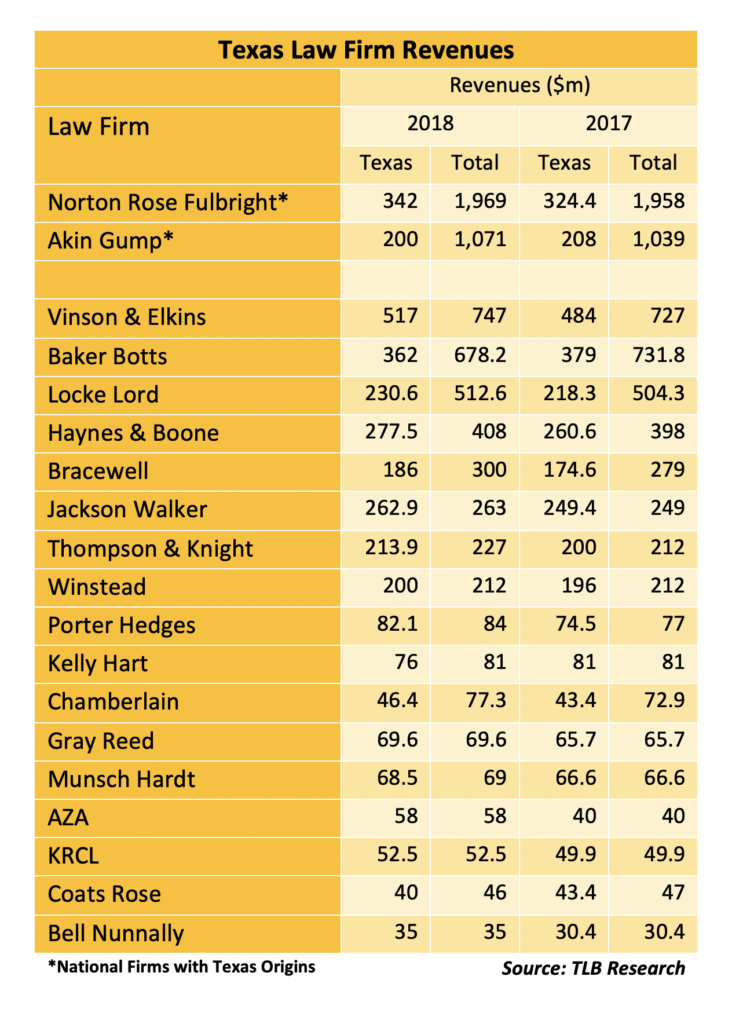

Norton Rose Fulbright ranked third in revenue in its Texas offices; Akin Gump ranked ninth. The two firms generated an estimated 18% of their total revenues from lawyers in their Texas offices.

Texas-based law firms have unquestionably been under siege by larger national legal operations with much deeper pockets. Prior to 2010, there were only a handful of national corporate law firms – Jones Day; Weil, Gotshal & Manges; King & Spalding and Baker McKenzie – with a sizeable presence in Texas.

As The Texas Lawbook reported in April, out-of-state law firms now account for 33 of the 50 highest-generating corporate law practices in Texas. Combined, they brought in $2.92 billion.

While the national law firms are thriving, many of the traditional Texas firms are holding their own.

Haynes and Boone, Jackson Walker, Porter Hedges and Vinson & Elkins are among the law firms that recorded record profits last year.

The Texas-based law firm showing the biggest revenue gains in 2018 was Houston litigation boutique Ahmad, Zavitsanos, Anaipakos, Alavi & Mensing, which reported $58 million in revenues last year – a 45% increase from 2017.

Eleven of the 17 Texas corporate firms have offices outside of the state.

The Texas Lawbook analysis of the data shows that the non-Texas offices of those 11 firms in 2018 employed 1,431 attorneys – seven lawyers fewer than the year prior – and generated $1.15 billion – a 2% decline from 2017.

Legal industry analysts say that any growth the Texas-based law firms are experiencing is happening with lawyers in its home offices in the state.

Dallas-based Locke Lord and Houston-based Baker Botts have expanded the most outside of Texas. Texas Lawbook data shows that 59% of Locke Lord lawyers worked in non-Texas offices and generated $282 million for the firm in 2018.

Baker Botts, which has proactively tried to expand beyond the Texas border, has 338 lawyers – 48% of its total lawyer count – in its offices outside the state. Those attorneys collected $325.2 million in 2018. Baker Botts recently elected a lawyer in its Palo Alto office to be its managing partner.

By contrast, V&E – the highest revenue producing law firm in Texas – has just 30% of its lawyers outside of state.