In its continuing recovery from the twin burdens of the April collapse in energy prices and a COVID-19 economy, both energy borrowers and energy lenders are predicting changes in their relationship, according to a flurry of data released Tuesday by Haynes and Boone.

Five separate reports on borrowing bases, price decks and energy company bankruptcies reveal an industry that is reshaping itself in the face of lower prices, lower demand and lower expectations in either the short or longer term.

For instance, in a semi-annual survey of 142 executives at oil & gas companies, energy lenders and industry service providers only 6% believe that the current reserve-based loan structure will survive as is. More than 4 in 5 said the current energy lending scheme will survive, but with a variety of changes —increased pricing, tighter financial covenants, high minimum hedging and more frequent borrowing base determinations. And 12% said banks will either lend solely on PDP with pre-1970s fixed-loan amortization or stop lending to oil & gas companies at all.

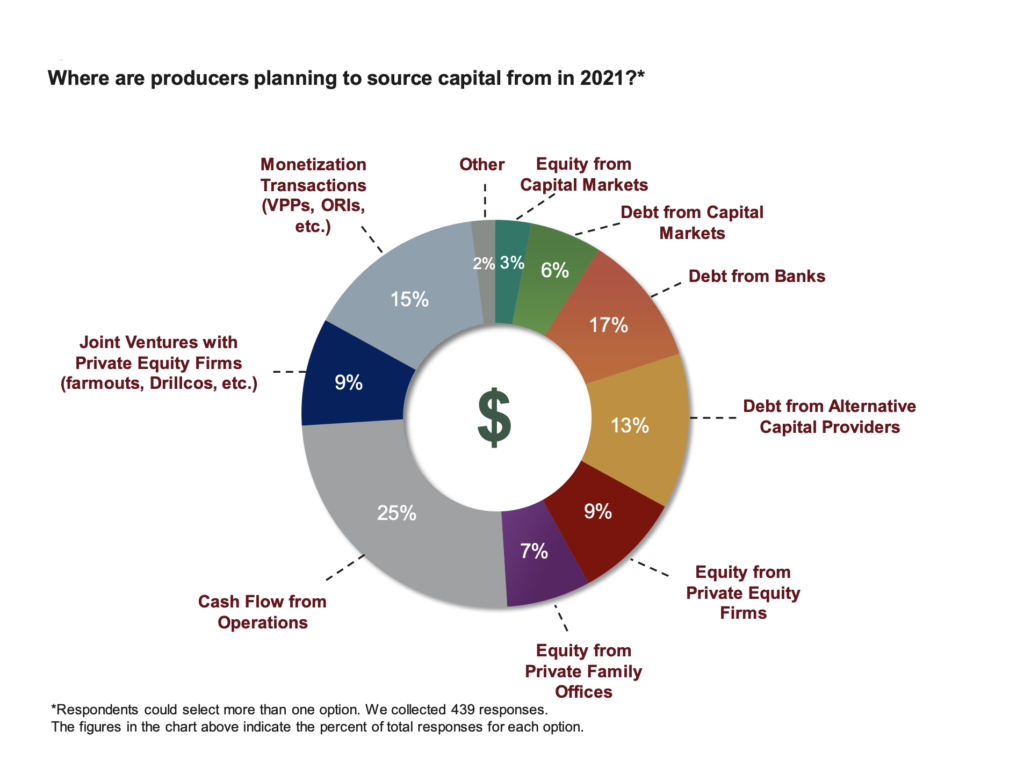

Already among producers there are adjustments in progress, according to the Haynes and Boone. Almost half say they expect to self-generate some of their capital needs in 2021 through cash flow from operations (25%), monetization transactions (15%) or joint ventures (9%).

And as for hedging, nearly 80% of the respondents in the September survey — including bankers and producers — report that reserve-based credit facility borrowers have already hedged from 40% to 70% of anticipated production over the next 12 months.

In a separate survey on borrowing base, Haynes and Boone surveyed 20 energy-lending banks about their current and future oil and gas price decks — the price at which a bank would extend credit to an energy producer. Although it is not the entire consideration, commodity pricing is basic to the lending algorithm at most energy-lending banks.

Compared to Haynes and Boone’s Spring report, predictions on oil prices remained the same. What changed, however, were the post-crash algorithms involved. Although prices recovered to $40/bbl, lenders say more conservative approaches to their lending calculus suggests an overall decrease of 15.7% in borrowing base.

“Rather than give some value to undrilled wells, producers are expecting banks to only give credit to proved producing wells,” says the report.

On the other hand, the average Fall base case is 13% higher, at least through 2023, than what was reported by lenders in the Haynes and Boone Spring report. The report notes that market sentiment in NYMEX strip pricing has improved since spring. But as the firm reports, whether those anticipated base case prices hold beyond six months “remains to be seen.”

Get the full reports: