Texas corporate lawyers feasted on mergers, acquisitions and joint ventures in 2021.

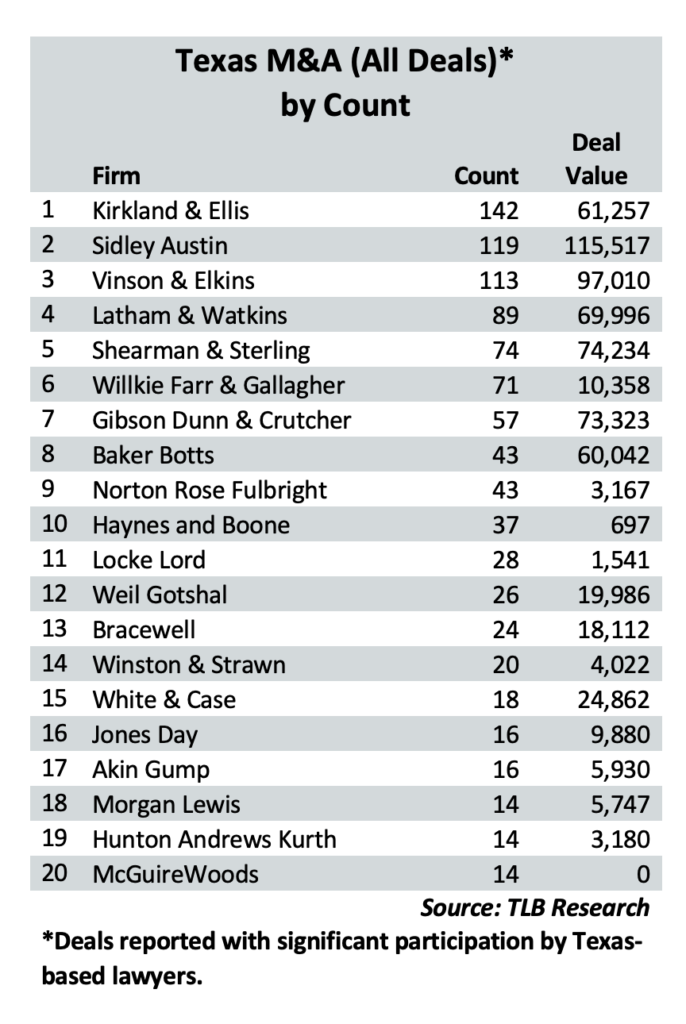

No law firm bagged more deals than the Texas offices of Kirkland & Ellis — though the corporate transactional baskets at Sidley, Vinson & Elkins and Latham & Watkins were incredibly full.

The Texas Lawbook‘sCorporate Deal Tracker annual report of M&A activity released last week showed that dealmakers in Texas did a record-smashing 929 corporate transactions last year valued at $601 billion.

Today, The Lawbook announces the ranking of law firms who did those deals.

Texas lawyers at three law firms – Kirkland, Sidley and V&E – were each involved in more than 100 transactions. Four other law firms – Latham & Watkins, Shearman & Sterling, Willkie Farr and Gibson Dunn – each worked on more than 50 M&A deals.

These seven law firms combined saw their Texas attorneys involved in 665 M&A transactions in 2021 – or 71% of the 929 total, according to exclusive Corporate Deal Tracker data.

Six Texas-based firms – V&E, Baker Botts, Haynes and Boone, Locke Lord, Bracewell and Akin Gump – hit the CDT’s top 20 M&A dealmakers of 2021. All six worked on 16 transactions or more.

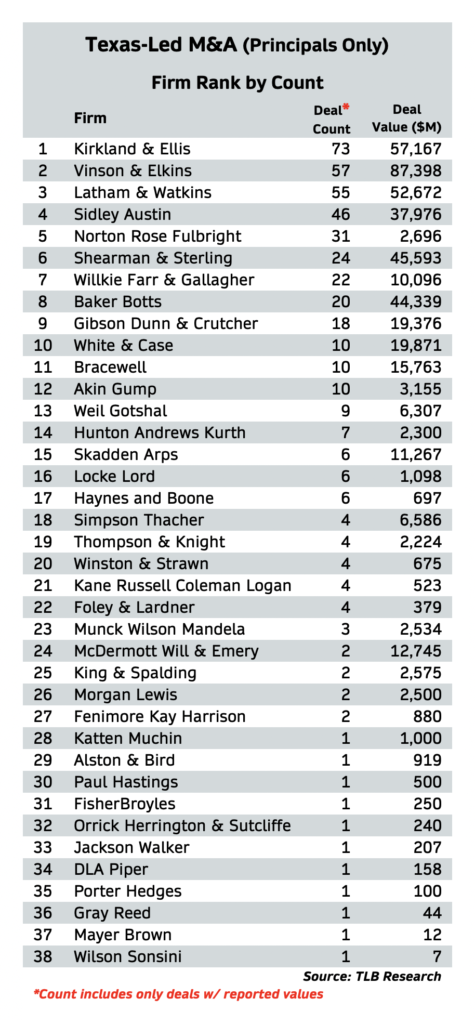

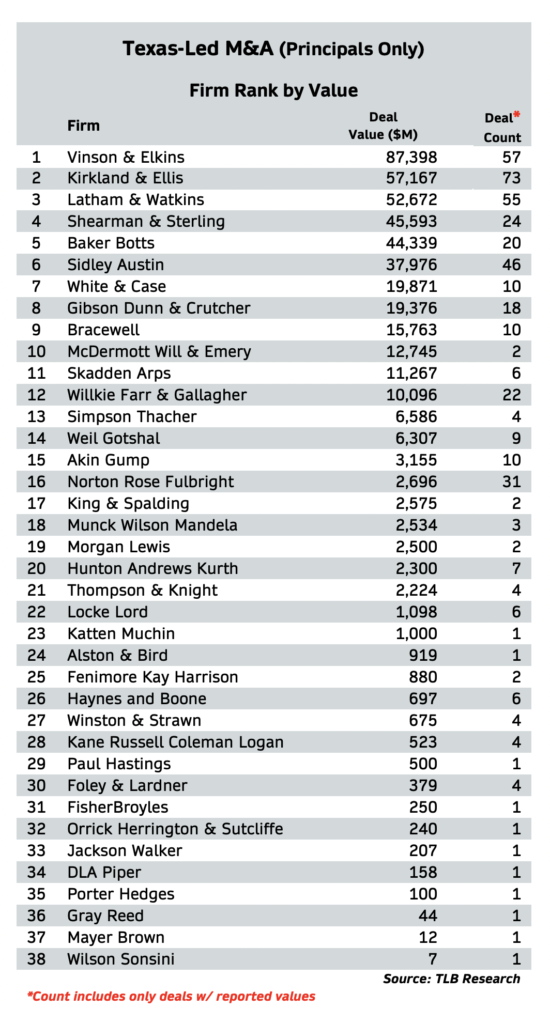

CDT Data shows that four law firms – Kirkland, V&E, Latham and Sidley – dominated the all-important role of lead counsel for the buyers, sellers and targets in non-confidential transactions. Those four firms had Texas lawyers who were the legal advisors in 231 deals with a combined value of $235 billion.

The Corporate Deal Tracker documents two kinds of corporate transactions handled by Texas lawyers: M&A activity (mergers, acquisitions, divestitures and joint ventures) and securities offerings. The Lawbook will report on securities offerings next week. The M&A law firm rankings also do not include financings, IPOs, SPAC issues (only de-SPAC Mergers) or fund creations.

The M&A rankings released today focus on two categories:

Deals that feature Texas lawyers as the lead counsel for principal parties — buyers, sellers or targets – in non-confidential transactions (meaning the parties and deal value are made public); and

Transactions – confidential and public – in which lawyers in Texas played a significant role in advising any client, such as third parties, conflicts committees, financial institutions or the principals. For example, some firms are hired by the principals for specific issues, such as antitrust or foreign trade matters, but they are not lead counsel.

Some law firms submitted deals claiming their Texas lawyers were the lead advisors, but their law firm’s own websites listed partners in New York or Chicago or elsewhere as the leads with Texas partners providing supporting counsel. The Texas Lawbook gave those firms credit for the overall representation but not as the lead counsel.

To be clear, lawyers representing any clients in any role in an M&A deal is lucrative and means six-digits in revenues.

But the big money is being lead counsel for the buyers, sellers or targets. The lead M&A advisors easily make $1,000-plus per hour and they bill a lot of hours handling negotiations, due diligence and financing. But their firms also call in their tax law partners, the lawyers who specialize in executive compensation or intellectual property issues. It is routine for the lead firms for the buyers and sellers to have 25 to 30 attorneys working on a major M&A transaction.

A dozen law firms, which include Akin Gump, Bracewell and White & Case, had Texas lawyers as the lead counsel for one of the principals.

Fifty-two law firms with offices in Texas submitted deals they handled to The Lawbook’s Corporate Deal Tracker. The CDT master list includes transactions in which the general counsel of Texas companies used out of state lawyers only, but those deals are not included the law firm rankings.

So, for example, if AT&T General Counsel David McAtee used only New York lawyers for V&E or Haynes and Boone or Sidley, the deals will show up in the CDT database, but V&E, Haynes and Boone and Sidley would not get credit for the deal in the rankings.

Of the 929 deals in the CDT data, 452 were non-confidential, 402 were confidential (meaning no deal value was disclosed) and the rest were transactions in which Texas in-house counsel were involved but no outside legal advisors in Texas played a significant role.

The Top Four

Kirkland ranks No. 1 in overall M&A deal count with its Texas attorneys involved in a record 142 transactions. Even more importantly, the Chicago-founded law firm had its Texas lawyers as lead counsel representing the buyers, sellers and targets in 73 non-confidential transactions in 2021, with a combined deal value of $57.2 billion.

The result, according to legal industry sources, is that Kirkland’s Texas offices will report record-shattering revenues and profits later this month. Kirkland advised the private-equity firm KKR in its $4.475 billion acquisition of Atlantic Aviation and Noble Corp. in its $3.4 billion merger with Maersk Drilling.

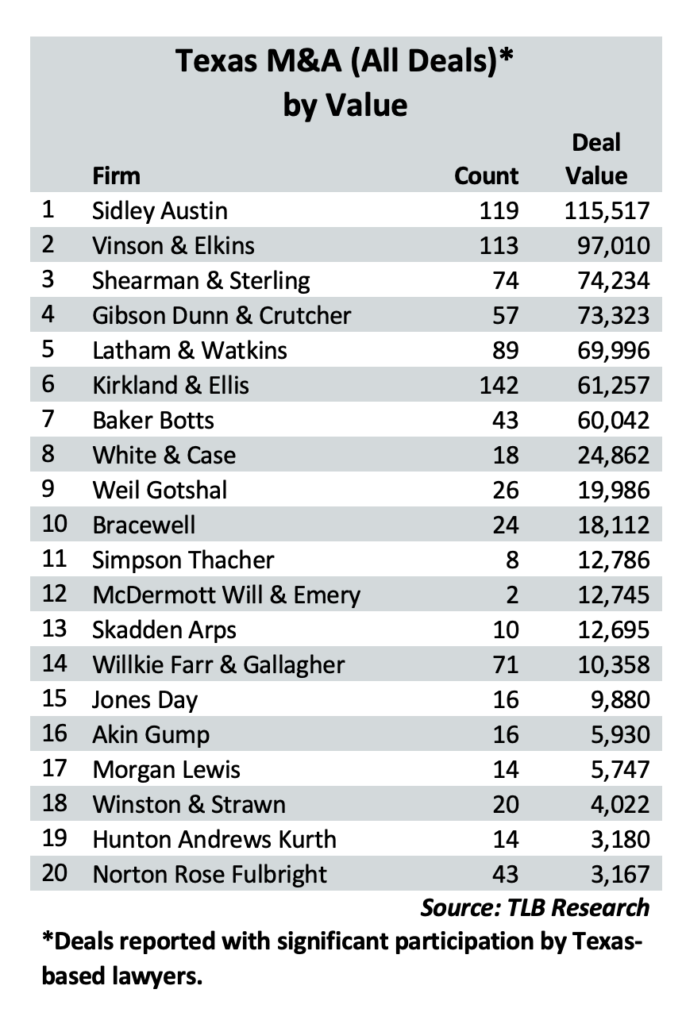

The Texas lawyers for Sidley, another Chicago-founded firm, were involved in 119 M&A transactions in 2021 that had a combined deal value of $115.5 billion. That places Sidley second in CDT overall M&A deal count and No. 1 in combined transactional value. The firm ranked fourth in the category of lead counsel for non-confidential deals with 46.

Legal industry analysts expect Sidley to report a record year in revenues and profits. Sidley lawyers in Texas advised American National Group in its $5.1 billion sale to Brookfield Asset Management.

Houston-based V&E lawyers in Texas worked on 113 transactions in 2021 with a combined deal value of $97 billion. On the lead legal advisors’ list, V&E ranks second in deal count (57) and No. 1 in deal value ($87.4 billion). V&E’s deal values were boosted by its representation of Australia-based Woodside Petroleum in its sale to BHP for $28 billion.

V&E leaders told The Texas Lawbook that the firm achieved record revenues and profits in 2021.

Latham, which opened its second Texas office last year in Austin, reported that its Texas attorneys worked on 89 M&A transactions in 2021 with a combined value of $70 billion. The firm ranks third as lead counsel for the buyers, sellers and targets in non-confidential transactions. Latham represented Energy Transfer when it paid $7.2 billion to buy Enable Midstream, which was advised by V&E.

Making the Top 10

Splitting fifth place in the Corporate Deal Tracker M&A charts are Norton Rose Fulbright and Shearman & Sterling.

Texas lawyers for Shearman & Sterling were involved in 74 M&A transactions in 2021 that had a combined deal value of $74.2 billion. Shearman was lead counsel for one of the principals in 24 of those deals.

Norton Rose Fulbright’s Texas offices were lead counsel for the principals in 31 deals and were involved in 43 transactions overall.

Lawyers in the Houston office of Willkie Farr advised clients involved in 71 M&A deals in 2021 – 22 of those were as lead counsel representing the buyers, sellers or targets.

Gibson Dunn lawyers in Dallas and Houston ranked seventh in the overall M&A chart with 57 deals valued at $73.3 billion. The firm was lead counsel for the principals in 18 non-confidential transactions, which placed in ninth.

Houston-headquartered Baker Botts ranked eighth in both the overall CDT M&A chart and in lead counsel in non-confidential deals. Baker Botts’ Texas attorneys worked on 43 transactions with a combined price tag of $60 billion – 20 of those deals were as lead counsel for the principals.

Dallas-based Haynes and Boone reported that its Texas lawyers worked on 37 M&A transactions in 2021 – six of those as lead advisors.

Unfortunately for Texas lawyers, the largest deal of 2021 – AT&T’s $43 billion divestiture of Time Warner Media to Discovery – was handled by in-house lawyers for the Dallas-based telecom giant.

(Editor’s note: The Texas Lawbook, in an earlier version of this article, undercounted the deal count and deal value for three law firms — Gibson Dunn & Crutcher, Haynes and Boone and Locke Lord. As a result of these corrections, Haynes and Boone jumped from 23 to 17 in the lead law firm deal count rankings, while Locke Lord went from 20 to 16. Gibson Dunn increased its lead advisor deal count from 13 to 18. The Texas Lawbook apologizes for this error.)