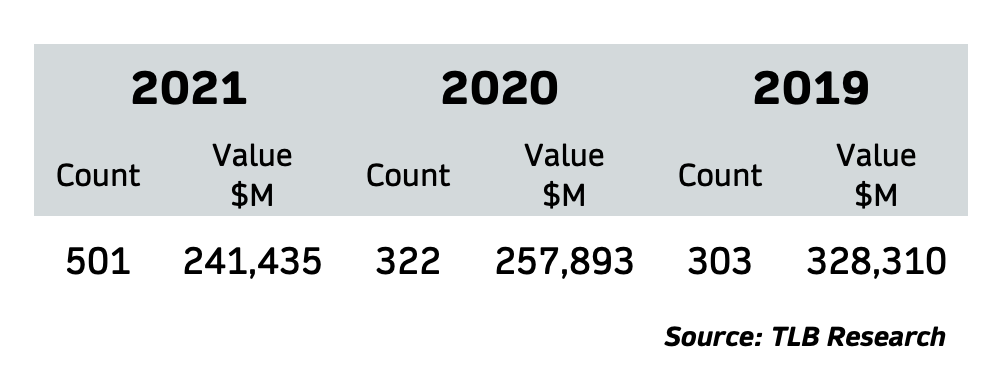

Capital markets transactions in Texas surged in 2021, with 501 deals in which Texas-based lawyers played a significant role, according to data compiled by The Texas Lawbook‘s exclusive Corporate Deal Tracker.

The number of capital market deals was up more than 55% over the 322 transactions recorded in 2020 and more than 65% over the 303 recorded in 2019.

“We did see an uptick in securities offerings in 2021, and I believe it was due to the lifting of the most restrictive COVID isolation and separation requirements,” said Michael O’Leary, a capital markets partner in the Houston offices of Hunton Andrews Kurth, where he co-heads the corporate team. He said pent up demand and a renewed appetite for investment fueled a new optimism as the economy returned to “normal.”

“In addition, many capital-intensive projects had been shelved during the COVID lockdowns, and with the economy opening back up as restrictions were relaxed, there was a return to the markets to raise capital to fund the delayed projects,” O’Leary said.

Vinson & Elkins partner Sarah Morgan, who co-heads the firm’s mergers and acquisitions and capital markets practice group in Houston, agrees: “Last year was just an extraordinarily active year all around across our corporate practice, including our capital markets group — which is not surprising given the build up from 2020 and the almost two years of major stimulus hitting markets.”

Mollie Duckworth, a partner at Latham & Watkins in Austin, said the 2021 uptick reflected her experience as well. For the first time in several years, she said, activity was robust “across the board” — equity and debt, traditional IPOs and SPACs and follow-on offerings — and was evident throughout multiple sectors.

While deals were up dramatically, overall valuations were down almost as dramatically, according to the Corporate Deal Tracker statistics. Deals in 2021 tended to be smaller — much smaller — with a total value of $241 billion, lower than the 2020 total of almost $258 billion and far lower than in 2019, when deals topped $328 billion. And the reasons for that discrepancy, said Duckworth, may lie in the sheer breadth of the deals themselves.

“The number of capital markets offerings over the last two years dramatically increased – not just in Texas, but really on a global basis,” Duckworth said. “One reason that the average size of the offerings came down could be that there is just a significantly larger sample size. As the equity markets, in particular, opened back up, we were seeing a wide variety of offerings from a range of issuers.”

In contrast, when capital markets aren’t as open, Duckworth added, “We tend to see fewer, larger offerings from more established issuers because they tend to be better positioned to successfully access the markets during more challenging times.”

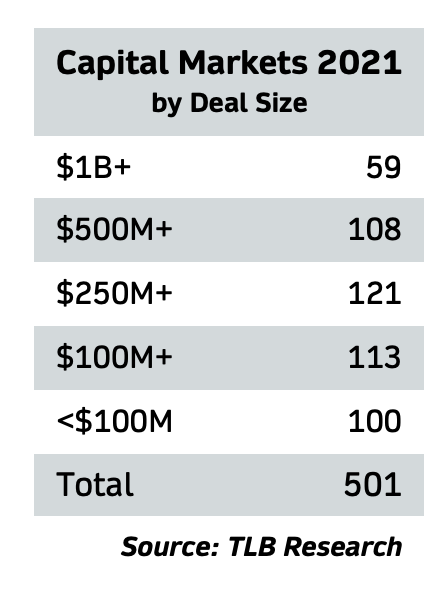

A breakdown of last year’s deals by stratum suggests as much. Of the 501 reported transactions, 59 deals were valued at $1 billion or more, by far the lowest in deal count. The most (121) occurred in the middle of the spectrum ($250 million to $499 million), with the rest spread evenly throughout.

In terms of business sector, energy remained dominant in the Texas capital markets, and changes in the energy market likely contributed, in their own way, to the rise in cap market deal count and the drop in average deal value. More conservative capital budgeting among the energy companies — traditionally the biggest spenders in the Texas marketplace — meant a reduced reliance on the capital markets. Even many of the larger deals revealed a notable aversion to debt reliance and an increased preference for cash.

“The reason the deals appear smaller is that they are more targeted than in the past,” said Houston partner Hillary Holmes of Gibson Dunn & Crutcher. “In both debt and equity offerings, investors demand from issuers a clearly stated and focused use of proceeds. That use of proceeds should facilitate growth or long term increase in free cash flow (including from debt refinancing).”

“In recent years many large energy companies decreased their capital expenditure budgets and relied more heavily on operating cash flows,” said Bill Howell, head of the Sidley Austin M&A and private equity practice in Dallas. “Large energy companies have historically made up a significant percentage of the dollars in capital markets transactions in Texas. With fewer energy companies looking to the capital markets for large transactions, the overall dollar value would have been negatively impacted.”

In many ways the capital markets reflected the energy market and its historical (and ongoing) transition, says partner Josh Davidson of Baker Botts in Houston.

“The traditional energy equity market remained depressed in 2021 despite an uptick in domestic drilling activity and a rise in oil and gas prices later in the year,” Davidson said. “There were a number of reasons for this, including the continuing desire by investors for capital discipline, the increased focus on free cash flow as opposed to growth, uncertainty about the duration of higher prices, increased governmental restrictions on oil and gas activities and pressure from many large institutional investors for partial divestment from fossil fuels.”

Davidson’s colleague at Baker Botts, Doug Getten, said that change in energy company approach had a profound effect on the capital markets.

“The high yield markets were typically accessed in 2021 as a way to refinance debt versus borrow new money to fund acquisitions. As companies are more focused on free cash flow than growth, they have less need of capital,” Getten said.

Holmes said she expects that energy transition will also continue as a force in the types of issues presented to the market.

“We will continue to see an increase in the percentage of debt offerings that are green bonds, blue bonds or sustainability linked bonds. Issuers will also leverage their sustainability message to promote their equity offering,” Holmes said.

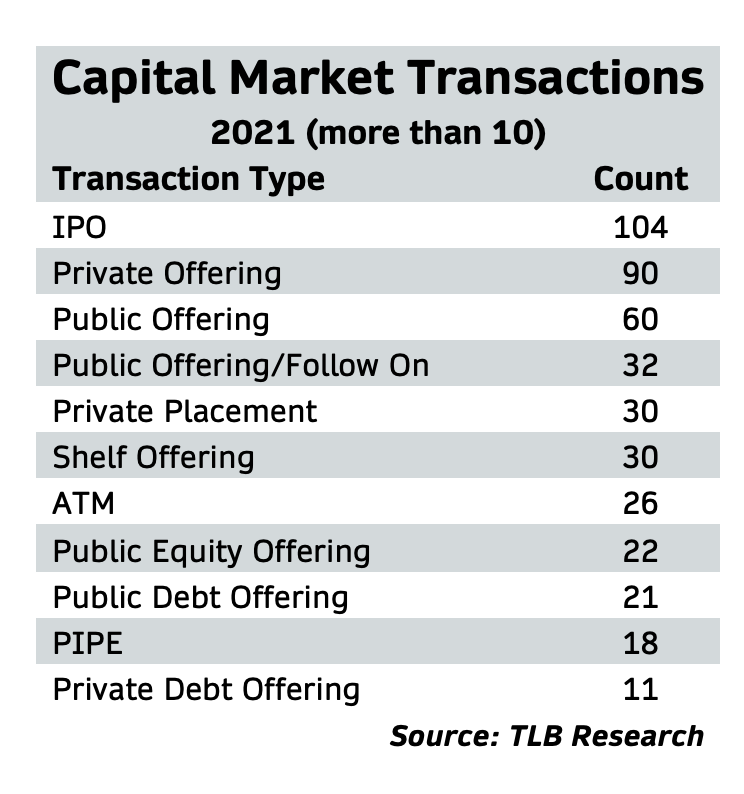

The cap markets in 2021 were also distinguished by the return of the IPO, a market space that had fallen from favor among investors. In 2021, Texas-based lawyers worked on 104 IPOs, or better than 11% of the 951 IPOs issued in the entire U.S. And the most visible reason for that generous share of the country’s IPO action was the rise of special purpose acquisition companies, or SPACs.

Of the 104 IPO transactions, 78 were SPAC issues. Put another way: While work on IPOs represented more than 20% of reported Texas capital markets transactions, SPACs represented 75% of those IPOs. And not only did work on SPACs account for rise in volume, SPAC issues likely help account for lower overall deal values, according to Sidley’s Howell.

“While SPAC activity increased the overall number of capital markets transactions across the market, the typical deal size for a SPAC is smaller. That became particularly true in the second half of 2021, as the appetite in the market for really large SPAC IPOs subsided,” Howell said.

Still, Baker Botts’ Davidson expects the SPAC market to stay in play, particular in energy, the sector dominated by Texas-based lawyers.

“Many of these SPACs are focused on acquiring business in the energy sector, particularly energy transition focused businesses. While the SPAC IPO market has been tightening up due to the large volume of capital chasing de-SPAC merger targets and SEC focus, we continue to see investors willing to put money into these vehicles, especially those with strong sponsors and management teams,” Davidson said.

For her part, V&E’s Morgan sees the surge in capital markets last year as much broader than SPACs.

“Obviously, dealmaking in the SPAC market, both in terms of both IPOs and deSPACs/PIPEs, was a key trend for 2021, but we experienced a huge number of deals in all aspects of the equity and debt capital markets across industries in 2021, far more than we had seen in the prior few years,” she said.

Even so, Morgan added, markets are beginning to shift. Fewer client companies are looking for deSPAC mergers and more are pursuing other means and sources, including private interim financings, private equity placements or more traditional IPOs, she said. Higher oil prices have slightly diminished some of the higher valuations of energy transition companies that were taking advantage of public support for sustainability. And the Russian invasion of Ukraine has added volatility to the market mix.

“So far, 2022 has generally been busy, but there is a LOT of volatility, so hard to tell when that will change and how many of these transactions get completed,” Morgan said.

“In any event, I’m not sure the world will ever see the crazy pace of dealmaking we saw in the first quarter of 2021 again, at least not for a period of time,” she continued.

Like Morgan, Emily Leitch said she expects 2022 to be more of the same, only less. Leitch, a partner at Shearman & Sterling in Houston, said Shearman, like many other firms firms in the Texas market, are now representing clients on a more global basis, which not only broadens firm reach but also makes firm deals vulnerable to a broader base of pressures and events.

“I think investor appetite for offerings has been, and will continue to be, choppy,” Leitch said. “With so many extreme macro-economic factors at play, it is hard to predict where capital markets will go this year. The volatility in the market is likely what kept transaction sizes down, but there has been a lot of dry powder waiting to be put to use, so you have seen many companies access the equity and debt markets over the last two years.”

“I don’t think the Texas market is as unique as it once was and probably is more reflective of the market at large,” Leitch added.