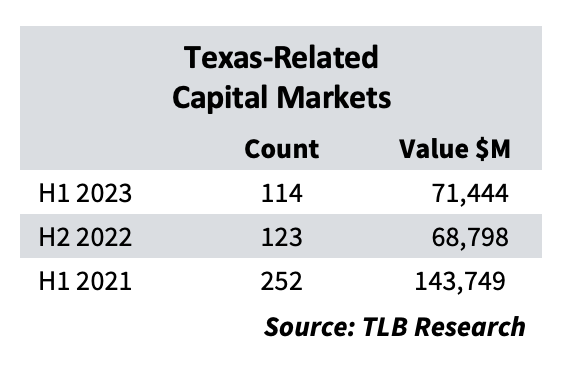

Exclusive CDT Data: Capital Markets Dominated by Latham Last Year

Whatever else may have happened in the Texas-related capital markets during 2024, the deals they represented left behind some unnervingly easy math. As is true of most years, debt issues outnumbered equity offerings about 2 to 1. But that doesn't mean there weren't some interesting trends and transactions alongside the usual reshuffling of debt.