CDT Roundup: 14 Deals, 9 Firms, 173 Lawyers, $21.4B

The third quarter of 2020 ended last week, not with a bang, but with increased volume of work for Texas lawyers. The CDT Roundup reports that the deals for the week had heft.

Free Speech, Due Process and Trial by Jury

The third quarter of 2020 ended last week, not with a bang, but with increased volume of work for Texas lawyers. The CDT Roundup reports that the deals for the week had heft.

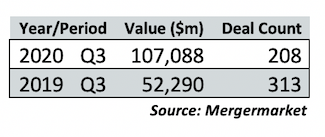

The Q3 Mergermarket numbers are in. Deals were also up. But also down from last year. Total value was up. But both are well below average and rate poorly against the last 14 years. Allen Pusey has the numbers.

In a move to reduce debt and consolidate operations, chemical giant Sasol has sold a 50% interest in some of its Louisiana operations to LyondellBasell. Texas lawyers from Kirkland and Latham had a big part in the $2 billion deal.

The big deal last week was the $7 billion sale of a 42% stake in Houston's Cheniere Energy. Sure, it was a big deal; but as the CDT Roundup notes, it also marks a major inflection point for U.S. LNG exports which didn't even exist 15 years ago.

Dallas-based Safe Harbor Marinas, a nationwide member-network of boating marinas was acquired Tuesday by Sun Communities, a REIT specializing in mobile home and RV communities. The Lawbook has the names of the lawyers involved.

Skadden and Kirkland counseled Devon Energy and WPX in a $12 billion merger-of-equals. The new entity will build on developed and proven assets to become a "fixed plus dividend" investment vehicle. The Lawbook has the names of the lawyers who made it happen.

The M&A deals announced last week were as diverse as they can get in a state generally perceived as all energy, all the time — or at least most of the time. But that diversification is part of both a Texas reality and a global trend. The CDT Roundup, with help from a couple of experts, explains.

This week's crop of deals are nothing if not diverse: a gold mining company, diapers, dried foods, luxury cars and RTD cocktails. The CDT Roundup breaks them down.

© Copyright 2026 The Texas Lawbook

The content on this website is protected under federal Copyright laws. Any use without the consent of The Texas Lawbook is prohibited.