The Texas Lawbook has received the latest numbers from Mergermarket on deal activity in Texas in the second quarter of 2021. And as legal and financial sources have already indicated, deal flow continued at a rampant clip in Texas with the second quarter eclipsing the first in deal value by nearly $113 billion and losing out on deal count by 23.

It should be noted, however, that Mergermarket used the enterprise value for SPAC mergers in its analysis of reported deals in addition to valuing AT&T’s planned blockbuster spin-off of WarnerMedia and combination with Discovery at more than $96 billion.

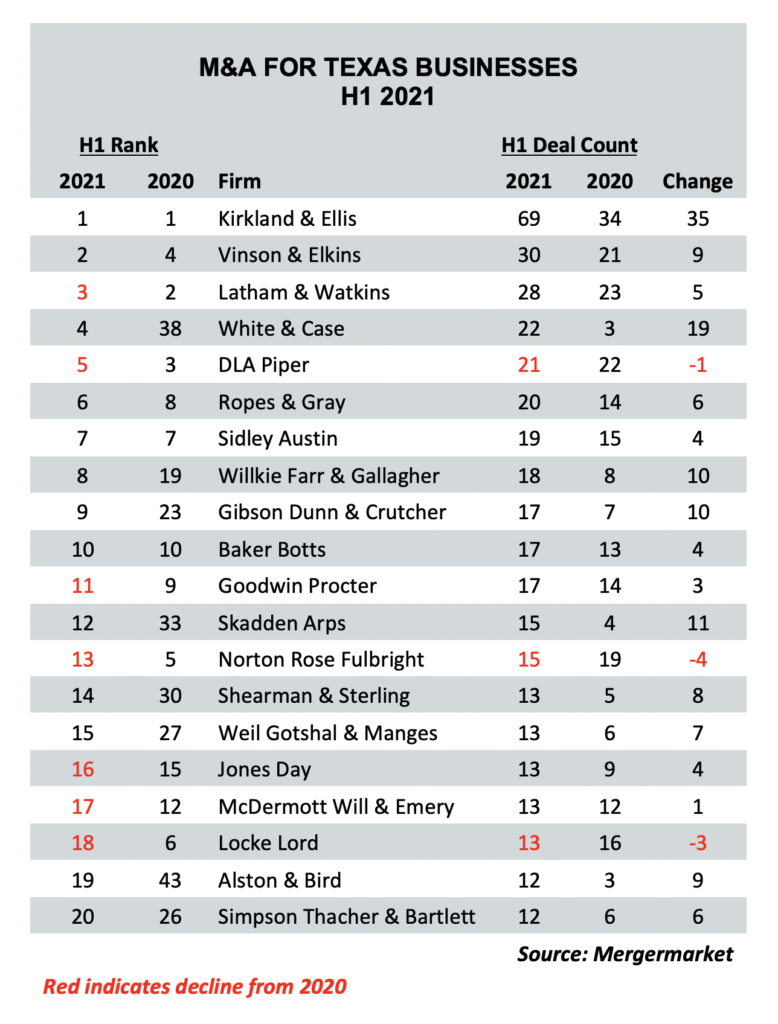

Some of the most striking findings from the Mergermarket report can be found in the legal league tables.

While transaction value by firm was weighted toward New York-based firms due to the AT&T transaction, Texas deal count by firm saw seismic shifts for a handful of newer players in the market and entities that are charging ahead in their revenue growth.

Comparing the first half of 2020 with the first half of 2021, the results aren’t shocking given the global pandemic and oil’s collapse. Deal value rose by more than 625% with 189 more deals. And the first half of 2021 has already surpassed the entire year of 2020 in value, according to Mergermarket.

Some of the shifts in deal count rankings grant a nod toward firms that are making a concerted effort to expand their corporate practices in Texas, beefing up particularly through lateral hiring.

The firms that saw the largest jumps in ranking by deal count – detailed more fully in a table below – were White & Case, leaping a whopping 34 places; Alston & Bird at 24; and Skadden at 21.

Kirkland & Ellis at No. 1, along with Simpson Thacher & Bartlett at No. 20, mark two of the firms with the fastest-growing revenues in the state last year with the former more than doubling the runner-up’s deal count.

Kirkland’s 2020 Texas revenues surged 35% last year, while Simpson Thacher’s spiked 58%.

The Lawbook plans to dive further into findings in the data in the coming days.

Last week, according to the Corporate Deal Tracker, 143 Texas-based lawyers at 13 firms took part in 11 M&A and funding transactions at more than a reported $1.59 billion in deal value and five capital market transactions at $2.4 billion.

Weekly Corporate Deal Tracker Roundup Stats

A compilation of weekly stats from The Lawbook's CDT Weekly Roundup

(Deal Values in Millions)

(Deal Values in Millions)

| Deal Count | Amount | Firms | Lawyers | M&A Count | M&A Value $M | CapM Count | ||

|---|---|---|---|---|---|---|---|---|

| 07-Mar-26 | 12 | $47,365 | 7 | 115 | 9 | $41,776 | 3 | $5,589 |

| 28-Feb-26 | 11 | $7,312 | 11 | 102 | 5 | $4,775 | 6 | $2,537 |

| 21-Feb-26 | 10 | $7,087 | 7 | 180 | 7 | $6,187 | 3 | $899 |

| 14-Feb-26 | 14 | $20,460 | 9 | 151 | 9 | $16,440 | 5 | $4,020 |

| 7-Feb-26 | 8 | $316,505 | 11 | 203 | 8 | $316,505 | 0 | 0 |

| 31-Jan-26 | 11 | $3,985 | 8 | 72 | 7 | $135 | 4 | $3,850 |

| 24-Jan-26 | 8 | $1,340 | 5 | 120 | 7 | $985 | 1 | $355 |

| 17-Jan-26 | 19 | $18,440 | 10 | 203 | 13 | $12,963 | 6 | $5,477 |

| 10-Jan-26 | 18 | $8,958 | 12 | 182 | 17 | $8,358 | 1 | $600 |

| 03-Jan-26 | 2 | $1,519 | 2 | 17 | 1 | $18.8 | 1 | $1,500 |

| 27-Dec-25 | 2 | $3,200 | 2 | 15 | 2 | $3,200 | 0 | 0 |

| 20-Dec-25 | 11 | $10,167 | 8 | 96 | 7 | $7,411 | 4 | $2,756 |

| 13-Dec-25 | 15 | $9,952 | 10 | 211 | 11 | $6,267 | 4 | $3,686 |

| 06-Dec-25 | 16 | $9,947 | 11 | 94 | 13 | $8,091 | 3 | $1,856 |

| 29-Nov-25 | 6 | $4,075 | 5 | 60 | 2 | $175 | 4 | $3,900 |

| 22-Nov-25 | 20 | $5,546 | 14 | 166 | 14 | $3,309 | 6 | $2,238 |

| 15-Nov-25 | 16 | $16,373 | 11 | 136 | 8 | $4,790 | 8 | $11,583 |

| 08-Nov-25 | 21 | $75,919 | 15 | 191 | 15 | $70,630 | 6 | $5,289 |

| 01-Nov-25 | 20 | $25,927 | 12 | 152 | 14 | $21,455 | 6 | $4,472 |

| 25-Oct-25 | 19 | $61,470 | 14 | 262 | 18 | $60,894 | 1 | $576 |

| 18-Oct-25 | 14 | $47,792 | 12 | 130 | 13 | $46,592 | 1 | $1,200 |

| 11-Oct-25 | 14 | $17,361 | 9 | 104 | 7 | $14,444 | 7 | $2,917 |

| 04-Oct-25 | 21 | $20,843 | 15 | 236 | 10 | $15,376 | 11 | $5,467 |

| 27-Sept-25 | 16 | $22,774 | 12 | 219 | 10 | $19,103 | 6 | $3,671 |

| 20-Sept-25 | 24 | $11,305 | 13 | 238 | 16 | $6,209 | 8 | $5,096 |

| 13-Sept-25 | 20 | $26,575 | 11 | 225 | 12 | $20,971 | 8 | $5,604 |

| 06-Sept-25 | 19 | $8,622 | 12 | 190 | 13 | $2,880 | 6 | $8,622 |

| 30-Aug-25 | 10 | $6,569 | 9 | 109 | 7 | $3,519 | 3 | $3,050 |

| 23-Aug-25 | 23 | $15,207 | 10 | 129 | 18 | $14,500 | 5 | $707 |

| 16-Aug-25 | 13 | $26,405 | 12 | 149 | 7 | $3,180 | 6 | $23,225 |

| 09-Aug-25 | 19 | $16,066 | 16 | 245 | 15 | $11,307 | 4 | $4,759 |

| 02-Aug-25 | 17 | $19,480 | 11 | 104 | 13 | $18,002 | 4 | $1,478 |

| 26-Jul-25 | 15 | $3,164 | 12 | 96 | 12 | $3,0023 | 3 | $162 |

| 19-Jul-25 | 14 | $6,080 | 14 | 97 | 9 | $4,165 | 5 | $1,915 |

| 12-Jul-25 | 15 | $13,012 | 14 | 208 | 12 | $10,902 | 3 | $2,110 |

| 05-Jul-25 | 9 | $15,778 | 8 | 91 | 4 | $7,280 | 5 | $8,498 |

| 28-Jun-25 | 13 | $7,777 | 8 | 154 | 7 | $2,031 | 6 | $5,746 |

| 21-Jun-25 | 16 | $5,984 | 10 | 113 | 11 | $3,087 | 5 | $2,897 |

| 14-Jun-25 | 9 | $478 | 8 | 133 | 6 | 0 | 3 | $478 |

| 07-Jun-25 | 16 | $26,210 | 11 | 196 | 11 | $24,744 | 5 | $1,466 |

| 31-May-25 | 19 | $23,381 | 11 | 166 | 12 | $18,665 | 7 | $4,717 |

| 24-May-25 | 15 | $24,033 | 11 | 121 | 13 | $23,624 | 2 | $409 |

| 17-May-25 | 16 | $21,760 | 12 | 145 | 11 | $18,615 | 5 | $3,145 |

| 10-May-25 | 24 | $33,175 | 16 | 206 | 19 | $30,765 | 5 | $2,410 |

| 03-May-25 | 11 | $4,249 | 13 | 90 | 11 | $2,226.5 | 2 | $2,022.5 |

| 26-Apr-25 | 12 | $8,787 | 9 | 168 | 9 | $6,011 | 3 | $2,776 |

| 19-Apr-25 | 11 | $8,097 | 7 | 138 | 9 | $7,985 | 2 | $112 |

| 12-Apr-25 | 13 | $2,392 | 8 | 152 | 10 | $2,065 | 3 | $327 |

| 05-Apr-25 | 19 | $27,762 | 15 | 188 | 16 | $25,473 | 3 | $2,289 |

| 29-Mar-25 | 21 | $8,188 | 10 | 258 | 16 | $4,125 | 5 | $4,064 |

| 22-Mar-25 | 19 | $6,485 | 14 | 231 | 15 | $4,128 | 4 | $2,857 |

| 15-Mar-25 | 13 | $13,737 | 13 | 151 | 10 | $9,932 | 4 | $3,805 |

| 8-Mar-25 | 7 | $2,234 | 5 | 66 | 5 | $224 | 2 | $2,100 |

| 1-Mar-25 | 11 | $3,050 | 8 | 75 | 10 | $2,550 | 1 | $500 |

| 22-Feb-25 | 12 | $16,397 | 7 | 149 | 6 | $6,635 | 6 | $9,862 |

| 15-Feb-25 | 17 | $12,136 | 13 | 134 | 10 | $9,411 | 2 | $2,725 |

| 8-Feb-25 | 14 | $7,154 | 9 | 179 | 9 | $4,950 | 5 | $2,204 |

| 1-Feb-25 | 16 | $10,068 | 7 | 200 | 11 | $7,553 | 5 | $2,515 |

| 25-Jan-25 | 14 | $10,261 | 10 | 125 | 9 | $2,207 | 5 | $8,054 |

| 18-Jan-25 | 19 | $7,382 | 15 | 316 | 12 | $2,300 | 7 | $5,082 |

| 11-Jan-25 | 21 | $33,560 | 16 | 187 | 16 | $32,521 | 5 | $1,039 |

| 4-Jan-25 | 9 | $6,827 | 9 | 80 | 9 | $6,827 | 0 | 0 |

| 21-Dec-24 | 11 | $2,798 | 11 | 92 | 8 | $2,229 | 3 | $570 |

| 14-Dec-24 | 15 | $5,323 | 12 | 186 | 12 | $3,812 | 3 | $1,511 |

| 07-Dec-24 | 16 | $4,766 | 10 | 231 | 11 | $2,321 | 5 | 2,445 |

| 30-Nov-24 | 10 | $10,291 | 9 | 103 | 4 | $8,290 | 6 | $2.001 |

| 23-Nov-24 | 15 | $4,553 | 15 | 153 | 11 | $3,379 | 4 | $1,174 |

| 16-Nov-24 | 17 | $11,488 | 11 | 245 | 13 | $10,186 | 4 | $1,303 |

| 09-Nov-24 | 14 | $2,110 | 12 | 139 | 12 | $1,410 | 2 | $700 |

| 02-Nov-24 | 12 | $52,788 | 11 | 107 | 11 | $52,738 | 1 | $50 |

| 26-Oct-24 | 8 | $3,160 | 8 | 65 | 7 | $3,065 | 1 | $75 |

| 19-Oct-24 | 12 | $5,304 | 11 | 136 | 11 | $4,554 | 1 | $750 |

| 12-Oct-24 | 17 | $8,438 | 12 | 150 | 15 | $8,116 | 2 | $322 |

| 05-Oct-24 | 22 | $23,181 | 12 | 189 | 15 | $19,980 | 7 | $3,201 |

| 28-Sep-24 | 11 | $2,356 | 7 | 144 | 7 | $53 | 4 | $2,303 |

| 21-Sep-24 | 12 | $9,568 | 10 | 169 | 5 | $4,101 | 7 | $5,467 |

| 14-Sep-24 | 24 | $10,988 | 12 | 235 | 16 | $7,175 | 8 | $3,813 |

| 7-Sep-24 | 12 | $20,420 | 16 | 168 | 11 | $20,307 | 1 | $112.9 |

| 31-Aug-24 | 13 | $20,631 | 9 | 134 | 12 | $14,775 | 1 | $5,856 |

| 24-Aug-24 | 19 | $8,452 | 21 | 325 | 16 | $7,102 | 3 | $1,350 |

| 17-Aug-24 | 25 | $49,196 | 16 | 304 | 11 | $39,386 | 14 | $9,810 |

| 10-Aug-24 | 20 | $12,264 | 15 | 312 | 16 | $9,794 | 4 | $2,470 |

| 03-Aug-24 | 26 | $16,498 | 16 | 334 | 18 | $8,137 | 8 | $8,361 |

| 27-Jul-24 | 19 | $16,442 | 21 | 271 | 15 | $13,838 | 4 | $2,604 |

| 20-Jul-24 | 15 | $16,016 | 14 | 184 | 10 | $14,232 | 5 | $1,784 |

| 13-Jul-24 | 20 | $17,220 | 14 | 265 | 18 | $7,146 | 2 | $10,074 |

| 6-Jul-24 | 11 | $3,941 | 11 | 95 | 8 | $2,650 | 3 | $1,291 |

| 29-Jun-24 | 14 | $6,296 | 15 | 224 | 8 | $6,296 | 6 | $1,927 |

| 22-Jun-24 | 12 | $5,679 | 8 | 137 | 5 | $210 | 7 | $5,469 |

| 15-Jun-24 | 13 | $9,895 | 16 | 214 | 10 | $5,280 | 3 | $4,615 |

| 8-Jun-24 | 19 | $23,859 | 13 | 239 | 12 | $19,436 | 7 | $4,423 |

| 1-Jun-24 | 12 | $34,510 | 11 | 147 | 9 | $26,110 | 3 | $8,400 |

| 25-May-24 | 13 | $9,684 | 15 | 171 | 10 | $4,434 | 3 | $5,250 |

| 18-May-24 | 11 | $5,490 | 11 | 173 | 8 | $3,129 | 3 | $2,361 |

| 11-May-24 | 22 | $14,855 | 14 | 227 | 16 | $11,105 | 6 | $3,750 |

| 4-May-24 | 13 | $3,139 | 9 | 87 | 10 | $1,297 | 3 | $1,842 |

| 27-Apr-24 | 10 | $6,684 | 6 | 28 | 10 | $6,684 | 0 | 0 |

| 20-Apr-24 | 19 | $15,989 | 11 | 147 | 9 | $5,208 | 10 | $10,781 |

| 13-Apr-24 | 13 | $8,952 | 9 | 76 | 10 | $1,652 | 3 | $7,300 |

| 6-Apr-24 | 23 | $26,616 | 14 | 222 | 14 | $13,501 | 8 | $13,116 |

| 30-Mar-24 | 12 | $9,286 | 8 | 136 | 8 | $4,299 | 4 | $4,987 |

| 23-Mar-24 | 18 | $5,451 | 17 | 266 | 16 | $4,759 | 2 | $692 |

| 16-Mar-24 | 21 | $11,437 | 13 | 186 | 14 | $9,316 | 6 | $2,070 |

| 9-Mar-24 | 23 | $4,695 | 21 | 218 | 19 | $2,723 | 4 | $1,972 |

| 2-Mar-24 | 20 | $9,108 | 19 | 372 | 14 | $4,558 | 6 | $4,550 |

| 24-Feb-24 | 19 | $16,382 | 12 | 248 | 15 | $9,507 | 4 | $6,875 |

| 17-Feb-24 | 16 | $29,932 | 15 | 157 | 12 | $29,216 | 4 | $716 |

| 10-Feb-24 | 25 | $10,750 | 17 | 196 | 19 | $5,372 | 6 | $5,379 |

| 3-Feb-24 | 12 | $8,416 | 18 | 125 | 9 | $3,416 | 3 | $5,000 |

| 27-Jan-24 | 9 | $8,165 | 9 | 87 | 8 | $7,815 | 1 | $800 |

| 20-Jan-24 | 14 | $4,084 | 12 | 109 | 12 | $3,219 | 2 | $865 |

| 13-Jan-24 | 17 | $33,588 | 12 | 256 | 12 | $26,765 | 5 | $6,823 |

| 6-Jan-24 | 8 | $7,915 | 8 | 84 | 6 | $7,265 | 2 | $650 |

| 30-Dec-23 | 17 | $14,599 | 12 | 99 | 15 | $2,714 | 2 | $11,885 |

| 23-Dec-23 | 23 | $4,182 | 13 | 219 | 16 | $1,813 | 7 | $2,370 |

| 16-Dec-23 | 13 | $16,436 | 13 | 280 | 7 | $15,150 | 5 | $1,286 |

| 9-Dec-23 | 26 | $14,633.90 | 17 | 244 | 16 | $8,095 | 10 | $6,538.90 |

| 2-Dec-23 | 13 | $6,720 | 9 | 57 | 12 | $6,630 | 1 | $90 |

| 25-Nov-23 | 9 | $4,835 | 9 | 131 | 6 | $1,785 | 3 | $3,050 |

| 18-Nov-23 | 22 | $6,568.70 | 17 | 184 | 14 | $4,709.20 | 8 | $1,859.50 |

| 11-Nov-23 | 15 | $9,825 | 13 | 179 | 12 | $6,581 | 3 | $3,244 |

| 4-Nov-23 | 15 | $20,582.50 | 14 | 193 | 12 | $19,417.50 | 3 | $1,165 |

| 28-Oct-23 | 18 | $68,419.10 | 18 | 152 | 15 | $66,646 | 3 | $1,773.10 |

| 21-Oct-23 | 16 | $6,755.90 | 16 | 165 | 15 | $6,755.90 | 1 | $3 |

| 14-Oct-23 | 14 | $67,851.20 | 13 | 125 | 9 | $61,998.50 | 5 | $5,852.70 |

| 7-Oct-23 | 17 | $6,595.50 | 13 | 228 | 16 | $5,995.50 | 1 | $600 |

| 30-Sep-23 | 17 | $1,896.45 | 13 | 189 | 14 | $806.45 | 3 | $1,090 |

| 23-Sep-23 | 23 | $6,432.70 | 17 | 230 | 16 | $1,402.80 | 7 | $5,029.90 |

| 16-Sep-23 | 25 | $23,226.70 | 23 | 353 | 16 | $17,239 | 9 | $5,987.70 |

| 9-Sep-23 | 12 | $6,369 | 8 | 102 | 7 | $4,311 | 5 | $2,058 |

| 2-Sep-23 | 14 | $2,522 | 6 | 92 | 13 | $1,322 | 1 | $1,200 |

| 26-Aug-23 | 17 | $12,160.25 | 13 | 202 | 15 | $6,573.25 | 2 | $5,587.00 |

| 19-Aug-23 | 19 | $11,505 | 13 | 213 | 15 | $11,255 | 4 | $250 |

| 12-Aug-23 | 19 | $9,698.80 | 13 | 184 | 7 | $3,270 | 12 | $6,428.80 |

| 5-Aug-23 | 13 | $5,201 | 12 | 118 | 12 | $5,051 | 1 | $150 |

| 29-Jul-23 | 15 | $21,031.60 | 13 | 196 | 11 | $18,292.00 | 4 | $2,739.60 |

| 22-Jul-23 | 18 | $3,992 | 12 | 130 | 13 | $2,808 | 5 | $1,184 |

| 15-Jul-23 | 13 | $8,254.95 | 13 | 81 | 13 | $8,254.95 | 0 | 0 |

| 8-Jul-23 | 16 | $5,441.45 | 12 | 172 | 11 | $2,443 | 5 | $2,998.45 |

| 1-Jul-23 | 16 | $6,872 | 10 | 105 | 12 | $5,474 | 4 | $1,398 |

| 24-Jun-23 | 13 | $10,914 | 16 | 201 | 10 | $7,874 | 3 | $3,040 |

| 17-Jun-23 | 17 | $5,880.70 | 15 | 151 | 15 | $4,705.70 | 2 | $1,175 |

| 10-Jun-23 | 19 | $8,516.10 | 13 | 111 | 16 | $6,252.40 | 3 | $2,263.70 |

| June 3 2023 | 12 | $6,104.42 | 12 | 138 | 8 | $4,256.92 | 4 | $1,847.50 |

| 27-May-23 | 17 | $12,200 | 10 | 67 | 11 | $6,165 | 6 | $6,035 |

| 20-May-23 | 11 | $22,458.10 | 8 | 103 | 4 | $19,455 | 7 | $3,003 |

| 13-May-23 | 12 | $7,034 | 10 | 101 | 8 | $5,460 | 4 | $1,574 |

| 6-May-23 | 20 | $3,297.60 | 18 | 196 | 17 | $2,985.60 | 3 | $312 |

| 29-Apr-23 | 23 | $3,691.20 | 18 | 135 | 17 | $1,969.70 | 6 | $1,721.50 |

| 22-Apr-23 | 16 | $5,570 | 14 | 104 | 14 | $4,750 | 2 | $1,000 |

| 15-Apr-23 | 12 | $23,818.10 | 9 | 59 | 10 | $21,618.10 | 2 | $2,200 |

| 8-Apr-23 | 16 | $7,949 | 9 | 173 | 9 | $5,472 | 7 | $3,477 |

| 1-Apr-23 | 21 | $18,676.70 | 12 | 175 | 11 | $10,926.70 | 10 | $7,750 |

| 25-Mar-23 | 15 | $8,779.50 | 10 | 141 | 5 | $2,362 | 10 | $6,416.50 |

| 18-Mar-23 | 7 | $14,048.80 | 6 | 69 | 5 | $13,345 | 2 | $703.80 |

| 11-Mar-23 | 21 | $11,576 | 16 | 165 | 16 | $8,131 | 5 | $3,445 |

| 4-Mar-23 | 20 | $9,668 | 11 | 228 | 16 | $8,209 | 4 | $1,459 |

| 25-Feb-23 | 13 | $5,335 | 13 | 130 | 12 | $4,235 | 1 | $1,200 |

| 18-Feb-23 | 14 | $5,743.70 | 13 | 158 | 8 | $898.70 | 6 | $4,845 |

| 11-Feb-23 | 16 | $12,088 | 12 | 137 | 12 | $9,965 | 4 | $2,123 |

| 4-Feb-23 | 17 | $8,066 | 15 | 140 | 13 | $5,614 | 4 | $2,452 |

| 28-Jan-23 | 7 | $2,180 | 7 | 75 | 5 | $1,692.75 | 2 | $488 |

| 21-Jan-23 | 17 | $5,768 | 16 | 174 | 12 | $1,918 | 5 | $3,850 |

| 14-Jan-23 | 11 | $2, 800 | 10 | 102 | 8 | $421 | 3 | $2,400 |

| 7-Jan-23 | 18 | $8,296 | 11 | 167 | 14 | $6,461 | 3 | $1,835 |

| 31-Dec-22 | 14 | $2,732 | 11 | 99 | 12 | $2,092 | 2 | $640 |

| 17-Dec | 14 | $7,919 | 13 | 115 | 12 | $7,419 | 1 | $500 |

| 10-Dec-22 | 14 | $10,093 | 12 | 88 | 11 | $7,093 | 3 | $3,000 |

| 3-Dec-22 | 26 | $12,800.90 | 11 | 172 | 20 | $4,141 | 6 | $8,659.90 |

| 26-Nov-22 | 8 | $2,266.70 | 8 | 5 | 3 | $76 | 5 | $2,190.70 |

| 19-Nov-22 | 21 | $2,886 | 15 | 212 | 19 | $2,550 | 2 | $336 |

| 12-Nov-22 | 13 | $15,093.70 | 9 | 81 | 9 | $14,200 | 4 | $893.70 |

| 5-Nov-22 | 25 | 19,337.20 | 16 | 509 | 22 | $8,267.20 | 3 | $11,070 |

| 29-Oct-22 | 15 | $7,805.30 | 9 | 116 | 14 | $7,180.30 | 1 | $625 |

| 22-Oct-22 | 20 | $8,193.50 | 13 | 253 | 13 | $5,442 | 7 | $2,751.50 |

| 15-Oct-22 | 9 | $3,046.10 | 9 | 139 | 7 | $2,588.30 | 2 | $457.80 |

| 8-Oct-22 | 19 | $2,011.80 | 12 | 114 | 16 | $833.80 | 3 | $1,178 |

| 1-Oct-22 | 23 | $5,532.90 | 16 | 156 | 18 | $4,952.30 | 5 | $580.60 |

| 24-Sep-22 | 18 | $5,194 | 14 | 216 | 15 | $4,050 | 3 | $1,144 |

| 17-Sep-22 | 21 | $8,352.30 | 12 | 320 | 15 | $4,759.60 | 6 | $3,592.70 |

| 10-Sep-22 | 15 | $19,853.50 | 10 | 126 | 13 | $19,403.60 | 2 | $450 |

| 3-Sep-22 | 9 | $2,312 | 9 | 62 | 9 | $2,312 | 0 | 0 |

| 27-Aug-22 | 16 | $30,891.70 | 10 | 135 | 15 | $30,666.40 | 1 | 227.7 |

| 20-Aug-22 | 12 | $1,977 | 8 | 152 | 9 | 925 | 3 | $1,052 |

| 13-Aug-22 | 18 | $8,004.70 | 11 | 242 | 11 | $2,844.70 | 7 | $5,160 |

| 6-Aug-22 | 24 | $7,948.90 | 12 | 240 | 17 | $3,577 | 7 | $4,371.90 |

| 30-Jul-22 | 8 | $6,941 | 9 | 78 | 7 | $6,839 | 1 | $102 |

| 23-Jul-22 | 11 | $801 | 11 | 92 | 10 | $801 | 1 | 0 |

| 16-Jul-22 | 14 | $3,650 | 10 | 122 | 14 | $3,650 | 0 | 0 |

| 9-Jul-22 | 10 | $3,557.70 | 7 | 68 | 9 | $3,557.70 | 1 | 0 |

| 2-Jul-22 | 18 | $8,609.40 | 13 | 152 | 15 | $2,754.40 | 3 | $5,855 |

| 25-Jun-22 | 15 | $6,142 | 13 | 146 | 9 | $2,017 | 6 | $4,125 |

| 18-Jun-22 | 17 | $11,890.10 | 14 | 228 | 15 | $11,410 | 2 | 479.7 |

| 11-Jun-22 | 17 | $7,600 | 12 | 123 | 10 | $2,300 | 7 | $5,300 |

| 4-Jun-22 | 12 | $2,937 | 10 | 127 | 9 | $692 | 3 | $2,245 |

| 28-May-22 | 9 | $3,197.60 | 11 | 86 | 9 | $3,197.60 | 0 | 0 |

| 21-May-22 | 14 | $7,284.50 | 12 | 185 | 11 | $6,609 | 3 | $675.50 |

| 14-May-22 | 11 | $306.60 | 9 | 80 | 10 | $306.60 | 1 | $225 |

| 7-May-22 | 16 | $10,451.75 | 12 | 108 | 12 | $1,827 | 4 | $8,624.75 |

| 30-Apr-22 | 16 | $2,296.50 | 16 | 157 | 12 | $895.50 | 4 | $1,401 |

| 23-Apr-22 | 10 | $2,241 | 11 | 58 | 8 | $1,641 | 2 | $600 |

| 16-Apr-22 | 11 | $6,643 | 7 | 156 | 8 | $2,359 | 3 | $4,284 |

| 9-Apr-22 | 17 | $4,429 | 14 | 184 | 11 | $1,690 | 6 | $2,739 |

| 2-Apr-22 | 13 | $1,755 | 8 | 84 | 10 | $1,145 | 3 | $610 |

| 26-Mar-22 | 11 | $3,205 | 8 | 65 | 6 | $200 | 5 | $3,005 |

| 19-Mar-22 | 13 | $2,239.17 | 9 | 106 | 13 | $2,239.17 | 0 | 0 |

| 12-Mar-22 | 18 | $12,016 | 11 | 239 | 15 | $11,965 | 2 | $51.35 |

| 5-Mar-22 | 17 | $6,786 | 13 | 137 | 13 | $5,161 | 4 | $1,625 |

| 26-Feb-22 | 12 | $5,095 | 8 | 149 | 9 | $4,437.50 | 3 | $658 |

| 19-Feb-22 | 17 | $22,229 | 17 | 174 | 14 | $21,354 | 3 | $875 |

| 12-Feb-22 | 12 | $2,344.70 | 10 | 73 | 8 | $641.70 | 4 | $1,703 |

| 5-Feb-22 | 11 | $2,503 | 8 | 99 | 11 | $2,503 | 0 | 0 |

| 29-Jan-22 | 11 | $3,872 | 12 | 101 | 12 | $3,872 | 0 | 0 |

| 22-Jan-22 | 13 | $5,143.50 | 10 | 99 | 12 | $4,842.50 | 1 | $301 |

| 15-Jan-22 | 12 | $7,605 | 9 | 155 | 9 | $6,480 | 3 | $1,025 |

| 8-Jan-22 | 13 | $8,256.20 | 11 | 102 | 13 | $8,256.20 | 0 | 0 |

| 1-Jan-22 | 9 | $1,273.80 | 6 | 50 | 9 | $1,273.80 | 0 | 0 |

| 25-Dec-21 | 21 | $4,734.75 | 11 | 176 | 16 | $3,410 | 5 | $1,324.75 |

| 18-Dec-21 | 26 | $7,325.20 | 15 | 193 | 18 | $3,640.20 | 8 | $3,685.20 |

| 11-Dec-21 | 16 | $5,017 | 10 | 109 | 13 | $1,417 | 3 | $3,600 |

| 4-Dec-21 | 14 | $2,310 | 8 | 86 | 8 | $2,310 | 6 | $1,882.05 |

| 27-Nov-21 | 9 | $3.460.1 | 10 | 101 | 6 | $1,758 | 3 | $1,702.60 |

| 20-Nov-21 | 20 | $22,792 | 15 | 157 | 12 | $18,864.50 | 8 | $3,928 |

| 13-Nov-21 | 21 | $26,729 | 12 | 178 | 13 | $11,822 | 8 | $14,907 |

| 6-Nov-21 | 12 | $8,303 | 13 | 157 | 10 | $6,682 | 3 | $1,621 |

| 30-Oct-21 | 21 | $10,368 | 15 | 218 | 15 | $9,24.4 | 6 | $1,103.00 |

| 23-Oct-21 | 21 | $18.783.1 | 15 | 222 | 11 | $12,314 | 10 | $6,468.60 |

| 16-Oct-21 | 15 | $3,868 | 11 | 118 | 15 | $2,293 | 2 | $1,575 |

| 9-Oct-21 | 20 | $8,610 | 16 | 175 | 16 | $7,795 | 4 | $815 |

| 2-Oct-21 | 14 | $6,250 | 11 | 137 | 10 | $5,200 | 4 | $1,050 |

| 25-Sep-21 | 11 | $11,460 | 9 | 93 | 7 | $10,200 | 4 | $1,250 |

| 18-Sep-21 | 11 | $16,603 | 8 | 99 | 8 | $15,084 | 3 | $1,519 |

| 11-Sep-21 | 17 | $10,653 | 11 | 103 | 13 | $8,503 | 4 | $2,150 |

| 4-Sep-21 | 13 | $7,222 | 10 | 89 | 11 | $6,715 | 2 | $507 |

| 28-Aug-21 | 12 | $763 | 9 | 63 | 11 | $663 | 1 | $100 |

| 21-Aug-21 | 12 | $29,659 | 7 | 79 | 11 | $29,579 | 1 | $80 |

| 14-Aug-21 | 22 | $17,845 | 11 | 199 | 12 | $12,805 | 10 | $5,04 |

| 7-Aug-21 | 17 | $13,670 | 12 | 139 | 15 | $11,766 | 2 | $1,904 |

| 31-Jul-21 | 21 | $8,160 | 11 | 134 | 10 | $3,574 | 10 | $4,586 |

| July 24,2021 | 21 | $6,367 | 11 | 139 | 15 | $3,712 | 6 | $2,655 |

| 17-Jul-21 | 14 | $4,009 | 11 | 124 | 12 | $2,015 | 2 | $1,994 |

| 10-Jul-21 | 16 | $3,997 | 13 | 143 | 11 | $1,597 | 4 | $2,4 |

| 3-Jul-21 | 24 | $7,492 | 13 | 94 | 16 | $3,769 | 8 | $3,722 |

| 26-Jun-21 | 10 | $4,995 | 7 | 85 | 8 | $3,847 | 2 | $1,148 |

| 19-Jun-21 | 28 | $16,830 | 8 | 228 | 9 | $1,861 | 19 | $14,968 |

| 12-Jun-21 | 26 | $27,238 | 15 | 209 | 19 | $25,602 | 7 | $1,636 |

| 5-Jun-21 | 15 | $15,539 | 13 | 100 | 13 | $14,709 | 2 | $600 |

| 29-May-21 | 35 | $20,279 | 11 | 145 | 28 | $18,64 | 7 | $1,639 |

| 22-May-21 | 24 | $53,208 | 14 | 174 | 17 | $51,047 | 7 | $2,161 |

| 15-May-21 | 18 | $10,620 | 13 | 220 | 11 | $5,870 | 7 | $4,809 |

| 8-May-21 | 17 | $10,400 | 11 | 156 | 15 | $8,386 | 2 | $2,500 |

| 1-May-21 | 21 | $7,200 | 16 | 115 | 12 | $3,808 | 9 | $3,392 |

| 24-Apr-21 | 8 | $20,200 | 9 | 31 | 8 | $20,200 | 0 | 0 |

| 17-Apr-21 | 14 | $6,270 | 8 | 102 | 11 | $40,180 | 3 | $2,260 |

| 10-Apr-21 | 15 | $8,940 | 13 | 129 | 14 | $7,990 | 1 | $950 |

| 3-Apr-21 | 18 | $19,513 | 10 | 151 | 12 | $16,923 | 6 | $2,590 |

| 27-Mar-21 | 27 | $13,942 | 15 | 244 | 14 | $4,300 | 13 | $9,633.50 |

| 20-Mar-21 | 11 | $2,046 | 4 | 102 | 3 | $270 | 8 | $1,776 |

| 13-Mar-21 | 15 | $3,270 | 9 | 109 | 6 | $538 | 9 | $2,732 |

| 6-Mar-21 | 24 | $13,617 | 10 | 196 | 13 | $10,395 | 11 | $3,222 |

| 27-Feb-21 | 19 | $8,105 | 12 | 139 | 15 | $4,970 | 4 | $3,135 |

| 20-Feb-21 | 9 | $8,820 | 9 | 153 | 8 | $8,520 | 1 | $300 |

| 13-Feb-21 | 12 | $4,852.60 | 7 | 81 | 7 | 2,766 | 5 | $2,086.60 |

| 6-Feb-21 | 18 | $9,752 | 13 | 153 | 14 | $5,222 | 4 | $4,530 |

| 30-Jan-21 | 18 | $9,449 | 9 | 182 | 15 | $8,753.80 | 3 | $695.30 |

| 23-Jan-21 | 14 | $8,150 | 8 | 118 | 6 | $4,000 | 8 | $4,150 |

| 16-Jan-21 | 17 | $6,783 | 13 | 138 | 11 | $2,400 | 6 | $4,382.90 |

| 9-Jan-21 | 22 | $6,829 | 14 | 135 | 18 | $3,139.30 | 4 | $3,690 |

| 2-Jan-21 | 7 | $1,466 | 7 | 60 | 7 | $1,466 | 0 | 0 |

| 26-Dec-20 | 18 | $15,900 | 12 | 163 | 16 | $5,300 | 1 | $600 |

| 19-Dec-20 | 18 | $9,769 | 14 | 110 | 14 | $8,426 | 4 | $1,343 |

| 12-Dec-20 | 10 | $7,200 | 9 | 100 | 9 | $3,325 | 1 | $3,830 |

| 5-Dec-20 | 15 | $4,261 | 9 | 122 | 9 | $2,780 | 6 | $1,481 |

| 28-Nov-20 | 19 | $7,758 | 10 | 110 | 13 | $4,003 | 6 | $3,755 |

| 14-Nov-20 | 14 | $864.10 | 14 | 157 | 12 | $289.10 | 2 | $575 |

| 7-Nov-20 | 13 | $6,332 | 9 | 129 | 9 | $2,483.50 | 4 | $3,849 |

| 31-Oct-20 | 10 | $3,995.80 | 8 | 103 | 6 | $3,231.10 | 4 | $754.70 |

| 24-Oct-20 | 6 | $18,100 | 6 | 58 | 5 | $17,709 | 1 | $350 |

| 17-Oct-20 | 8 | $351.90 | 5 | 55 | 8 | $351.90 | 0 | 0 |

| 10-Oct-20 | 7 | $5,229 | 3 | 50 | 4 | $735 | 3 | $4,494 |

| 3-Oct-20 | 14 | $21,428 | 9 | 173 | 9 | $17,535 | 5 | $3,893 |

| 26-Sep-20 | 10 | $12,770 | 8 | 93 | 5 | $10,300 | 5 | $2,470 |

| 19-Sep-20 | 14 | $8,365 | 9 | 101 | 6 | $1,020 | 8 | $7,345 |

| 12-Sep-20 | 6 | $4,406 | 8 | 59 | 3 | $1,270 | 3 | $3,136 |

| 5-Sep-20 | 11 | $5,191 | 8 | 117 | 9 | $4,061 | 2 | $1,130 |

| 29-Aug-20 | 11 | $2,531 | 9 | 94 | 5 | $1,130 | 6 | $1,401 |

| 22-Aug-20 | 18 | $6,574 | 12 | 140 | 7 | $1,930 | 11 | $4,644 |

| 15-Aug-20 | 13 | $4,991 | 10 | 97 | 7 | $1,216 | 6 | $3,775 |

| 8-Aug-20 | 12 | $32,092 | 11 | 112 | 9 | $30,457 | 3 | $1,635 |

| 1-Aug-20 | 7 | $5,287 | 8 | 76 | 5 | $3,687 | 2 | $1,600 |

| 25-Jul-20 | 9 | $18,751 | 6 | 67 | 7 | $18,403 | 2 | $348 |

| 18-Jul-20 | 6 | $1,982.50 | 5 | 50 | 4 | $1,407.50 | 2 | $575 |

| 11-Jul-20 | 11 | $565.10 | 12 | 75 | 10 | $65.10 | 1 | $500 |

| 4-Jul-20 | 10 | $8,889 | 8 | 98 | 9 | $8,788 | 1 | $100.30 |

| 27-Jun-20 | 8 | $6,874 | 10 | 50 | 5 | $4,972.50 | 3 | $2,081.50 |

| 20-Jun-20 | 12 | $4,444 | 9 | 115 | 7 | $2,829 | 5 | $1,615 |

| 13-Jun-20 | 6 | $3,582 | 4 | 37 | 2 | $350 | 4 | $3,232 |

| 6-Jun-20 | 11 | $3,213.70 | 8 | 65 | 7 | $470 | 4 | $2,743.70 |

| 30-May-20 | 8 | $7,335 | 7 | 48 | 6 | $4,639 | 2 | $2,697 |

| 23-May-20 | 4 | $432.40 | 4 | 34 | 3 | $432.40 | 1 | 0 |

| 16-May-20 | 6 | $310 | 6 | 34 | 5 | $310 | 1 | 0 |

| 9-May-20 | 18 | $5,630 | 16 | 124 | 14 | $3,180 | 4 | $2,450 |

| 2-May-20 | 15 | 10,400 | 10 | 90 | 8 | $1,900 | 7 | $,8,500 |

| 25-Apr-20 | 8 | $3,400 | 9 | 36 | 5 | $1,000 | 3 | $2,450 |

| 18-Apr-20 | 19 | $9,500 | 14 | 92 | 8 | $185.70 | 11 | $9,360 |

| 11-Apr-20 | 12 | $6,000 | 9 | 40 | 5 | $190 | 7 | $5,800 |

| 4-Apr-20 | 14 | $8,200 | 11 | 68 | 10 | $2,200 | 4 | $6,000 |

| 28-Mar-20 | 16 | $6,500 | 13 | 96 | 10 | $3,700 | 6 | $2,800 |

| 21-Mar-20 | 11 | $11,910 | 7 | 33 | 7 | $2,250 | 4 | $9,960 |

| 14-Mar-20 | 7 | 809.8 | 6 | 34 | 6 | 684.8 | 1 | 125 |

| 7-Mar-20 | 16 | $2,500 | 15 | 70 | 13 | $669 | 3 | $1,400 |

| 29-Feb-20 | 13 | $15,260 | 13 | 128 | 11 | $11,760 | 2 | $3,500 |

| 22-Feb-20 | 12 | $3,700 | 10 | 92 | 10 | $2,560 | 2 | $1,130 |

| 15-Feb-20 | 16 | $1,250 | 10 | 84 | 12 | $35 | 4 | $1,222 |

| 8-Feb-20 | 18 | $6,080 | 14 | 123 | 14 | $2,595 | 4 | $3,485 |

| 1-Feb-20 | 21 | $20,900 | 12 | 101 | 14 | $17,860 | 7 | $3,060 |

| 25-Jan-20 | 13 | $7,430 | 13 | 62 | 12 | $6,430 | 1 | $1,000 |

| 18-Jan-20 | 23 | $9,580 | 15 | 120 | 19 | $6,580 | 4 | $3,000 |

| 11-Jan-20 | 21 | $14,200 | 18 | 199 | 16 | $1,020 | 5 | $13,200 |

| 4-Jan-20 | 22 | $6,400 | 11 | 119 | 16 | $3,204 | 6 | $3,245 |

| 28-Dec-19 | 22 | $7,150 | 19 | 175 | 18 | $6,800 | 4 | $327.40 |

| 14-Dec-19 | 24 | $36,300 | 23 | 167 | 19 | $9,500 | 5 | $26,800 |

| 7-Dec-19 | 11 | $10,400 | 11 | 55 | 7 | $1,082 | 4 | $9,370 |

| November 30. 2019 | 14 | $2,450 | 12 | 126 | 12 | $1,760 | 2 | $692.50 |

| 23-Nov-19 | 16 | $1,995 | 10 | 41 | 11 | $615 | 5 | $1,380 |

| 16-Nov-19 | 15 | $3,820 | 13 | 135 | 11 | $2,500 | 4 | $1,271 |

| 9-Nov-19 | 25 | $12,900 | 17 | 182 | 23 | $12,200 | 2 | $575 |

| 2-Nov-19 | 10 | $2,470 | 12 | 61 | 9 | 2,450 | 3 | $22 |

| 26-Oct-19 | 12 | $5,560 | 14 | 70 | 11 | $3,860 | 1 | $1,700 |

| 19-Oct-19 | 8 | $6,600 | 8 | 138 | 8 | $6,600 | 0 | 0 |

| 12-Oct-19 | 19 | $4,300 | 14 | 55 | 16 | $3,800 | 3 | $500 |

| 5-Oct-19 | 18 | $14,500 | 19 | 166 | 15 | $11,100 | 3 | $3,400 |

| 28-Sep-19 | 19 | $8,100 | 18 | 132 | 18 | $7,560 | 1 | $550 |

| 21-Sep-19 | 14 | $6,300 | 16 | 66 | 11 | $2,160 | 3 | $4,170 |

| 14-Sep-19 | 15 | $23,800 | 12 | 56 | 11 | $21,250 | 4 | $2,570 |

| 7-Sep-19 | 17 | $3,500 | 15 | 98 | 14 | $1,900 | 3 | $1,600 |

| 31-Aug-19 | 5 | $8,700 | 6 | 50 | 5 | $8,700 | 0 | 0 |

| 24-Aug-19 | 16 | $10,000 | 14 | 82 | 15 | $4,250 | 1 | $5,750 |

| 16-Aug-19 | 10 | $1,680 | 5 | 52 | 7 | $650 | 3 | $950 |

| 9-Aug-19 | 17 | $17,700 | 15 | 68 | 14 | $3,900 | 3 | $13,800 |

| 2-Aug-19 | 13 | $5,760 | 12 | 108 | 13 | $5,760 | NA | NA |

| 27-Jul-19 | 11 | $7,300 | 13 | 76 | 8 | $6,570 | 3 | $730 |

| 20-Jul-19 | 13 | $11,800 | 13 | 125 | 11 | $5,300 | 2 | $6,500 |

| 13-Jul-19 | 10 | $775 | 7 | 46 | 8 | $542.50 | 2 | $233 |

| 6-Jul-19 | 7 | $2,500 | 9 | 85 | 7 | $2,500 | 0 | 0 |

| 29-Jun-19 | 23 | $8,290 | 15 | 154 | 17 | $2,300 | 6 | $5,970 |

| 22-Jun-19 | 17 | $10,700 | 10 | 139 | 14 | $7,700 | 3 | $3,000 |

| 15-Jun-19 | 11 | $13,500 | 14 | 160 | 11 | $13,500 | NA | NA |

| 8-Jun-19 | 13 | $2,870 | 17 | 55 | 11 | $1,570 | 2 | $1,300 |

| 1-Jun-19 | 10 | $4,460 | 11 | 60 | 8 | $4,140 | 2 | $315 |

| 25-May-19 | 17 | $4,360 | 14 | 79 | 14 | $3,700 | 3 | $612 |

| 18-May-19 | 22 | $9,000 | 17 | 150 | 16 | $3,400 | 6 | $5,600 |

| 11-May-19 | 18 | $19,800 | 17 | 177 | 15 | $18,300 | 3 | $1,500 |

| 4-May-19 | 10 | $7,075 | 6 | 32 | 8 | $6,900 | 2 | $175 |

| 27-Apr-19 | 15 | $3,200 | 14 | 117 | 14 | $3,160 | 1 | $40 |

| 20-Apr-19 | 13 | $13,500 | 10 | 90 | 9 | $12,200 | 4 | $1,300 |

| 13-Apr-19 | 16 | $38,900 | 14 | 91 | 14 | $37,800 | 2 | $1,100 |

| 6-Apr-19 | 12 | $6,870 | 11 | 94 | 10 | $6,730 | 2 | $50 |

| 30-Mar-19 | 15 | $6,470 | 12 | 84 | 10 | $7,91.5 | 5 | $5,677 |

| 23-Mar-19 | 18 | $6,450 | 14 | 91 | 14 | $5,042 | 4 | $1,408 |

| 16-Mar-19 | 14 | $10,180 | 12 | 115 | 11 | $8,800 | 3 | $1,300 |

| 9-Mar-19 | 9 | $1,800 | 6 | 49 | 8 | $1,300 | 1 | $500 |

| 2-Mar-19 | 20 | $3,033 | 16 | 107 | 14 | $1,817 | 6 | $1,262 |

| 23-Feb-19 | 12 | $2,040 | 8 | 69 | 9 | $614.60 | 3 | $1,430 |

| 16-Feb-19 | 16 | $9,970 | 18 | 77 | 16 | $9,970 | 0 | 0 |

| 9-Feb-19 | 14 | $6,400 | 10 | 110 | 14 | $6,400 | 0 | 0 |

| 2-Feb-19 | 18 | $6,740 | 15 | 99 | 16 | $5,720 | 2 | $950 |

| 26-Jan-19 | 13 | $2,770 | 11 | 67 | 11 | $918.95 | 2 | $1,850 |

| 19-Jan-19 | 15 | $3,819 | 16 | 76 | 12 | $2,594 | 3 | $1,225 |

| 12-Jan-19 | 18 | $7,283 | 14 | 92 | 15 | $1,683 | 3 | $5,600 |

| 5-Jan-19 | 10 | $529 | 12 | 50 | 10 | $529 | 0 | 0 |

| 22-Dec-18 | 17 | $2,570 | 13 | 87 | 14 | $941 | 3 | $1,629 |

| 15-Dec-18 | 10 | $2,860 | 8 | 26 | 8 | $264 | 2 | $2,600 |

| 8-Dec-18 | 15 | $1,819 | 16 | 65 | 12 | $552 | 3 | $1,267 |

| 1-Dec-18 | 12 | $7,500 | 10 | 90 | 9 | $1,200 | 3 | $6,200 |

| 28-Nov-18 | 15 | $4,500 | 11 | 107 | 14 | $4,000 | 1 | $500 |

| 19-Nov-18 | 18 | $6,137 | 13 | 98 | 13 | $2,142 | 5 | $3,995 |

| 14-Nov-18 | 18 | $9,200 | 13 | 152 | 15 | $8,500 | 3 | $694 |

| 6-Nov-18 | 16 | $17,300 | 16 | 183 | 14 | $16,361 | 2 | $950 |

| 29-Oct-18 | 14 | $14,400 | 18 | 127 | 17 | $13,800 | 1 | $600 |

| 24-Oct-18 | 13 | $6,140 | 13 | 126 | 11 | $5,122 | 2 | $1,018 |

| 17-Oct-18 | 18 | $18,390 | 15 | 125 | 14 | $12,292 | 4 | $6,098 |

| 10-Oct-18 | 29 | $3,149 | 18 | 104 | 20 | $1,647 | 9 | $819 |

| 2-Oct-18 | 18 | $9,300 | 11 | 67 | 14 | $7,300 | 4 | $2,000 |

| 25-Sep-18 | 13 | $7,000 | 11 | 75 | 10 | $6,000 | 3 | $995 |

| 18-Sep-18 | 9 | $3,570 | 7 | 44 | 9 | $3,570 | 0 | 0 |

| 11-Sep-18 | 13 | $5,900 | 10 | 132 | 13 | $5,900 | 0 | 0 |

| 7-Sep-18 | 14 | $5,000 | 15 | 86 | 11 | $4,000 | 3 | $1,000 |

| 29-Aug-18 | 15 | $20,700 | 14 | 79 | 13 | $4,700 | 2 | $16,000 |

| 20-Aug-18 | 10 | $12,400 | 11 | 53 | 8 | $11,380 | 3 | $1,057 |

| 14-Aug-18 | 12 | $19,900 | 12 | 132 | 9 | $18,889 | 3 | $1,011 |

| 7-Aug-18 | 16 | $68,600 | 11 | 106 | 13 | $67,259 | 3 | $1,340 |

| 31-Jul-18 | 15 | $15,100 | 15 | 95 | 11 | $13,060 | 4 | $2,060 |

| 23-Jul-18 | 13 | $2,130 | 15 | 60 | 10 | $1,804 | 3 | $1,100 |

| 17-Jul-18 | 14 | $5,370 | 17 | 98 | 9 | $4,310 | 5 | $1,100 |

| 9-Jul-18 | 16 | $11,200 | 15 | 74 | 10 | $11,080 | 6 | $862 |

| 3-Jul-18 | 13 | $7,000 | 7 | 81 | 12 | $6,330 | 1 | $750 |

| 25-Jun-18 | 15 | $8,800 | 13 | 97 | 9 | $4,970 | 6 | $3,930 |

| 18-Jun-18 | 13 | $14,200 | 14 | 80 | 7 | $221 | 6 | $14,290 |

| 11-Jun-18 | 12 | $6,300 | 8 | 96 | 8 | $5,910 | 4 | $803 |

| 6-Jun-18 | 13 | $14,500 | 10 | 88 | 8 | $14,154 | 5 | $579 |

| 31-May-18 | 11 | $4,890 | 10 | 63 | 8 | $3,240 | 3 | $1,790 |

| 22-May-18 | 15 | $20,400 | 11 | 63 | 9 | $19,808 | 6 | $885 |

| 15-May-18 | 15 | $4,700 | 15 | 106 | 10 | $3,900 | 5 | $643 |

| 9-May-18 | 11 | $1,400 | 13 | 88 | 9 | $1,300 | 2 | $560 |

| 1-May-18 | 8 | $14,250 | 7 | 88 | 7 | $13,400 | 1 | $450 |

| 24-Apr-18 | 12 | $5,300 | 6 | 61 | 11 | $4,470 | 1 | $800 |

| 17-Apr-18 | 9 | $1,800 | 10 | 44 | 7 | $2,330 | 2 | $1,434 |

| 11-Apr-18 | 11 | $2,500 | 8 | 32 | 6 | $1,690 | 5 | $809 |

| 3-Apr-18 | 15 | $13,400 | 11 | 121 | 9 | $12,020 | 6 | $1,090 |

| 28-Mar-18 | 10 | $4,000 | 10 | 92 | 7 | $3,870 | 3 | $215 |

| 19-Mar-18 | 17 | $5,800 | 13 | 51 | 10 | $590 | 7 | $5,165 |

| 12-Mar-18 | 15 | $3,130 | 11 | 43 | 11 | $2,360 | 4 | $788 |

| 6-Mar-18 | 19 | $5,400 | 13 | 116 | 10 | $1,530 | 9 | $4,860 |

| 27-Feb-18 | 20 | $6,600 | 13 | 69 | 14 | $5,530 | 6 | $1,030 |

| 19-Feb-18 | 15 | $5,500 | 14 | 111 | 10 | $3,990 | 6 | $1,980 |

| 12-Feb-18 | 23 | $10,900 | 17 | 157 | 12 | $7,110 | 11 | $3,840 |

| 5-Feb-18 | 16 | $8,600 | 13 | 100 | 7 | $1,330 | 9 | $7,800 |

| 30-Jan-18 | 11 | $12,600 | 11 | 68 | 5 | $7,300 | 6 | $4,982 |

| 24-Jan-18 | 19 | $9,400 | 15 | 129 | 5 | $2,010 | 14 | $7,337 |

| 18-Jan-18 | 10 | $6,280 | 8 | 49 | 2 | $2,100 | 8 | $4,188 |

| 9-Jan-18 | 12 | $16,500 | 12 | 92 | 9 | $15,890 | 3 | $475 |

| 3-Jan-18 | 10 | $2,500 | 9 | 47 | 8 | $2,350 | 2 | $150 |

| 27-Dec-17 | 15 | $9,000 | 15 | 113 | 9 | $7,568 | 6 | $1,784 |

| 18-Dec-17 | 15 | $13,800 | 16 | 164 | 9 | $13,010 | 7 | $1,118 |

| 11-Dec-17 | 14 | $9,700 | 10 | 126 | 12 | $2,940 | 4 | $8,500 |

| 4-Dec-17 | 6 | $1,800 | 6 | 31 | 5 | $1,510 | 1 | $300 |

| 28-Nov-17 | 7 | $3,850 | 8 | 76 | 4 | $3,260 | 3 | $285 |

| 16-Nov-17 | 10 | $2,700 | 10 | 48 | 6 | $1,840 | 4 | $856 |

| 8-Nov-17 | 15 | $2,380 | 17 | 91 | 10 | $1,860 | 5 | $516 |

| 1-Nov-17 | 12 | $4,700 | 17 | 94 | 9 | $3,400 | 4 | $1,300 |

| 23-Oct-17 | 15 | $10,500 | 10 | 67 | 10 | $9,780 | 4 | $1,530 |

| 18-Oct-17 | 6 | $2,000 | 37 | 3 | $225 | 3 | $1,820 | |

| 10-Oct-17 | 12 | $6,570 | 100 | 9 | $3,880 | 3 | $3,360 | |

| 2-Oct-17 | 8 | $3,100 | 11 | 19 | 3 | $1,630 | 5 | $1,750 |

| 25-Sep-17 | 8 | $4,880 | 8 | 79 | 5 | $2,660 | 5 | $2,070 |

| 18-Sep-17 | 9 | $4,770 | 3 | $300 | 6 | $4,470 | ||

| 12-Sep-17 | 11 | $4,430 | 8 | $2,030 | 3 | $2,400 | ||

| 1-Sep-17 | 4 | $1,310 | 3 | $317 | 1 | $1,000 | ||

| 23-Aug-17 | 11 | $13,640 | 9 | 8 | $11,840 | 3 | $1,800 |

Compared with the previous week’s roundup, reported deal value fell for both M&A and funding and capital markets transactions with 87 Texas lawyers from 13 firms chipping in. Year-over-year, 98 lawyers from eight firms took part in nine M&A or funding transactions valued at a reported $8.7 billion and a single capital markets transaction just over $100 million.

Note: Texas Lawbook corporate transactions editor Claire Poole contributed to this article.

M&A/FUNDING

Healthcare-focused SPAC Picks 2 Targets

HealthCor Catalio Acquisition Corp. has selected two targets that will hit the public markets as part of a special purpose acquisition company merger: Hyperfine Inc., the creator of the first FDA-approved portable magnetic resonance imaging device, and Liminal Sciences Inc., a medical device development company focused on measuring key vitals in the brain.

HealthCor has about $375 million in cash, including $126 million in private investment in public equity funding.

J.P. Morgan acted as exclusive financial advisor to Hyperfine and Liminal while Mintz, Levin, Cohn, Ferris, Glovsky and Popeo provided legal counsel to both.

Jefferies was financial advisor on the transaction. Jefferies also acted as capital markets advisor and co-lead placement agent along with Evercore Group and Wells Fargo Securities in relation to the private placement.

Kirkland & Ellis, in addition to Paul Hastings, advised Health Cor and the private placement agents on the transaction on legal matters.

Houston partners Debbie Yee, Sean Wheeler and Cephas Sekhar led the Kirkland team along with Houston associates Camille Walker, Jack Chadderdon, Carter Johnston and Tomi Olutoye.

Additional Texas-based help came from Houston partners Rob Fowler and Stephanie Jeane, Houston and Dallas partner David Wheat, Dallas associate Noah Allen and Houston associates Sarah Byrd, Sam Roberts, David Branham, Nicole Martin and Charles Inclan.

Oaktree Co-invests as Diversified Makes Further Cotton Valley, Haynesville Plays

Independent energy company Diversified Energy announced plans to purchase upstream assets and related facilities across the Cotton Valley formation and Haynesville shale in Texas and Louisiana from Tanos Energy Holdings III for $308 million.

Those plans mark a concurrent transaction with Oaktree Capital Management, which announced first in October intentions to co-invest by way of a joint participation agreement with Diversified.

The parties expect to close the transaction in mid-August.

Additionally, Oaktree plans to join Diversified on its recently announced purchase of certain Indigo Materials assets, also located in the Cotton Valley.

Willkie Farr & Gallagher represented Oaktree with a team led by Houston partners Michael De Voe Piazza and David Aaronson.

Truist Securities Inc. acted as Diversified’s exclusive financial advisor.

Shearman & Sterling advised Diversified in the transaction with a team that led by Houston partner Jeremy Kennedy with assistance from associates John Craven and Will Johnson.

Houston partners Todd Lowther and Daniel Tristan, Dallas partner Luckey McDowell, Dallas senior associate Julia Pashin and Houston associate Molly Harding.

Brookfield Asset Management acquired the controlling interest in Oaktree in 2019.

Patterson-UTI to Buy San Antonio Company

Houston-based Patterson-UTI Energy entered into an agreement to acquire Pioneer Energy Services for $295 million.

Patterson-UTI will gain San Antonio-based Pioneer’s 16 super-spec drilling rigs in the U.S. and eight pad-capable rigs in Colombia, among other assets.

Gibson Dunn advised Patterson-UTI Energy Inc. on the transaction with a team led by Houston partner Tull Florey with assistance from Orange County associate Darren Kerstien, Houston associate Jordan Rex and New York associate Tracey Tomlinson.

Additional Texas-based help came by way of Dallas partners David Sinak and Krista Hanvey and associates Michael Cannon and Gina Hancock.

Pioneer Energy Services tapped Vinson & Elkins as its legal counsel with a team led by Houston partners Chris Collins and Matt Strock with assistance from Houston associates David Lassetter and Matthew Fiorillo.

Also advising were Houston partner John Lynch and associate Adam Bateman on tax matters, along with Houston and Dallas partner David D’Alessandro and Houston associate Mary Daniel Morgan on executive compensation and benefits.

Pioneer selected Simmons Energy, a division of Piper Sandler, and Tudor, Pickering, Holt & Co. as financial advisors (Terry Padden from Simmons and BJ Walker from TPH).

Latham & Watkins represented Piper Sandler, financial advisor to Pioneer Energy Services, on the transaction with a corporate deal team led by New York and Orange County partner Charles Ruck and Houston partner James Garrett.

The transaction should close in the fourth quarter.

Westlake Subsidiary to Buy PVC Fittings Company

Westlake Chemical Corp. unit North American Pipe Corp. announced plans to purchase a designer, engineer and manufacturer of injected-molded PVC fittings.

Should the deal close, NAPCO would pick up LASCO Fittings from Dutch manufacturer Aalberts for $252.2 million.

Baker Botts advised Westlake on legal matters.

Houston partners Tim Taylor and Carina Antweil led the efforts for the firm along with Austin senior associate J. Michael Portillo and Houston associate Bryson Manning.

Additional Texas-based assistance came from Houston partners Jon Lobb, Gail Stewart, Connie Simmons Taylor, Scott Janoe and Kevin Jacobs; Dallas partner Jennifer Trulock; Houston special counsel Michelle Eber; Houston associates Gabriela Alvarez, Fred Carbone, Austin Jennings, Cole Killion and Kristina Vu; and Dallas associate Snow Rui.

L. Benjamin Ederington is senior vice president, general counsel, chief administrative officer and secretary for Westlake.

Westlake, which is based in Houston, recently announced plans to purchase the North American building products businesses of Boral Industries, also using Taylor and Antweil from Baker Botts.

FisherBroyles Reps Allen Company in Carve-out

Allen, Texas-based PFSweb has sold its customer experience and commerce agency business unit to Merkle Inc.

Merkle will pay about $250 million to PFSweb as part of the carve-out deal. PFSweb, which is traded on the Nasdaq, is eyeing proceeds from the transaction to pay down its senior financing facilities in full.

Raymond James provided financial counsel to PFSweb while FisherBroyles represented the company on the legal front.

Dallas partner Soren Lindstrom led the cross-border FisherBroyles team. Additional Texas-based aid came from Dallas partner Mark Mathis.

Contango to Acquire ConocoPhillips Wyoming Assets

Contango Oil & Gas Co., a Fort Worth-based independent oil and gas company, announced intentions to acquire ConocoPhillips’ Wyoming natural gas assets.

Contango plans to fund the $67 million purchase price with cash on hand and availability under its existing revolving credit facility.

The transaction is expected to close in the third quarter.

Skadden advised Contango on legal matters on the transaction while Lazard served as financial advisor.

M&A partner Cody Carper and energy and infrastructure projects associate David Passarelli, both of Houston, led the Skadden team and managing directors Dan Hamilton and Harris Ghozali and director Mark Lund in Houston led the Lazard team. Carper just joined the firm from Willkie Farr in January.

Contango entered into a definitive merger agreement with KKR-backed Independence Energy that would see the combined company headquartered in Houston. The deal is expected to close late in the third quarter.

Blackbuck Gets $50M Bump From Riverstone Fund

Midland’s Blackbuck Resources has closed a sustainability-linked term loan with Riverstone Credit Partners, an energy and power credit fund managed by private equity firm Riverstone Holdings.

Blackbuck, a Permian Basin-focused water infrastructure provider to the oil and gas industry, is looking to the financing for additional growth liquidity. The $50 million commitment is subject to an accordion feature tied to sustainability performance targets set internally by Blackbuck.

Foley & Lardner acted as legal counsel to Blackbuck.

A Houston-based finance team led the Foley team with partner Hoang Quan Vu in addition to of counsel Felisa Elayne Sanchez and Neal Bakare, associate Jennifer Gardner and paralegal Debra Vincent.

Additional Texas-based team members Houston partners Michael Abbott, James Howard and Randall Jones and associate Eun Sung Lim provided additional Texas-based counsel on the transaction.

PE-backed Energy Company to Change Hands

WildFire Energy I has entered into a definitive agreement to acquire exploration and production company Hawkwood Energy.

Both energy firms are backed by big names in private equity. WildFire, an energy platform based in Houston, was founded in 2019 with funding from Kayne Anderson, Warburg Pincus and the management team, while Hawkwood, started in 2012 in Denver, began with a line-of-equity commitment with Warburg Pincus and Ontario Teachers’ Pension Plan as lead investors.

Financial specifics of the transaction were not disclosed, although the deal represents an enterprise valuation of Hawkwood of about $650 million.

Once the transaction closes, Hawkwood’s existing shareholders will keep about half of the company, while the other half will be held by WildFire’s management team and Kayne Anderson.

Along with the acquisition, Kayne Anderson and WildFire’s management team plan to make a significant equity investment that will substantially de-lever the company.

Locke Lord represented WildFire in legal matters in the transaction with Houston partners Mitch Tiras, Kevin Peter and Jennie Simmons leading the effort.

Other Texas-based lawyers that worked on the transaction included Houston partners Terry Radney, Hunter Summerford, Jerry Higdon, Eric Larson, Sara Longtain, Ed Razim, Buddy Sanders and Jeff Wallace; Houston associates Evan Blankenau, Jason McCloskey, Andrew Nelson, Lauren Richter, Case Towslee and Kenton Wilson; and Dallas partner Van Jolas.

Kirkland & Ellis advised Warburg and Hawkwood in the transaction.

Corporate partners Adam Larson, Kim Hicks and Chris Heasley, all based in Austin and Houston, along with Houston associates Alia Heintz and Jenna McCord, led the transaction for Kirkland.

Additional Texas-based assistance included Houston corporate associates Jennifer Gasser, Mya Johnson, Zach Scott, James Murphy and Sean Valentine; Houston debt finance partner Rachael Lichman and associates Mahalia Doughty and Catalina Bravo Correa; Dallas and Houston tax partner David Wheat and Houston associate Joe Tobias; and Dallas environmental transactions partner Jonathan Kidwell and associate Courtney Tibbetts.

The transaction is expected to close in the third quarter.

NGP-backed Mesa II Makes Portfolio Buy

Mesa Royalties II closed on the acquisition of a mineral and royalty portfolio consisting of about 15,000 acres in the Haynesville shale with 472 existing proved developed producing wells.

The seller and financial terms of the deal were not disclosed.

Kirkland & Ellis and Willkie Farr & Gallagher advised Mesa.

The Kirkland team was led by real asset transactions partner Chris Heasley of Austin and Houston and Dallas associate William Eiland.

Real asset transactions partner David Castro of Houston, along with Dallas and Houston tax partner David Wheat and Houston associate Joe Tobias, also aided on the transaction.

Houston partners Michael De Voe Piazza and Robert Jacobson led the Willkie team.

Mesa recently received equity commitments of $150 million from Dallas-based NGP by way of its NGP Natural Resources XII and NGP Royalty Partners earlier this year.

MAM, Ontario Teachers Bet on Washington’s Largest Utility

Macquarie Asset Management and Ontario Teachers’ Pension Plan Board have joined forces to acquire a stake in Puget Holdings for an undisclosed sum.

The pair will acquire a 31.6% interest in the holding company for Washington’s largest electric and natural gas utility from another institutional investor, Canada Pension Plan Investment.

Upon close of the acquisition, for which financial terms were not disclosed, MAM and Ontario Teachers will each hold a 15.8% stake in the company.

Kirkland & Ellis counseled MAM and Ontario Teachers in the transaction with a team led by corporate partners Kristin Mendoza of New York and Allan Kirk of Houston and New York associates Brandon Gershowitz and Marie-Joe Abi-Nassif.

A timeline for closing on the transaction was also not disclosed. It has to pass muster with regulators.

Cypress Creek to Be Acquired by EQT Fund

EQT Infrastructure plans to acquire Cypress Creek Renewables with an eye toward further expanding its development pipeline execution, fleet optimization and expansion in addition to scaling its operations and maintenance services business.

Through its EQT Infrastructure V fund, EQT will purchase the company from funds managed by HPS Investment Partners and Temasek.

Transaction terms were not disclosed. The deal is expected to close in the second half of the year.

Cypress Creek selected Kirkland & Ellis as legal counsel and Morgan Stanley & Co. as exclusive financial advisor.

Corporate partner Michael Considine of Dallas and New York associate Rami Totari led the transaction with additional Texas-based assistance from capital markets and transactional partner Matt Pacey.

Barclays acted as financial advisor to EQT while Simpson Thacher & Bartlett represented the company in legal matters.

CAPITAL MARKETS

Enbridge Issues $1.5B in Senior Notes

Canada’s Enbridge Inc. closed on a green-linked bond tied to a larger $1.5 billion in financing.

The company, which focuses on transportation of crude oil and natural gas, issued $1 billion 12-year 2.5% senior notes. Additionally, Enbridge closed on $500 million of 30-year 3.4% senior notes.

The $1 billion note incorporated emissions and inclusion goals.

Enbridge plans to use the proceeds from the issuance to repay debt, fund capital projects and for general corporate purposes.

Baker Botts represented the underwriters with a Houston-based corporate team led by partners Joshua Davidson and Natasha Khan and associates Garrett Hughey, Malakeh Hijazi and Christopher Carreon.

Additional Texas-based counsel was provided by Austin partner Paulina Williams, Austin special counsel Clint Culpepper, Houston special counsel Chuck Campbell, Houston senior associate Katie McEvilly and Houston associate Austin Echols.

Mississippi Power Co. Announces $525M in Senior Notes

Mississippi Power Co., a wholly owned subsidiary of Atlanta-based Southern Co., has issued two notes offerings, including $200 million of series 2021 A floating rate senior notes due June 28, 2024 and $325 million of series 2021 B 3.1% senior notes due July 30, 2051.

Mississippi Power, which is investor-owned and trades on the New York Stock Exchange, plans to use proceeds from the series B offering to finance or refinance one or more projects that meet eligibility criteria tied to wind or solar power, renewables or diverse or small business suppliers.

Balch & Bingham and Troutman Pepper Hamilton Sanders advised Mississippi Power in the transaction on legal matters.

Hunton Andrews Kurth counseled Barclays Capital, Mizuho Securities USA Inc., RBC Capital Markets and Piper Jaffray as underwriters. New York partners Steven Friend and Peter K. O’Brien led the Hunton AK team with Houston-based assistance from partner Robert McNamara and associate Tim Strother.

Fresh SPAC IPO Hits NYSE

Acropolis Infrastructure Acquisition Corp., a special purpose acquisition company seeking a North American target tied to infrastructure, infrastructure services and related sectors, unveiled a $300 million offering of 30 million units of Class A common stock.

Acropolis is sponsored by an affiliate of Apollo Global Management.

Credit Suisse Securities is acting as a joint bookrunner and representative of the underwriters.

Apollo Global Securities, Citigroup Global Markets, Barclays Capital and Evercore Group are joint bookrunners with Siebert Williams Shank & Co. serving as co-bookrunner.

Latham & Watkins represented the underwriters in legal matters with a team led by Houston partner Ryan Maierson.

CTO Realty Growth Closes Upsized Offering

As part of an upsized public offering, CTO Realty Growth issued $75 million of 6.375% Series A cumulative redeemable preferred stock.

Hunton Andrews Kurth represented the underwriter, Wells Fargo Securities, with a team led by Richmond partner James V. Davidson along with Houston associates Marshall Heins, Casey Shaw and Alexa N. Williams; and Miami associate Andrew Spector.

V&E counseled CTO Realty Growth.

Both Hunton AK and V&E have previously represented the same entities in past offerings associated with CTO, such as this one from May.

Note: Bracewell’s counsel to Evercore in Enviva’s drop-down acquisitions announced in June were added to this Roundup.