© 2016 The Texas Lawbook.

By Natalie Posgate

(Nov. 2) – The number of securities offerings and the size of those offerings skyrocketed during the third quarter of 2016 compared to one year earlier, but the totals fall far short of the record amount of corporate dollars raised during the first half of 2015.

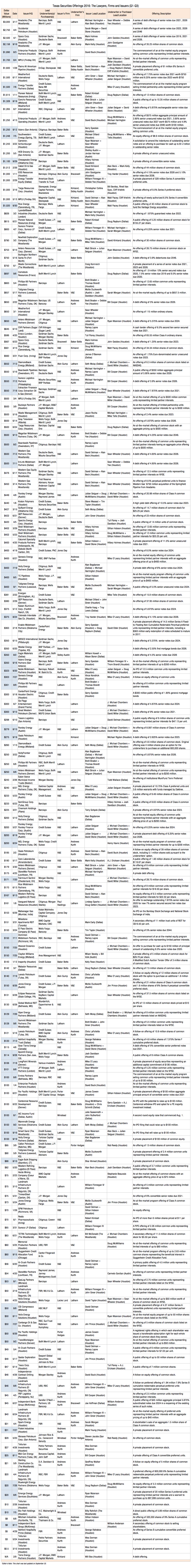

The Texas Lawbook’s Corporate Deal Tracker shows that Texas lawyers handled 69 debt and equity offerings during July, August and September – a 72.5 percent increase over the same period in 2015.

The third quarter offerings raised $26.1 billion – up from $17 billion in Q3 2015, but are still far shy of the 93 securities offerings for $41.6 billion during last year’s second quarter, which was the best quarter for offering count in 2015.

It was the second consecutive quarter in which Texas corporate lawyers and their clients returned to the capital markets – albeit in modest numbers – after nine months in which securities offerings were few and far between, according to the Corporate Deal Tracker.

Legal experts say that the energy industry, which found it so difficult to raise capital through securities offerings between July 2015 and March 2016, are now fueling the capital markets recovery.

The Corporate Deal Tracker’s examination of the 188 securities offerings during the first three quarters of 2016 found:

• Approximately 26 percent were debt offerings;

• Approximately 59 percent were equity offerings, of which 15 percent were at-the-market equity programs, 5 percent were IPOs and 39 percent were follow-on or other common stock offerings;

• Approximately 15 percent were private offerings;

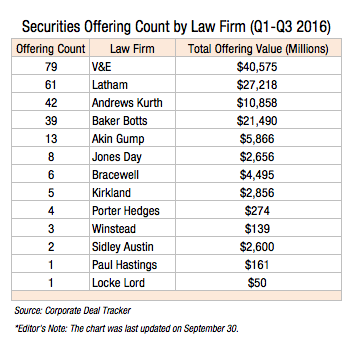

• Vinson & Elkins continues to top the leaderboard, handling at least 30 percent more capital markets work than any other firm; and,

• Latham & Watkins, Andrews Kurth Kenyon, Baker Botts and Akin Gump are the law firms that fill out the top five.

Legal experts say most of the securities offerings this year involve oil and gas companies either making strategic acquisitions located in desirable shale plays – such as the Permian Basin in West Texas – or looking to raise cash to improve their balance sheets.

“We’ve seen issuers who are making acquisitions in basins with higher returns and more demand,” Seiguer said. “Companies making smart acquisitions have found very strong demand for offerings of both their equity and debt securities.”

To the delight of many, one particular offering type that began to make a comeback in the second and third quarters with energy companies was the mother of all economic growth indicators: the initial public offering.

Texas attorneys handled nine IPOs during the first nine months of 2016. Andrews Kurth Kenyon, Jones Day, Akin Gump, Baker Botts and Kirkland & Ellis each worked on one IPO. Latham & Watkins played a role in three.

V&E worked on seven IPOs.

All but two have made it to or beyond the pricing phase, though some did not advance past the S-1 filing phase until the fourth quarter. Those two opted instead to be acquired by a private equity firm or a competitor. Another two of the IPOs involved companies not related to the energy industry.

By contrast, Texas lawyers worked on only five IPOs in all of 2015, according to Corporate Deal Tracker data.

“I think as long as you continue to have stability on commodity prices or no shocks to the system, you’ll continue to see additional energy IPOs over the next six to 12 months,” said Seiguer, who has represented the issuers or underwriters on four of the IPOs that have closed or been publicly announced in 2016.

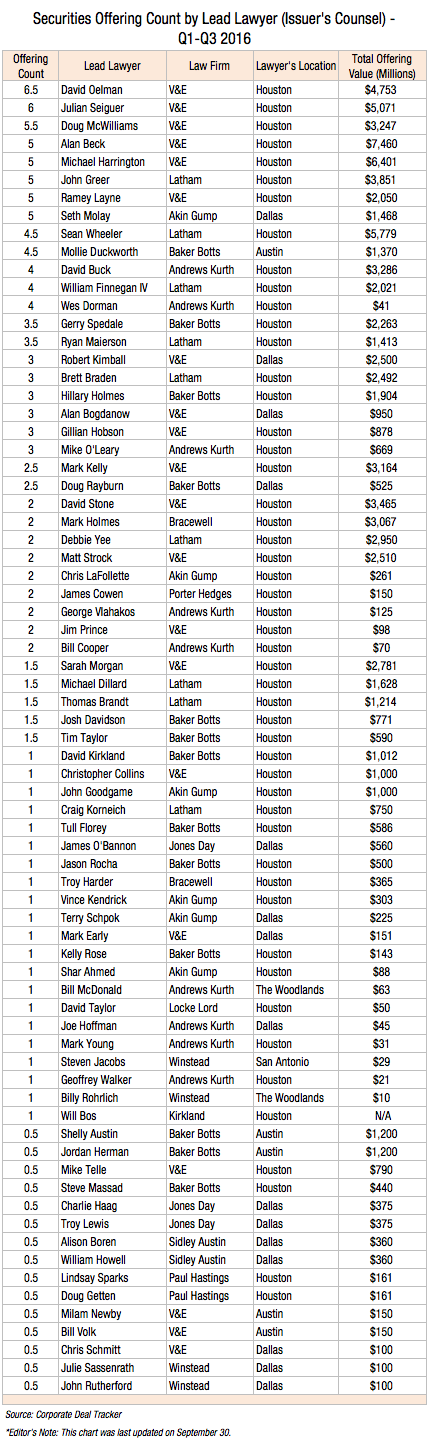

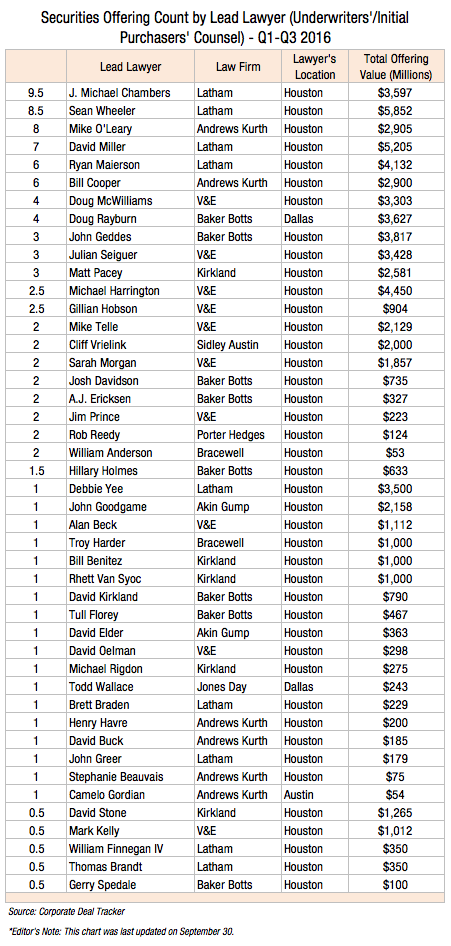

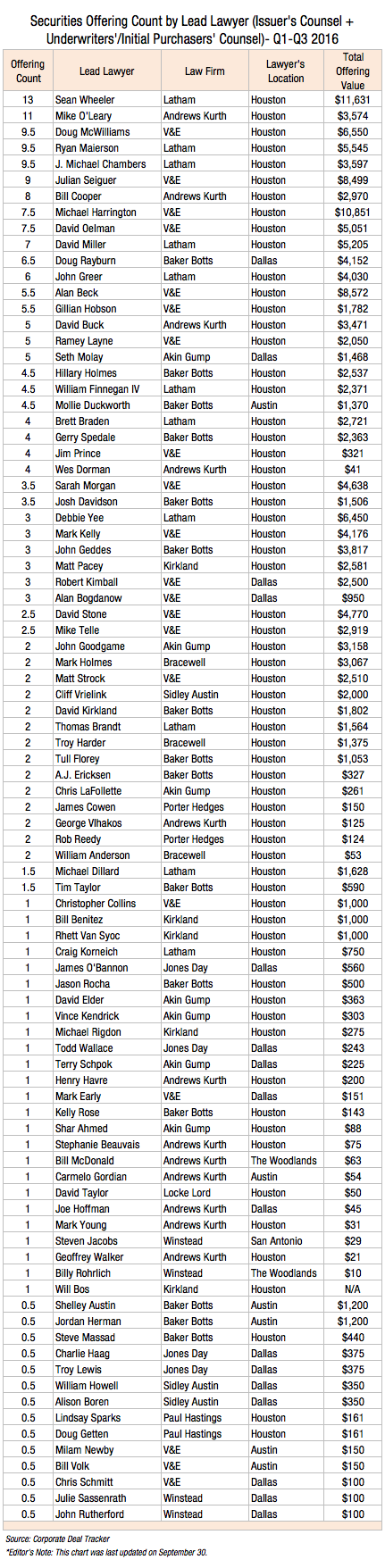

Sean Wheeler, a partner in Latham’s Houston office who ranks No. 1 on the Corporate Deal Tracker for leading the most securities offerings so far in 2016, said the majority of IPOs the energy market has seen this year has involved exploration and production companies going public as C corporations.

“This is quite different from prior years, where the bulk of the new issue activity consisted of master limited partnerships tapping the IPO market,” Wheeler said. “With the exception of Noble Midstream, the MLP IPO market has been relatively dormant since the middle of 2015, and I would expect it to continue to lag for another six months.”

Wheeler said he anticipates seeing a couple more energy IPOs in the fourth quarter “actually price, a number of companies make filings to initiate the IPO process and a reasonable amount of follow-on offering activity” until the December slowdown associated with the holidays.

“The general consensus is that everyone is ready for 2016 to be over and that 2017 will be much brighter for energy companies – both in terms of capital markets transactions and M&A activity,” he said.

Up next in the series: The Texas Lawbook conducts a comprehensive Q&A with Wheeler, who has led or co-led 16 securities offerings this year for issuers and underwriters.

© 2016 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.