© 2015 The Texas Lawbook.

By Natalie Posgate and Mark Curriden

(April 6) – Three law firms in Texas dominated the corporate transactional marketplace during the first three months of 2015.

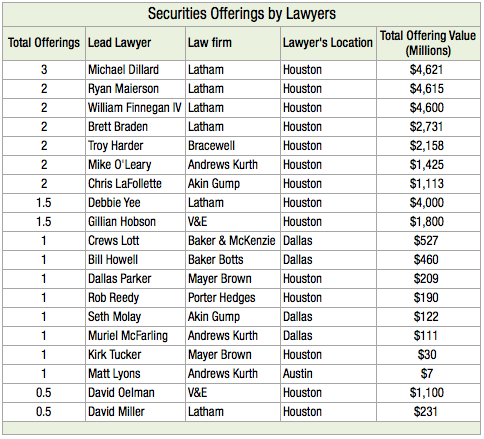

Vinson & Elkins continues to dominate the world of M&A in the energy sector. Andrews Kurth and Latham & Watkins rule the world of securities offerings.

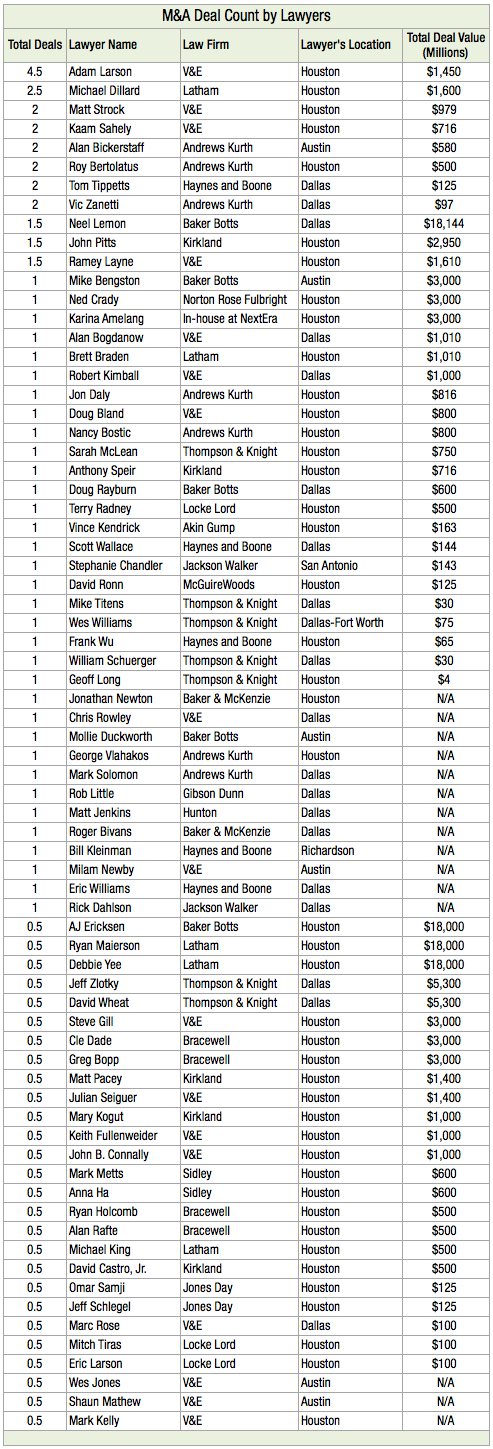

Two Houston-based business lawyers – Michael Dillard of Latham and Adam Larson of V&E – were the most prolific transactional lawyers in January, February and March.

The Texas Lawbook’s Corporate Deal Tracker shows that Texas-based lawyers worked on 52 mergers, acquisitions, divestitures and joint ventures in the first quarter of 2015. Those 52 deals had a total value of $38.9 billion.

The Texas Lawbook’s Corporate Deal Tracker reports M&A activity and securities offerings handled by lawyers based in Texas, even if those transactions involve non-Texas-based companies. By contrast, our colleagues at Mergermarket, an independent global M&A research firm, document M&A based on the headquarters of the corporate buyer and seller.

The Corporate Deal Tracker ranks matters by value and includes the announcement date, the names of the companies involved and the lawyers and their law firms.

In addition, the Corporate Deal Tracker ranks the law firms and the lawyers handling the transactions.

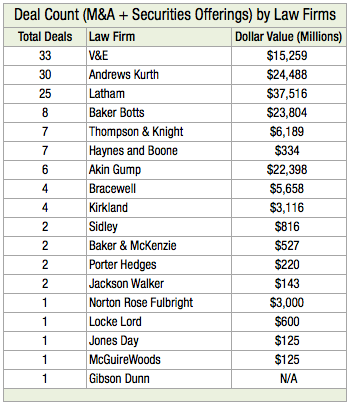

During Q1, the Corporate Deal Tracker shows that V&E was a lead law firm in 33 separate transactions valued at $14.8 billion.

Andrews Kurth represented clients, many of them underwriters, in 30 matters that had a combined value of $24.5 billion. The Houston-based firm handled 18 securities offerings with a cumulative worth of $11.9 billion.

Latham came in third with 25 total transactions, but it was number one in total deal value at $37.5 billion. Twenty of the firm’s corporate matters were securities offerings that brought $16.9 billion to the firm’s clients.

Latham and Baker Botts were the lead law firms in the first quarter’s biggest deal, which was Energy Transfer Partners’ $18 billion acquisition of Regency Energy Partners in January. Akin Gump was also involved in the matter.

The Corporate Deal Tracker ranks Baker Botts fourth with eight transactions valued at $23.8 billion. Thompson & Knight and Haynes and Boone tied for fifth, followed by Akin Gump and Bracewell.

The most prolific corporate lawyer during the first quarter was Michael Dillard of Latham, who was the lead lawyer in securities offerings valued at $4.6 billion and three M&A deals that carried a price tag of $1.6 billion. (Dillard shared one of his deals with a fellow Latham partner.)

V&E Houston partner Adam Larson was nearly as busy. Larson was the lead counsel in five acquisitions worth $1.45 billion.

Dillard and Larson were actually across the table from each other in January in a $100 million energy transaction involving Talara Capital and Spring, Texas-based New Century.

© 2015 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.