© 2015 The Texas Lawbook.

By Mark Curriden

(July 6) – Energy Future Holdings is spending more than $600,000 a day – including weekends and holidays – in legal and financial advisory fees and expenses as part of its restructuring efforts in federal bankruptcy court, putting the case on track to be one of the costliest bankruptcies in U.S. history.

Since filing for reorganization under Chapter 11 in April 2014, lawyers and financial advisers have charged EFH $230 million through June 1, according to court records examined by The Texas Lawbook.

Lawyers involved in the litigation, who asked not to be identified, predict that the bill will likely hit $500 million before the bankruptcy is over.

Delaware Bankruptcy Court filings show that law firms, financial advisers and management restructuring experts are billing the Dallas-based energy company about $18.3 million per month, which is $1 million more a month than American Airlines paid its lawyers and consultants during its restructuring.

“I knew this case was going to be extraordinarily expensive because this is a $45 billion restructuring and it is very complex,” said EFH General Counsel Stacey Doré. “But when you actually see the numbers, it is astonishing.”

Photo credit: Dallas Business Journal

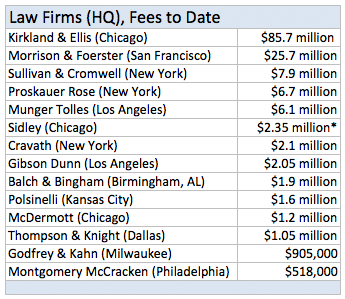

Chicago-based Kirkland & Ellis, which is EFH’s lead bankruptcy counsel, is getting the lion’s share of the legal fees and expenses: $85.7 million so far. Morrison & Foerster, a San Francisco law firm representing creditors in the bankruptcy, has filed to be paid $25.7 million.

“Kirkland & Ellis lawyers had to get to know nearly every aspect of our operation… in order for the firm to lead what we believe will be a successful restructuring,” Doré said.

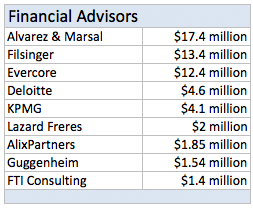

The financial and bankruptcy management advisers are also scoring big on EFH’s troubles. The global restructuring firm Alvarez & Marsal has charged $17.4 million so far. Colorado-based Filsinger Energy Partners has billed EFH $13.4 million for its consulting services. New York banking adviser Evercore Partners has billed $12.4 million so far.

The financial advisers charge either a single hourly rate for all the people they have working on the bankruptcy or a monthly flat fee.

Federal bankruptcy law provides that the lawyers and advisers be paid first, before creditors receive any money they are owed.

Court records show that more than 50 lawyers, including 29 from Kirkland, are charging EFH more than $1,000 an hour, according to court records. Nearly all the lawyers are based in New York, Chicago or Delaware, where EFH filed the bankruptcy petition.

Kirkland tax partner Todd Maynes, who represented United Airlines and General Motors in high-profile tax disputes, charges the most: $1,375 an hour.

“No lawyer is actually worth $1,200 an hour and $18 million a month is an extraordinary amount of money,” said former American Airlines General Counsel Gary Kennedy. “This shows why bankruptcy has become almost too expensive for most companies.”

But the most questionable charge, according to Kennedy and lawyers in the case, was filed with the bankruptcy court on June 23 by Cravath, which is seeking to be paid $295 an hour for the work of two law students who are clerking for the firm for the summer. Other law firms also have summer associates working on the bankruptcy, but they did not charge EFH for their services.

“That must be a gold-plated summer clerk,” Kennedy said. “But there’s not much Stacey can do about it.

“EFH’s problem is, there’s no end in sight and the enormous fees are only going to continue,” Kennedy said.

Delaware Bankruptcy Judge Christopher Sontchi, 14 months into the bankruptcy, issued a scheduling order on July 2 that puts the case on track to be resolved next March or April at the earliest.

While EFH’s advisor fees far exceed the $45 million so far in the Radio Shack bankruptcy, they are half the $416 million in fees and expenses that American Airlines incurred in its two-year restructuring.

The most expensive bankruptcy in history continues to belong to Lehman Brothers, which led to more than $2 billion in adviser fees over four years. Lawyers and financial advisors in the Enron bankruptcy billed $780 million for their services.

Doré said she has a lawyer in her corporate in-house department flyspecking all the bills and they do push back at times.

“It is a lot different and more difficult to manage outside lawyers in a bankruptcy case than in a regular case because you are under the microscope of the court,” Doré said.

© 2015 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.