Baker Botts, Haynes Boone, Bracewell and Vinson & Elkins are four of the largest corporate law firms headquartered in Texas by attorney headcount and revenue.

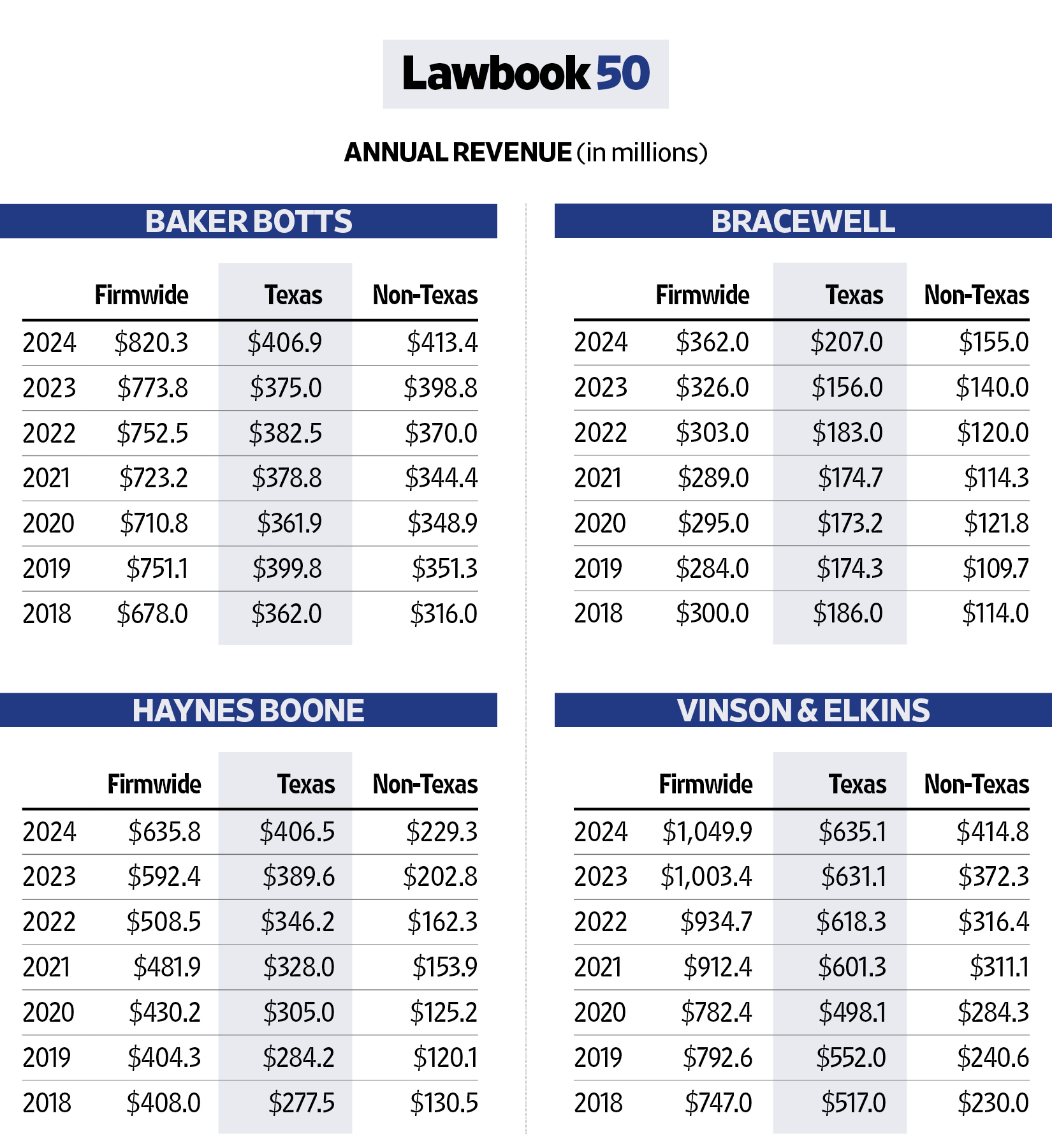

All four reported record revenues and record profits in 2024, according to the Texas Lawbook 50, which tracks the financials of the largest law firms operating in Texas.

Combined, they employed 2,360 lawyers and generated nearly $2.9 billion in firmwide revenues in 2024.

Lawbook 50 data also shows another interesting trend: All four are growing more than twice as fast outside of Texas than they are in their home state offices.

In 2024, 45.6 percent of the lawyers working at Baker Botts, Haynes Boone, Bracewell and V&E were practicing in offices beyond the Lone Star State. It was only 30 percent in 2011.

Lawyers in those firms’ non-Texas offices generated $1.21 billion in 2024 — up from $821.7 million in 2019, according to Lawbook research.

That 47 percent jump in revenue over six years compares to the 18 percent increase the four firms grew during the same period from their Texas operations — from $1.41 billion in 2019 to $1.66 billion last year.

“The Texas corporate law market is a fantastic, growing and competitive market, but the downside is that there is a limit to the high-level legal talent available, especially in Dallas and Houston,” said Kent Zimmermann, a consultant with the Zeughauser Group. “We are increasingly seeing Texas firms looking at other markets where there is talent available for them to grow.”

Zimmermann said that a handful of Texas firms have successfully grown in California, Washington, D.C., and internationally, while others are more focused on “more unique markets,” such as Charlotte, Denver, Orange County and the suburbs of Washington, D.C.

“Successful corporate law firms follow two things: money and talent,” Zimmermann said. “The two are intimately connected.”

Legal industry insiders point out that the cost of luring experienced lawyers via lateral hiring has become expensive in Dallas and Houston.

Elite corporate law firms are paying $3 million to $7 million for partners with significant practice experience and $8 million to $13 million for top-level partners with substantial books of business.

It is difficult for strong Texas-based firms, such as Baker Botts, Bracewell, Haynes Boone and V&E, to match those compensation offers. So, they have three growth options: grow organically through associate hiring and training, steal lawyers from smaller Texas firms or look for talent outside the state.

“Baker Botts is strong in intellectual property law and we naturally see the firm adding lawyers in California, where the talent for IP lawyers is more concentrated,” Zimmermann said.

Haynes Boone

No corporate law firm headquartered in Texas is expanding faster outside the state than Haynes Boone, which now has 11 non-Texas offices, including three international outposts.

Texas Lawbook 50 data shows that the Dallas-based firm saw its Texas lawyer full-time equivalent headcount decline by six attorneys in 2024, while it grew by 30 lawyers in its out-of-state operations.

Haynes Boone opened a Charlotte office in 2019 with three lawyers. It now has 25 attorneys there. Over the past few years, the firm has grown its London office to more than 50 lawyers. And its New York office is now its second-largest outpost, with more than 110 attorneys.

The result of growth is increased revenue.

The firm reported $635.8 million in 2024 revenue firmwide, which was seven percent more than the year before. But its surge in non-Texas revenue outpaced its in-state gross income growth three to one.

The Texas lawyers for Haynes Boone generated revenue of $406.5 million — a four percent year-over-year increase, according to Lawbook 50 data.

By comparison, the firm’s non-Texas attorneys reported $229.3 million — a 13 percent jump.

Between 2019 and 2024, Haynes Boone has seen its non-Texas revenue increase 91 percent — from $120.1 million to $229.3 million, according to Lawbook 50 data.

During that same period, the Texas offices grew revenue by 43 percent.

Bracewell

Bracewell started its efforts to expand nationally in 2005 when it announced former New York City Mayor Rudy Giuliani was joining the Houston-based energy law firm as a named partner. The decadelong partnership worked as the firm was able to grow its white collar and regulatory practices significantly in New York and Washington, D.C.

The firm has steadily grown its global presence — it has U.S. offices in New York, Seattle and Washington, D.C., and international offices in Dubai, London and Paris — and revenue from its non-Texas lawyers comprised 43 percent of Bracewell’s $362 million in revenue in 2024.

Lawbook 50 data shows that Bracewell has witnessed three consecutive years of strong revenue growth, both in Texas and outside the state. In fact, both numbers were records for the firm.

Bracewell’s Texas attorneys generated $207 million in revenue in 2024 — a 13 percent increase since 2022. In comparison, the firm’s non-Texas lawyers brought home $155 million — a 29 percent jump from 2022.

The firm boasts a strong public policy and energy regulatory practice in the nation’s capital, which bodes well for its 2025 revenues as legal demand for such work has skyrocketed during the first four months of a turbulent Trump administration.

“Our regulatory practice has been robust,” said Bracewell managing partner Greg Bopp. “We’ve had the firm’s best years. National and international operations, especially in London and Dubai, have been records. And 2025 is on target to be even better than 2024.”

Baker Botts

While all four Texas-headquartered firms have intentionally and aggressively expanded outside the state, Baker Botts has, for two consecutive years, generated more money — albeit slightly more — from its non-Texas lawyers than those in its home state.

The Houston-based firm reported $820.3 million in firmwide revenue in 2024 — a six percent year-over-year increase.

Lawbook 50 data shows that Baker Botts made $406.9 million from its Dallas, Houston and Austin operations and $413.4 million from its nine non-Texas offices.

Baker Botts has international outposts in Brussels, Dubai, London, Riyadh and Singapore. The firm opened its Singapore operation in 2022 and now has 13 attorneys in the office.

The firm’s huge emphasis on technology and intellectual property law has propelled its growth in Palo Alto and San Francisco.

“We are focused on the twin engines of energy and technology,” said Baker Botts managing partner Danny David. “We want to focus on efforts that are real, that are long term, and 2024 shows us thar our strategy is working.”

Since 2018, Baker Botts has increased its Texas revenue by 12 percent — from $362 million to $406.9 million last year, according to Lawbook 50 data. By comparison, the firm has seen its non-Texas revenue grow by 31 percent over those same six years — from $316 million to $413.4 million.

Vinson & Elkins

Houston-based V&E is by far the most profitable of the four firms.

V&E revenue topped the $1 billion mark for the second consecutive year, but the firm has experienced outsized growth in its non-Texas offices.

Lawbook 50 data shows that V&E lawyers in Texas collected $635.1 million in 2024 — a gain of less than one percent from the year before.

But the firm’s lawyers in its 10 non-Texas offices generated $414.8 million last year — an 11.4 percent jump from 2023.

V&E has three Texas offices and U.S. outposts in Denver, Los Angeles, New York, Richmond, San Francisco and Washington, D.C. It also has international offices in Dubai, Dublin, London and Tokyo.

Since 2018, V&E has seen its revenue from non-Texas operations go from $230 million to $414.8 million in 2024 — an 80 percent jump. By comparison, V&E’s Texas lawyers have increased revenue by 23 percent over that time frame.

Texas Lawbook 50 Articles Already Published

- Texas Firm Headcount Inched Up 1%

- Susman Godfrey Scores ‘Second Best Year Ever’

- Kirkland is Texas’ First Billion-Dollar Law Firm

- Eight Firms — All Texas, All the Time, All Profitable

- The Texas Magnificent Seven

- Texas Firms Reap Financial Benefits of a ‘Perfect Storm’

Upcoming Texas Lawbook 50 Articles

- The Texas Elites — These are firms that have reached extraordinary financial success when judged by revenue per lawyer and profits per partner.

- The Texas Lawbook 50 Revenue Breakdown — A multi-year examination of Texas law firm revenues divided by three categories: Texas legal firms, the Texas operations of national law firms, and the half-dozen Texas firms that merged with national law firms.

State of the Texas legal market webcast (June 11, 10 a.m. Central)

You are invited to join The Texas Lawbook and Michael J. McKenney from Citi Private Bank’s Law Firm Group for a conversation examining the state of the Texas legal market. Topics include:

- Q1 revenue performance in Texas compared to other markets

- H2 outlook

- Billing rate growth

- M&A and litigation activity

- Review of key takeaways from Texas Lawbook 50 reporting

Registration is complimentary for Texas Lawbook Premium Subscribers; $50 for Basic Subscribers; $100 for Non-subscribers. Email brooks.igo@texaslawbook.net to sign up.