© 2016 The Texas Lawbook.

By Bryce Erickson of Mercer Capital

(Sept. 15) – In recent years, the value of privately held professional sports franchises has become particularly newsworthy. Analysts, investors and fans have an interest in watching team owners buy and sell teams and in learning the going prices for their teams.

But are team owners doing as well as some may portray? How do their investments compare to those of their peers investing in the stock markets?

We attempt to answer these questions based on some known data sources and return analytics over time. The answers are interesting but not entirely clear.

There are two components to an investor’s rate of return: first, interim returns in the form of cash flows or dividends, and, second, price appreciation.

Many commentators and writers have noted that some major league sports franchises have incurred operating losses in past years. For example, at one point it appeared that the MLB franchises on average had operating losses as players’ salaries increased faster than revenues. This was a big factor underlying NFL and NHL lockouts in 2011 and 2012.

There appears to be a silver lining, however: the price appreciation realized from the increased values of these major league franchises.

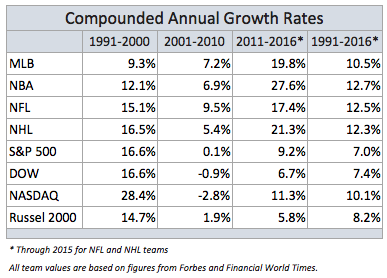

We traced over time the estimated appreciation (by league) of the values of sports teams, according to Forbes magazine. We also tracked the returns over the same time frames of several familiar equity market indices. The table below summarizes our findings.

We tracked this data going all the way back to 1991. We then sorted the returns over different decades – the 1990s, the 2000s, and our current decade. Finally, we aggregated it for the 25 total years of data.

We observe that equity markets outperformed league appreciation in the 1990s, but then the leagues caught up in the 2000s and 2010s. The biggest reason for the significant increase in the 2000s and the 2010s is television contracts – specifically, increases in national TV contracts for the NFL and NBA, and regional and local contracts for MLB and NHL (and to a lesser degree the NBA).

Consider these examples:

• The NFL saw its national TV contract increase dramatically in the last several renewals – its most recent being the most signifi¬cant. The 2014 season was the first year of the NFL’s nine-year deal with Fox, CBS and NBC. The networks will pay about $3.1 billion in rights fees every season – 63 percent more than the previous deal.

• The NBA, which signed a nine-year deal with ESPN, Turner Broadcasting and other networks, had total fees worth $2.4 billion in 2014. This skyrocketed to $3.6 billion a year, up from about $930 million in the contracts reached in 2007. In addition, NBA teams have benefited from increased local TV rights that have usually doubled or even tripled in annual rights fees in the last five years.

• For MLB and NHL teams, the majority of TV revenue comes from local TV contracts. These contracts have appreciated substantially in the last five years, being three to five times higher than contracts signed five to seven years ago.

This increased TV revenue has been the primary driver of the very strong price appreciation in the 2000s and particularly since 2011.

Since 2011, MLB team values have increased on average 19.8 percent compounded, according to Forbes. The Forbes value estimates for NBA teams increased 27.6 percent for the same period. The NFL increased 17.4 percent, and the NHL 21.3 percent.

This short five-year period has seen the highest percentage increase in the last 25 years. The compounded increases are 10 percent to 13 percent for the four major sports leagues over the past 25 years. In comparison, the DOW increased 7.4 percent compounded, the NASDQ 10.1 percent, the S&P 500 7 percent and the Russell 2000 8.2 percent.

Solely from an appreciation point of view, an investment in a major league sports franchise appears to have been a very good return in the last 25 years, especially in the last five years. Of course, these returns vary by team and nothing is guaranteed.

It is also notable that some teams have incurred operating losses that will offset a significant amount of the total return. This can impact investments in the form of debt or even capital calls from investors.

This gets even more complicated when considering the value of minority interests in teams whose ability to monetize their returns is more uncertain. In fact, minority interests typically trade (however infrequently) at lower value levels than what the pro-rata value of a franchise would otherwise be worth.

Therefore, appreciation returns that appear positive can come with drawbacks as well. Critical analysis is important to investors to help them determine if their returns are worth the risks.

Bryce Erickson, ASA, MRICS is a Senior Vice President with Mercer Capital, a national business valuation and financial advisory services firm. Bryce has been involved with hundreds of valuation and related engagements since his entry into the valuation profession in 1998 and has extensive experience valuing professional sports franchises.

© 2016 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.