Corporate law firms in Texas had another blockbuster year in 2024.

Record revenues. Record profits.

The top business law firms operating in Texas in 2024 worked more hours for more corporate clients and charged those clients record-high rates — some now topping $2,600 an hour for premium services.

The demand for high-dollar elite legal expertise and services in Texas came from companies and private equity firms involved in dealmaking for infrastructure and energy transition projects and businesses engaged in bet-the-company disputes, often battling other businesses or government agencies in court.

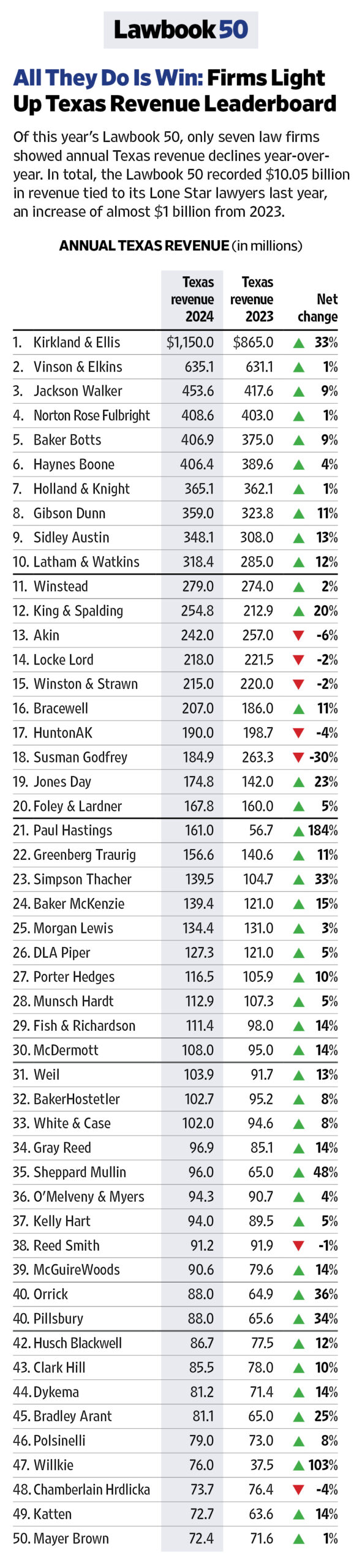

The Texas Lawbook 50, which tracks the revenue generated by lawyers and law firms operating in Texas, found that 34 of the 50 largest corporate firms achieved record-high revenues in 2024, and an even higher percentage achieved record profits.

“2024 was a really good year — hours were up, rates were up, demand was up, growth was up,” said Jackson Walker managing partner Wade Cooper, whose firm achieved record revenues and profits in 2024.

The Lawbook 50 numbers for 2024 are staggering. Of the top 50 firms:

- Forty-three reported revenue increases last year over 2023;

- Twenty-six grew gross income by double digits;

- Eight had a 25 percent jump or more in revenue;

- A dozen law firms grew their Texas revenues by $30 million or more — double the number that did so in 2023;

- Two-thirds of the top 50 firms showed profits per partner of $1.5 million or more;

- One-third recorded profits per partner of $3 million or more, and nearly 20 percent reported profits per partner of $5 million or more;

- Two corporate law firms — Paul Hastings and Willkie Farr — joined the Lawbook 50 for the first time by more than doubling their Texas revenues in 2024; and

- The Lawbook 50 recorded its first law firm to achieve more than $1 billion in revenue in Texas.

The Texas Lawbook surveyed more than 70 law firms operating in Texas regarding their headcount, total revenues, revenues per lawyer and profits per equity partner. Most firms provided the requested data. Other law firms provided simple lawyer headcount and RPL, which were used to calculate Texas revenues. The Lawbook also used other sources, including interviews with key partners, former partners, legal industry analysts, data from publications such as American Lawyer and other third-party sources that collect and analyze firm revenues.

“We had an outstandingly successful year by any measure,” said Baker Botts managing partner Danny David, whose firm scored a nine percent increase in Texas revenues in 2024. “We’re not just busy — we are busier than ever. Success begets success.”

The Lawbook 50 totaled $10.05 billion in Texas revenues in 2024 — up 10 percent from 2023.

By comparison, the Lawbook 50 grew revenue 8.6 percent in 2023 versus 2022. But this year’s increase is still far shy of the 17.3 percent bounce the top 50 reported in 2021, as the economy came out of the Covid-19 pandemic.

“There’s been a perfect storm for law firms in Texas,” said Kent Zimmermann, a law firm consultant with the Zeughauser Group. “An extraordinary amount of money has flown into Texas, and law firms follow the money.”

“There has been an unprecedented increase in profitability across law firms,” Zimmermann said. “As the war chests of law firms grow, they have used the money to invest and expand their operations in Texas.”

Fifteen years ago, fewer than a dozen law firms in Texas had profits per partner of $1 million or more.

In 2024, 90 percent of the Lawbook 50 reported PPP of at least $1 million.

The Texas offices of eight corporate law firms — Gibson, Dunn & Crutcher, King & Spalding, Kirkland & Ellis, Latham & Watkins, Paul Hastings, Sidley Austin, Simpson Thacher and Weil, Gotshal & Manges — each achieved profits per partner of $5 million or more, according to Lawbook 50 data.

All eight are firms either headquartered or founded in Chicago, Los Angeles, New York and Atlanta. None is based in Texas.

Two Texas-based law firms — Susman Godfrey and Vinson & Elkins — scored profits per partner exceeding $4 million.

Legal industry analysts point out that profits per partner, which are based on equity partners, can be easily manipulated by law firms shifting some partners to a non-equity income designation and thus not eligible for profit sharing.

The Big Dogs Hunt

Kirkland and V&E remained the top two firms for revenue in Texas for the sixth consecutive year — though Kirkland widened its lead significantly.

The Texas lawyers of Kirkland, which is the world’s richest law firm, made an astonishing $1.15 billion in revenue in 2024 — up $285 million, or 33 percent over the prior year.

Kirkland’s 2024 revenue in Texas was more than No. 2 V&E ($635.1 million) and No. 3 Jackson Walker ($453.6 million) combined.

“We hit record highs in revenue and profits,” said V&E chair Keith Fullenweider. “Litigation was the busiest part of the firm, especially tax litigation. Our energy regulatory practice has been very active. It was the third straight year of choppy M&A activity.”

“Overall, we have a lot of excitement about the strong economy in Texas,” Fullenweider said.

Jackson Walker reclaimed the third spot by growing Texas revenue by nine percent. Susman Godfrey, which jumped to No. 3 last year due to the collections of two huge contingency fee agreements, dropped to 18th on the Lawbook 50 revenue ranking.

Norton Rose Fulbright, Baker Botts, Haynes Boone, Holland & Knight, Gibson Dunn, Sidley and Latham round out the top 10. Combined, the Texas lawyers at the top 10 firms collected $4.44 billion in revenue in 2024.

“We had another year of great targeted growth,” said Krista Hanvey, co-managing partner of the Dallas office of Gibson Dunn, which grew revenues by 11 percent and is now the eighth largest law firm in Texas.

Yvette Ostolaza, a Dallas partner and global chair of Sidley Austin’s management committee, said that elite corporate firms like Sidley will continue to grow in Texas.

“We continue to invest in practices including life sciences, healthcare, private equity and technology,” Ostolaza said. “Litigation and international arbitration practice remains strong, especially an uptick in privacy and product liability matters. And Texas lawyers were involved in 36 deals, including cross-border transactions, with deal values of $1 billion or more.”

Sidley saw its Texas revenue jump 13 percent in 2024 to more than $348 million, which was a record high, and its profits per partner exceeded $5 million for the first time.

Fourteen of the Lawbook 50 are Texas legacy law firms, meaning they were founded in Texas and are still headquartered in Texas.

Nineteen of the top 50 firms did not even have an office in Texas 15 years ago. In 2010, Texas legacy firms generated 92 percent of the revenue in the Lawbook 50, but only 38 percent in 2024.

The 36 national firms in the Lawbook 50 generated $6.29 billion from their Texas operations, while the 14 Texas-based firms reported $3.76 billion in Texas revenue.

Texas’ Magnificent Seven

While 43 of the Lawbook 50 increased their Texas revenue in 2024, seven firms, including Kirkland, grew at an extraordinary pace.

The most spectacular growth in 2024 happened at Paul Hastings, which saw its Texas revenue jump from $56.7 million in 2023 to $161 million last year — a 184 percent increase. The firm started 2024 with 33 attorneys in Texas but has added more than 50 lawyers in Dallas and Houston.

Willkie Farr burst onto the Lawbook 50 for the first time in 2024, generating $76 million in Texas revenues — up 103 percent from 2023.

Sheppard Mullin jumped from 45th in the Lawbook 50 in 2023 to 35th in 2024, thanks to a 48 percent jump in Texas revenue. The firm’s Texas offices generated $96 million in 2024 — up from $65 million a year earlier — by adding more than 25 attorneys in the state.

Orrick and Pillsbury increased their Texas revenue in 2024 by 36 percent and 34 percent, respectively.

And New York-based Simpson Thacher’s revenue in Texas hit $139.5 million last year — a 33 percent year-over-year increase.

“2024 was a great year — demand for our legal services was very high,” said Breen Haire, co-managing partner of Simpson Thacher’s Houston office. “My move to Texas 21 years ago was one of the best decisions I have ever made. Texas has one of the most robust corporate practices in the country.”

Three law firms — Ahmad, Zavitsanos & Mensing, Spencer Fane and Perkins Coie — barely missed making the Lawbook 50, despite achieving extraordinary growth in 2024.

AZA, which ranked 51st, reported $72 million in revenue last year — up 31 percent from 2023. Spencer Fane increased its Texas revenue 16 percent in 2024 to $71 million. And the Texas lawyers for Perkins Coie generated $68.7 million last year — an eight percent jump.

Texas Lawbook 50 Articles Already Published

- Texas Firm Headcount Inched Up 1%

- Susman Godfrey Scores ‘Second Best Year Ever’

- Kirkland is Texas’ First Billion-Dollar Law Firm

- Eight Firms — All Texas, All the Time, All Profitable

- The Texas Magnificent Seven

Upcoming Texas Lawbook 50 Articles

- Firms from Five Cities (Chicago, Dallas, Houston, Los Angeles and New York) Battle for Texas Lawbook 50 Revenue Supremacy

- Three Texas Legacy Firms Grow East, West and Overseas

- Annual Revenues of the Texas Legacy Firms — In and Outside of Texas