© 2017 The Texas Lawbook.

By Natalie Posgate

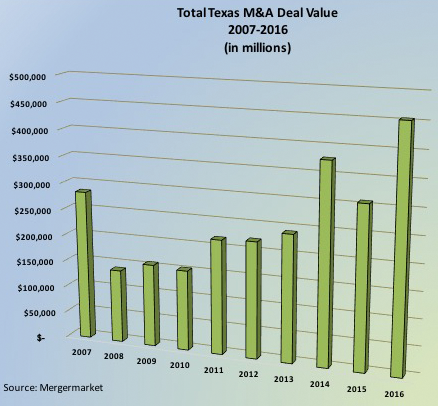

(Feb. 27) – The battle to represent Texas corporations in their largest mergers, acquisitions and divestitures is being won by a half-dozen law firms with offices in Texas and more than a dozen that have no presence in the state at all.

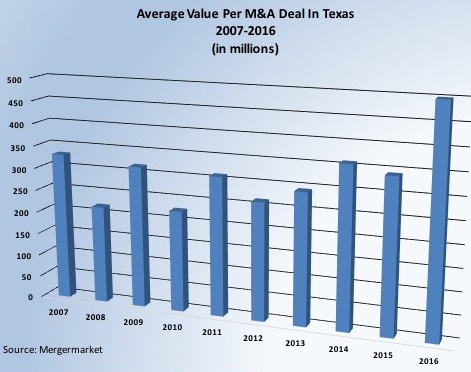

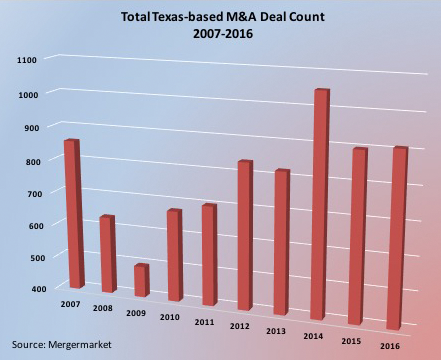

New data from independent research firm Mergermarket shows Texas-based businesses are turning to national law firms headquartered outside of the state to handle the crème de la crème of mega-mergers, acquisitions and divestitures in 2016.

Texas corporate executives are increasingly limited in their use of Texas firms for mid-market and upper-mid-market transactions or megadeals in the small billions, according to the M&A statistics.

There is one exception, according to Mergermarket: Vinson & Elkins, which increased the number of deals it did for Texas companies by 31 percent in 2016 and more than doubled the total value of the transactions it handled.

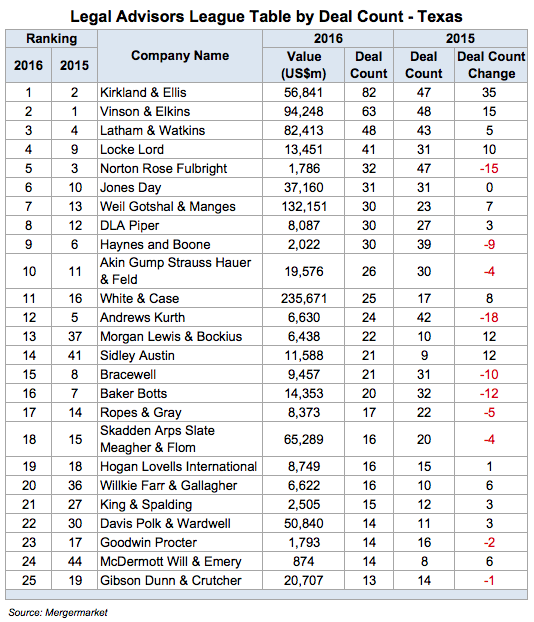

No law firm had more success in corporate transactions in 2016 than Chicago-based Kirkland & Ellis, which only opened its Houston office in April 2014. Kirkland advised Texas companies on 82 separate deals in 2016 – up from 47 in 2015, which is a 74 percent increase. Kirkland has benefited greatly from the firm’s dominance in bankruptcy Chapter 11 restructurings in the oil patch, which resulted in dozens of subsequent M&A deals for Kirkland corporate partners.

“The numbers show that three law firms are now fighting to advise in the biggest and the best M&A in Texas – Kirkland, V&E and Latham & Watkins,” says Chad Watt, an M&A analyst with Mergermarket. “These three firms are taking more and more of the largest transactions.

Watt points out that Jones Day, which is advising NextEra in its $18 billion purchase of Oncor, and Weil, Gotshal & Manges, which represented Progressive Waste Solutions in its $8 billion acquisition of Waste Connections, are national firms with offices in Dallas, Houston and Austin that also do a significant number of deals for Texas clients.

Besides deal value, the new data makes it clear that non-Texas-based law firms are poaching on the pure number of deals involving Texas corporations. For example:

- Eighteen of the 25 law firms that did the most M&A for Texas businesses are based outside of the state;

- Of the seven Texas firms in the rankings, five did fewer transactions in 2016 than they did in 2015, which was a horribly slow year for M&A;

- Thirteen of the 18 out-of-state law firms did more mergers, acquisitions and divestitures in 2016 than they did in 2015;

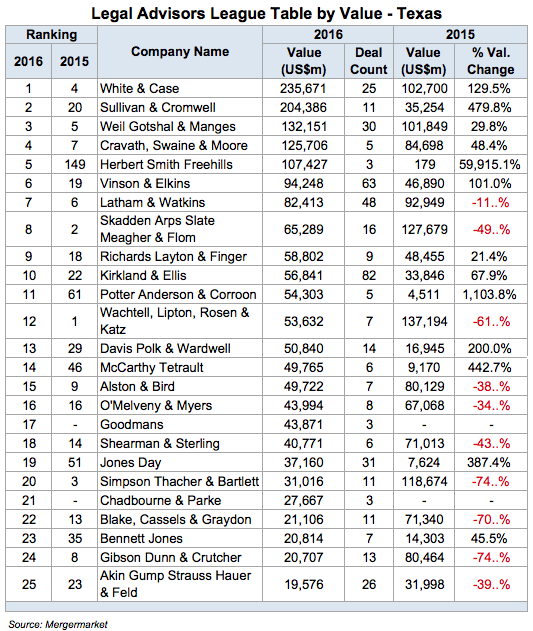

Mergermarket’s ranking by deal value demonstrates the trend even more dramatically. The Texas data shows:

- Twenty-four of the 25 highest-ranking law firms by M&A deal value are based outside of the state;

- Fourteen of the 25 law firms, such as White & Case, Sullivan & Cromwell and Cravath, Swaine & Moore, do not even have an office in Texas;

- Only one Texas-based firm even made the top 25 list for deal value – V&E, which ranks sixth;

- The top five law firms ranked by deal value – White & Case, Sullivan & Cromwell, Cravath, Weil and Herbert Smith – are all involved in AT&T’s $105 billion acquisition of Time Warner.

The primary reason for the shift, according to Watt and other legal experts, is that the national firms have hired scores and scores of the top M&A dealmakers away from Texas-based law firms during the past six years. Many of these M&A partners with significant books of business often see their annual compensation double or even triple when they lateral to the national law firms.

The most recent example occurred three weeks ago when Gibson Dunn announced it is launching a Houston office by hiring away eight lawyers from Latham and Baker Botts. A week later, Baker Botts announced that it snagged nine highly regarded partners from Norton Rose Fulbright. It was unheard of only a decade ago for one of the big three – Baker Botts, V&E or Fulbright, as it was known then – to poach partners from each other.

Beyond lateral hiring, Watt also says many of the Texas-based companies operate nationally and globally, which likely accounts for the large presence of New York law firms advising in the megadeals.

“There wasn’t a moment when a CEO club got together and said, ‘Let’s hire New York firms instead of Texas,” Watt says. “Unless the roots and relationship is with Texas-based firms, it’s probably how things have evolved with large businesses in Texas.

“Once you start dealing with transactions in the “B’s” is when you start hiring New York firms,” he adds.

To demonstrate this, Akin Gump, which was founded in Dallas but is now based in Washington, D.C., advised in 26 M&A deals in 2016. New York-based White & Case led 25 transactions.

But the combined deal value of White & Case’s M&A was $235.7 billion, which was 12 times the cumulative value of the transactions handled by Akin Gump, according to Mergermarket. White & Case is involved in the two largest deals of 2016 – representing Time Warner in its $105 billion sale to AT&T and advising Sunoco Logistics in its $51.4 billion merger with Energy Transfer Partners.

The battle for middle market to smaller megadeals involving Texas companies is equally as stiff.

Locke Lord had a second straight year of strong M&A growth. The Texas firm advised on 41 deals in 2016 – a 30 percent jump from the year before. Norton Rose Fulbright ranks fifth in deal count with 32, but that is down from 47 in 2015. Baker Botts and Bracewell also saw a 30 percent decline in M&A deal count in 2016.

But Norton Rose Fulbright may gain ground in future league tables. The global firm announced last week that it is officially swallowing New York-based Chadbourne & Parke. Chadbourne lawyers actually worked on two of the 20 largest deals for Texas-based companies in 2016 – advising NextEra on its $18.4 billion acquisition of Oncor and the subsequent $6.8 billion formation of Vista Energy, which is the umbrella company for TXU Energy and Luminant.

Chadbourne advised in only three transactions involving Texas businesses in 2016, but those three deals had a combined value of $27.7 billion – compared with Norton Rose Fulbright’s 32 deals valued at $1.8 billion.

Investment Banker Rankings

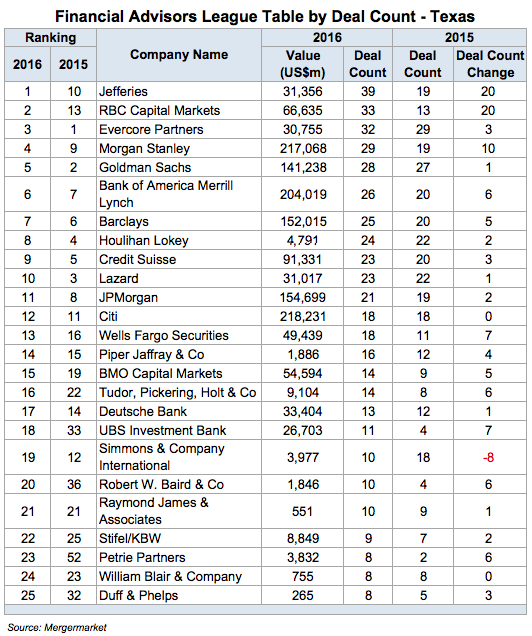

Those in the investment banking and financial advisory world definitely cheered the return of energy M&A in the second half of 2016.

In fact, 24 of the 25 financial advisers increased their M&A deal count for Texas-based companies last year. The one firm that witnessed a decline, Simmons & Co., was purchased by another firm, Piper Jaffray, in the middle of the year. Combined, the two firms also experienced an increase

No two financial advisers rode the wave of energy M&A more than Jeffries and RBC Capital Markets.

Jefferies ranked number one in Mergermarket M&A deal count in 2016 by advising in 39 transactions, which is double the number it handled a year earlier. RBC nearly tripled the number of deals it worked – from 13 in 2015 to 33 last year.

Morgan Stanley saw its deal count jump 50 percent in 2016 – from 19 transactions to 29. The size of those deals were enormous, as the combined value of Morgan Stanley’s transactions reached $217 billion – up 118 percent from a year earlier. Morgan Stanley acted as the financial advisers in three of the four largest deals of 2016.

Citi, which was Sunoco Logistics’ sole financial adviser in its $51.4 billion merger with ETP, barely edged out Morgan Stanley for highest cumulative deal value at $218.2 billion.

Mergermarket bases its data on mergers, acquisitions, joint ventures or divestitures that involved a Texas-based company on the buyer’s, seller’s or target’s side.

Editor’s Note: The Texas Lawbook plays no role in the collection of Mergermarket’s data. Mergermarket simply pulls its Texas-specific data for the Lawbook on a quarterly basis.

© 2017 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.