Most journalists – even the best of them – are simply reporters who effectively get information from their sources and communicate the information through analysis and storytelling.

There are a handful of journalists, however, who are truly subject matter experts in the issues they cover. New Texas Lawbook correspondent Claire Poole is one of those, as she has been reporting and writing about oil and gas M&A in Houston for 16 years.

Another is Chad Watt, a long-time journalist who has worked for the independent research firm Mergermarket for nearly a decade. Chad knows more about M&A in Texas than anyone other than Claire.

The great news is that Chad is also a close friend of The Texas Lawbook, and he has been since we started this publication nearly six years ago.

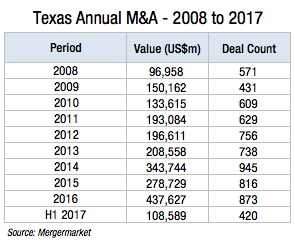

Every quarter, Chad and the amazing team at Mergermarket, which is a subsidiary of Acuris, provide The Texas Lawbook with exclusive data involving Texas businesses involved in mergers, acquisitions, joint ventures and divestitures.

The Texas M&A data from Mergermarket includes:

-

- Total deal count and deal value for all reported transactions during the current year;

-

- M&A deal count and deal value broken down by quarter for the past decade;

-

- The 30 largest deals by deal value;

-

- The 30 legal advisers who handled (1) the most deals and (2) the largest deals; and

-

- The 30 financial advisers who handled (1) the most deals and (2) the largest deals.

In return, The Texas Lawbook provides Chad and Mergermarket with our exclusive Corporate Deal Tracker data, which documents all M&A activity and securities offerings handled by lawyers based in Texas. By sharing and combining our data and knowledge, we are able to provide Texas Lawbook readers with the most in-depth analysis and intelligence available in the marketplace.

This weekend, Chad and I discussed the Mergermarket deal data for H1 2017, which shows that M&A activity was flat but healthy during the first six months of the year.

“Last fall, it seemed like there was a billion-dollar transaction being announced just about every Monday morning,” he says. “After blowing the doors off in the second half of 2016, H1 2017 was not going to be able to compete.

“The 420 deals announced so far is still a pretty strong number – and truthfully, it was probably as well as we should have expected,” Chad says.

Texas-based businesses were involved in 200 or more deals in 13 of the last 15 quarters, dating back to October 2013, he points out. The two quarters that failed to reach 200 transactions were Q3 2015 with 196 deals and Q1 2016 with 194 deals.

By contrast, only one of the 24 quarters between 2008 and Q3 2013 surpassed 200 transactions involving Texas companies. That was Q4 2012, which recorded 235 deals.

“The Texas market has essentially seen 15 consecutive quarters with about 200 or more deals,” Chad says. “Before the third quarter of 2013, 200 deals was the high water mark. Since then, 200 deals has been the floor.

“During this time period, we also have seen the development and growth of a private equity ecosystem in Texas,” he says. “TPG Group used to be the only game in town. Now, the Crescent in uptown Dallas is filled with PE firms that have raised a lot of money and are investing a lot of money.”

While admitting that oil and gas continue to be the largest driving force in Texas M&A, Chad says several other business sectors have also come of age.

He points no further than the largest and easily the most talked about M&A deal involving a Texas company during the first half of 2017: Amazon’s acquisition of Austin-based Whole Foods for $13.5 billion.

Seventeen of the 30 largest deals involving Texas companies were energy-related. Only a few years ago, it was 25 of the 30.

“Texas has developed a robust and mature M&A practice for lawyers and investment bankers during the past few years,” Chad says. “It is going to be interesting to see if we can keep up this level and pace of dealmaking during the second half of 2017.

“We’ve had so many deals completed that the market may need a period to digest it all,” he says. “There’s a real danger of developing M&A congestion or heartburn.”

Click here to read The Texas Lawbook article by Claire Poole with all the details, updated data and analysis for H1 2017 M&A involving Texas businesses.