© 2016 The Texas Lawbook.

By Natalie Posgate

(July 26) – M&A lawyers in Texas who thought the first quarter was bad should brace for even worse news.

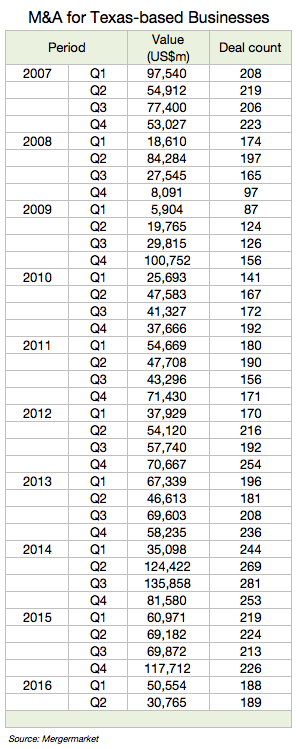

Deal count was pathetically low during the second quarter of 2016 and the value of the transactions that were announced plummeted to lows the market has not seen since 2009 and the Great Recession. In addition, an increasing number of large deals being considered fell apart before closing.

The average value of mergers, acquisitions, divestitures and joint ventures involving Texas-based businesses, according to the independent research firm Mergermarket, dropped from $462 million in the second quarter of 2014 to $309 million last year to $163 million this past April, May and June.

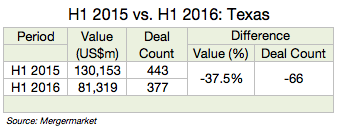

Mergermarket reports that Texas companies were involved in 189 deals during the second quarter with a combined value of $30.77 billion – 56 percent less than last year and a 75 percent decline from Q2 2014.

“It is true the size is smaller,” said Mike O’Leary, a corporate partner in Andrews Kurth’s Houston office. “You have the commodity prices so much lower now, so deals getting done don’t have as many zeros after them as they did in 2014 and before. There is deal flow – just not much of it.”

Texas companies announced 377 M&A transactions during the first six months of 2016 – 15 percent fewer than the first half of 2015 and 27 percent less than in 2014, according to Mergermarket.

Legal experts say the lingering downturn in the energy sector, which accounts for 20 percent of Texas M&A activity, is causing privately-held oil and gas companies to decline to make the deal amount public.

“Of the 377 deals reported, 160 have no values disclosed, which usually means a private company is involved,” said Chad Watt, an analyst with Mergermarket. “Public deals are way down.”

One factor, according to Watt and others, is that deal flow in business sectors such as technology and healthcare, which historically do not disclose the value of their transactions, was strong.

“Private company deals worth $500 million and below still comprise of more than 90 percent of all M&A volume,” said Wilson Chu, a partner at McDermott Will & Emery in Dallas.

And if there’s anything unique about this cycle, it’s that an alarming amount of deals are not closing, legal experts say.

Rick Dahlson, a partner in Jackson Walker’s Dallas office who heads the firm’s corporate and securities practice group, said the firm has stayed busy with numerous deals, but the number of “dead deals,” or transactions that fail to close, he has witnessed in the first half of the year is unlike anything he has seen before.

“We had three deals worth close to half a billion dollars in the last six months, and all deals have failed,” Dahlson said.

Jason Schumacher of Locke Lord said his firm has noticed the same phenomenon.

“The reality between whether we’re talking about 2016 or 2015 is we have worked on far more deals than have actually closed,” said Schumacher, an energy M&A partner in Locke Lord’s Dallas office. “More so than any other time in my career – even compared to 2009 and 2010 during that downturn. This downturn has been different. We’ve been busy, but in other ways.”

Among the “other ways” of being busy, Schumacher and others say, is legal work that does not appear in Mergermarket’s data. It involves helping clients address their balance sheets and other tasks.

“Everyone has been extremely busy with restructurings and internal organizations in this market,” said Michael Considine, a partner in Jones Day’s Dallas office. “Reworking and restructuring with lenders internally is taking a lot of corporate focus, but that’s not showing up on any deals [and league tables].”

“I’d anticipate a fairly healthy amount of upstream M&A activity with the pricing having firmed up a little bit,” said John B. Connally, a Houston-based partner at Vinson & Elkins who is co-head of the firm’s energy transactions and projects practice group.

Lawyers working on deals outside the energy sector say their practices have remained robust this year.

“I think the markets are prime for a lot of industries,” Considine said. “Oil and gas is going through its own natural downturn now, but other industries like manufacturing, retail, technology and healthcare are still very strong. We’re still seeing a lot of work in those areas.”

Chu, who specializes in the converging fields of health-tech and financial-tech, said the incentives and opportunity as well as the uncertainty tied to Obamacare has created tremendous deal opportunities in the healthcare space.

“When there’s uncertainty and chaos, it creates other opportunity,” Chu said.

© 2016 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.