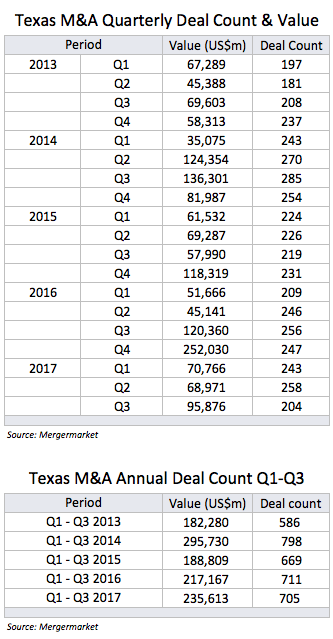

The number of Texas businesses involved in mergers and acquisitions declined during the third quarter of 2017 to the lowest point in more than four years.

Texas-based companies were either buyers or sellers in 204 corporate transactions between July 1 and Sept. 30 – a 21 percent drop from both the second quarter of 2017 and the third quarter of 2016, according to the research firm Mergermarket.

The deal count is lowest since the second quarter of 2013, which recorded 181 transactions involving Texas corporations.

But Mergermarket reports that the cumulative value of the Texas deals jumped 39 percent – from $69 billion in Q2 2017 to $96 billion in Q3. Even so, the Q3 deal value is 20 percent less than the $120 billion in transactions in the third quarter of 2016.

The third quarter recorded the two largest deals of 2017 and six of the top 10, including Sempra Energy’s $18.8 billion acquisition of Oncor from Energy Future Holdings.