Wilson Cribbs and Goren’s Tony Marré and Derek Pershing recently reached the $1 billion mark for real estate deals handled over the last year-and-a-half, trading around everything from luxury apartments to retail centers to storage facilities. Marré talks about what’s fueling all the work – and what may be to come.

CDT Roundup: 13 Deals, 12 Firms, 108 Lawyers, $5.76B

There is some anxiety ahead of this week’s expected approval by Anadarko Petroleum shareholders of the company’s $38 billion sale to Occidental Petroleum. Though approval won’t likely thwart Carl Icahn’s proxy fight, it will allow Oxy to size-up assets whose sale might help pay down the transaction’s sizable debt. In her weekly Roundup, Claire Poole discusses the ramifications along with a week’s worth of Texas M&A deals.

Texas Lawyers Behind Three Billion-Dollar-Plus Deals

Attorneys at the Texas offices of Jones Day, Orrick, Shearman and Gibson Dunn help paper up big transactions for Britain’s BBA Aviation, France’s Veolia and a JV between Colombia’s Ecopetrol and Oxy.

Kirkland Leads Texas M&A H1 Rankings…By Far

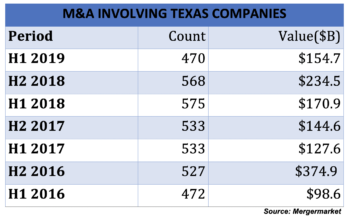

M&A activity involving Texas companies may have declined during the first six months of 2019, but the slump has not impacted the corporate transactional machine that is Kirkland & Ellis. The Texas Lawbook has exclusive Mergermarket data ranking the top 30 law firms representing Texas businesses in dealmaking.

Darwin Bruce Sees Gold in Small-to-Middle Market M&A

Darwin Bruce, former long-time GC for T.D. Jakes, is pioneering a new initiative designed to significantly improve M&A and CapM opportunities for small and middle market business community in Texas. The lower middle market is woefully underserved, even though those are the businesses driving the economy, but Bruce says he plans to fix that.

HuntonAK, V&E advise on Osaka’s $610M Sabine Oil purchase

Osaka’s purchase of Houston-based Sabine will give it the target’s entire natural gas position in East Texas and make it the first Japanese acquirer of a U.S. shale gas developer. Claire Poole has the details.

DBJ: Merger Agreement Terminated between CEC Entertainment, Leo Holdings

CEC Entertainment, owner of Chuck E. Cheese and Peter Piper Pizza and part of Queso Holdings Inc., announced that its merger agreement with Leo Holdings Corp. (NYSE: LHC) has been

Mergermarket: Texas M&A Plummeted in H1 2019

If you’ve been paying attention to M&A numbers in recent weeks, you already know this: compared to last year, the first half of 2019 has been lackluster. Deal count is down. Deal values are down. “Exceedingly cautious,” is the way one lawyer describes the market. Claire Poole bears the bad news from our exclusive Mergermarket data.

CDT Roundup: 10 Deals, 7 Firms, 46 Lawyers, $775.5M

Deal activity involving Texas lawyers continued to be weak this past week – and way weaker than this time last year, which doesn’t portend a great second half of the year. Claire Poole has the numbers.

Callon-Carrizo: It’s All About Relationships

Baker Botts had done work for Carrizo Oil & Gas for 22 years. Kirkland had been developing a relationship with Callon Petroleum management for the last several years. In the end, the two law firms helped put together a combination of the two companies that one analyst says will join an elite group that can achieve double-digit production growth while generating meaningful free cash flow.

- « Go to Previous Page

- Go to page 1

- Interim pages omitted …

- Go to page 38

- Go to page 39

- Go to page 40

- Go to page 41

- Go to page 42

- Interim pages omitted …

- Go to page 47

- Go to Next Page »