Almost 4,000 PE funds are now competing in a congested market for money-raising and PE-backed buyouts are down in number and value for the second quarter, according to Preqin. In her weekly roundup, Claire Poole has the major deals last week involving Texas lawyers and stats that describe an increasingly circumspect market for M&A.

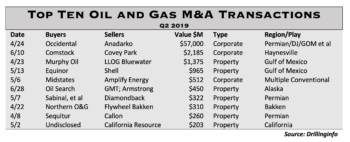

Drillinginfo: O&G M&A Rebounded in Q2

M&A in the oil and gas sector reached $65 billion in the second quarter. Even though $57 billion of that was the Occidental purchase of Anadarko, the remaining $7.6 billion was four times the $2 billion logged in the first quarter. The bad news: it’s still far lower than the $19 billion quarterly averages just a few years ago. Claire Poole clarifies.

CDT Roundup: 23 Deals, 15 Firms, 154 Lawyers, $8.29B

It’s S-L-O-W out there in the global M&A market. Deal value reached $842 billion in the second quarter. But that’s down 27% from last year. Deal count is the lowest since 2008. Dealmakers have the jitters. And yet…The first half was the third strongest on record. And U.S. dealmaking hit its first $1 trillion half. Claire Poole deciphers these seeming contradictions in her weekly Roundup, and balances out the week that was.

CDT Roundup: 17 Deals, 10 Firms, 139 Lawyers, $11.7B

IPOs are hot, especially among venture capital-backed firms. How hot? In the first two months of Q2 there have been 21 offerings that generated more value than 10 of the last 11 years. And with some big names reportedly in the wings, things could get hotter. Claire Poole takes the market’s pulse in Texas, along with her weekly report on the week in deal-making in the Lone Star State.

Bracewell Aids Prosperity on $2.1B LegacyTexas Purchase

Houston-based Prosperity Bancshares is acquiring Dallas-based LegacyTexas Financial Group, a $2.1 billion deal that will help expand Prosperity’s presence in the North Texas market. Bracewell assisted in the transaction and Claire Poole has the specifics.

Kirkland, STB Advise on C&J Energy’s $1.8B Merger with Keane

The Keane Group and C&J Energy announced a merger this week, creating a new pressure pumping giant worth an estimated $1.8 billion in enterprise value. Two national law firms leaned heavily on their Texas-based lawyers to pull off the deal and Claire Poole has the names.

Three Texas Firms Counsel on Comstock’s $2.2B Purchase of Covey Park

The natural gas producer’s acquisition of Denham Capital-backed Covey Park makes it the leader in the Haynesville Shale. Plus, Dallas Cowboys owner Jerry Jones increases his investment in Comstock to $1.1 billion in the deal. Claire Poole has the details.

Attorney-Client Privilege Preservation During M&A Due Diligence

Due diligence often requires significant exchanges of confidential information. One of the vexing problems with those exchanges is how they can be accomplished without waiving work product protections, attorney-client privileges and similar protections and privileges. Byron Egan and Bryan McCrory look at the potential pitfalls and offer some practical suggestions.

El Paso Electric Goes Private in $4.3 Billion Buyout

In a $4.3 billion deal with Infrastructure Investments Fund, publicly-traded utility El Paso Electric Co. announced Monday that it has agreed to be taken private. Claire Poole has deal specifics and the potential implications for the City of El Paso.

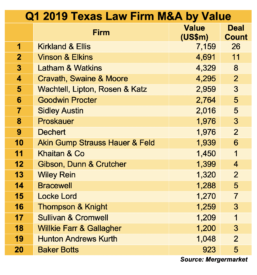

Kirkland, V&E, Latham Top Charts in Deal Values for Texas Companies

Kirkland & Ellis, Vinson & Elkins and Latham & Watkins topped the charts in M&A deal value for Texas businesses during the first quarter of 2019. They also topped the charts in deal count, new Mergermarket data shows.

- « Go to Previous Page

- Go to page 1

- Interim pages omitted …

- Go to page 39

- Go to page 40

- Go to page 41

- Go to page 42

- Go to page 43

- Interim pages omitted …

- Go to page 47

- Go to Next Page »