NASCAR Holdings will assume control of four new speedways, including the iconic ovals at Daytona and Talladega, after International Speedway Corp. accepted a $2 billion purchase offer. Claire Poole has the names of the Texas-based Baker Botts crew that helped push the deal to the finish line.

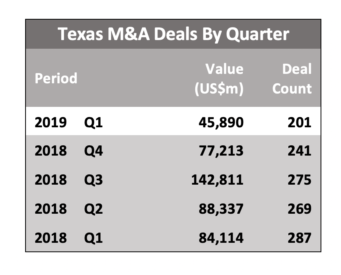

Data Shows Dramatic Drop in Q1 M&A

Deal counts in Texas dropped precipitously in the first quarter of 2019. Although the count was over the much-valued 200 mark, deal values were even worse. The Lawbook’s Claire Poole has the exclusive Mergermarket figures.

Josh Bammel of Kratos: Busy, Busy, Busy

Dallas investment banker Josh Bammel left Generational Equity in 2007 to form Kratos Capital. He hasn’t looked back. Specializing in transactions between $20 million and $75 million, Bammel just closed his 121st deal. He shares his perspectives on the business with Claire Poole.

Occidental Picks Savvy Cravath Lawyer for Anadarko Counter Offer (alas, no Texans)

Occidental Petroleum didn’t go with a Texas lawyer for its $38 billion counter-bid for Anadarko Petroleum Corp., whose board already agreed to a $33 billion purchase by Chevron. The company chose Faiza Saeed, presiding partner at Cravath, whose media and entertainment clients have included Time Warner, Disney and DreamWorks. Still, Saeed is no stranger to the energy industry, as Claire Poole reveals.

Q&A: Ryan Maierson’s Big Month and What It Says About the M&A Market

Latham & Watkins partner Ryan Maierson has been very, very busy, leading three billion-dollar deals in the last month. The Lawbook’s Claire Poole had a chance to talk to him about those deals and what they say about dealmaking right now.

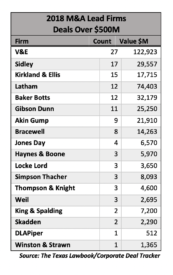

Inside the $3 Billion Legal Industry Battle for M&A Dealmaking in Texas

Law firms in Texas are engaged in a fierce battle to represent businesses, private equity funds and banks involved in mergers, acquisitions, divestitures and joint ventures – and an estimated $3 billion in legal fees are at stake.

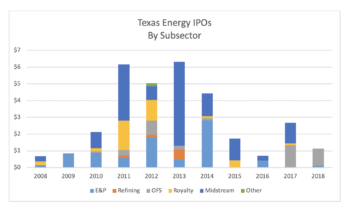

Texas IPO Activity in 2018 and 2019 Preview

Although the first half of 2018 saw a flurry of energy IPOs, the decrease in oil and gas prices created a difficult IPO environment for the remainder of the year, and no energy IPOs by Texas-headquartered companies were completed during that time. As it turned out, all 13 of the Texas IPOs registered during 2018 were emerging growth companies. But there were some high points and a few emerging trends, and E. Ramey Layne and his colleagues at V&E discuss them at length.

CERAWeek: M&A=Meh&A

With major M&A activity reduced to a few blockbuster simplification transactions and IPOs all but dead, the consensus of those on the floor at CERAWeek is that management is leery of deals when major investors have no interest. “We’re going through a major period of adjustment,” says Credit Suisse banker Osmar Abib. The Lawbook’s Claire Poole reports.

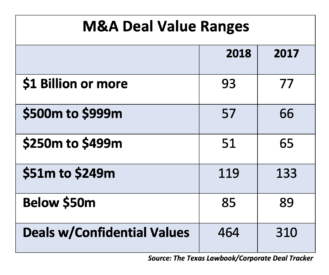

CDT 2018: More Work, More Money, More PE Influence

Lawyers in Texas reported work on 18 percent more transactions last year than in 2017 with $1 billion-plus deals dominating the activity. Claire Poole takes a deep dive into data collected exclusively by The Texas Lawbook’s Corporate Deal Tracker.

Top Texas M&A Deals of 2018

Here are the top 50 M&A transactions involving Texas-headquartered companies in 2018 as compiled exclusively for The Texas Lawbook by Mergermarket.

- « Go to Previous Page

- Go to page 1

- Interim pages omitted …

- Go to page 40

- Go to page 41

- Go to page 42

- Go to page 43

- Go to page 44

- Interim pages omitted …

- Go to page 47

- Go to Next Page »