Part Four of a Four Part Series

Note: The chart in this story has been updated to correct revenue figures for Locke Lord.

The rivalry between Dallas and Houston started generations ago, well before the two Texas megacities, separated by just 240 miles, joined the ranks of the nation’s economic powerhouses, with great and growing concentrations of corporate power and wealth.

Ah, yes, big business and money – the catnip that entices corporate lawyers.

Both Dallas and Houston have throngs of them. But which city has more? And where are they raking in the most money?

The kingpin of Texas corporate law – Dallas or Houston?

The Lawbook declares both winners for 2020 – in a pair of tight races. Dallas got the upper hand for the most corporate lawyers. Houston took the prize for total revenue.

Rivalries need stirring – so here goes. An average Houston lawyer was more productive – by around $90,000 a year. Take that Dallas. Houston might not have an edge in revenue without the lawyers on Dallas firms’ payrolls who office in H-Town. Take that Houston.

Geography and Corporate Law

In 2020, more than 7,200 lawyers worked at the firms in The Texas Lawbook 50, our annual rankings of the state’s top corporate law firms. Taken together, they generated more than $6.7 billion in revenues for their firms.

Extracting the Dallas and Houston shares required making some choices. Dozens of out-of-state firms employ large concentrations of lawyers in both Dallas and Houston. Include them?

Although these lawyers work in Texas, they might just as well be considered extensions of Chicago, Los Angeles, New York or someplace else. The Lawbook wrote about them as such in a July story. We recognized Kirkland & Ellis and Sidley being from Chicago, Gibson Dunn and Latham & Watkins as Los Angeles firms, the New York origins of Simpson Thacher and Weil Gotshal – and so on. Turning around and allocating these lawyers to Houston and Dallas would be too much.

What’s left are 18 Texas-based firms – but, taken together, they’re enough to provide a meaningful comparison between Dallas and Houston. First, these 18 firms are still a big force, collectively producing more than 40% of the Lawbook 50 revenues and employing nearly 50% of its lawyers. Second, the Texas-based firms have deep roots in the state that the Kirklands et al. struggle to match – that ought to count for something.

The Texas-based firms present their own geographic ambiguity. The big ones like Houston’s Vinson & Elkins and Dallas’ Haynes and Boone employ scores of lawyers in both cities, plus Austin and places across the country as well. We focused on the legal market rather than the firm – i.e., on where lawyers worked, Dallas or Houston?

Revenue per lawyer gave us a ballpark figure of the Texas-based lawyers’ contribution to each city’s corporate legal market in 2020.

Our accounting isn’t complete. Some firms were too small to make The Lawbook 50. More important in close contests, reliable financial data wasn’t available for some firms – notably, Houston’s Susman Godfrey and Yetter Coleman and Dallas’ McKool Smith and Carrington Coleman. Taken together, these Texas-based firms account for more than 350 Texas lawyers and hundreds of millions of dollars in legal billings.

Today, Dallas and Houston firms aren’t all that different – but each city once had its own personality in corporate law, offering a keener sense of place.

Buoyed by century-old giants such as Baker Botts, Fulbright & Jaworski and Vinson & Elkins, Houston corporate law operations had been viewed as institutional and staid. A firm would hire youngsters fresh out of law schools, and they spent their whole careers moving up the ranks.

Dallas firms were viewed as more entrepreneurial. They would grow faster and recruit more aggressively, going from a few dozen to a couple of hundred lawyers in a matter of three or four years. But some firms collapsed almost as quickly – Jenkens & Gilchrist and Johnson & Wortley, to name two.

The big Houston law firms had an unwritten policy for decades against recruiting from the ranks of their competitors. No such policy existed for the Dallas firms.

Headcounts – Hooray, Dallas

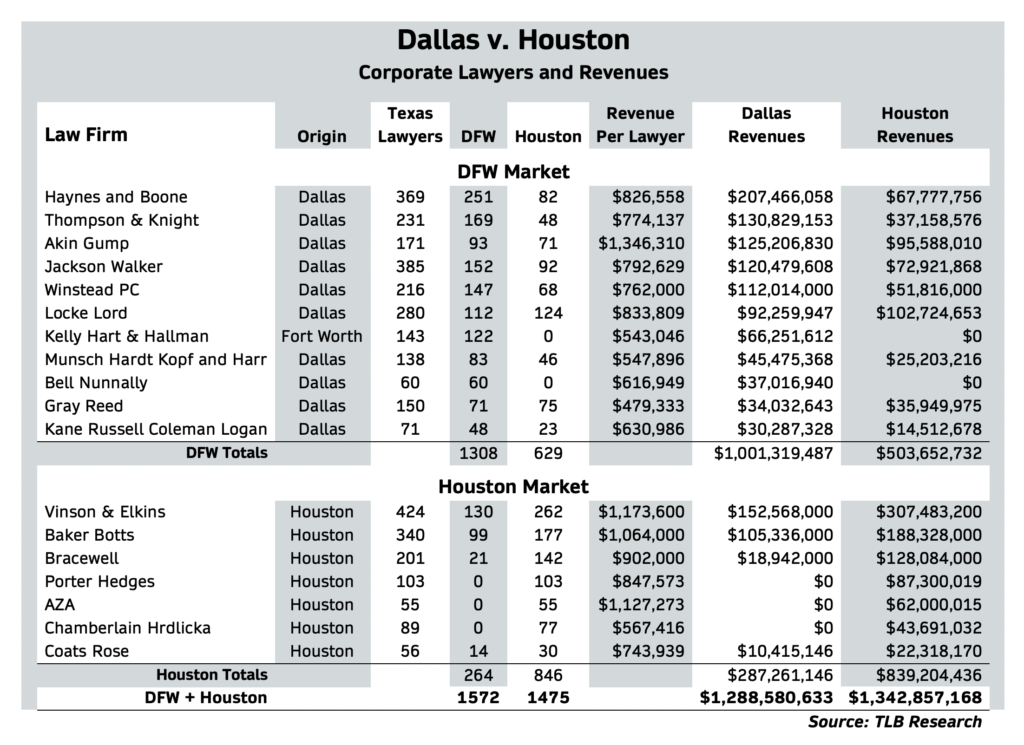

Among the 18 Texas-based firms in 2020, the Dallas-Fort Worth area had 1,572 corporate lawyers, nearly 100 more than the Houston area’s 1,475 (see chart above).

Seven firms had more than 100 DFW lawyers, led by Haynes and Boone at 251. Together, these firms employed 69% of Lawbook 50’s corporate law practitioners in DFW.

Five firms had more than 100 Houston lawyers, led by V&E at 262. They accounted for 55% of the Lawbook 50’s Houston corporate lawyers.

Dallas and Houston aren’t separate realms in corporate law. Nine of 11 Dallas firms had offices in Houston. Locke Lord and Gray Reed, both headquartered in Dallas, actually employed more lawyers in Houston than in Dallas. Haynes and Boone had Dallas’ largest contingent in Houston with 124 lawyers, followed by Jackson Walker at 92.

Overall, Dallas firms employed about 43% of Houston lawyers – a total of 629.

Dallas did more for Houston’s totals than Houston did for Dallas’ totals. Three of the seven Houston firms didn’t even see a need for Dallas offices. The four others had 264 lawyers, just 17% percent of the Dallas’ corporate lawyers. Leaders in the Houston firms’ Dallas lawyer headcount were Vinson & Elkins at 130 and Baker Botts at 99.

In addition to home-grown companies, lawyers working in Dallas are getting new business from corporate relocations into North Texas, including Toyota, Charles Schwab, McKesson, Smoothie King and YUM Brands.

Revenues – You Go, Houston

Houston-based lawyers produced more than $1.3 billion in revenue in 2020, eclipsing the Dallas total by about $54 million. The gap amounts to a middle-market law firm, the equivalent of San Francisco-based Orrick, ranked No. 41 on the Lawbook 50.

Dallas had more lawyers, but the Houston market rose to the top on higher revenues per lawyer, the analysts’ preferred measure of law firm finances. Among the 18 firms, Dallas-based Akin Gump posted the top RPL at $1,346,210 – but Houston firms took the next five spots, including V&E at $1,173,000, AZA at $1,127,273 and Baker Botts at $1,064,000.

On a weighted-average basis for 2020, the RPL gap was $910,412 for Houston lawyers versus $819,500 for Dallas lawyers – a gap of about $90,000, less than half the $202,500 starting pay of a newly minted corporate attorney.

Seven firms had Dallas revenues over $100 million – five from Dallas, two from Houston. Dallas’ top revenue generator was home-grown Haynes and Boone at more than $207 million – no surprise. But Houston’s V&E was second at $153 million, coming in ahead of Dallas’ Thompson & Knight ($130 million) and Akin Gump ($125 million).

Only one Dallas firm had Houston revenues above $100 million – with Locke Lord at $102.7 million followed by Akin Gump at $95.6 million.

Given the narrow gap in revenues, Houston couldn’t have risen to the top spot without a boost from the lawyers Dallas firms employ in Houston. The Dallas firms generated revenues of $494 million in Houston, compared with $287 million for Houston firms in Dallas. The $207 million difference is four times larger than the gap between the cities in total revenue.

Houston law firms, especially those with large energy M&A practices, have benefited significantly from the influx of private equity money into the oil patch and clean energy operations.

A Feud Running on Fumes?

The Dallas-Houston rivalry doesn’t inspire the venom it once did. In the past three decades or so, the economies of both Dallas and Houston have diversified, the two cities became alike in terms of potential corporate clients. The two legal markets are integrating – within the firm and among them.

Nearly three-quarters of the Texas-based firms employ lawyers in both cities – making them teammates as much as rivals. About 30% of the lawyers work for firms in the other city. Among firms headquartered in Dallas and Houston, those in one city have forged working relationships with those in the other city.

Then there’s the arrival of so many out-of-state firms that gained market share in the past decade. Have they given rise to a new rivalry, with Dallas and Houston on the same side in a contest with non-Texas firms? The one sure thing: The Texas corporate legal market is always in transition.

The Texas Lawbook series on Texas-based firm finances:

Aug. 12, Part 1 looked at how 18 Texas-based firms fared on key financial metrics in 2020, plus a midyear survey on expectations for headcounts and revenues in 2021.

Aug. 16, Part 2 focused on the six big Texas-based firms trying to compete against the nation’s top firms in Texas and elsewhere.

Aug. 23, Part 3 surveyed 10 Texas-based firms that aren’t among the financial titans of corporate law. They’ve found a niche in the Texas legal market and managed steady growth.

Today, Part 4 reveals an ironic twist The Lawbook found when trying to determine whether Dallas or Houston can claim to be the capital of Texas corporate law.