It would be easy to dismiss the 2022 market for mergers and acquisitions in Texas as a disappointment – especially as compared to 2021, a post-pandemic record-setting year.

But that would be misleading — maybe downright wrong — according to top Texas dealmakers and exclusive data compiled by The Texas Lawbook.

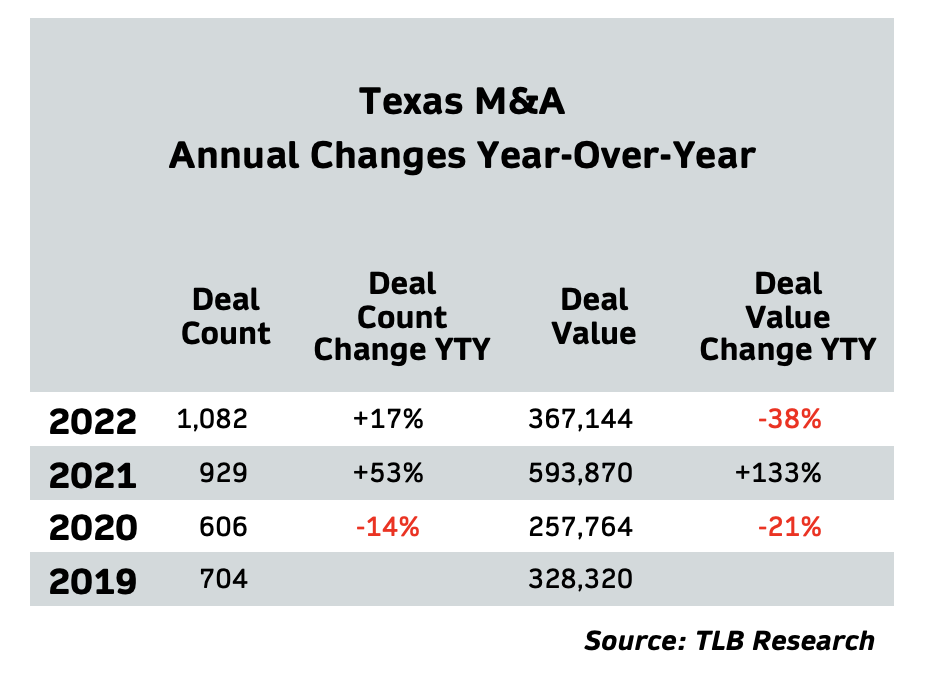

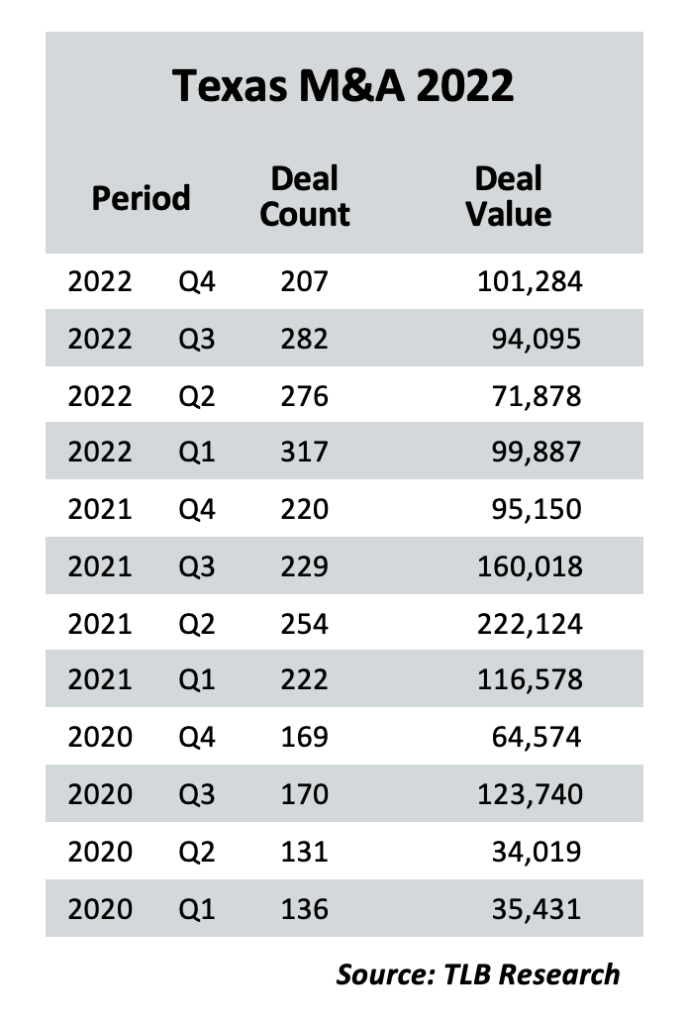

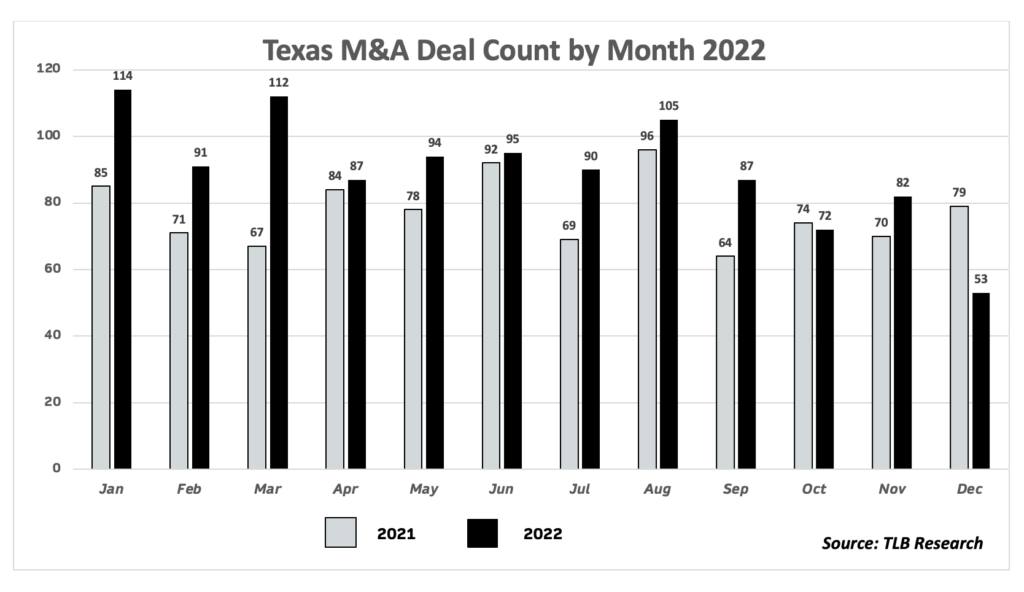

While 2022 deal values of $367 billion were down 38 percent from 2021’s $594 billion, the year proved extremely busy for lawyers, who advised on 1,082 M&A transactions, nearly 17 percent more deals than the 929 recorded in the previous record-setting year.

“M&A in 2022 was more halting and cautious than in 2021, but not any less busy,” notes Ryan Maierson, a partner in the Houston offices of Latham & Watkins.

Kevin Henderson, a principal in Dallas-based SMB Law Group, said his firm thrived in 2022 with small-market deals. “From our view 2022 was very hot for small business M&A.”

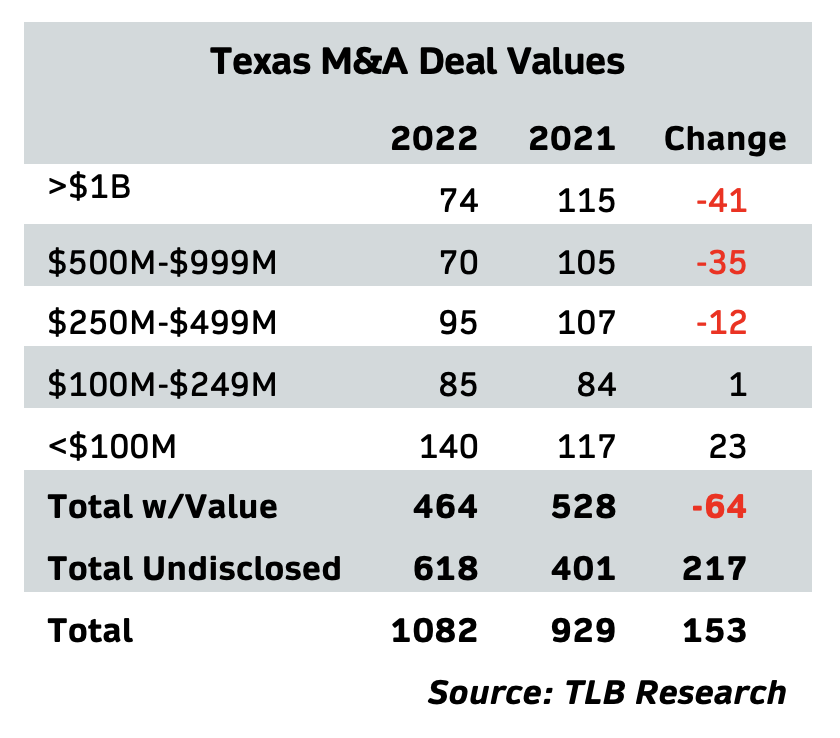

The stats bear that out: there were simply more deals bearing smaller or undisclosed values.

In 2021, there were 327 deals valued at $250 million or more. In 2022, there were only 239 deals of $250 million or more: 88 fewer. Significantly, the largest drop was in deals valued at $1 billion or more, from 115 in 2021 to 74 in 2022.

Moreover, deals with undisclosed values rose from 43 percent of all deals reported in 2021 to 57 percent of deals reported in 2022.

While the Corporate Deal Tracker tracks the work of Texas lawyers on M&A regardless of its geographic source, the overall outcome — a higher deal count coupled with lower aggregate value — is reflected, as well, in M&A transactions involving only Texas-headquartered companies.

Exclusive data on such transactions provided to The Texas Lawbook by Dealogic reflects 1,681 mergers or acquisitions in 2022 — where one or more of the parties are Texas headquartered — topped the 1,637 similar Texas-related deals in 2021. On the other hand, deal value on those deals ($422.4 billion in 2021 and $260 billion in 2022) was down by more than 38%.

So, why the mixed market-message?

The reasons for caution can be found in the news, says Kirkland & Ellis partner Adam Larson. “Given the triple headwinds of COVID-19, the Russia-Ukraine War and inflation over the back half of the year, 2022 ended up stronger than I expected,” Larson said.

Maierson agrees: “Rising inflation, ongoing challenges arising from the pandemic and a volatile stock market all contributed to periods in which dealmakers retreated to the sidelines.”

Both, however, credit the market’s resilience to dealmaker creativity and the large inventories of still-unspent cash. “There are unprecedented levels of private capital to be deployed, there are industries ripe for consolidation, and there are companies that recognize that merging with competitors can make for a stronger balance sheet that is better able to withstand downturns,” said Maierson.

Adds Larson, “There was a great creativity and innovation in dealmaking, especially in the infrastructure, sustainability and tech sectors.”

To his point the largest deal of the year — a $30 billion agreement between Brookfield Infrastructure and chip-maker Intel — was neither a merger nor an acquisition, but rather a manufacturing joint venture, a deal that drew attention for its creativity as well as its size.

Morgan Lewis partner Sameer Mohan suggests that simple stat comparisons between 2022 and 2021 are problematic.

“Deal values were down in 2022 undoubtedly, but in one sense it’s unfair to view last year in comparison to the remarkable year we experienced in 2021 which was spurred by the diminishing Covid pandemic and a strong desire for dealmaking after a return to more normalcy following the uncertainty of 2020,” Mohan said.

But the impact of global and economic events in the M&A market differed from sector to sector and market to market. Whatever the disruption in deal flow because of inflationary hiccups in small business loans, small business deals held their own because of the sheer breadth of opportunity.

“The incredible opportunity in the small business space is that the breadth of highly profitable businesses is incomprehensible: traditional home services, professional services, SaaS, Ecomm, health care, manufacturing, education, entertainment; the list goes on,” Henderson said.

The same held true in some sectors of the larger market. The all-important Texas energy industry, for instance, reacted with resilience, according to Danielle Patterson, an energy partner at Vinson & Elkins.

“While upstream oil and gas was almost non-existent in Q1 of 2022, there was a significant and sudden uptick in that work for the remainder of the year, which was a surprising reversal,” Patterson said. “But key macroeconomic conditions changed. Midstream oil and gas work had been slower in years past, but we definitely saw more midstream M&A and joint venture work in 2022 than years prior.”

Whit Roberts, a partner in the Dallas offices of O’Melveny & Myers, said his firm was an outlier from the global trend in that regard: logging fewer deals at higher price tags.

“Globally, our 2022 deal count was slightly down, but the aggregate value of deals we worked on was up 30 percent,” Roberts said. “We attribute this to the diversity of our M&A platform. Our client base is well-distributed across strategic buyers and sellers, mid-market and up-market private equity sponsors, and domestic and international dealmakers across a wide swath of sectors. As a result, in a year when certain segments of the market were slow, many of our clients — particularly in the technology, energy transition, mid-market private equity, and cross-border segments — kept us busy.”

Roberts counts the energy transition space as one of the year’s surprises.

“O’Melveny continued to be strong in technology sector deals, including several billion-dollar-plus transactions. Also, our mid-market private equity clients were active throughout the year,” Roberts said. “But the standout sector for us was energy transition, where we saw an enormous volume of small, mid-sized, and large-dollar transactions targeting areas like electric vehicles, EV charging infrastructure, clean energy storage, and related services and technology — particularly from international investors.”

V&E’s Patterson wasn’t quite as surprised, but credits changes in economic policy with boosting a sector that was already making waves.

“We clearly have a lot of momentum in clean energy investments. Our energy transition work has had significant tail winds for the past several years, and the passage of the Inflation Reduction Act (IRA) acted as an additional catalyst to that activity.”

She says much of its impact is yet to be felt, particularly as agencies like the IRS weigh in with their interpretations of the far-reaching law. “Some folks may have wanted or expected an immediate explosion in energy transition M&A with the passage of the IRA, but that of course couldn’t necessarily be the case. We (lawyers, business teams, the industry collectively) needed time to digest the IRA’s many components and understand how it could shape future energy transition projects and deals in a thoughtful way,” Patterson said.

Mohan notes that the rise of energy transition hasn’t diminished the role of more traditional O&G.

“We are clearly in an ‘all of the above’ era – traditional, transitional and longer-term energy sources. I don’t see that lessening, irrespective of the national political landscape as we begin to head into 2024 and another Presidential election season. For example, the recent comments from President Biden’s Energy Secretary Jennifer Granholm was an acknowledgment, from an administration largely fighting the oil and gas industry, of how fossil fuels will be critical for a long time regardless of the technological and developmental progress with alternative and renewable sources,” Mohan said.

There was another big surprise in 2022: SPACs did not go away.

Latham’s Maierson, who has led scores of SPAC transactions in recent years, said the anticipated death of the SPAC never really materialized.

“While the financial press focused on the increasing regulatory impediments to SPAC dealmaking and the poor trading of post-deSPAC public companies, 2022 was nonetheless the second most active year for deSPACs in history,” Maierson said. “While we witnessed the fewest U.S. IPOs in 30 years, there were almost 200 SPAC mergers announced in 2022.”

“It has been harder to keep cash in the trust account and harder to raise third-party financing through PIPE investments, but SPACs appear to have become a fixture in the landscape of getting companies public, particularly when the equity capital markets are effectively closed.”

Kirkland’s Larson says SPAC deals have evolved in the face of the various criticisms and concerns: “Continued creativity in the SPAC markets and the ability to still get deals done even in the face of unfriendly equity capital markets and an uncertain SEC regulatory regime was surprising. Our PE clients always continue to innovate, but I was surprised to see how quickly they moved up and down the capital structure as the ’22 market evolved, with renewed interest in JVs, preferred equity, convertible debt and other private credit structures that provide capital and downside protection in a more challenging market.”