The Texas lawyers at 12 corporate law firms were involved as lead counsel in 20 or more mergers and acquisitions during the first nine months of 2022. Four of those law firms were lead legal advisors in more than 60 deals.

One firm saw its attorneys in Austin, Dallas and Houston hit triple digits in deal count for lead legal advisors during the first three quarters of 2022.

The Texas Lawbook has released its exclusive Corporate Deal Tracker M&A law firm rankings for Jan. 1 through Sept. 30. These are mergers, acquisitions, divestitures and joint ventures handled by the Texas dealmakers, whether the companies or private equity firms are based in Texas or Dubai. The mission is to document transactional work done by lawyers in the Lone Star state.

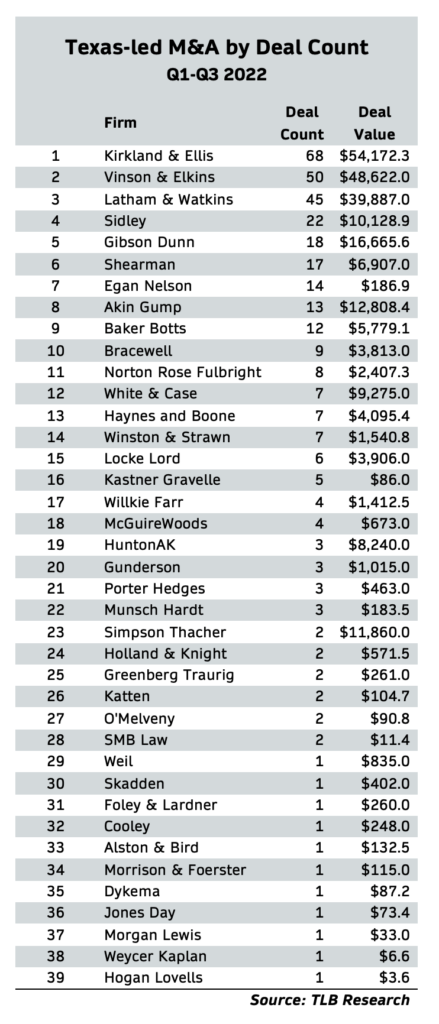

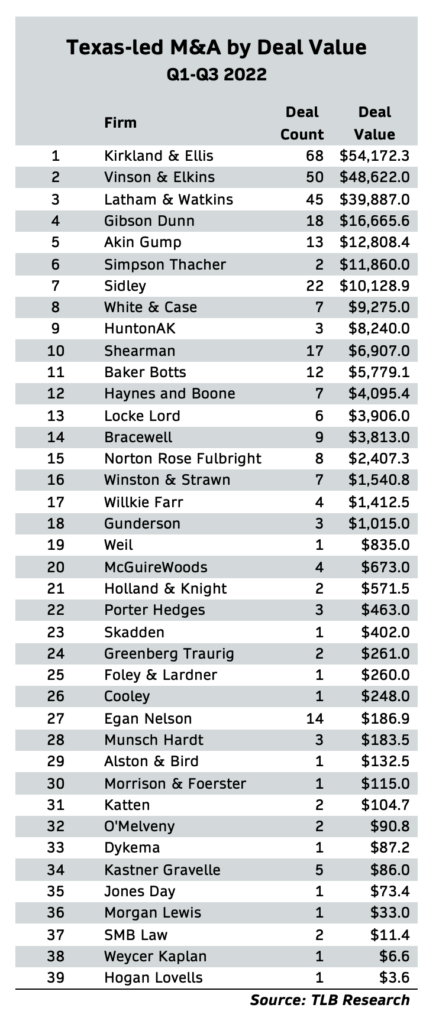

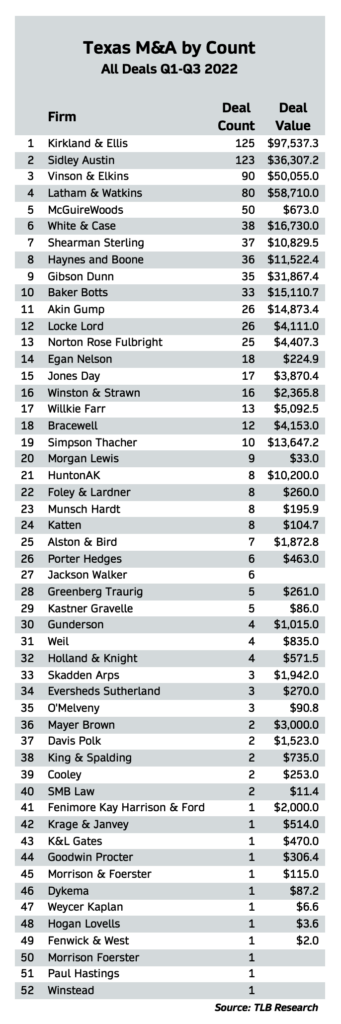

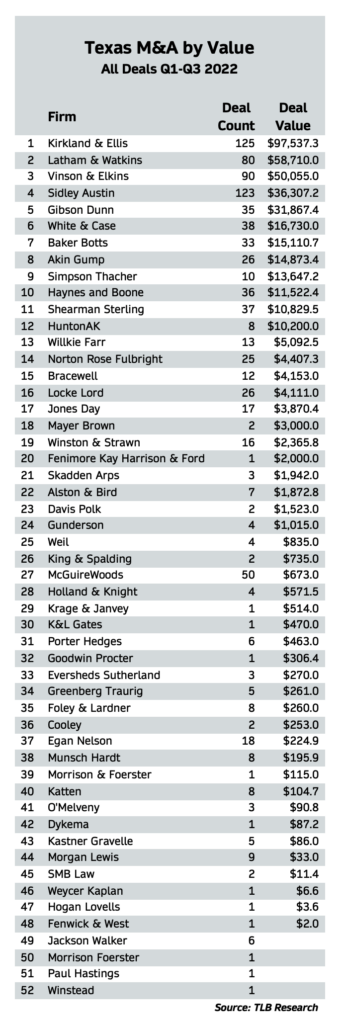

The CDT, which relies on law firms to report their own transactions, breaks down the data in two categories: First, law firms in which Texas attorneys were the lead legal advisors representing buyers, sellers and targets; and second, law firms in which Texas lawyers represented any party – be it the principles, investment bankers, conflicts committees and so forth. In both lists, transactions with disclosed and undisclosed deal values are counted.

Overall, 52 law firms reported the deals their Texas lawyers handled to the Corporate Deal Tracker – up from 44 during the first six months.

Only 11 of the 52 firms are headquartered in Texas.

In the newest M&A Corporate Deal Tracker rankings, four elite law firms – Kirkland & Ellis, Latham & Watkins, Sidley and Vinson & Elkins – separated themselves from the rest on pure deal volume. When computing the rankings by deal value, add Gibson, Dunn & Crutcher to the elite list.

The leaderboard in M&A work mirrors the rankings of the corporate law firms generating the most revenues and profits in Texas.

The CDT data for Q1-Q3 shows Kirkland ran the table. The Chicago-founded firm with more than 350 lawyers in Texas ranked No. 1 in lead legal counsel in both deal count (117) and deal value ($54.17 billion).

Kirkland attorneys in the firm’s three Texas offices narrowly claimed the top ranking for overall deal count (125) and deal value ($97.5 billion). The overall deal count includes M&A in which Kirkland’s Texas lawyers led the deal or merely worked on the transaction.

During the third quarter alone, Texas lawyers for Kirkland were involved in 43 transactions with a combined value of nearly $47 billion.

Sidley, another global corporate firm founded in Chicago, ranked No. 2 in overall deal count, reporting that its Texas attorneys worked on 123 deals with a combined value of $36.3 billion during the first nine months of 2022. Of those 123 transactions, Sidley’s Texas lawyers were lead advisors for the buyers, sellers or targets in 63. During Q3 alone, Sidley lawyers in Texas worked on 36 transactions.

Houston-based V&E reported that its Texas lawyers worked on 90 transactions with a combined value of $50 billion during the first three quarters of this year. But V&E dealmakers in Texas were lead advisors on 84 of those matters, ranking the firm the No. 2 on the lead law firm’s chart. Attorneys for V&E in Texas worked on 22 deals with a combined value of $10 billion.

Latham, a law firm founded in Los Angeles, ranked second in total deal value ($58.7 billion), fourth in total deal count (80) and third in lead counsel for the buyers, sellers or targets (71). Latham’s Texas lawyers worked on 29 transactions worth more than $18 billion.

Gibson Dunn, which also was founded in Los Angeles, reported that its Texas lawyers were involved in 35 M&A deals, which ranked ninth overall, that had a combined value of $31.9 billion, which is No. 5 in CDT deal value.

The Texas lawyers at McGuireWoods worked on 50 corporate transactions to rank fifth. They were followed by White & Case, Shearman & Sterling, Haynes and Boone, Baker Botts, Akin Gump, Locke Lord and Norton Rose Fulbright – all with 25 to 38 deals listed in the CDT.