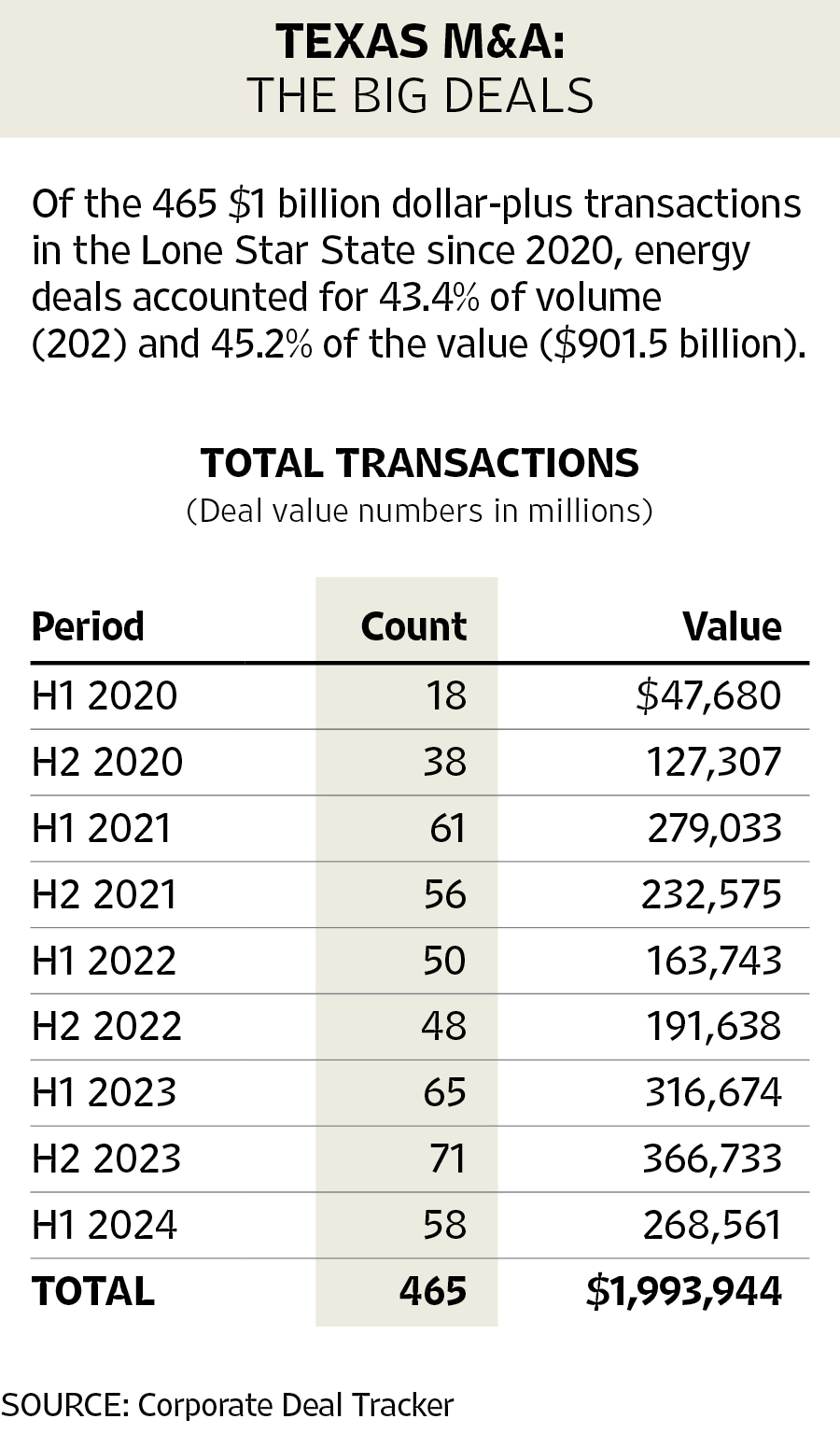

Nothing says Texas M&A better than a billion-dollar deal. And in the first half of 2024, there were plenty of them: 58 to be exact.

Data reported to the Texas Lawbook‘s exclusive Corporate Deal Tracker show those 58 Texas-related transactions amount to the fourth-best half of billion-dollar-plus activity since 2020, in both volume and value. In aggregate, those 58 billion-dollar deals represented 21.9 percent of deal activity for the entire first half of 2024.

At the top of the list, of course, was an energy deal: Diamondback Energy’s $26 billion acquisition in February of Endeavor Energy Resources, a deal that typified the consolidation of oil and gas activity in nearly every major region in the U.S., but particularly in the Permian.

Second was also an energy deal: The ConocoPhillips acquisition in May of Marathon Oil for $22.5 billion. That acquisition helped consolidate the ConocoPhillips presence in key shale plays in North Dakota’s Bakken, as well as Eagle Ford and, again, the Permian Basin.

In fact, energy deals accounted for 43.4 percent of billion-dollar transactions in the first half and 45.2 percent of their reported dollar value. By comparison, energy transactions comprised 31 percent of all M&A in the first half of 2024 and 48 percent of total reported value.

But energy wasn’t the only player, especially among the largest deals.

Rounding out the top five were Home Depot’s $18.25 billion acquisition in March of McKinney-based SRS Distribution; Silver Lake’s $13 billion purchase in April of Endeavor Group Holdings, a major sports and entertainment company and BlackRock’s $12.5 billion absorption of Global Infrastructure Partners announced in January.

And adding Web3 “gamification” technology to the mix, Carrollton-based Tronic Ventures in March announced its purchase of Tronic, a subsidiary of JBB Ventures, for a reported $12.25 billion.

But beyond the $10 billion-plus megadeals, energy ruled:

- In a massive energy services transaction announced in April, Schlumberger acquired ChampionX Corp., headquartered in The Woodlands, for $7.7 billion.

- In January, Chesapeake Energy upped its midstream holdings with the $7.4 billion acquisition of Houston’s Southwestern Energy.

- And, also in January, Sunoco acquired NuStar Energy of San Antonio for $7.3 billion.

The waste management sector — which has morphed in the past years to include environmental services, recycling and even renewable energy — again flexed its diversity with Texas-based Waste Management’s $7.2 billion acquisition of Stericycle, a medical waste management company.

And stirred by the development of AI-related investments, data centers — once a remote and specialized real estate investment — have become an important play in M&A transactions as evidenced by the $6.4 billion acquisition in January of Denver-based Vantage Data Centers by Digital Bridge.