In mid-October, Kirkland & Ellis partners Sean Wheeler and Doug Bacon represented Parsley Energy in its $2.27 billion purchase of Jagged Peak Energy, which was advised by Vinson & Elkins partner Steve Gill.

That same week, V&E partners Danielle Patterson and Keith Fullenweider and Kirkland partners John Pitts and Cyril Jones were the legal advisors for Momentum Midstream and Indigo Natural Resources in their $2.25 billion sale of assets to DTE Energy.

Just a week earlier, Latham & Watkins partner Ryan Maierson represented Warburg Pincus-backed Citizen Energy Operating in its $1 billion acquisition of Roan Resources, which hired V&E partners Steve Gill and Alan Beck as its lead counsel. Warburg Pincus used Kirkland’s Adam Larson and Kim Hicks as its legal advisors.

More and more, lawyers at Kirkland, Latham and V&E – three of the most profitable and expensive law firms operating in Texas – see each other across the table in the biggest M&A deals in the Lone Star State.

In fact, Texas Lawbook research shows that at least two – and a few times all three – of those law firms represented clients in the same mergers, acquisitions and joint ventures involving Texas-based companies nearly three-dozen times the past two years.

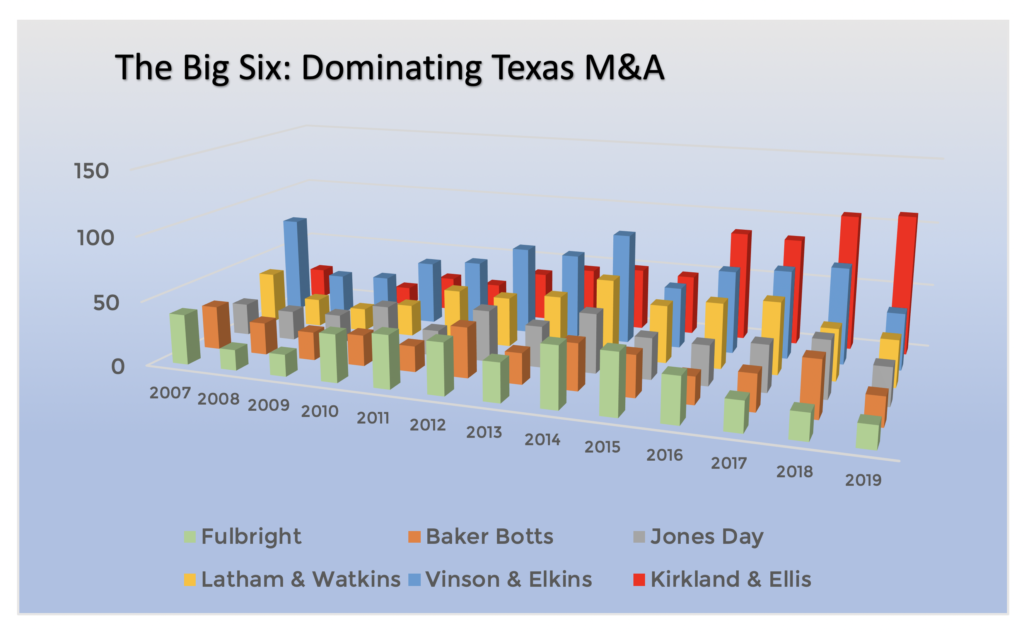

But new data also shows that the dominance of the trio of law firms in Texas dealmaking is far from a new trend. The numbers are staggering.

During the past 13 years, V&E, Kirkland and Latham combined have been involved in nearly 2,000 M&A transactions in Texas valued at just shy of $2 trillion, according to data provided exclusively to The Texas Lawbook by the independent financial research firm Mergermarket.

“These are three elite corporate law firms that have gained the trust and loyalty of some of the biggest companies and private equity funds in the world – companies and funds that do a lot of business in Texas,” says Chicago law firm consultant Kent Zimmermann.

“These are three law firms that are in direct competition with each other for talent and clients, but they are successful because they are different,” Zimmermann says.

To be sure, other corporate law firms operating in Texas have done their fair share of dealmaking.

Eight Texas-based law firms – Norton Rose Fulbright, Baker Botts, Akin Gump, Hunton Andrews Kurth, Locke Lord, Bracewell, Haynes and Boone and Thompson & Knight – worked on 2,205 transactions over the 13 years that had a combined price tag of $1.6 trillion.

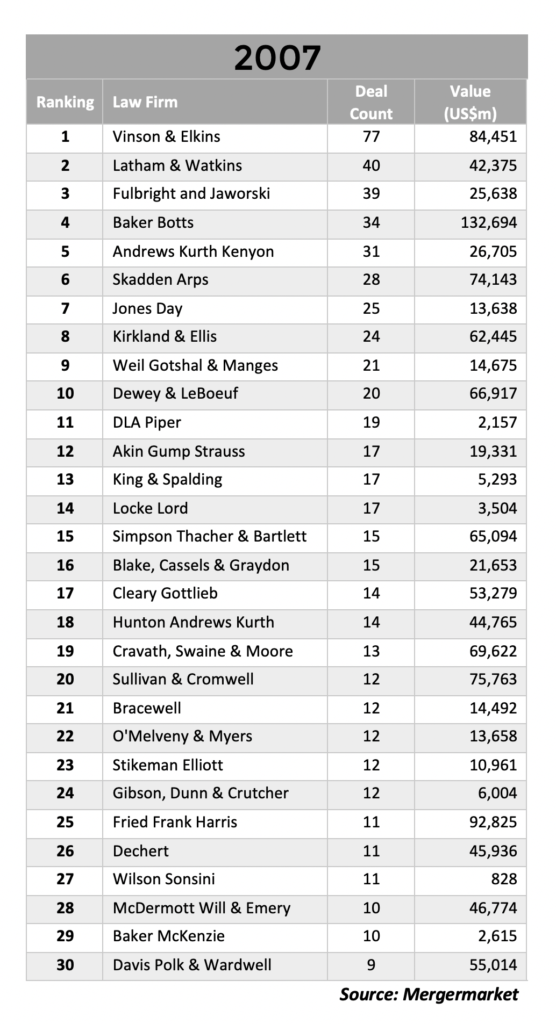

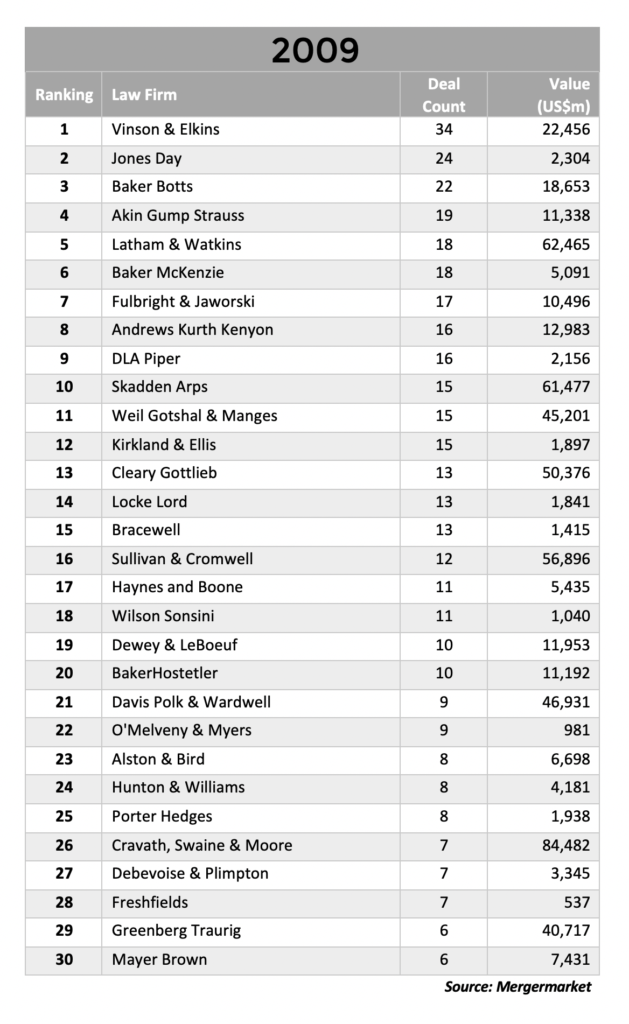

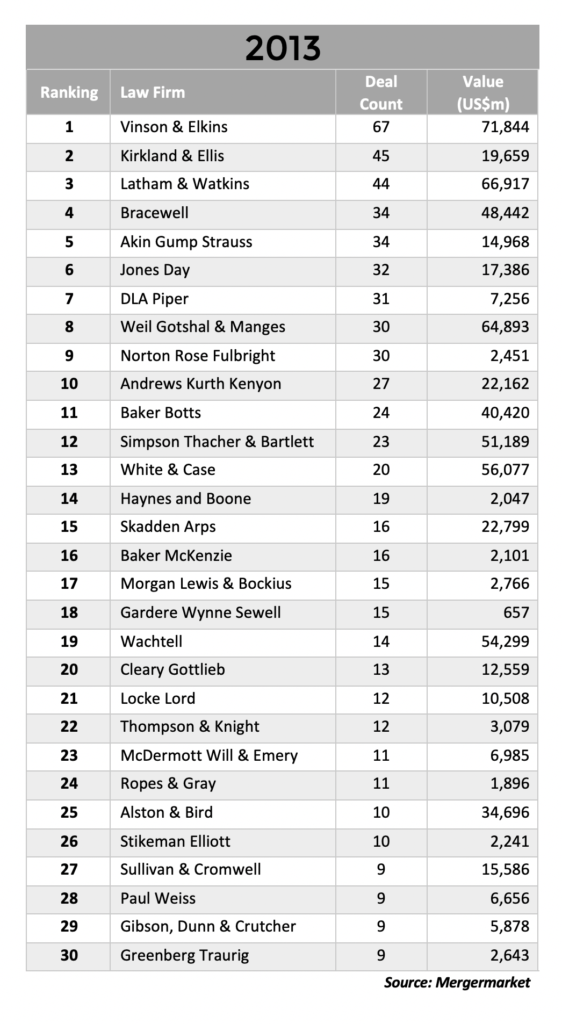

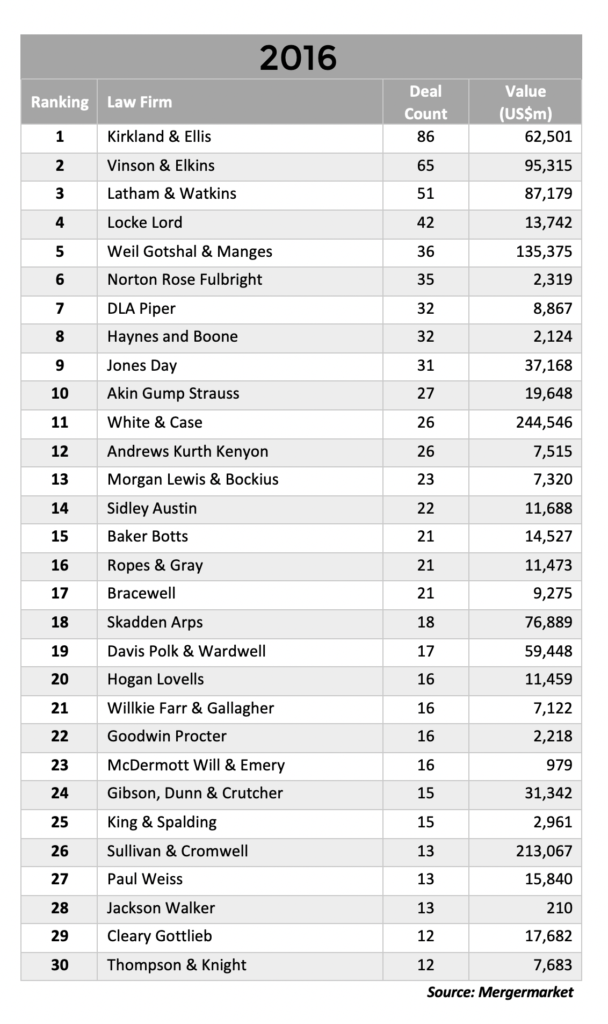

Between 2007 and 2014, corporate lawyers at Akin Gump, Andrews Kurth, Baker Botts, Bracewell and Fulbright regularly ranked in the top 10 in Mergermarket’s top law firms for deal counts. None of those five firms has been in the top 10 more than twice during the past five years.

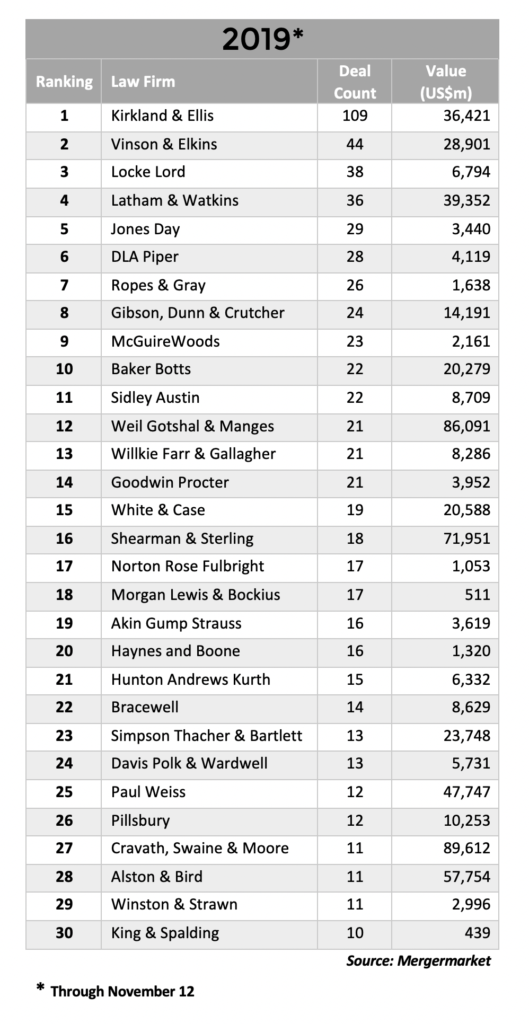

One exception is Locke Lord, which has found a niche doing mergers and acquisitions for middle market businesses. Locke Lord actually ranks fourth during the past four years in deal count with 163 M&A transactions valued at $40.9 billion.

Three large global law firms – Jones Day, Weil, Gotshal & Manges and DLA Piper – also rank high in the Mergermarket rankings. In fact, those three rank fifth, seventh and eighth in Texas deal count for law firms during the past 13 years, representing clients in 1,096 deals valued at $1.2 trillion.

There are two measurements for M&A transactions: deal count and deal value. For example, since the start of 2007, DLA Piper lawyers worked on 358 transactions with an average value of $188.3 million. Weil handled three-dozen fewer deals over the same time period, but the average price tag of those transactions exceeded $2.27 billion.

Three elite national law firms – Gibson, Dunn & Crutcher, Sidley Austin and Shearman & Sterling – barely registered on the Mergermarket charts for Texas M&A between 2007 and 2015.

All three law firms made significant lateral hires in their Houston, Dallas and Austin offices the past three years and have made significant inroads into the Texas M&A community. In fact, Gibson Dunn and Sidley have been in the top 10 for deal count each of the past two years and Shearman has been in the top 10 for deal value.

The very same day in October that the Warburg Pincus-backed Citizen Energy Operating transaction was announced, lawyers at Gibson Dunn, Latham and Baker Botts were finalizing a $6.2 billion deal for Hess Global Infrastructure Partners.

Latham partners Thomas Brandt and Bill Finnegan represented Hess Global Infrastructure Partners. Gibson Dunn partner Hillary Holmes advised a conflicts committee of Hess Midtream. Baker Botts partner Josh Davidson worked for the financial advisor, Intrepid Partners. Holmes, it should be noted, was previously a partner at Baker Botts and Finnegan was a partner at V&E.

The New Big Three

For decades, Baker Botts, Fulbright and V&E were viewed as “The Big Three” and dominated M&A and litigation legal work in Texas.

But Mergermarket data makes it clear that there is a new “Big Three” in Texas for corporate transactions work: Kirkland, Latham and V&E.

Between Jan. 1, 2007, and Nov. 12, 2019, the three corporate law firms were the legal advisors in 1,951 M&A transactions involving Texas-based companies and private equity firms – deals with a combined value of $1.996 trillion.

No other law firms even come close to handling the volume of M&A activity of those three. And the gap has only grown wider during the past four years.

“Our lawyers see lawyers from Kirkland and Latham on the other side most of the time,” V&E Chairman Mark Kelly said in an interview earlier this year.

The Mergermarket data, which tracks every M&A transaction involving a Texas company as the buyer, seller or third party, gives extraordinary insight into dramatic shifts that have taken place in the Texas corporate legal world since the Great Recession of 2008.

The starting point in this story is 1001 Fannin Street in downtown Houston – the headquarters of Vinson & Elkins.

No legal practice has represented more Texas businesses in M&A activity during the past dozen years than V&E, a 102-year-old Houston-based law firm.

Since 2007, V&E lawyers have worked on 771 transactions with a combined price tag of $800 billion.

Long known for its ties to the oil and gas industry, V&E did 77 deals in 2007 valued at $84.4 billion – which was nearly double the number of transactions handled by Fulbright & Jaworski, Baker Botts or any other law firm operating in Texas. That year, for example, V&E represented the private equity firm TPG Capital for its role in the $45 billion leveraged buyout of TXU Energy.

Legal industry analysts say V&E’s dominance can be explained in three points:

- The firm has more corporate transactional lawyers in Texas than any other law firm;

- The shale revolution and energy boom played directly into V&E’s strength; and

- V&E learned decades ago the strategic importance of placing its lawyers in-house with its clients as general counsel, who then hired their old colleagues at V&E to do their legal work.

“Our alumni are very important to the firm, including those who go in-house,” Kelly said.

The strategy paid off. Between 2007 and 2014, V&E lawyers worked on 431 M&A transactions valued at $442.1 billion, according to Mergermarket.

Norton Rose Fulbright was a distant second with 264 during the eight-year span. Baker Botts followed with 224 deals. Andrews Kurth had 204 transactions. Bracewell did 183 deals, while Akin Gump did 165.

But V&E and the entire Texas corporate legal market witnessed a significant shift starting in 2010 when Latham opened an office in Houston by hiring away top partners from V&E, Baker Botts and other firms.

Soon, other top national law firms, such as Sidley, Simpson Thacher and Gibson Dunn, followed. All grew by poaching lawyers from the Texas-based firms.

Latham and Sidley grew quickly and steadily.

For example, Latham averaged 20 deals per year in Texas between 2007 and 2010, but more than doubled its deal count after it opened a Houston office. In fact, Latham ranked in the top five for most M&A activity in Texas every year since 2010.

Mergermarket reports that Latham lawyers have represented clients in 518 M&A deals in Texas with a total value of $796.8 billion during the past 13 years.

Then came April 2014.

Kirkland opened its first Texas office in Houston. The firm stole Andrew Calder away from Simpson Thacher, and then Calder convinced scores of other top corporate lawyers from a handful of other corporate law firms to join him.

In 2014, Kirkland ranked third in the Texas M&A rankings, working on 49 deals compared to 87 by V&E, according to Mergermarket.

Kirkland strategically used its prestigious bankruptcy and restructuring legal practice to catapult its M&A practice. For example, Kirkland lawyers in New York and Chicago led the $45 billion restructuring of Energy Future Holdings between 2014 and 2018, but the firm’s Houston lawyers handled several major multibillion-dollar M&A deals that resulted from the bankruptcy.

In 2015, V&E’s lead evaporated. The Houston-based firm worked on 48 Texas transactions, while Kirkland did 47 and Latham handled 45.

A year later, Kirkland claimed the No. 1 spot, handling 86 Texas deals compared to 65 for V&E and 51 for Latham.

In July 2018, Kirkland opened an office in Dallas and its share of the M&A market has been breathtaking.

So far in 2019, Kirkland has handled 109 Texas M&A transactions – a new record by a law firm in a single year and more than double runner-up V&E, which has handled 44 deals involving Texas-based companies or private equity firms.

“You cannot help but be awed by what Kirkland has done,” Zimmermann said.

Editor’s Note: Coming Monday, The Texas Lawbook and Mergermarket examine the top 10 law firms in Texas by deal value. FYI, Kirkland is not in the top 10.