© 2016 The Texas Lawbook.

By Natalie Posgate

DALLAS (Nov. 1) – If one were to look at Jim Griffin’s 2016 monthly calendar, there would be quite a few events scribbled in.

FEBRUARY: The corporate lawyer boxed up his belongings in Silicon Valley and moved 1,700 miles to anchor his M&A practice at Weil, Gotshal & Manges’ office in Dallas, the city where he first began his legal career. Griffin moved to the West Coast in 2011 after practicing at Winstead and Norton Rose Fulbright in Dallas, and spent the last couple of years dividing his time between Weil’s Silicon Valley and Dallas offices.

LATE APRIL/EARLY MAY: He handled back-to-back acquisitions for Oracle, a California-based integrated cloud and platform services company, which totaled $1.2 billion.

JUNE 13: He worked on one of the largest tech deals announced so far this year: Microsoft’s $26.2 billion purchase of LinkedIn.

JUNE 30: The parent company of Blackboard, a learning technology provider giant used widely in higher education, agreed to purchase Higher One, an online tuition payment platform, for $260 million. Griffin led the deal for Blackboard’s parent, Providence Equity Partners.

JULY 5: The Fourth of July weekend ended with Griffin wrapping up Gores Holdings’ $725 million purchase of the once-bankrupt Hostess Brands, a transaction that also converted the Twinkies baker to a publicly-traded company.

JULY 27: Griffin handled another acquisition for Oracle that is the ninth largest deal of the year so far handled by a Texas lawyer, according to The Texas Lawbook’s Corporate Deal Tracker: Oracle’s $9.3 billion purchase of NetSuite, a cloud-driven business software company based in San Mateo, Calif.

AUGUST: Griffin represented Kettle Cuisine in its acquisition of fellow food manufacturer Del Monaco Foods.

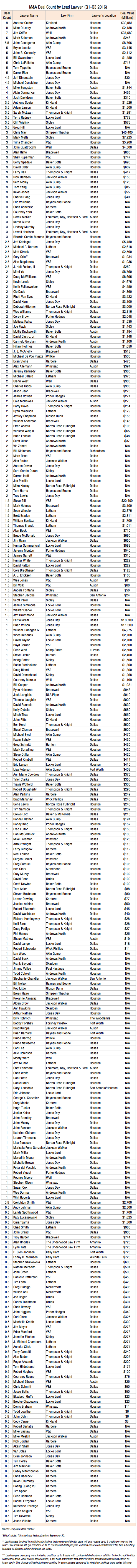

NOW: The nonstop grind of Griffin’s schedule has paid off. He currently ranks at no. 3 for deal count among 301 other leading M&A lawyers in Texas, according to new data from The Texas Lawbook’s Corporate Deal Tracker. He ranks No. 2 for handling the deals with the highest value, just behind Simpson Thacher & Bartlett’s Chris May.

“November and December do get busy,” Griffin recently told The Texas Lawbook in the lobby of the Dallas Ritz Carlton during UT Law’s 12th Annual Mergers and Acquisitions Institute conference. “Looking at my desk right now, I’m anticipating I’ll be busy all the way through the year.”

Griffin said 2016 “started off slow” for him – and the Corporate Deal Tracker data indicates that. Of the seven deals Griffin led in the first nine months of the year, all occurred in the second and third quarters.

But after any blockbuster year for M&A, Griffin said the first three months of the following year can be slow. ‘Blockbuster’ indeed would be a way to describe Griffin’s work in 2015; he ended the year working on Dow Chemical’s $130 billion “merger of equals” with fellow chemical and agricultural giant DuPont.

“I think of it more as a hangover from the craziness of 2015,” he said. “People were so active in 2015 that it took a while to get going.”

Once it did get going, the bulk of Griffin’s M&A work occurred within the technology sector. Griffin has also worked on a couple of food & beverage-related deals this year – a sector that has seen significant growth among Texas M&A lawyers. The Corporate Deal Tracker indicates there have been 13 such deals in the first three quarters of the year, and about half of those deals occurred in the third quarter.

Griffin pointed out that the food & beverage industry has seen a great deal of change in recent years – whether it’s consumers’ change in preferences to organic versus nonorganic, local versus non-local, or an emergence of a trend (the food truck and taco crazes, or consumers increasingly ordering delivery via Uber Eats or Postmates).

“Anytime there’s a change in the industry, there’s an opportunity for M&A,” he said.

Asked what determines whether it will be a busy year for tech deals, he said it all derives from whether M&A as a whole will be active.

“There has to be confidence,” Griffin said. “I think buyers really drive M&A more than sellers. People have to have confidence particularly from the buy side – not with their own operation, but what the market will look like.”

Griffin said the confidence factor is not just exclusive to tech deals.

“The basic premise is the market needs confidence,” he said. “If there’s a lack of clarity, or volatility in the future, that significantly affects M&A volume.”

Whether he’s working on a deal under $500 million or an historical multibillion-dollar transaction, Griffin said “every deal brings its unique challenges,” though many times, the “same issues” are there regardless of the size.

“What’s fun is being in the room as you’re working with both parties [to try to] get them to come to a transaction that is in the best interest of both parties and their stockholders,” Griffin said. “Being fortunate and honored enough to be considered part of that group and being brought in to help is a huge part of what I do.”

© 2016 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.