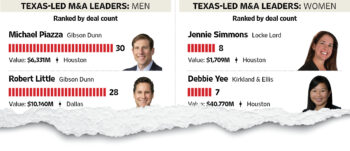

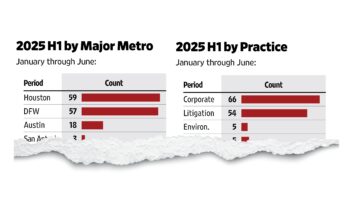

CDT Roundup: 19 Deals, 13 Firms, 118 Lawyers, $8.5B

Deals are down across the globe, according to Refinitiv. In the U.S. the view is a little more complicated. In Texas, it's a lot more complicated — but in a good way. The CDT Roundup has the numbers for you to consider, along with the usual rundown of last week's deals.