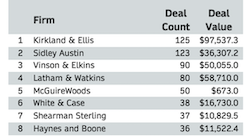

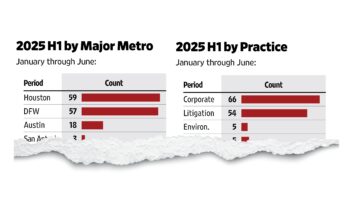

CDT Roundup: 14 Deals, 13 Firms, 115 Lawyers, $7.9B

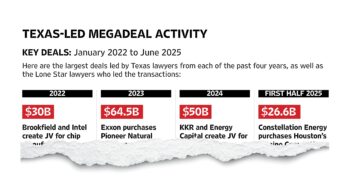

The Mergermarket year-end polling is out and the results are optimistic. More than 60 percent of decision-maker respondents from 300 corporate and PE firms predict overall increases in M&A, despite the ongoing threat of inflation and continued geopolitical challenges. The CDT Roundup has details of the survey, as well as which markets they are predicting will prosper. As always, there are the names of Texas lawyers who advised on 14 deals reported last week.