© 2016 The Texas Lawbook.

By Natalie Posgate

(Aug. 8) – Deal activity is slower for mergers, acquisitions, divestitures, joint ventures and securities offerings these days, which means a tighter and more competitive market among Texas transactional lawyers and their respective firms, new data suggests.

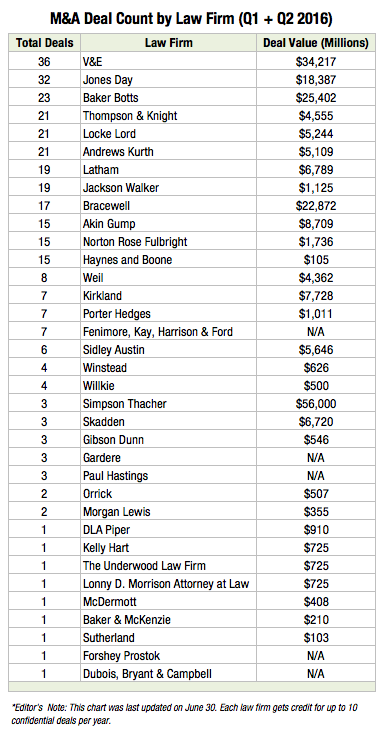

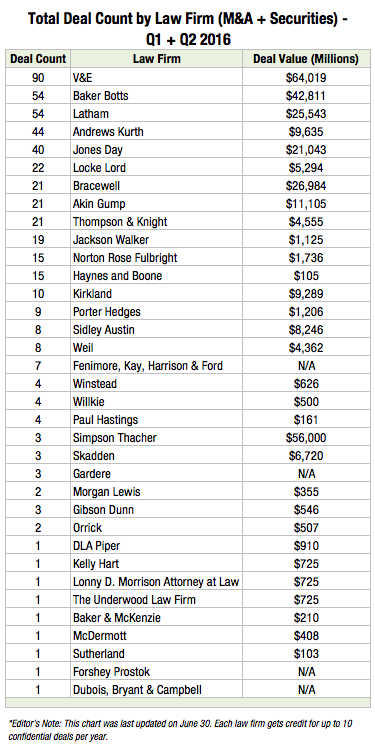

New numbers from The Texas Lawbook’s Corporate Deal Tracker show that 17 law firms share the top 10 rankings for M&A deal count during the first half of 2016. Fourteen firms made the top 10 in deal count for M&A and capital markets deals combined.

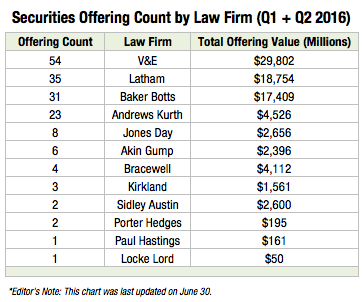

No law firm handled more M&A deals and securities offerings than Vinson & Elkins, which handled 90 such transactions in the first half of this year. That figure is 40 percent higher than the number handled by Baker Botts and Latham & Watkins, which both tied for No. 2 with 54 such deals.

It was a closer call for M&A deals. Though V&E also ranked No. 1 for deal count in that category by handling 36 M&A deals during H1 2016, Jones Day was not too far behind, handling 32. Baker Botts, Thompson & Knight, Locke Lord and Andrews Kurth closely followed.

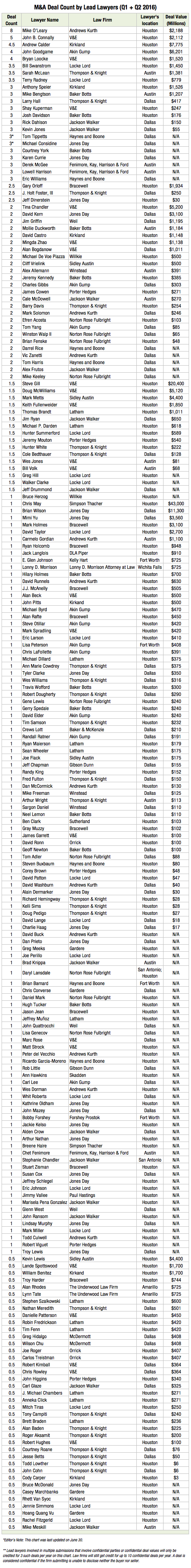

Houston-based lawyers dominated leading deals in both M&A and capital markets, though city representation for M&A deals was a bit more diverse. Out of the 212 attorneys working on M&A deals during H1 2016, more than half (58 percent) are from Houston. Dallas lawyers comprised 32 percent of the lawyer pool, while Austin lawyers comprised 7 percent. A small number of attorneys from Fort Worth, Amarillo, San Antonio and Wichita Falls also worked on M&A deals.

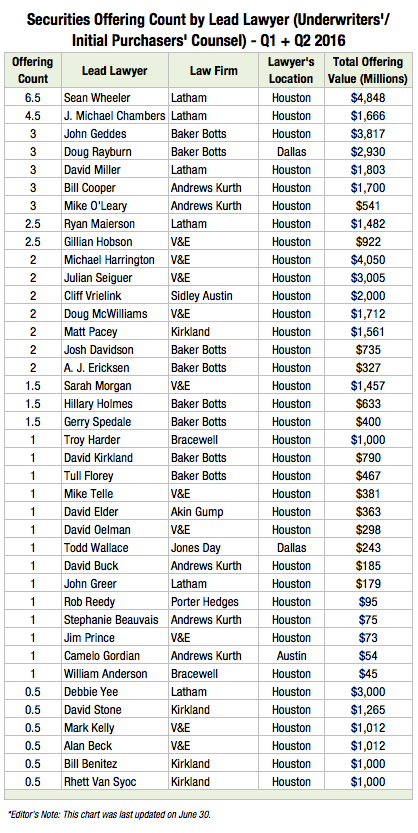

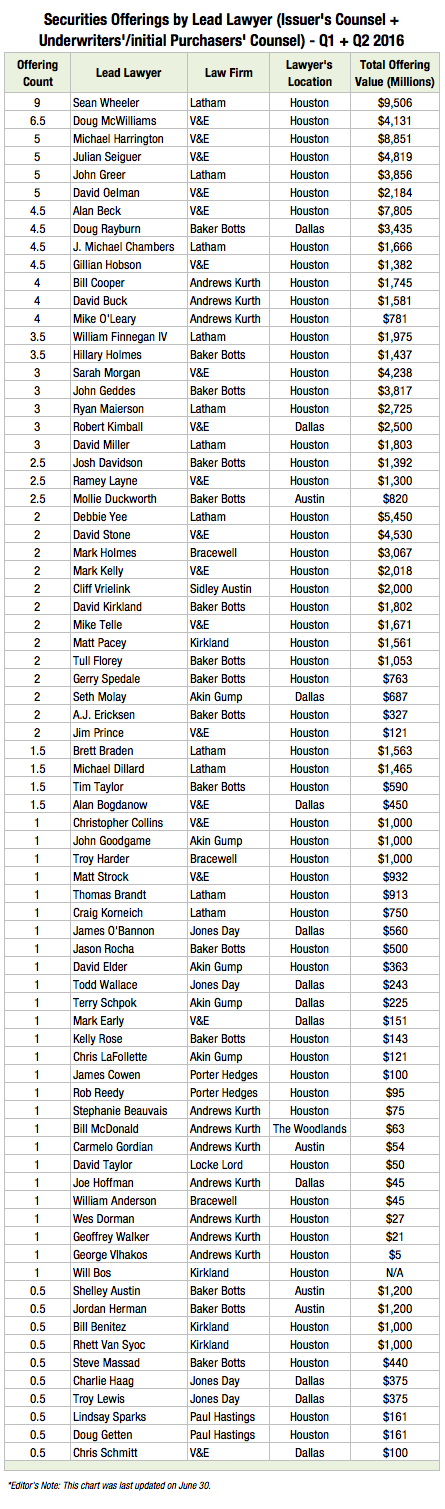

Of the 76 lawyers who led capital markets deals this year, 79 percent are based in Houston and The Woodlands, 17 percent are in Dallas and 9 percent are in Austin.

The most prolific M&A lawyer was Mike O’Leary of Andrews Kurth, who led eight M&A deals during the first half of the year. O’Leary’s results are flipped from a year ago, when he led only two M&A deals during H1 2015 but ranked No. 1 in leading securities offerings. At this time last year, O’Leary had led 17 capital markets deals for issuers and underwriters. In light of the ongoing capital markets downturn, O’Leary has only led four such deals in the first half of this year.

V&E partner John B. Connally ranks second and Kirkland & Ellis partner Andrew Calder ranks third for M&A deal count during H1 2016.

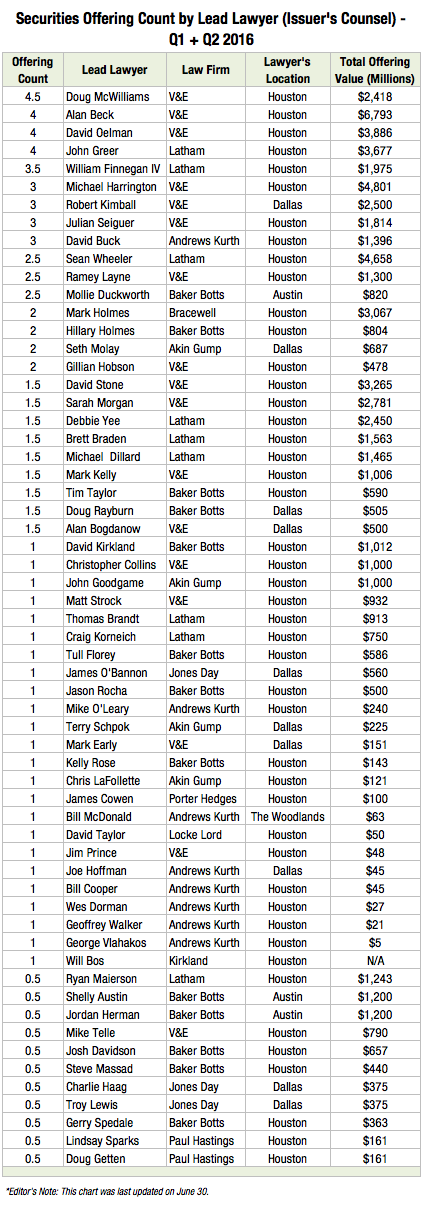

So far this year, Latham & Watkins partner Sean Wheeler ranks No. 1 for overall securities offering deal count. The Houston partner has led or co-led 10 capital markets deals for issuers and underwriters. Coming in second is V&E partner Doug McWilliams, who ranks No. 1 for deal count solely on the issuer’s side.

Eleven attorneys tie for third, fourth and fifth place in leading capital markets deals for issuers and underwriters combined. Michael Harrington, Julian Seiguer and David Oelman of V&E and John Greer of Latham are in a four-way tie for third place; V&E partners Gillian Hobson and Alan Beck, Baker Botts partner Doug Rayburn, and Latham partner J. Michael Chambers are also in a four-way tie for fourth place; while Andrews Kurth colleagues Bill Cooper, David Buck and Mike O’Leary are in a three-way tie for fifth place.

(Editor’s Note: On deals involving two lead attorneys, the Corporate Deal Tracker only awards a half-credit to each attorney, which is why some numbers in the charts reflect a different value than the overall amount of deals of which a lawyer was considered a lead attorney.)

© 2016 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.