When Texas Capital Bank and Independent Bank Group announced their $5.5 billion merger Monday, the two Texas-focused financial institutions hired two elite New York law firms as their legal advisors: Sullivan & Cromwell and Wachtell, Lipton, Rosen & Katz.

The transaction is a perfect example of a decades-old trend of Texas businesses turning away from corporate law firms headquartered in the state to handle their most important legal work and instead relying on more established – and more expensive – elite Wall Street firms.

The trend is also supported by new data provided exclusively to The Texas Lawbook by the independent financial research firm Mergermarket.

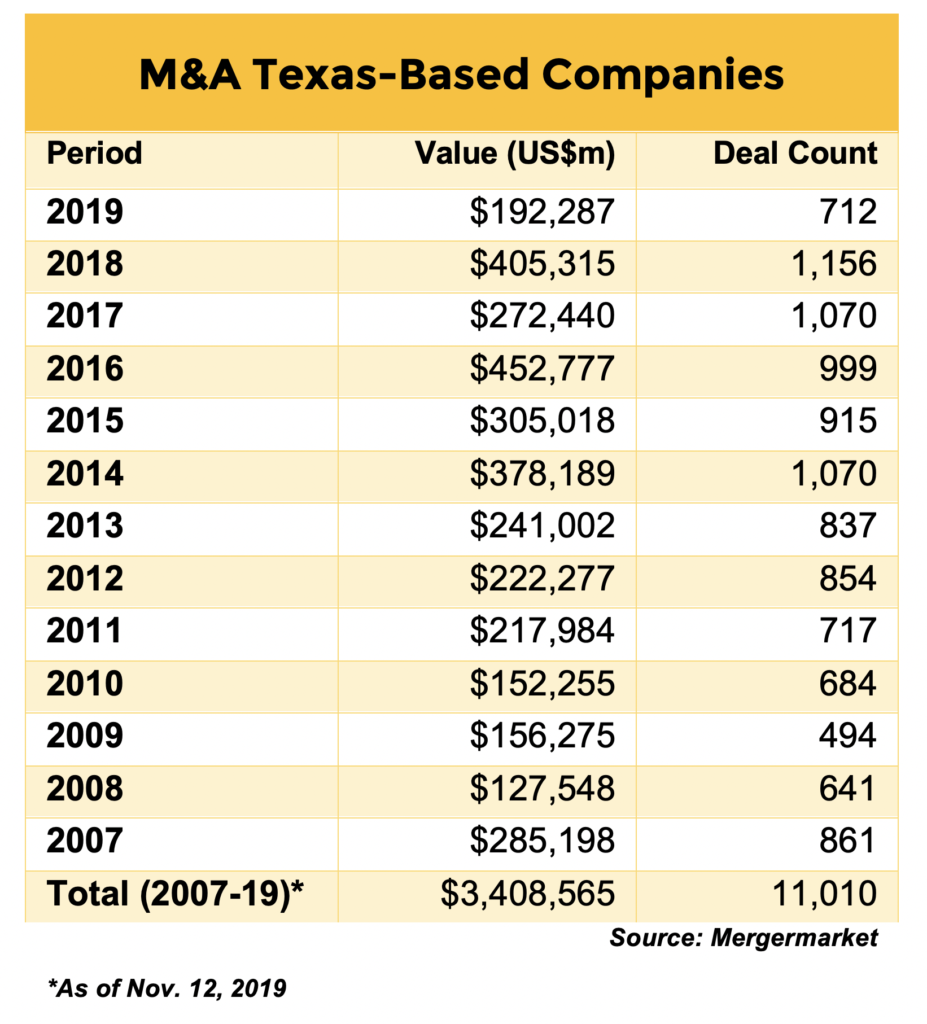

Mergermarket reports that there have been 11,013 M&A transactions in Texas between Jan. 1, 2007, and Nov. 12, 2019.

The combined value of those deals is $3,408,565,000,000.

There are two distinct methods to rank law firms regarding M&A activity: deal count and deal value.

M&A experts widely agree that the largest transactions are not always the most complex or even the most financially rewarding for the law firms who handle the deals for their clients.

Even so, the biggest deals – those with a price tag of $1 billion or more – get the most attention.

Since 2007, there have been more than 400 M&A transactions involving Texas-based businesses or private equity firms as the buyer or seller valued at $1 billion or more, according to research conducted by The Texas Lawbook and Mergermarket, an independent financial research firm.

More than 40 of those deals have been priced at $10 billion or higher, including two so far this year – Occidental Petroleum’s $54 billion acquisition of Anadarko Petroleum and IFM Investors’ $10.1 billion purchase of Buckeye Partners.

At The Lawbook’s request, Mergermarket identified the law firms who advised the buyers, sellers and third parties (such as conflicts committees and financial advisors) to determine which firms did the most legal work involving Texas M&A between 2007 and this past November.

Last week, The Lawbook reported an in-depth analysis regarding M&A deal count in Texas. You can read that article here.

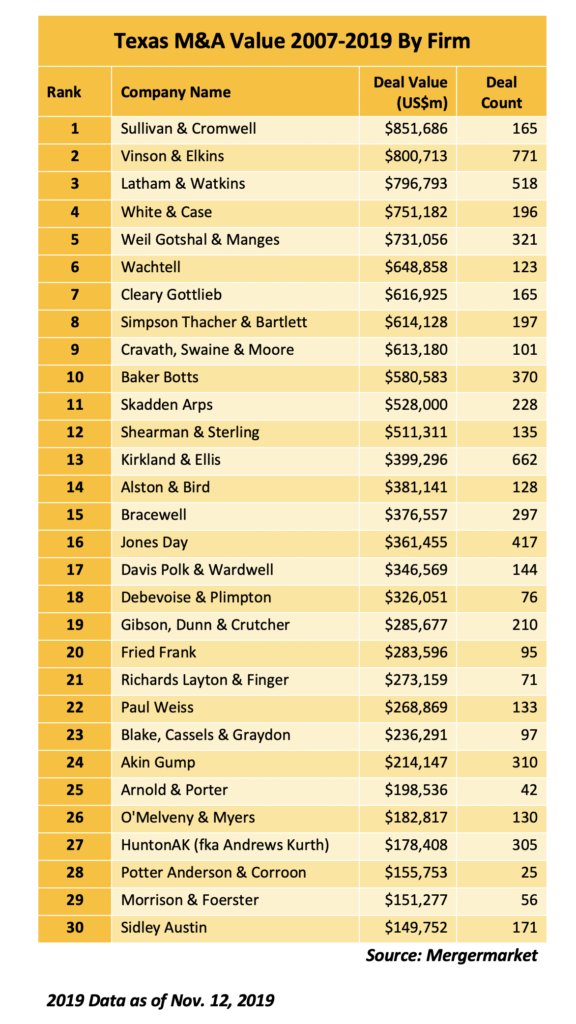

Today, Mergermarket identifies the law firms that did the most Texas M&A by deal value over the past 13 years. The answer is simple:

Large, national elite law firms – most based outside of Texas – are the clear choice of general counsel of Texas corporations to do their biggest deals.

Twenty-five of the top 30 M&A law firms by deal value in Texas are headquartered elsewhere. Four of the top 10 firms do not have an office in the state, including Sullivan & Cromwell; Wachtell, Lipton; Cleary Gottlieb Steen & Hamilton; and Cravath, Swaine & Moore.

Of the five Texas law firms on the list – Akin Gump, Baker Botts, Bracewell, Hunton Andrews Kurth and Vinson & Elkins — all but Akin Gump are based in Houston.

The data, according to legal experts, demonstrates that large corporations still tend to turn to New York law firms to handle their biggest transactions.

Topping the Mergermarket chart is Sullivan & Cromwell, a New York-based firm that has been the legal advisor on 165 transactions valued at a whopping $851.7 billion. So far this year, Sullivan has been involved in three multibillion-dollar Texas deals, including Advanced Disposal Services $4.8 billion sale to Waste Management, Alliance Data Systems’ $4.4 billion sale to Epsilon Data Management and AT&T’s $4.5 billion acquisition of a 9.5% stake in Hulu.

V&E ranks second with $800.7 billion in M&A deal value. Baker Botts ranks 10th with 370 deals with a price tag of $580.6 billion. Bracewell is 15th with 297 transactions valued at $376.6 billion. Akin Gump, which was founded in Dallas and is now co-headquartered in Washington, D.C., ranks 24th with a deal value of $214.1 billion over the past 13 years. And Hunton Andrews Kurth ranks 27th with $178.4 billion.

Latham is third in transactional value at $796.8 billion.

White & Case and Weil, Gotshal & Manges round out the top five.

White & Case, which opened its Houston office in February 2018, was a legal advisor this year in the IFM Investors acquisition of Buckeye Partners for $10.1 billion and Oryx Midstream Services’ $3.6 billion sale to Stonepeak Infrastructure Partners. All told, the New York firm has represented Texas buyers, sellers or third parties in 196 transactions with a combined price tag of $751.2 billion.

White & Case and Sullivan are the only two law firms to ever exceed $200 billion in deal value in a single year in Texas. Both did it in 2016. Sullivan represented AT&T in its 2017 purchase of Time Warner for $85 billion, while White & Case was the legal advisor to the financial advisors in the transaction. White & Case also represented the financial advisors in Energy Transfer Partners’ $51.4 billion merger with Sunoco Logistics. Sullivan lawyers handled Enbridge’s $41.4 billion purchase of Spectra Energy. White & Case also advised the financial advisors in that deal.

Weil Gotshal, a Wall Street firm that opened in Dallas in 1987, has been involved in 321 Texas deals valued at $731 billion.

This year alone, Weil lawyers have represented clients in three of the four largest transactions in Texas, including Occidental Petroleum’s $54.4 billion acquisition of Anadarko, Sinclair Broadcast Group’s $9.6 billion purchase of Fox Sports Net and Total SA’s $8.8 billion buy of certain Anadarko assets. Latham and Cravath were also involved in the Sinclair – Fox Sports Net deal.

Weil also represented the financial advisors in the 2016 AT&T – Time Warner deal.

Then there are the two most elite of the elite law firms – Wachtell Lipton and Cravath.

To start, Cravath is involved in the four largest Texas M&A deals so far this year. Cravath represented Occidental Petroleum, while Wachtell advised Anadarko in this year’s $54.4 billion deal. Cravath also advised Walt Disney in its sale of Fox Sports Net to Sinclair , Buckeye Partners in its deal with IFM Investors and Anadarko in its deal with Total.

For its part, Wachtell Lipton also represented Epsilon Data Management in its $4.4 billion buy of Alliance Data Systems in April. Last year, Wachtell was outside counsel to Energen in its $9.2 billion sale to Midland-based Diamondback Energy, which was advised by Akin Gump.

So far in 2019, Cravath and Weil Gotshal rank first and second in deal count. The more the market changes, the more it sometimes stays the same.