By Mark Curriden, Senior Legal Affairs Writer for The Texas Lawbook and Mark Druskoff, Reporter for Mergermarket

HOUSTON (March 6, 2012) – Capital markets lawyers in Texas predict a resurgence starting slowly in the second quarter of 2012 and gaining steam in the summer.

Fingers crossed.

The Texas Lawbook surveyed more than two-dozen capital markets lawyers in Austin, Dallas and Houston about the world of initial public offerings for the next 10 months. Their conclusion: all financial indications are in place for IPOs to regain a resemblance of pre-2008 markets.

The 26 lawyers interviewed predict that 2012 will be as good or better than 2011. However, those lawyers say that the recovery in the capital markets depends heavily on the economy continuing to grow, the stock market climbing and global financial risks declining.

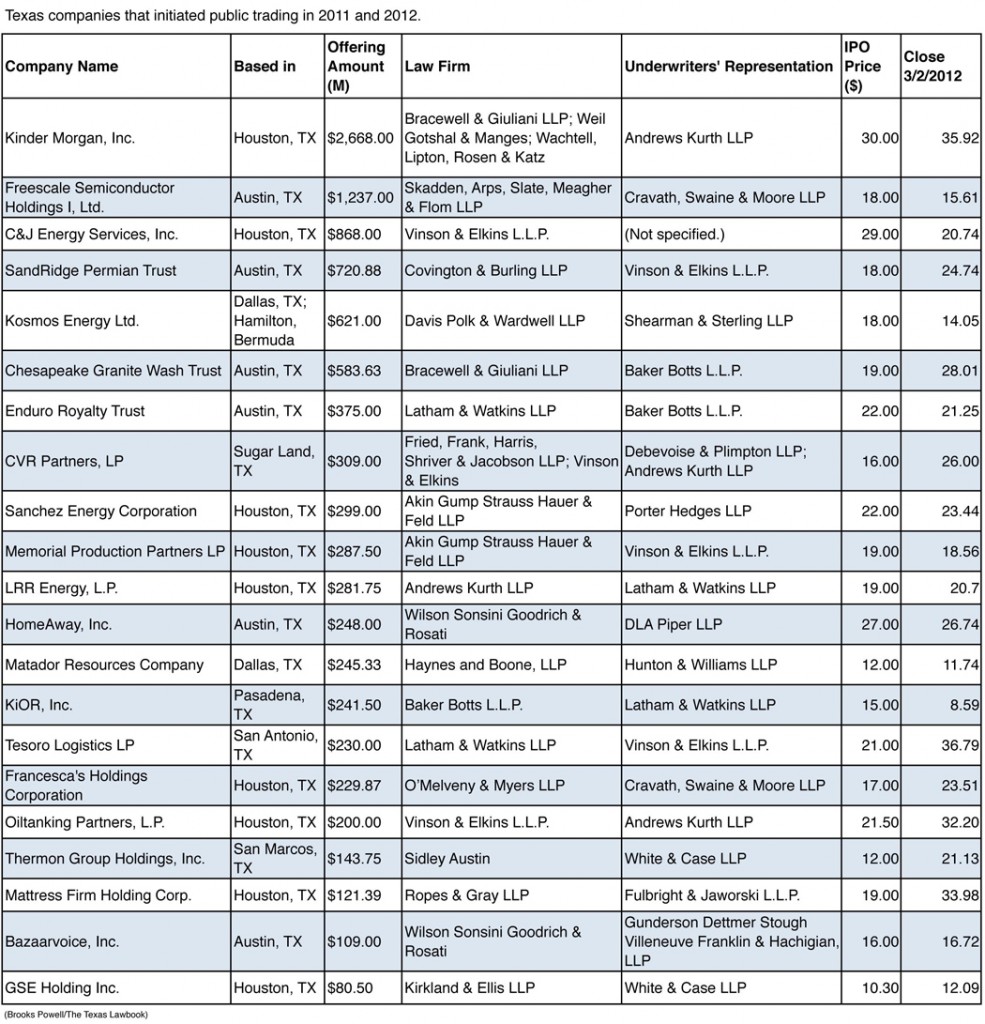

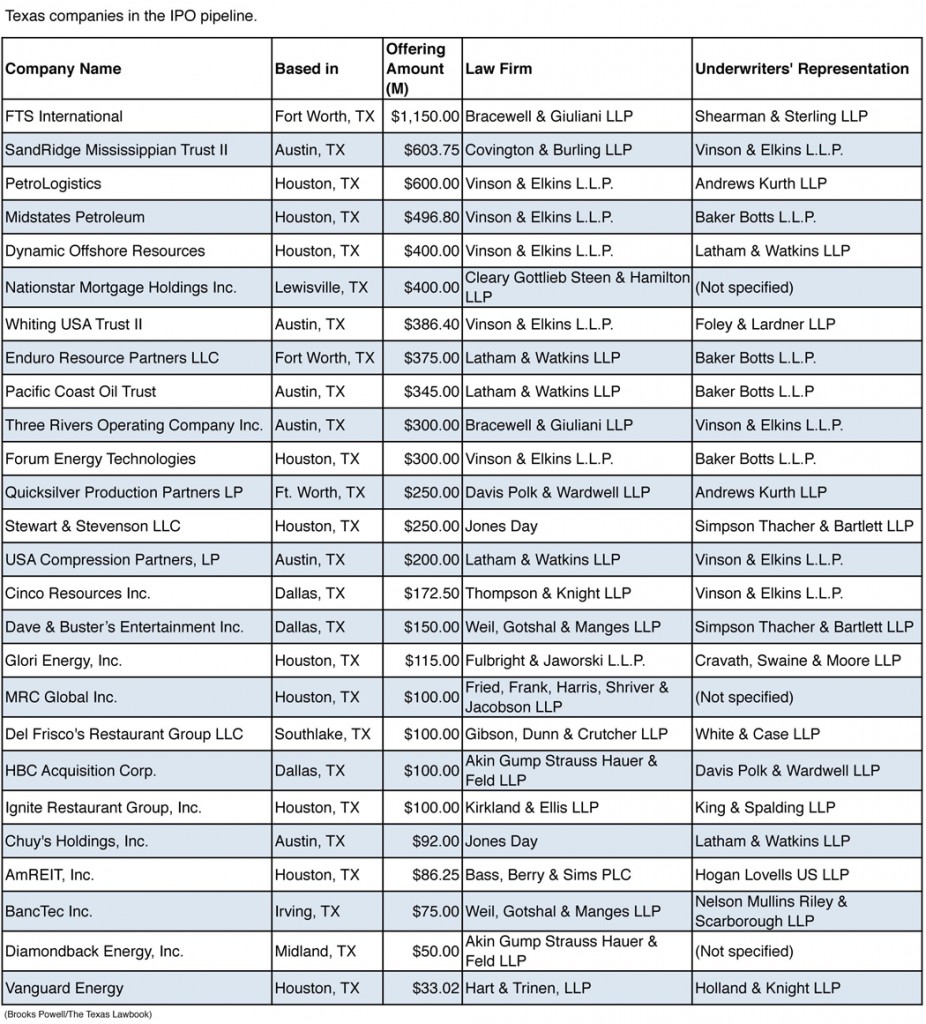

Twenty-one Texas-based companies have started trading publicly since January 1, 2011. There are another 26 Texas companies in the IPO pipeline.

“I think 2012 could be a very strong year for capital markets,” says Hunton & Williams partner Steve Leshin. “As the market and the economy continue to improve, we will see IPO activity improve.”

The Texas Lawbook survey found that most lawyers believe there will be more IPOs filed this year, but that most of those IPOs will be smaller in size and more sensitive to market volatility.

Initial public offerings mean solid revenues for law firms. Even smaller IPOs generate about $500,000 for law firms, while the larger IPOs can generate $1.5 million or more in revenue for the legal team, depending on the complexity of the corporate structure, as well as the size and timing of the transaction.

Of course, 2011 fell far short of being a banner year.

“Lawyers still see nervous clients,” says Terry Schpok, a partner at Akin Gump Strauss Hauer & Feld. “The institutional buyers are concerned about European banks and about market volatility that could send opening day shares of an IPO immediately falling.”

Schpok and other capital markets lawyers also say they hear deep concerns from smaller sized clients considering an IPO.

“Smaller companies are weighing what kind of regulatory environment they will be stepping into when they go public,” he says. “

While the capital markets practice in Texas was significantly better last year than for firms on the East and West coasts, it still fell far short of expectations.

There’s no surprise about the reason for the Texas edge: oil and gas.

“Clearly what’s driving capital markets [in Texas] is primarily the energy sector,” said Jim O’Bannon, a partner at Jones Day in Dallas.

Of the 125 U.S. companies that went public last year, 21 were energy-related. Ten of those businesses are Texas-based, according to data from Renaissance Capital.

The largest was Kinder Morgan, which was the fifth largest IPO in the world in 2011, raising an estimated $2.9 billion. Bracewell & Giuliani represented the Houston-based natural gas pipeline and storage company. Bracewell is also representing FTS International, a Fort Worth-based hydraulic fracturing firm seeking to raise $1.15 billion in its planned IPO later this year.

PwC Capital Markets reports that the energy sector raised $6.4 billion through IPOs in 2011, which was double the amount in 2010 and triple the numbers for 2009. In its February 2012 IPO report, PwC said that renewable and green energy companies will continue to seek public offerings, despite the disappointing volume that the 2011 offering generated.

Of the more than 200 IPOs currently in the pipeline, more than 10 percent are energy related.

Across all industries, Texas law firms represented companies that raised $8.9 billion through IPOs in 2011, according to data from Mergermarket. In addition, Texas attorneys with out-of-state firms advised multiple Texas companies on going public.

Attorneys in the Austin offices of Wilson Sonsini Goodrich & Rosati and DLA Piper helped HomeAway makes its public debut in June. Meanwhile Latham & Watkins Houston-based lawyers helped take two companies in 2011 and advised underwriters on six others.

Six Texas companies went public that were not energy-related, including HomeAway and Freescale Semiconductor.

Akin Gump partner David Elder says handling a company’s IPO is the best way for Texas law firms to get in on the ground floor representing a business. With the currency of a publicly traded stock and new capital, companies have the dry powder to go out and do M&A deals, which is the bread-and-butter for transaction lawyers, he said.

That’s exactly the deal with Kinder Morgan, which used its newfound cash to make a $21 billion offer to purchase El Paso. The transaction is still pending. El Paso shareholders are expected to approve the sale in a vote scheduled for this Friday.

Representing oil and gas companies returns an even bigger dividend since they are intense users of outside transactional advice, said David Oelman, co-head of Vinson & Elkins’ capital markets practice.

Of the 47 Texas businesses that either went public since January 2011 or are in the IPO pipeline, V&E represented either the company or the underwriter a dozen times. Baker Botts and Latham & Watkins each represent eight businesses or the underwriters. Andrews & Kurth is involved in five IPOs, while Akin Gump and Bracewell can each claim four.

In addition to investor appetite for oil and gas issuances by corporations, retail demand for master limited partnerships (MLPs) have also been on the rise, noted several attorneys. Since MLPs are used almost exclusively by energy companies, Texas practitioners have enjoyed a double helping of capital markets work.

MLPs have been increasing in popularity over the last decade but had an outsized share of the IPO market this year, said V&E’s Oelman.

The impetus has come from retail investors chasing the high yields that MLPs offer to their unitholders, said John Goodgame, a capital markets practitioner at Akin Gump.

The lion’s share of MLPs in the energy sector during the past couple years have been handled by Vinson & Elkins and Latham & Watkins. Akin Gump, Baker Botts, Bracewell, and Fulbright & Jaworski are also active players in the MLP market.

V&E is widely recognized as the birthplace of the modern MLP law practice, having done scores of them over the past decade for energy clients, including 14 in 2010 and 2011.

Latham, which has 45 lawyers in Houston, has quickly established its expertise in the MLP area, working on 11 MLP IPOs during the past two years.

Don’t expect the growth to end anytime soon, said Michael Chambers, co-head of Latham’s oil and gas capital markets practice. Latham’s presence will grow to be “considerably larger” in Houston, he emphasized, because the firm doesn’t “just want to be a player [in oil and gas transaction work]; we want to be the dominant player.”

Mark Druskoff is a Houston-based correspondent for Mergermarket, an online financial newswire.

Click here for a more detailed chart.

Click here for a more detailed chart.

PLEASE NOTE: Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

Leave a Reply

You must be logged in to post a comment.