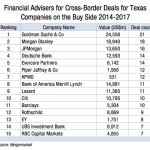

Competition between corporate law firms and investment banks to advise buyers and sellers involved in multinational dealmaking in Texas is dominated by non-Texas-based operations with a few exceptions. The top law firms are Latham, Kirkland, V&E and Norton Rose Fulbright, while Goldman Sachs, JPMorgan and Morgan Stanley dominate the world of financial advisers. The Texas Lawbook has the exclusive details.

More Stories

Houston IP Firm Opens Seventh Office

Firm officials say the new three-lawyer office in San Diego will help the firm serve its clients in Southern California better.

Polsinelli Shareholder Gemma Descoteaux Named President-Elect of ACG-DFW

Descoteaux chaired the Women in Association of Corporate Growth DFW group in 2015.

Michael Hurst to Receive DAYL Foundation Award of Excellence

Hurst will be recognized on Dec. 11 at the DAYL Foundation’s annual luncheon.

Andrews Kurth Kenyon Promotes Eight to Partner

Six of the eight are based in the firm’s Houston headquarters.

Winstead Signs Houston Labor and Employment Team

Two partners and two associates from Houston labor and employment boutique Alaniz Schraeder Linker Farris Mayes have joined Winstead.

SEC: Houston Financial Adviser Defrauded Investors

The SEC charged Houston investment adviser James C. Tao of Presidio Venture Capital with misappropriating funds and making material misstatements to those who contributed to the private equity fund he created. Court records show Tao agreed to settle with the SEC instead of face trial and will pay $314,000 in fines and disgorgement.

Morgan Lewis Gives Boost to Houston Healthcare Practice

The lateral hires include the co-leader of BakerHostetler’s healthcare practice and the vice president of legal affairs at the University of Texas Medical Branch at Galveston.

Energy Partner Daniel LeFort Jumps to K&L Gates

Over a career that spans more than 40 years, LeFort has held various corporate in-house roles at ExxonMobil, Calpine Corporation and Qatar Petroleum, where he was assistant general counsel from 2006 to 2010.

Baker Botts Elevates 11 to Partner, Eight in Texas

Four are based in Houston, and Dallas and Austin are home to two each.