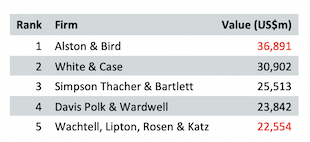

Nearly all the firms handling the largest M&A deals in Texas are based outside of the state. Nearly a half of them have no office in Texas. And only three of the top 40 are headquartered in Dallas or Houston. The deal value rankings can be highly misleading, and all legal analysts agree it is an inferior measure to deal count rankings. Even so, it is a fun number to discuss. So, we do.

Weil, Latham Advise on Topgolf/Callaway Merger

A Weil team from Dallas co-led the $2.5 billion merger of Topgolf with Callaway. A California-led team from Latham advised Callaway. The Texas Lawbook has the names of the lawyers involved.

CDT Roundup: 6 Deals, 6 Firms, 58 Lawyers, $18.1B

There were two massive deals this past week in the energy space which together were worth $17.1 billion. Does this mark a change in the current M&A environment? Maybe. But the real change may lie much deeper in the numbers. The CDT Roundup explains.

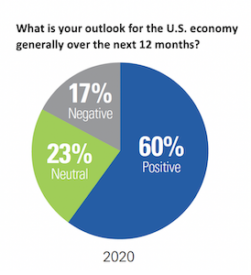

Dykema M&A Survey Reveals Guarded Optimism

Dykema’s 16th Annual M&A Survey is out, and the results are upbeat — but cautious. COVID-19 is the culprit, of course, but respondents were considerably more positive than this time last year. In a week that began with a stock market tumble fueled by a mixed government response to COVID-19, more than 70% of the nation’s top business executives surveyed said they are essentially optimistic that the market for mergers and acquisitions will strengthen in the next 12 months. The Lawbook has the details.

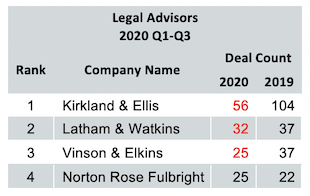

Mergermarket: Two-Thirds of Law Firms Handled Fewer M&A Deals in 2020

The battle of law firms in Texas for M&A has been turbulent so far this year. Nine of the top 10 firms and 33 of the top 40 firms saw a decline in M&A activity during the first nine months. Kirkland is way down in deal count, but still way ahead of everyone else. Norton Rose Fulbright, McDermott, Porter Hedges and King & Spalding are up.

Gibson, V&E Advise on $7.6B Pioneer Natural Resources Purchase of Parsley Energy

Irving-based Pioneer Natural Resources is buying Parsley Energy for $4.5 billion in stock and the assumption of $3.1 billion of Parsley’s debt. Texas Lawbook writer Allen Pusey has the lawyers for Gibson Dunn and Vinson & Elkins.

ConocoPhillips, Concho Resources Combine in $9.5B Deal

Consolidation in the shale oil business took a big step Monday morning with the announcement that major Permian player Concho Resources has agreed to combine with Houston-based ConocoPhillips.

CDT Roundup: 8 Deals, 5 Firms, 52 Lawyers, $5.2B

The week was defined by one big deal, a drop to single-digit transactions and a flurry of reports on the energy industry by Haynes and Boone that provide context for the transactions that pass through the CDT Roundup.

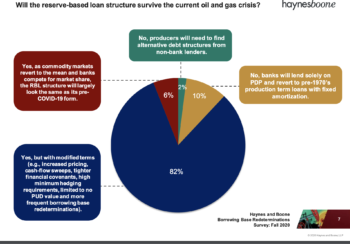

Haynes and Boone Energy Reports: Lower Bases, Less Credit, More Hedging

Energy companies are likely going to face a new lending environment, even when the nation exits from its current coronavirus woes, according to new reports by Haynes and Boone. Even though prices have stabilized banks are changing the rules, and O&G companies are moving toward greater self-reliance in the process.

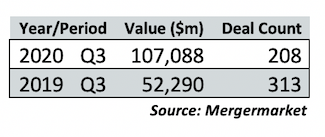

Mergermarket Q3: Value Up, Deal Count Up. And Down.

The Q3 Mergermarket numbers are in. Deals were also up. But also down from last year. Total value was up. But both are well below average and rate poorly against the last 14 years. Allen Pusey has the numbers.

- « Go to Previous Page

- Go to page 1

- Interim pages omitted …

- Go to page 27

- Go to page 28

- Go to page 29

- Go to page 30

- Go to page 31

- Interim pages omitted …

- Go to page 47

- Go to Next Page »