The recent decline in M&A activity in energy and especially in the previously redhot midstream sector has limited the viable exit opportunities for most sponsor-backed midstream oil, gas or water portfolio companies in the near term. But this temporary period creates an ideal environment for sponsors and management to take an introspective look at their portfolio companies and begin preparing for their eventual sale, once the oil and gas industry has recovered and the M&A market has stabilized.

CDT Roundup: 7 Deals, 8 Firms, 76 Lawyers, $5.3B

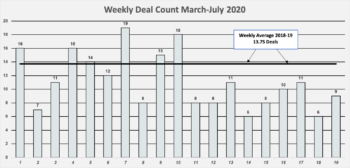

How hard has the coronavirus been on transactional activity from week to week? We decided to check the figures from March through July against the same time period during the two previous years. Here’s what we found.

Akin Gump Helps 7-Eleven Take Speedway for $21B

So much for low-cost M&A pickups at the bankruptcy court. Japanese-owned 7-Eleven bought 3,900 Speedway locations from Marathon Petroleum on Sunday for $21 billion. The Lawbook has the lawyers who made the deal happen.

Post-COVID M&A – A Braver, Newer World

The coronavirus is not only changing the way we live, it is having a noticeable impact on the way deals are getting done. BoyarMiller shareholder Larry Wilson and GulfStar managing director Colt Luedde take a look at how the COVID-19 pandemic is affecting the buying and selling of businesses and how it could continue to shape M&A in the future.

Baker Botts, Latham Advise in NRG’s $3.6B Acquisition of Direct Energy

North American power company NRG announced Friday it is acquiring Houston-based Direct Energy. The deal extends the reach of NRGs retail power business well beyond Texas.

CDT Roundup: Six Deals, 5 Firms, 50 Lawyers, $1.98B

During a horrible stretch for traditional oil and gas transactions, there is one category of energy transactions that has been holding its own: renewables. And even under the mudslide of bankruptcies and recap transactions, it’s hard not to notice that Texas lawyers are beginning to cash in.

V&E Leads Noble Energy’s Sale to Chevron

Houston-based Noble Energy GC Rachel Clingman chose Vinson & Elkins to lead the oil and gas company’s sale to Chevron for $5 billion or $13 billion in enterprise value, which includes debt. Chevron hired lawyers at Paul Weiss and Shearman & Sterling as its legal advisors. This is the largest M&A deal in the Texas oil patch this year.

CDT Roundup: 11 Deals, 12 Firms, 75 Lawyers, $565.1M

With the transactional markets a mess, you might expect venture capital to be lagging. A new report by PitchBook suggests that your instincts are correct. This week’s CDT Roundup has the details.

CDT Roundup: 10 Deals, 8 Firms, 98 Lawyers, $8.9B

This week’s numbers may hold a glimpse of a foreseeable future: one full of DIP lending, consolidation, reshuffled credit, renewable energy and re-securitized debt.

Kirkland-Dallas Involved In $2.65B Uber Acquisition of Postmates

Uber Technologies, which has sought to delay planned investments in Texas due to the COVID-19 pandemic, announced the acquisition of one of its home-delivery rivals. Allen Pusey has the details.

- « Go to Previous Page

- Go to page 1

- Interim pages omitted …

- Go to page 29

- Go to page 30

- Go to page 31

- Go to page 32

- Go to page 33

- Interim pages omitted …

- Go to page 47

- Go to Next Page »