CDT Roundup: 16 Deals, 10 Firms, 105 Lawyers, $6.9B

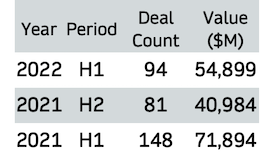

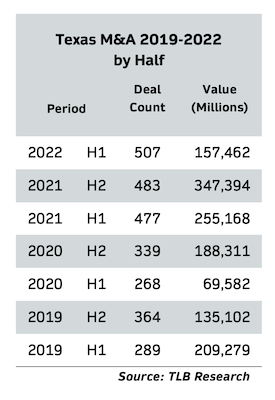

In addition to warmer temperatures, the end of spring brings us the end of Q2/H1, and a good time to check on the mid-year status of dealmaking. This week is our roundup of what the CDT Roundup has been reporting for the past six months. That, and a roster of lawyers involved in the 11 M&A/Funding deals and five CapM transactions reported last week.