Last week was a big one for capital markets transactions, in spite of…well, everything. M&A? Not so much. In her weekly CDT Roundup, Claire Poole has names and numbers for the deals that kept Texas lawyers busy while they WFH.

Paul Hastings Brings Back Restructuring Lawyer, This Time as Partner

The move returns the Blank Rome attorney to his former firm, where he last served as counsel.

CDT Roundup: 12 Deals, 9 Firms, 40 Lawyers, $6B

Deals are being terminated or renegotiated all over the place due to the coronavirus and fallen oil prices, with one seller in Texas taking a 30% haircut. Meanwhile, deal activity among Texas lawyers is beginning to slide with no letup in sight.

Kirkland Houston Partner Departs for Akin Gump

UPDATED The attorney specializes in private equity financings and debt restructurings in the energy industry, including special and distressed situations.

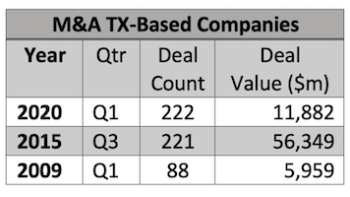

Texas M&A Falls Dramatically in Q1

For 51 consecutive quarters, energy was the dominant sector for M&A in Texas. That streak ended during the first three months of 2020, as M&A activity plunged in deal value to levels not witnessed since the Great Recession. Not one of the seven biggest-dollar Texas deals had anything to do with oil and gas, according to Mergermarket. The Texas Lawbook has the details.

CDT Roundup: 14 Deals, 11 Firms, 68 Lawyers, $8.2B

First quarter global M&A activity fell back to levels not seen since 2013 with U.S. results eerily similar to 2008. Meanwhile, dealmaking involving Texas lawyers keeps chugging along thanks to transactions already in the works and some companies’ moves to shore up liquidity.

Report: Bankrupt Oil and Gas Producers Number 215 Since 2015

Oilfield services providers followed with 204 bankruptcies over the last five years and midstream providers amounted to 30, according to Haynes and Boone. But few in the oil and gas industry will be immune given low oil prices and uncertainty around the demand-sapping coronavirus.

Report: Borrowing Bases Expected to Slide at Least 20% After Oil Free-Fall

The results contrast with Haynes and Boone’s fall survey, which found the largest share of respondents predicting a 10% decrease during redetermination season.

CDT Roundup: 16 Deals, 13 Firms, 96 Lawyers, $6.5B

Preliminary data shows that global deal value slid 28% in the first quarter, with private equity firms making up a bigger chunk. Texas dealmakers haven’t been immune, although last week saw flat activity year-over-year with deal closings, restructuring work and private equity reloading to hunt for opportunities.

Bradley Arant Energy Attorney Moves to Munsch Hardt in Houston

The new shareholder has in-house experience, including as general counsel at private equity-backed Northern Star Generation.