Bleak Deal Times Ahead After an Already Down 2019

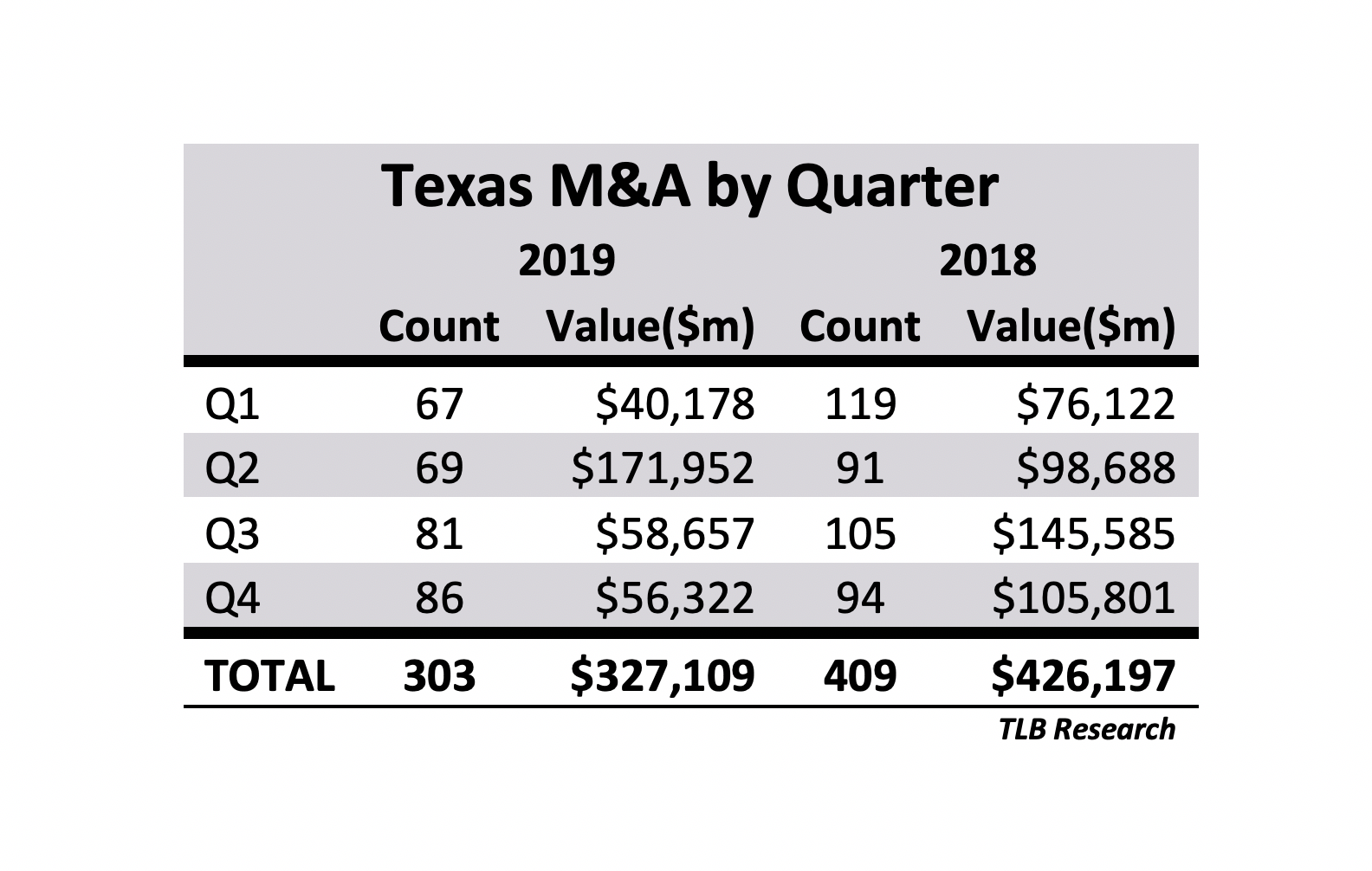

Exclusive data collected by The Texas Lawbook's Corporate Deal Tracker shows that transactions handled by lawyers in the state dropped by a quarter on a volume and value basis last year, thanks to the unpopular oil and gas sector. And 2020 is expected to be much worse given the coronavirus, uncertainty in the financial markets and low oil prices.