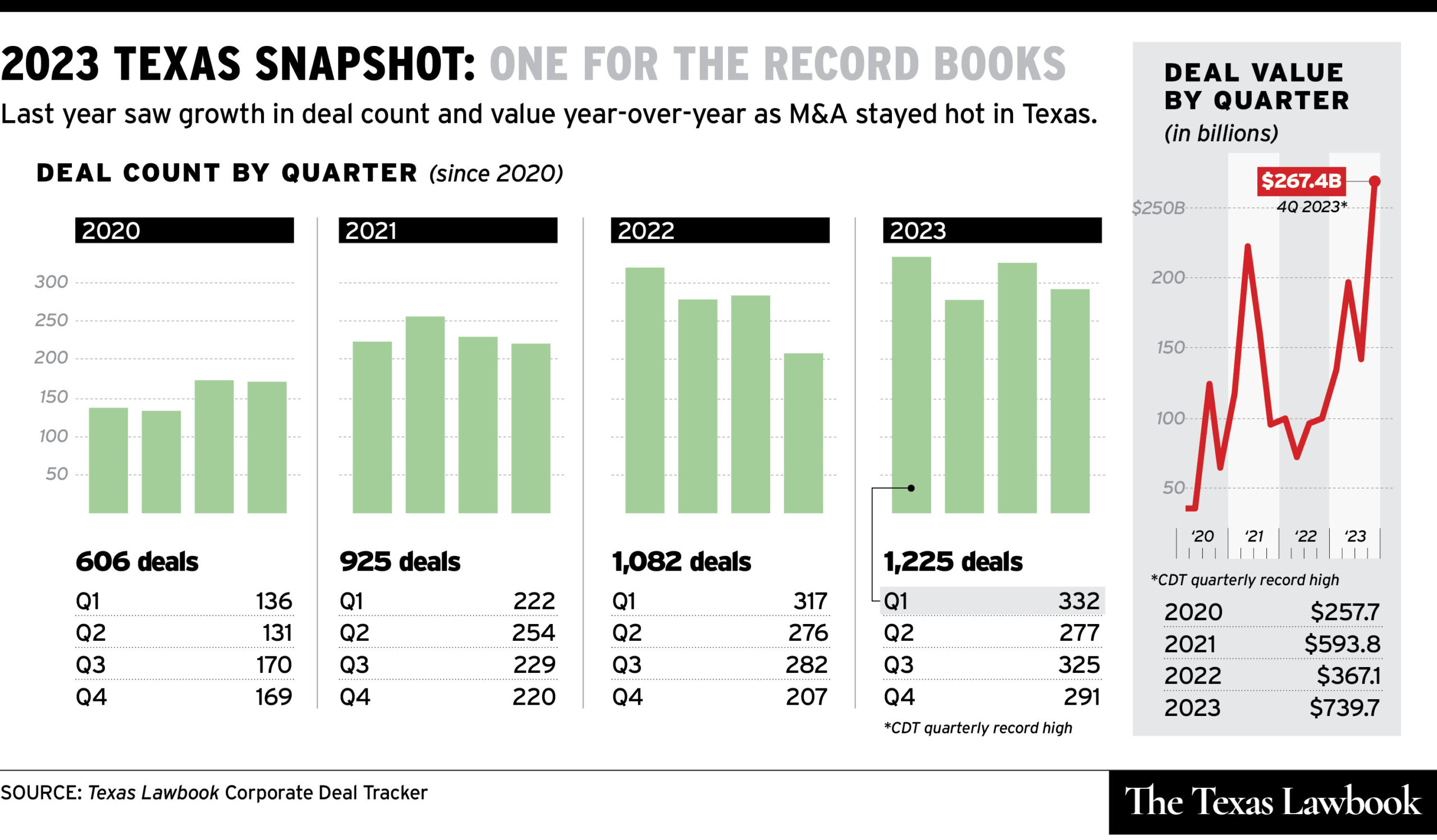

2023 M&A: A Statistical Elephant and a Parallax View

Texas-related M&A data for 2023 compiled from The Texas Lawbook's exclusive Corporate Deal Tracker reveals a strangely successful year — even a record year in some quarters. A record number of Texas-related deals were reported: 1,225 mergers, acquisitions, and joint ventures with an aggregate value of $739.7 billion. That's a 13.2 percent climb in deal volume over 2022 (1,082) and more than double year-over-year values ($367.1 billion).