Campbell Soup Company Agrees to Acquire Sovos Brands Inc.

Weil partner James Griffin co-led a team from Weil representing Sovos Brands investor Advent International. The Lawbook has the details.

Free Speech, Due Process and Trial by Jury

Weil partner James Griffin co-led a team from Weil representing Sovos Brands investor Advent International. The Lawbook has the details.

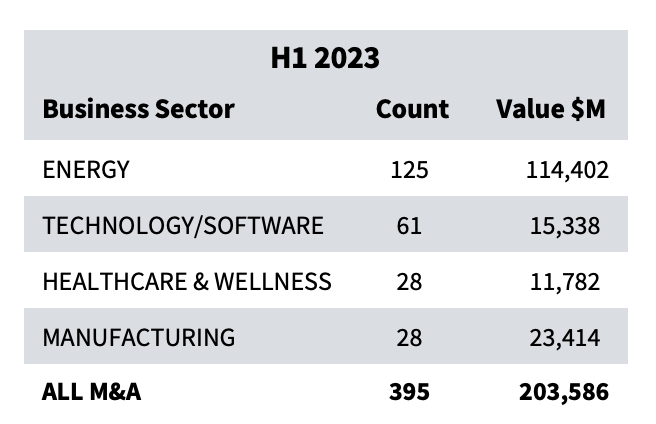

There were 395 Texas-related M&A deals during the first six months of the year. The biggest aren't always the most consequential; context matters. The Lawbook's Claire Poole asked a few Texas M&A experts to choose five from among them the 395 that seem most important to the current market.

According to a recent report by PitchBook, private equity deals are a mixed bag of late: deal count up a wisp from Q1; deal value down double-digits. Is that terrible? Maybe not. The Roundup looked at the numbers from PitchBook and there are a few surprises and maybe a little perspective; that, along with the usual run-down of the week's M&A deals.

Whether upstream or midstream or energy services, the energy sector seems to have adapted to realities of the marketplace to hold its place at the top of the M&A food chain.

Plano-based Reata specializes in the treatment of neurological complications with cellular metabolism and inflammation associated with neurological diseases. The all-cash transaction is being treated as a combination and is expected to close in the fourth quarter of this year.

Texas dealmakers don't do pessimism. There's no point. Downtimes provoke creativity. Uptimes demand energy. And even during times of lean money markets, Texas seems to maintain an ample supply of both. As we move past a mediocre first half in 2023, the CDT Roundup looks at sources of optimism for what's coming — with the assistance of a new report from Intralinks. And, course, there are the names of the Texas lawyers behind 18 deals reported last week.

The firm's Dermarkar previously advised the private equity firm on deals, including during his tenure at Jones Day.

U.S. buyout and exit deals are seeing double-digit year-over-year declines, fundraising is shrinking and acquisition finance markets have stiffened in the face of interest rate uncertainty, according to Mergermarket. Against that backdrop comes a survey of 100 PE firm executives who are among those searching for places to place an estimated $1.1 trillion in dry-powder cash. In this week’s CDT Roundup, Claire Poole discusses what they see on the investment horizon after 12-18 months of investor caution, along with the names of lawyers involved in last week’s 13 M&A and funding deals.

© Copyright 2026 The Texas Lawbook

The content on this website is protected under federal Copyright laws. Any use without the consent of The Texas Lawbook is prohibited.