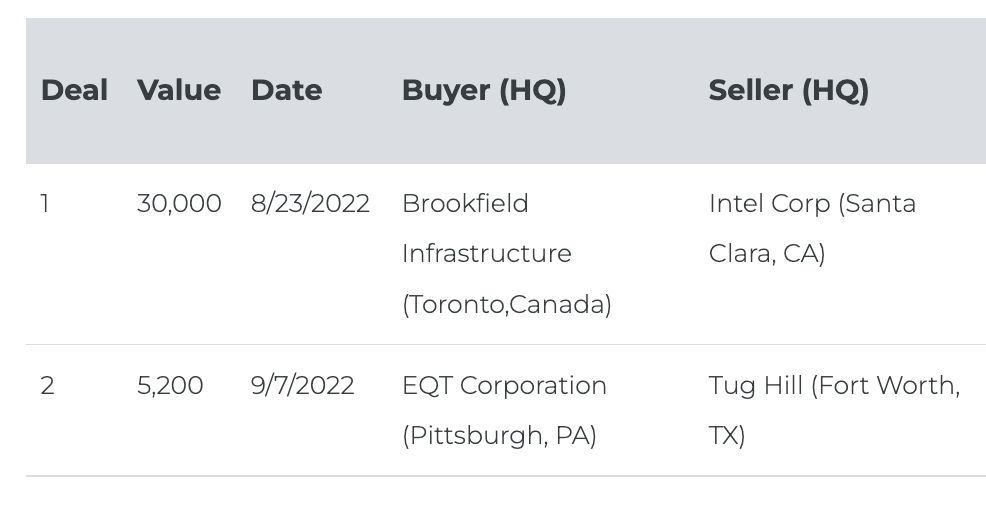

CDT Roundup: 15 Deals, 9 Firms, 116 Lawyers, $7.8B

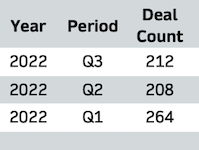

With blank check IPOs and de-SPAC mergers dwindling in number, the third quarter of 2022 may have spelled the most conclusive evidence yet that the SPAC track has peaked as a quick path to public trading for companies that covet a ticker symbol. Blame it on inflation or on the quality of the targets themselves, but according to Pitchbook SPACs have proved themselves unable to sustain the enthusiastic pricing they experienced just a year ago. The CDT Roundup has those details, as well as the names of the firms and Texas lawyers who reported transactions last week.